-

Scrutiny over US claim that Mexican drone invasion prompted airport closure

Scrutiny over US claim that Mexican drone invasion prompted airport closure

-

Trump to undo legal basis for US climate rules

-

Protesters, police clash at protest over Milei labor reform

Protesters, police clash at protest over Milei labor reform

-

Dyche sacked by Forest after dismal Wolves draw

-

France seeks probe after diplomat cited in Epstein files

France seeks probe after diplomat cited in Epstein files

-

Rivers among 2026 finalists for Basketball Hall of Fame

-

Israel president says antisemitism in Australia 'frightening'

Israel president says antisemitism in Australia 'frightening'

-

Trump orders Pentagon to buy coal-fired electricity

-

Slot hails 'unbelievable' Salah after matching Liverpool assist record

Slot hails 'unbelievable' Salah after matching Liverpool assist record

-

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

-

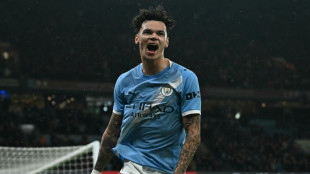

Guardiola eyes rest for 'exhausted' City stars

Guardiola eyes rest for 'exhausted' City stars

-

US pushes for 'dramatic increase' in Venezuela oil output

-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

-

Messi out with hamstring strain as Puerto Rico match delayed

-

Kane helps Bayern past Leipzig into German Cup semis

Kane helps Bayern past Leipzig into German Cup semis

-

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

-

Arsenal stroll in Women's Champions League play-offs

Arsenal stroll in Women's Champions League play-offs

-

Milei labor law reforms spark clashes in Buenos Aires

-

Bangladesh's political crossroads: an election guide

Bangladesh's political crossroads: an election guide

-

Bangladesh votes in landmark polls after deadly uprising

-

US stocks move sideways after January job growth tops estimates

US stocks move sideways after January job growth tops estimates

-

Man City close in on Arsenal with Fulham cruise

-

Mike Tyson, healthy eating advocate for Trump administration

Mike Tyson, healthy eating advocate for Trump administration

-

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

-

Brighton's Milner equals Premier League appearance record

Brighton's Milner equals Premier League appearance record

-

Seahawks celebrate Super Bowl win with title parade

-

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

-

Trump tells Israel's Netanyahu Iran talks must continue

Trump tells Israel's Netanyahu Iran talks must continue

-

England to face New Zealand and Costa Rica in pre-World Cup friendlies

-

'Disgrace to Africa': Students turn on government over Dakar university violence

'Disgrace to Africa': Students turn on government over Dakar university violence

-

Simon in credit as controversial biathlete wins Olympic gold

-

McIlroy confident ahead of Pebble Beach title defense

McIlroy confident ahead of Pebble Beach title defense

-

US top official in Venezuela for oil talks after leader's ouster

-

Ukraine will only hold elections after ceasefire, Zelensky says

Ukraine will only hold elections after ceasefire, Zelensky says

-

WHO urges US to share Covid origins intel

-

TotalEnergies can do without Russian gas: CEO

TotalEnergies can do without Russian gas: CEO

-

Instagram CEO denies addiction claims in landmark US trial

-

Israel's Netanyahu pushes Trump on Iran

Israel's Netanyahu pushes Trump on Iran

-

EU leaders push rival fixes to reverse bloc's 'decline'

-

BMW recalls hundreds of thousands of cars over fire risk

BMW recalls hundreds of thousands of cars over fire risk

-

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

-

Colombia election favorite vows US-backed strikes on narco camps

Colombia election favorite vows US-backed strikes on narco camps

-

French court to rule on July 7 in Marine Le Pen appeal trial

-

Jones says England clash 'perfect game' for faltering Scotland

Jones says England clash 'perfect game' for faltering Scotland

-

Norway's ex-diplomat seen as key cog in Epstein affair

-

Swiatek fights back to reach Qatar Open quarter-finals

Swiatek fights back to reach Qatar Open quarter-finals

-

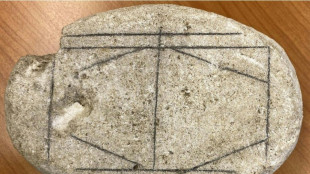

AI cracks Roman-era board game

Minera Don Nicolas Enters Option Agreement with AngloGold Ashanti Argentinian Subsidiary, Cerro Vanguardia SA, for the Sale of its Michelle Exploration Properties for Total Consideration of US$14 Million

Initial US$4 Million Option Payment; Further strengthening balance sheet

Remaining consideration of US$10 Million payable on exercise within 3 years

Company well-positioned to drive future growth via its operating Minera Don Nicolas gold mine in Argentina and its Mont Sorcier High Grade Iron Ore development project in Quebec

Cerrado Gold Inc. (TSX.V:CERT)(OTCQX:CRDOF)(FRA:BAI0) ("Cerrado" or the "Company") announces that it and its wholly owned subsidiary, Minera Don Nicolas S.A. ("MDN"), have entered into an option agreement ("Option Agreement") with Cerro Vanguardia S.A. ("CVSA") a wholly-owned subsidiary of AngloGold Ashanti Holdings Plc, whereby MDN has granted to CVSA the option ("Option") to purchase a 100% interest (the "Transaction") in certain properties (the "Michelle Properties") located in the south region of MDN's Minera Don Nicolas Project in Santa Cruz, Argentina, for total consideration of the Argentina peso equivalent of US$14 million (approximately C$19 million) (the "Purchase Price"), subject to the fulfilment of certain conditions. The Option Agreement was ratified December 23, 2024, with effect December 18, 2024.

