-

Dieng powers Bucks over NBA champion Thunder

Dieng powers Bucks over NBA champion Thunder

-

Japan seizes Chinese fishing vessel, arrests captain

-

Bangladesh political heir Tarique Rahman poised for PM

Bangladesh political heir Tarique Rahman poised for PM

-

Asian stocks track Wall St down but AI shift tempers losses

-

Bangladesh's BNP claim 'sweeping' election win

Bangladesh's BNP claim 'sweeping' election win

-

Drones, sirens, army posters: How four years of war changed a Russian city

-

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

-

North Korea warns of 'terrible response' if South sends more drones

-

NASA crew set for flight to ISS

NASA crew set for flight to ISS

-

'Punk wellness': China's stressed youth mix traditional medicine and cocktails

-

Diplomacy, nukes and parades: what to watch at North Korea's next party congress

Diplomacy, nukes and parades: what to watch at North Korea's next party congress

-

Arsenal, Man City eye trophy haul, Macclesfield more FA Cup 'miracles'

-

Dreaming of glory at Rio's carnival, far from elite parades

Dreaming of glory at Rio's carnival, far from elite parades

-

Bangladesh's BNP heading for 'sweeping' election win

-

Hisatsune grabs Pebble Beach lead with sparkling 62

Hisatsune grabs Pebble Beach lead with sparkling 62

-

Venezuela amnesty bill postponed amid row over application

-

Barca taught 'lesson' in Atletico drubbing: Flick

Barca taught 'lesson' in Atletico drubbing: Flick

-

Australia's Liberals elect net zero opponent as new leader

-

Arsenal must block out noise in 'rollercoaster' title race: Rice

Arsenal must block out noise in 'rollercoaster' title race: Rice

-

Suns forward Brooks banned one game for technical fouls

-

N. Korea warns of 'terrible response' if more drone incursions from South

N. Korea warns of 'terrible response' if more drone incursions from South

-

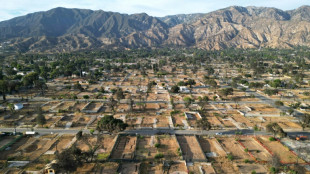

LA fires: California probes late warnings in Black neighborhoods

-

Atletico rout Barca in Copa del Rey semi-final first leg

Atletico rout Barca in Copa del Rey semi-final first leg

-

Arsenal held by Brentford to offer Man City Premier League title hope

-

US snowboard star Kim 'proud' as teenager Choi dethrones her at Olympics

US snowboard star Kim 'proud' as teenager Choi dethrones her at Olympics

-

Chloe Kim misses Olympic milestone, Ukrainian disqualfied over helmet

-

Tech shares pull back ahead of US inflation data

Tech shares pull back ahead of US inflation data

-

'Beer Man' Castellanos released by MLB Phillies

-

Canada PM to join mourners in remote town after mass shooting

Canada PM to join mourners in remote town after mass shooting

-

Teenager Choi wrecks Kim's Olympic snowboard hat-trick bid

-

Inter await Juve as top guns go toe-to-toe in Serie A

Inter await Juve as top guns go toe-to-toe in Serie A

-

Swiatek, Rybakina dumped out of Qatar Open

-

Europe's most powerful rocket carries 32 satellites for Amazon Leo network into space

Europe's most powerful rocket carries 32 satellites for Amazon Leo network into space

-

Neighbor of Canada mass shooter grieves after 'heartbreaking' attack

-

French Olympic ice dance champions laud 'greatest gift'

French Olympic ice dance champions laud 'greatest gift'

-

Strange 'inside-out' planetary system baffles astronomers

-

Teenager Choi denies Kim Olympic snowboard hat-trick

Teenager Choi denies Kim Olympic snowboard hat-trick

-

Swiss bar owners face wrath of bereaved families

-

EU vows reforms to confront China, US -- but split on joint debt

EU vows reforms to confront China, US -- but split on joint debt

-

Rubio heads to Munich to heap pressure on Europeans

-

Less glamour, more content, says Wim Wenders of Berlin Film Fest

Less glamour, more content, says Wim Wenders of Berlin Film Fest

-

What is going on with Iran-US talks?

-

Wales 'means everything' for prop Francis despite champagne, oysters in France

Wales 'means everything' for prop Francis despite champagne, oysters in France

-

Giannis out and Spurs' Fox added to NBA All-Star Game

-

The secret to an elephant's grace? Whiskers

The secret to an elephant's grace? Whiskers

-

Chance glimpse of star collapse offers new insight into black hole formation

-

UN climate chief says 'new world disorder' threatens cooperation

UN climate chief says 'new world disorder' threatens cooperation

-

Player feels 'sadness' after denied Augusta round with grandsons: report

-

Trump dismantles legal basis for US climate rules

Trump dismantles legal basis for US climate rules

-

Former Arsenal player Partey faces two more rape charges

Reyna Silver Announces Third Tranche Closing Of Previously Announced Non-brokered Private Placement

VANCOUVER, BC AND HONG KONG / ACCESS Newswire / February 28, 2025 / Reyna Silver Corp. (TSXV:RSLV)(OTCQX:RSNVF)(FRA:4ZC)("Reyna" or the "Company") is pleased to announce a third closing of its previously announced private placement offering (the "Offering") of units ("Units"). In aggregate, the Company issued 1,420,000 Units in the third closing for aggregate gross proceeds of CAD$ 106,500.00.

