-

Cracknell given Six Nations debut as Wales make changes for France

Cracknell given Six Nations debut as Wales make changes for France

-

L'Oreal shares sink as sales miss forecasts

-

Bangladesh nationalists celebrate landslide win, Islamists cry foul

Bangladesh nationalists celebrate landslide win, Islamists cry foul

-

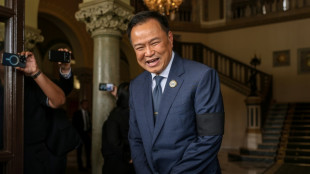

Thai PM agrees coalition with Thaksin-backed party

-

Zimbabwe pull off shock win over Australia at T20 World Cup

Zimbabwe pull off shock win over Australia at T20 World Cup

-

Merz, Macron to address first day of Munich security meet

-

Three dead, many without power after storm lashes France and Spain

Three dead, many without power after storm lashes France and Spain

-

Bennett half-century as Zimbabwe make 169-2 against Australia

-

Asian stocks track Wall St down as traders rethink tech bets

Asian stocks track Wall St down as traders rethink tech bets

-

'Weak by design' African Union gathers for summit

-

Nigerian conservative city turns to online matchmaking for love

Nigerian conservative city turns to online matchmaking for love

-

Serb-zero: the 'iceman' seeking solace in extreme cold

-

LeBron James nabs another NBA milestone with triple-double in Lakers win

LeBron James nabs another NBA milestone with triple-double in Lakers win

-

Hundreds of thousands without power after storm lashes France

-

US Congress impasse over migrant crackdown set to trigger partial shutdown

US Congress impasse over migrant crackdown set to trigger partial shutdown

-

AI's bitter rivalry heads to Washington

-

South Korea hails 'miracle' Choi after teen's landmark Olympic gold

South Korea hails 'miracle' Choi after teen's landmark Olympic gold

-

England seek statement Six Nations win away to Scotland

-

Trent return can help Arbeloa's Real Madrid move forward

Trent return can help Arbeloa's Real Madrid move forward

-

Battling Bremen braced for Bayern onslaught

-

Bangladesh nationalists claim big election win, Islamists cry foul

Bangladesh nationalists claim big election win, Islamists cry foul

-

Tourists empty out of Cuba as US fuel blockade bites

-

Tearful Canadian mother mourns daughter before Carney visits town shaken by killings

Tearful Canadian mother mourns daughter before Carney visits town shaken by killings

-

Italy dream of cricket 'in Rome, Milan and Bologna' after historic win

-

Oscars museum dives into world of Miyazaki's 'Ponyo'

Oscars museum dives into world of Miyazaki's 'Ponyo'

-

Dieng powers Bucks over NBA champion Thunder

-

Japan seizes Chinese fishing vessel, arrests captain

Japan seizes Chinese fishing vessel, arrests captain

-

Bangladesh political heir Tarique Rahman poised for PM

-

Asian stocks track Wall St down but AI shift tempers losses

Asian stocks track Wall St down but AI shift tempers losses

-

Bangladesh's BNP claim 'sweeping' election win

-

Drones, sirens, army posters: How four years of war changed a Russian city

Drones, sirens, army posters: How four years of war changed a Russian city

-

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

-

North Korea warns of 'terrible response' if South sends more drones

North Korea warns of 'terrible response' if South sends more drones

-

NASA crew set for flight to ISS

-

'Punk wellness': China's stressed youth mix traditional medicine and cocktails

'Punk wellness': China's stressed youth mix traditional medicine and cocktails

-

Diplomacy, nukes and parades: what to watch at North Korea's next party congress

-

Arsenal, Man City eye trophy haul, Macclesfield more FA Cup 'miracles'

Arsenal, Man City eye trophy haul, Macclesfield more FA Cup 'miracles'

-

Dreaming of glory at Rio's carnival, far from elite parades

-

Bangladesh's BNP heading for 'sweeping' election win

Bangladesh's BNP heading for 'sweeping' election win

-

Hisatsune grabs Pebble Beach lead with sparkling 62

-

Darrell Kelley and Business Partners to Visit Ghana for Humanitarian Engagement and Exploratory Discussions

