-

Scrutiny over US claim that Mexican drone invasion prompted airport closure

Scrutiny over US claim that Mexican drone invasion prompted airport closure

-

Trump to undo legal basis for US climate rules

-

Protesters, police clash at protest over Milei labor reform

Protesters, police clash at protest over Milei labor reform

-

Dyche sacked by Forest after dismal Wolves draw

-

France seeks probe after diplomat cited in Epstein files

France seeks probe after diplomat cited in Epstein files

-

Rivers among 2026 finalists for Basketball Hall of Fame

-

Israel president says antisemitism in Australia 'frightening'

Israel president says antisemitism in Australia 'frightening'

-

Trump orders Pentagon to buy coal-fired electricity

-

Slot hails 'unbelievable' Salah after matching Liverpool assist record

Slot hails 'unbelievable' Salah after matching Liverpool assist record

-

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

-

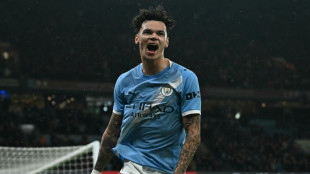

Guardiola eyes rest for 'exhausted' City stars

Guardiola eyes rest for 'exhausted' City stars

-

US pushes for 'dramatic increase' in Venezuela oil output

-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

-

Messi out with hamstring strain as Puerto Rico match delayed

-

Kane helps Bayern past Leipzig into German Cup semis

Kane helps Bayern past Leipzig into German Cup semis

-

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

-

Arsenal stroll in Women's Champions League play-offs

Arsenal stroll in Women's Champions League play-offs

-

Milei labor law reforms spark clashes in Buenos Aires

-

Bangladesh's political crossroads: an election guide

Bangladesh's political crossroads: an election guide

-

Bangladesh votes in landmark polls after deadly uprising

-

US stocks move sideways after January job growth tops estimates

US stocks move sideways after January job growth tops estimates

-

Man City close in on Arsenal with Fulham cruise

-

Mike Tyson, healthy eating advocate for Trump administration

Mike Tyson, healthy eating advocate for Trump administration

-

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

-

Brighton's Milner equals Premier League appearance record

Brighton's Milner equals Premier League appearance record

-

Seahawks celebrate Super Bowl win with title parade

-

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

-

Trump tells Israel's Netanyahu Iran talks must continue

Trump tells Israel's Netanyahu Iran talks must continue

-

England to face New Zealand and Costa Rica in pre-World Cup friendlies

-

'Disgrace to Africa': Students turn on government over Dakar university violence

'Disgrace to Africa': Students turn on government over Dakar university violence

-

Simon in credit as controversial biathlete wins Olympic gold

-

McIlroy confident ahead of Pebble Beach title defense

McIlroy confident ahead of Pebble Beach title defense

-

US top official in Venezuela for oil talks after leader's ouster

-

Ukraine will only hold elections after ceasefire, Zelensky says

Ukraine will only hold elections after ceasefire, Zelensky says

-

WHO urges US to share Covid origins intel

-

TotalEnergies can do without Russian gas: CEO

TotalEnergies can do without Russian gas: CEO

-

Instagram CEO denies addiction claims in landmark US trial

-

Israel's Netanyahu pushes Trump on Iran

Israel's Netanyahu pushes Trump on Iran

-

EU leaders push rival fixes to reverse bloc's 'decline'

-

BMW recalls hundreds of thousands of cars over fire risk

BMW recalls hundreds of thousands of cars over fire risk

-

Norris quickest in Bahrain as Hamilton calls for 'equal playing field'

-

Colombia election favorite vows US-backed strikes on narco camps

Colombia election favorite vows US-backed strikes on narco camps

-

French court to rule on July 7 in Marine Le Pen appeal trial

-

Jones says England clash 'perfect game' for faltering Scotland

Jones says England clash 'perfect game' for faltering Scotland

-

Norway's ex-diplomat seen as key cog in Epstein affair

-

Swiatek fights back to reach Qatar Open quarter-finals

Swiatek fights back to reach Qatar Open quarter-finals

-

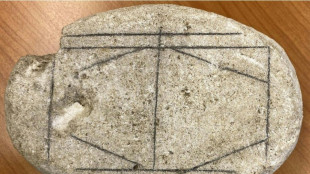

AI cracks Roman-era board game

Battery X Metals Announces Closing of Non-Brokered Private Placement and Debt Settlement

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

("Battery X Metals" or the "Company") announces the closing of its previously announced non-brokered private placement financing (the "Private Placement"). The Company issued 11,999,998 units (each, a "Unit") at a price of $0.05 per Unit for aggregate gross proceeds of $599,999.94.