Each Unit was issued at a price of CAD$0.075 and consists of one common share of the Company (each, a "Common Share") and one common share purchase warrant (each, a "Warrant"). Each Warrant is exercisable for 36 months from the date of issuance to acquire one additional Common Share at an exercise price CAD$0.12.

The Company previously announced on February 5, 2025 a first closing of the Offering of 14,889,999 Units for aggregate gross proceeds of CAD$1,116,749.93 and on February 14, 2025 a second closing of the Offering of 21,439,900 Units for aggregate gross proceeds of CAD$1,607,992.50. In aggregate, the Company has issued 37,749,899 Units for aggregate gross proceeds of $2,831,242.43 to date in the Offering, inclusive of the first closing, second closing and third closing.

As part of the first closing and the second closing, certain insiders of the Company have subscribed for a total of 15,699,999 Units for a total consideration of $1,177,499.93, which constitute "related party transactions" within the meaning of Regulation MI 61-101 respecting Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The transactions will be exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value of any shares issued to, or the consideration paid by, such persons will exceed 25% of the Company's market capitalization.

The Company will pay a cash finder's fee equal to 7.0% of the gross proceeds raised on certain investments in the first closing, second closing and third closing for an aggregate fee of CAD$98,440.73 and will issue 1,292,543 Finder Warrants (as defined below) to eligible finders.

The Units were offered by way of private placement pursuant to exemptions from prospectus requirements and in accordance with National Instrument 45-106 - Prospectus Exemptions. All securities issued in the third closing are subject to a hold period expiring June 29, 2025, in accordance with applicable securities laws and the policies of the TSX Venture Exchange (the "TSXV").

The Company may sell additional Units in the Offering in one or more subsequent closings, on such dates as the Company may determine. Closing of the Offering is subject to certain conditions including, but not limited to, the receipt of all necessary approvals, including acceptance by the TSXV.

The Company may pay certain eligible finders a cash fee of up to 7% of the gross proceeds raised in respect of the Offering from subscribers introduced by such finders to the Company, including for amounts raised in subsequent closings, if any. The Company may also issue to eligible finders such number of finder warrants (each, a "Finder Warrant") equal to 7% of the number of Units sold under the Offering to subscribers introduced by such finders to the Company. The Finder Warrants, to the extent they are issued, shall entitle the holder thereof to acquire one Common Share at a price of $0.075 per Common Share for a period of 36 months from the date of issuance.

The Company intends to use the proceeds from the Offering for ongoing exploration, maintenance and development of the Company's properties and general working capital and corporate purposes.

Additionally, the Company announces that its OTC listing will transition from the OTCQX Best Market to the OTCQB Venture Market, effective March 3, 2025. The transition is required because of OTCQX minimum price requirements. Trading on the OTCQB will continue under the same ticker symbol, ensuring continued accessibility for investors. This transition does not affect the company's listing on other exchanges.

For Further Information, Please Contact:

Bethany Terracina, Vice President Investor Relations

[email protected]

www.reynasilver.com

About Reyna Silver Corp.

Reyna Silver is a growth-oriented junior exploration and development company. Reyna Silver focuses on exploring for high-grade, district-scale silver deposits in Mexico and the United States. In Nevada USA, Reyna Silver has entered into an option to acquire 70% of the 12,058-hectare "Gryphon Summit Project". The Gryphon Project shows features indicating uniquely superimposed/overprinted Silver-Lead-Zinc-Copper Carbonate Replacement (CRD), Carlin Gold and Critical Metals mineralization. Also in Nevada, Reyna Silver is advancing its option to acquire 100% of the "Medicine Springs Project" where Reyna Silver is exploring a potentially significant Silver-Lead-Zinc-Copper CRD-skarn-Porphyry system. Reyna Silver´s Mexican assets are 100% owned and include the "Guigui Project" and "Batopilas Project", both located in Chihuahua State. The Guigui Project covers the interpreted source area for the Santa Eulalia Carbonate Replacement Deposit District and Batopilas covers most of Mexico´s historically highest-grade silver system.

Forward Looking Information

This release may contain forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements may include, without limitation, statements relating to the Offering and the use of proceeds therefrom. The forward-looking statements contained in this press release are expressly qualified in their entirety by this cautionary statement. All forward-looking statements in this press release are made as of the date of this press release. The forward-looking statements contained herein are also subject generally to assumptions and risks and uncertainties that are described from time to time in the Company's public securities filings with the Canadian securities commissions. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward looking statements. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States or any other jurisdiction. No securities may be offered or sold in the United States or in any other jurisdiction in which such offer or sale would be unlawful absent registration under the U.S. Securities Act of 1933 (the "U.S. Securities Act"), as amended, or an exemption therefrom or qualification under the securities laws of such other jurisdiction or an exemption therefrom.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES.

SOURCE: Reyna Silver Corp.

View the original press release on ACCESS Newswire

F.Schneider--AMWN