Darrell Kelley and Business Partners to Visit Ghana for Humanitarian Engagement and Exploratory Discussions

-

The New Ariane 64 with 4 P120C Boosters Successfully Launches Amazon Leo Satellites

-

What is IRA Eligible Gold? Complete Guide to IRA Approved Metals and Gold IRA Investing Released

What is IRA Eligible Gold? Complete Guide to IRA Approved Metals and Gold IRA Investing Released

-

CelLBxHealth PLC - Aligning Regulatory Approach with Commercial Needs

-

Venezuela amnesty bill postponed amid row over application

Venezuela amnesty bill postponed amid row over application

-

Barca taught 'lesson' in Atletico drubbing: Flick

-

Australia's Liberals elect net zero opponent as new leader

Australia's Liberals elect net zero opponent as new leader

-

Arsenal must block out noise in 'rollercoaster' title race: Rice

-

Suns forward Brooks banned one game for technical fouls

Suns forward Brooks banned one game for technical fouls

-

N. Korea warns of 'terrible response' if more drone incursions from South

American Critical Minerals Announces Trading on the OTCQB

VANCOUVER, BRITISH COLUMBIA / ACCESS Newswire / March 17, 2025 / American Critical Minerals Corp. ("American Critical Minerals" or the "Company") (CSE:KCLI)(OTCQB:APCOF)(Frankfurt:2P3) is pleased to announce that the OTC Markets Group has approved the trading of its common shares on the OTCQB® Venture Market ("OTCQB"). The Company's common shares start trading on the OTCQB under the symbol "APCOF" as of the opening of the market on March 17, 2025.

Uplisting to the OTCQB will provide the Company with additional liquidity, greater awareness and a more seamless trading experience for U.S. shareholders and reflects the fact that the Green River Project is focused on strengthening US Critical Minerals supply chains. The Company's common shares will also continue to trade on the Canadian Securities Exchange ("CSE") under the symbol "KCLI" and the Frankfurt Stock Exchange ("Frankfurt") under the symbol "2P3".

The OTCQB is the premier marketplace for early stage and developing U.S. and international companies including those in the mining and natural resources sectors. Companies listed on the OTCQB are current in their reporting and undergo an annual verification and management certification process. Investors can find real-time quotes and market information for the Company on www.otcmarkets.com.

Simon Clarke, President and CEO stated,"we are delighted to be approved for trading on the OTCQB. It is a key step in our process of increasing awareness about the large-scale potential of the Green River Project in the Paradox Basin, Utah, and its potential to strengthen US Food Security and US Energy Independence. The combination of a very large, high grade Exploration Target for Potash with significant Lithium Bearing Brines underpins the Projects' potential to supply 2 Critical Minerals at a time when the US is prioritizing the need to strengthen such Supply Chains. This approval makes it simpler for existing and future US Investors to trade shares in American Critical Minerals."

About American Critical Minerals' Green River Potash and Lithium Project

The Green River Potash and Lithium Project is situated within Utah's highly productive Paradox Basin, located 20 miles northwest of Moab, Utah and has significant logistical advantages including close proximity to major rail hubs, airport, roads, water, towns and labour markets. It also benefits from close proximity to the agricultural and industrial heartland of America and numerous potential end-users for its products.

The history of oil and gas production across the Paradox Basin provides geologic data from historic wells across the Project, and the wider Basin, validating and de-risking the potential for high grade potash and large amounts of contained lithium. Wells in and around the project reported lithium up to 500 parts per million ("ppm"), bromine up to 6,100 ppm and boron up to 1,260 ppm (Gilbride & Santos, 2012). This data is reinforced by nearby potash production and the advanced stage of neighbouring lithium projects. The Paradox Basin is believed to contain up to 56 billion tonnes of lithium brines, potentially the largest such resource in US.

