-

Three dead, many without power after storm lashes France and Spain

Three dead, many without power after storm lashes France and Spain

-

Bennett half-century as Zimbabwe make 169-2 against Australia

-

Asian stocks track Wall St down as traders rethink tech bets

Asian stocks track Wall St down as traders rethink tech bets

-

'Weak by design' African Union gathers for summit

-

Nigerian conservative city turns to online matchmaking for love

Nigerian conservative city turns to online matchmaking for love

-

Serb-zero: the 'iceman' seeking solace in extreme cold

-

LeBron James nabs another NBA milestone with triple-double in Lakers win

LeBron James nabs another NBA milestone with triple-double in Lakers win

-

Hundreds of thousands without power after storm lashes France

-

US Congress impasse over migrant crackdown set to trigger partial shutdown

US Congress impasse over migrant crackdown set to trigger partial shutdown

-

AI's bitter rivalry heads to Washington

-

South Korea hails 'miracle' Choi after teen's landmark Olympic gold

South Korea hails 'miracle' Choi after teen's landmark Olympic gold

-

England seek statement Six Nations win away to Scotland

-

Trent return can help Arbeloa's Real Madrid move forward

Trent return can help Arbeloa's Real Madrid move forward

-

Battling Bremen braced for Bayern onslaught

-

Bangladesh nationalists claim big election win, Islamists cry foul

Bangladesh nationalists claim big election win, Islamists cry foul

-

Tourists empty out of Cuba as US fuel blockade bites

-

Tearful Canadian mother mourns daughter before Carney visits town shaken by killings

Tearful Canadian mother mourns daughter before Carney visits town shaken by killings

-

Italy dream of cricket 'in Rome, Milan and Bologna' after historic win

-

Oscars museum dives into world of Miyazaki's 'Ponyo'

Oscars museum dives into world of Miyazaki's 'Ponyo'

-

Dieng powers Bucks over NBA champion Thunder

-

Japan seizes Chinese fishing vessel, arrests captain

Japan seizes Chinese fishing vessel, arrests captain

-

Bangladesh political heir Tarique Rahman poised for PM

-

Asian stocks track Wall St down but AI shift tempers losses

Asian stocks track Wall St down but AI shift tempers losses

-

Bangladesh's BNP claim 'sweeping' election win

-

Drones, sirens, army posters: How four years of war changed a Russian city

Drones, sirens, army posters: How four years of war changed a Russian city

-

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

-

North Korea warns of 'terrible response' if South sends more drones

North Korea warns of 'terrible response' if South sends more drones

-

NASA crew set for flight to ISS

-

'Punk wellness': China's stressed youth mix traditional medicine and cocktails

'Punk wellness': China's stressed youth mix traditional medicine and cocktails

-

Diplomacy, nukes and parades: what to watch at North Korea's next party congress

-

Arsenal, Man City eye trophy haul, Macclesfield more FA Cup 'miracles'

Arsenal, Man City eye trophy haul, Macclesfield more FA Cup 'miracles'

-

Dreaming of glory at Rio's carnival, far from elite parades

-

Bangladesh's BNP heading for 'sweeping' election win

Bangladesh's BNP heading for 'sweeping' election win

-

Hisatsune grabs Pebble Beach lead with sparkling 62

-

The New Ariane 64 with 4 P120C Boosters Successfully Launches Amazon Leo Satellites

The New Ariane 64 with 4 P120C Boosters Successfully Launches Amazon Leo Satellites

-

What is IRA Eligible Gold? Complete Guide to IRA Approved Metals and Gold IRA Investing Released

-

CelLBxHealth PLC - Aligning Regulatory Approach with Commercial Needs

CelLBxHealth PLC - Aligning Regulatory Approach with Commercial Needs

-

Venezuela amnesty bill postponed amid row over application

-

Barca taught 'lesson' in Atletico drubbing: Flick

Barca taught 'lesson' in Atletico drubbing: Flick

-

Australia's Liberals elect net zero opponent as new leader

-

Arsenal must block out noise in 'rollercoaster' title race: Rice

Arsenal must block out noise in 'rollercoaster' title race: Rice

-

Suns forward Brooks banned one game for technical fouls

-

N. Korea warns of 'terrible response' if more drone incursions from South

N. Korea warns of 'terrible response' if more drone incursions from South

-

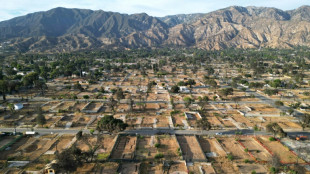

LA fires: California probes late warnings in Black neighborhoods

-

Atletico rout Barca in Copa del Rey semi-final first leg

Atletico rout Barca in Copa del Rey semi-final first leg

-

Arsenal held by Brentford to offer Man City Premier League title hope

-

US snowboard star Kim 'proud' as teenager Choi dethrones her at Olympics

US snowboard star Kim 'proud' as teenager Choi dethrones her at Olympics

-

Chloe Kim misses Olympic milestone, Ukrainian disqualfied over helmet

-

Tech shares pull back ahead of US inflation data

Tech shares pull back ahead of US inflation data

-

'Beer Man' Castellanos released by MLB Phillies

Highlander Silver Closes $32 Million Bought Deal Private Placement

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES.