The Purchase Price is payable in the following stages:

US$4 million equivalent in Argentina pesos at the CCL Buyers rate upon grant of the Option); and

US$10 million equivalent in Argentina pesos at the CCL Buyers rate upon exercise of the Option within 3 years.

During the Option Period CVSA will take operational control of the Michelle Properties.

Mark Brennan, CEO and Chairman commented: "The option of these non-core properties to CVSA, the logical owner of these properties, is highly accretive to Cerrado and its shareholders. The Transaction will immediately improve the balance sheet and short-term capital position at MDN, allowing us to focus on our core properties. With current strong operating cashflows at MDN and capital proceeds from asset sales, we are very well positioned to pursue strong growth programs at MDN and at our Mont Sorcier high grade iron project, as well as look at additional opportunities to grow the Company in the near term."

Transaction Summary and Details

The Michelle Properties are a collection of 14exploration concessions, totaling approximately 14,000 hectares located approximately 100 km to the South-East of the MDN plant and 10 km to the North-West of CVSA's Cerro Vanguardia Mine. The Michelle Properties are highlighted in the following map:

MDN will receive from CVSA the Argentina CCL peso equivalent of US$4 million to MDN on or about December 27, 2024.

CVSA may exercise the Option at its sole discretion at any time within three (3) years unless earlier terminated (the "Option Period") by providing an exercise notice to MDN and paying the exercise price of the Argentina pesos equivalent of US$10 million. The Option may be exercised at CVSA's sole discretion at any time during the Option Period, provided that the required payment has been paid by CVSA. Pursuant to the terms of the Option Agreement, CVSA is intended to assume operational control of the Michelle Properties from the date of the Option Agreement until the expiry of the Option Period.

Royalty and Stream Holders

Concurrent with the Transaction, MDN obtained prior written consents to the Transaction and exercise of the Option from all holders of royalties and metals streams applicable to the Michelle Properties (the "Consents"), including RG Royalties, LLC ("Royal Gold"), a subsidiary of Royal Gold Inc., Sandstorm Gold Limited ("Sandstorm"), a subsidiary of Sandstorm Gold Royalties, and Sprott Private Resource Streaming and Royalty (B) Corp. ("Sprott"). Receipt of the Consents reduces risks and expedites closing if CVSA elects to exercise the Option.

Prior to executing the Option Agreement, Royal Gold was paid all accrued royalty amounts outstanding as of September 30, 2024, and Sandstorm was paid a lump sum. Both Royal Gold and Sandstorm agreed to waive all accrued interest and penalties on royalty amounts outstanding as of September 30, 2024, provided that in the case of Sandstorm, all royalty amounts are paid when due in instalments over the next two quarters. The waiver of accrued interest and penalties, taken together with the repayment of outstanding royalties, results in substantial reductions of Company accounts payable. In connection with the Consents and the waiver of interest and penalties, the Company provided corporate guarantees to Royal Gold and Sandstorm relating to their royalty agreements with MDN, and MDN and has conditionally agreed to pay Sandstorm up to US$500,000 in connection with a cap on royalty payments on the Michelle Properties subject to the existing maximum royalty amount of approximately $1,300,000 that may be payable to Sandstorm under the applicable Sandstorm royalty agreement.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Cerrado Gold Inc., who is a Qualified Person as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the 100% owner of both the producing Minera Don Nicolás and Las Calandrias mine in Santa Cruz province, Argentina. In Canada, Cerrado Gold is developing its 100% owned Mont Sorcier Iron Ore and Vanadium project located outside of Chibougamou, Quebec.

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a 100% interest in the high grade, high purity Mont Sorcier Iron Ore and Vanadium project, which has the potential to produce a premium iron ore concentrate over a long mine life at low operating costs and with low capital intensity. Furthermore, its high grade and high purity product facilitates the migration of steel producers from blast furnaces to electric arc furnaces, contributing to the decarbonization of the industry and the achievement of SDG goals.

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

Email: [email protected]

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, that CVSA will exercise the Option, receipt by Cerrado of the whole Purchase Price including the $10 million upon exercise the Option, the value of Argentina pesos at the CCL Buyers rate, that MDN will satisfy conditions relating to the waiver of interest and penalties. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions, including, but not limited to the satisfactory completion of due diligence by Amarillo and the exercise of the Option by Amarillo, the satisfaction of all conditions to closing of the Proposed Transaction, including the receipt of all required approvals (including regulatory and shareholder approval), cash flow generated from MDN and changes in economic and monetary policies and regulations in jurisdictions in which Cerrado and its subsidiaries operate. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

D.Cunningha--AMWN