The Company holds a 100% interest in eleven State of Utah (SITLA) mineral and minerals salt leases covering approximately 7,050 acres, 1,094 federal lithium brine claims (BLM Placer Claims) covering 21,150 acres, and 11 federal (BLM) potash prospecting permits covering approximately 25,480 acres. Through these leases, permits and claims the Company has the ability to explore for potash, lithium and potential by-products across the entire Green River Project (approx. 32,530 acres). The Company is authorized to drill a total of 7exploratory drill holes across the Project (pending bonding the recently approved 4 drill holes).

Intrepid Potash Inc. (IPI) is America's largest potash company and only U.S. domestic potash producer and currently produces potash from its nearby Moab Solution Mine, which the Company believes provides strong evidence of stratigraphic continuity within this part of the Paradox Basin (www.intrepidpotash.com). Anson Resources Ltd. (ASN) has advanced lithium development projects contiguous to the northern boundary of our Green River Project and neighbouring to the south. Anson has a large initial resource, robust definitive feasibility study and has commenced piloting operations through its partnership with Koch Technology Solutions ("KTS"), as well as an offtake agreement with LG Energy Solution. The Anson exploration targets encompasses the combined Mississippian Leadville Formation and the Pennsylvanian Paradox Formation brine-bearing clastic layers, which also underlie American Critical Minerals' entire project area. (www.ansonresources.com).

In 2022, the U.S. imported approx. 96.5% of its annual potash requirements with domestic producers receiving a higher sales price due to proximity to market (intrepidpotash.com/ August 15, 2024, Investor Presentation). In March 2024, the US Senate introduced a Bill to include key fertilizers and potash on the US Department of Interior list of Critical Minerals which already includes lithium. Recent market estimates suggest that the global potash market is over US$50 billion annually and growing at a compound annual growth rate ("CAGR") of close to 5%. Lithium demand is now estimated to be over 1 million tonnes globally and growing at close to a 20% CAGR.

Qualified Person

The Technical content of this news release has been reviewed and approved by Dean Besserer, P.Geo., the Chief Operations Officer ("COO") of the Company and a qualified person for the purposes of NI 43-101.

On behalf of the Board of Directors

Simon Clarke, President & CEO

Contact: (604)-551-9665

*Agapito Associates Inc. Technical report (October 2012) quantifies the Green River Potash Project's potash exploration potential in the form of a NI 43-101 Exploration Target. The Exploration Target estimate was prepared in accordance with the National Instrument 43-101 -Standards of Disclosure for Mineral Projects ("NI 43-101"). It should be noted that Exploration Targets are conceptual in nature and there has been insufficient exploration to define them as Mineral Resources, and, while reasonable potential may exist, it is uncertain whether further exploration will result in the determination of a Mineral Resource under NI 43-101. The Exploration Target stated in the Agapito Report is not being reported as part of any Mineral Resource or Mineral Reserve

**United States Geological Survey, Mineral Commodity Summaries, January 2024 (https://pubs.usgs.gov/periodicals/mcs2024/mcs2024-potash.pdf).

Cautionary Statements Regarding Forward Looking Information

This news release contains forward-looking information within the meaning of applicable securities legislation. Forward-looking information is typically identified by words such as: believe, uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Important factors that could cause actual results to differ from this forward-looking information include those described under the heading "Risks and Uncertainties" in the Company's most recently filed MD&A. The Company does not intend, and expressly disclaims any obligation to, update or revise the forward-looking information contained in this news release, except as required by law. Readers are cautioned not to place undue reliance on forward-looking expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. Such statements include, without limitation, statements regarding future confirmation drilling and its intended outcomes and the intended use of proceeds from the oversubscribed financing. Although the Company believes that such statements are reasonable, it can give no assurances that such expectations will prove to be correct. All such forward-looking information is based on certain assumptions and analyses made by the Company in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. This information, however, is subject to a variety of risks and information.

SOURCE: American Critical Minerals Corp.

View the original press release on ACCESS Newswire

Ch.Kahalev--AMWN