Each Unit consists of one common share in the capital of the Company (each, a "Share") and one transferable common share purchase warrant of the Company (each, a "Warrant"), with each Warrant entitling the holder to acquire on additional Share (each, a "Warrant Share") at a price of $0.075 per Warrant Share Until December 24, 2026.

The Company intends to use the proceeds raised from the Private Placement for general working capital and outstanding payables. The securities issued under the Private Placement will be subject to a statutory hold period in accordance with applicable securities laws of four months and one day from the date of issue, expiring April 25, 2025.

Debt Settlement

The Company also announces that further to its news release dated December 11, 2024, it has settled debt in the aggregate amount of $600,000 (the "Debt Settlement") owed by the Company to certain insiders and creditors of the Company in exchange for an aggregate of 11,999,999 units (each, a "Debt Settlement Unit"), at a price of $0.05 per Debt Settlement Unit.

Each Debt Settlement Unit consists of one common share in the capital of the Company (each, a "Debt Settlement Share") and one transferable common share purchase warrant of the Company (each, a "Debt Settlement Warrant"), with each Debt Settlement Warrant entitling the holder to acquire on additional Debt Settlement Share (each, a "Debt Settlement Warrant Share") at a price of $0.075 per Debt Settlement Warrant Share Until December 24, 2026.

The securities issued under the Debt Settlement will be subject to a statutory hold period in accordance with applicable securities laws of four months and one day from the date of issue, expiring April 25, 2025.

The Company obtained shareholder approval by written consent from shareholders (excluding Related Parties) holding approximately 52% of the Company's issued and outstanding Shares to close both the Private Placement and Debt Settlement, in accordance with Policy 4.6(2)(a)(i)(2) of the Canadian Securities Exchange.

The debt settlements with Massimo Bellini Bressi and Dallas Pretty (the "Insider Settlements") are "related party transactions" within the meaning of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Insider Settlements are exempt from the valuation requirement of MI 61-101 by virtue of the exemptions contained in section 5.5(b) of MI 61-101 as the Company's common shares are not listed on a specified market and from the minority shareholder approval requirements of MI 61-101 by virtue of the exemption contained in section 5.7(1)(a) of MI 61-101 in that the fair market value of the Insider Settlements do not exceed 25% of the Company's market capitalization. As the material change report disclosing the Insider Settlements is being filed less than 21 days before the transaction, there is a requirement under MI 61‐101 to explain why the shorter period was reasonable or necessary in the circumstances. In the view of the Company, it is necessary to immediately close the Insider Settlements and therefore, such shorter period is reasonable and necessary in the circumstances to improve the Company's financial position.

None of the securities acquired in the Private Placement and Debt Settlement will be registered under the United States Securities Act of 1933, as amended (the "1933 Act"), and none of them may be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act. This news release shall not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of the securities in any state where such offer, solicitation, or sale would be unlawful.

About Battery X Metals Inc.

Battery X Metals (CSE:BATX)(OTCQB:BATXF)(FSE:R0W, WKN:A3EMJB) is committed to advancing the global clean energy transition through the development of proprietary technologies and domestic battery and critical metal resource exploration. The Company focuses on extending the lifespan of electric vehicle (EV) batteries, through its portfolio company, LIBRT1, recovering battery grade metals from end-of-life lithium-ion batteries, and the acquisition and exploration of battery and critical metals resources. For more information, visit batteryxmetals.com.

149% owned Portfolio Company

On Behalf of the Board of Directors

Massimo Bellini Bressi, Director

For further information, please contact:

Massimo Bellini Bressi

Chief Executive Officer

Email: [email protected]

Tel: (604) 741-0444

Disclaimer for Forward-Looking Information

This news release contains forward-looking statements within the meaning of applicable securities laws, including statements related to the use of proceeds of the Private Placement. Forward-looking statements reflect management's current beliefs, expectations, and assumptions based on available information as of the date of this release. However, these statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied. Such risks include, but are not limited to the ability of the Company to execute on its business strategy, obtain additional financing and funds as required and on market terms, and susceptibility to fluctuations in the market and the industries in which the Company operates. Additional details regarding risks and uncertainties are available in the Company's filings on SEDAR+. The forward-looking statements in this news release are made as of the date hereof, and Battery X Metals disclaims any intention or obligation to update or revise such statements, except as required by law. Investors are cautioned not to place undue reliance on these forward-looking statements.

SOURCE: Battery X Metals

M.Fischer--AMWN