TORONTO, ON / ACCESS Newswire / March 11, 2025 / Highlander Silver Corp. (CSE:HSLV)("Highlander Silver" or the "Company") is pleased to announce that it has closed its previously announced bought deal private placement, pursuant to which the Company sold 23,000,000 common shares of the Company (the "Shares") at a price of $1.40 per Share for aggregate gross proceeds of $32,200,000, which includes the full exercise of the underwriters' option (the "Offering"). The Offering was conducted by a syndicate of underwriters led by Ventum Financial Corp. (the "Lead Underwriter"), as lead underwriter and sole bookrunner, and including BMO Nesbitt Burns Inc., Haywood Securities Inc., National Bank Financial Inc., Canaccord Genuity Corp., Stifel Nicolaus Canada Inc. and TD Securities Inc. (collectively, the "Underwriters").

Daniel Earle, President and CEO, commented, "We are deeply grateful to close our oversubscribed, upsized offering, with the continued support and investment of the Lundin family. I was delighted to be able to participate in the offering alongside my colleagues and all members of the Board, led by Richard Warke and Jerrold Annett. The strength of this financing supports expanding our community hiring and development plans as we prepare to ramp-up exploration activities at San Luis after the rainy season ends in Central Peru."

The Company intends to use the net proceeds from the Offering to fund the advancement of exploration activities at the Company's San Luis gold-silver project in Peru, as well as for working capital and general corporate purposes. The Shares are subject to a statutory hold period of four months and one day under applicable Canadian securities laws and the Company has entered into a customary lock-up pursuant to which it has agreed not to issue common shares for 120 days without the consent of the Lead Underwriter, subject to limited ordinary-course exceptions. In connection with the Offering, the Underwriters received a cash fee in an amount representing 6.0% of the gross proceeds of the Offering.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

All currency references herein are to Canadian dollar unless otherwise stated.

About Highlander Silver

Highlander Silver is advancing a portfolio of silver exploration and development assets in the Americas, including the bonanza grade San Luis gold-silver project that is located adjacent to the Pierina mine in Central Peru. Highlander Silver is backed by the Augusta Group, which boasts an exceptional track record of value creation totaling over $4.5B in exit transactions, and supported by strategic shareholders, the Lundin family and Eric Sprott. The Company is listed on the Canadian Securities Exchange ("CSE") under the ticker symbol HSLV. Additional information about Highlander Silver and its mineral projects can be viewed on the Company's SEDAR+ profile at (www.sedarplus.ca) and its website at www.highlandersilver.com.

Neither the CSE nor the Canadian Investment Regulatory Organization accepts responsibility for the adequacy or accuracy of this news release.

For further information, please contact:

Arun Lamba, Vice President Corporate Development

Email: [email protected]

Cautionary Notes and Forward-looking Statements

Certain information contained in this news release constitutes "forward-looking information" under Canadian securities legislation. This includes, but is not limited to, information or statements with respect to the Offering, including statements with respect to the completion of the Offering and the anticipated use of the net proceeds therefrom; the future exploration plans of the Company, timing of future exploration, anticipated results of exploration and potential mineralization of the Company's mineral projects. Such forward looking information or statements can be identified by the use of words such as "believes", "plans", "suggests", "targets" or "prospects" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "will" be taken, occur, or be achieved. Forward-looking information involves known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the Company and/or its subsidiaries to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking information. Such factors include, among others, general business, economic, competitive, political and social uncertainties, the actual results of current exploration activities, changes in project parameters as plans continue to be refined, future prices of precious and base metals, accident, labour disputes and other risks of the mining industry, and delays in obtaining governmental approvals or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that could cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking information contained herein are made as of the date of this news release. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change, except as required by applicable securities laws. Accordingly, the reader is cautioned not to place undue reliance on forward-looking information.

SOURCE: Highlander Silver Corp.

View the original press release on ACCESS Newswire

A.Rodriguezv--AMWN