-

Russia, Ukraine to hold talks in Geneva on February 17-18

Russia, Ukraine to hold talks in Geneva on February 17-18

-

Ukraine's Heraskevych hopes 'truth will prevail' in Olympics appeal

-

Dumplings and work stress as Chinese rush home for Lunar New Year

Dumplings and work stress as Chinese rush home for Lunar New Year

-

Macron denounces 'antisemitic hydra' as he honours 2006 Jewish murder victim

-

India-Pakistan: Hottest ticket in cricket sparks T20 World Cup fever

India-Pakistan: Hottest ticket in cricket sparks T20 World Cup fever

-

Cross-country king Klaebo equals Winter Olympics record with eighth gold

-

Ukraine's Heraskevych appeals to CAS over Olympic ban as Malinin eyes second gold

Ukraine's Heraskevych appeals to CAS over Olympic ban as Malinin eyes second gold

-

Stocks mostly drop after Wall Street slide

-

Sophie Adenot, the second French woman to fly to space

Sophie Adenot, the second French woman to fly to space

-

Alleged rape victim of Norway princess's son says she took sleeping pills

-

Activist group Palestine Action wins legal challenge against UK ban

Activist group Palestine Action wins legal challenge against UK ban

-

Driven by Dhoni, Pakistan's X-factor tweaker Tariq targets India

-

Davidson set to make history as Ireland seek to rebound against Italy

Davidson set to make history as Ireland seek to rebound against Italy

-

Europe defends NATO, US ties at security gathering

-

China's fireworks heartland faces fizzling Lunar New Year sales

China's fireworks heartland faces fizzling Lunar New Year sales

-

Bangladesh's Yunus 'banker to the poor', pushing democratic reform

-

Cracknell given Six Nations debut as Wales make changes for France

Cracknell given Six Nations debut as Wales make changes for France

-

L'Oreal shares sink as sales miss forecasts

-

Bangladesh nationalists celebrate landslide win, Islamists cry foul

Bangladesh nationalists celebrate landslide win, Islamists cry foul

-

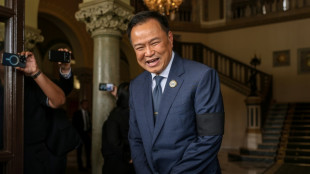

Thai PM agrees coalition with Thaksin-backed party

-

Zimbabwe pull off shock win over Australia at T20 World Cup

Zimbabwe pull off shock win over Australia at T20 World Cup

-

Merz, Macron to address first day of Munich security meet

-

Three dead, many without power after storm lashes France and Spain

Three dead, many without power after storm lashes France and Spain

-

Bennett half-century as Zimbabwe make 169-2 against Australia

-

Asian stocks track Wall St down as traders rethink tech bets

Asian stocks track Wall St down as traders rethink tech bets

-

'Weak by design' African Union gathers for summit

-

Nigerian conservative city turns to online matchmaking for love

Nigerian conservative city turns to online matchmaking for love

-

Serb-zero: the 'iceman' seeking solace in extreme cold

-

LeBron James nabs another NBA milestone with triple-double in Lakers win

LeBron James nabs another NBA milestone with triple-double in Lakers win

-

Hundreds of thousands without power after storm lashes France

-

US Congress impasse over migrant crackdown set to trigger partial shutdown

US Congress impasse over migrant crackdown set to trigger partial shutdown

-

AI's bitter rivalry heads to Washington

-

South Korea hails 'miracle' Choi after teen's landmark Olympic gold

South Korea hails 'miracle' Choi after teen's landmark Olympic gold

-

England seek statement Six Nations win away to Scotland

-

Trent return can help Arbeloa's Real Madrid move forward

Trent return can help Arbeloa's Real Madrid move forward

-

Battling Bremen braced for Bayern onslaught

-

Bangladesh nationalists claim big election win, Islamists cry foul

Bangladesh nationalists claim big election win, Islamists cry foul

-

Tourists empty out of Cuba as US fuel blockade bites

-

Tearful Canadian mother mourns daughter before Carney visits town shaken by killings

Tearful Canadian mother mourns daughter before Carney visits town shaken by killings

-

Italy dream of cricket 'in Rome, Milan and Bologna' after historic win

-

Oscars museum dives into world of Miyazaki's 'Ponyo'

Oscars museum dives into world of Miyazaki's 'Ponyo'

-

Dieng powers Bucks over NBA champion Thunder

-

Japan seizes Chinese fishing vessel, arrests captain

Japan seizes Chinese fishing vessel, arrests captain

-

Bangladesh political heir Tarique Rahman poised for PM

-

Asian stocks track Wall St down but AI shift tempers losses

Asian stocks track Wall St down but AI shift tempers losses

-

Bangladesh's BNP claim 'sweeping' election win

-

Drones, sirens, army posters: How four years of war changed a Russian city

Drones, sirens, army posters: How four years of war changed a Russian city

-

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

-

North Korea warns of 'terrible response' if South sends more drones

North Korea warns of 'terrible response' if South sends more drones

-

NASA crew set for flight to ISS

Heramba Electric plc Announces Receipt of Notice from Nasdaq Regarding the Minimum Market Value Requirement

DÜSSELDORF, GERMANY AND ATLANTA, GA / ACCESS Newswire / March 25, 2025 / As previously disclosed, and pursuant to the terms and conditions set forth in the Share Purchase Agreement, dated as of July 25 and 26, 2023, by and among Heramba GmbH ("Heramba"), Heramba Holdings, Inc. ("Heramba Holdings"), Knorr-Bremse Systeme für Schienenfahrzeuge GmbH ("KB GmbH") and Knorr-Brake Holding Corporation ("KB US"), as amended pursuant to the Amendment Agreement to Share Purchase Agreement, dated as of January 31, 2024, on February 6, 2024, (i) KB GmbH, as sole shareholder of Kiepe Electric GmbH, sold and transferred 85% of the equity interests in Kiepe GmbH, as well as certain receivables and shareholder loans, to Heramba, and (ii) KB US, as the sole member of Kiepe Electric LLC ("Kiepe US" and together with Kiepe GmbH, "Kiepe"), sold and transferred all ownership interests in Kiepe US, as well as certain receivables, to Heramba Holdings.

As previously disclosed, and pursuant to the terms and conditions set forth in the Business Combination Agreement, dated as of October 2, 2023, by and among Project Energy Reimagined Acquisition Corp., Heramba Electric plc, Heramba Merger Corp., Heramba Limited and Heramba, effective as of July 26, 2024, the business combination contemplated by the Business Combination Agreement was consummated resulting in, among other matters, each of Heramba, Heramba Holdings, Kiepe GmbH and Kiepe US becoming direct or indirect subsidiaries of the Company.

As previously disclosed, on January 9, 2025, Heramba received letters (the "Demand Letters") from KB GmbH demanding payment of certain funds allegedly owed under the Share Purchase Agreement, totaling approximately EUR 24,855,000 in the aggregate plus applicable default interest (collectively, the "Demanded Amounts"). Heramba and the Company subsequently delivered response letters to contest the Demanded Amounts and propose further discussions; however, no resolution was reached.

As previously disclosed, on January 30, 2025, as a consequence of the outstanding Demanded Amounts and in accordance with certain obligations under applicable German insolvency law, the managing director of Heramba determined that Heramba was currently unable to pay its existing liabilities due and may also be overindebted. Following such determination and upon authorization by the Company as sole shareholder of Heramba, on January 30, 2025, the managing director of Heramba filed for the opening of ordinary insolvency proceedings over the assets of Heramba (the "Insolvency Filing") with the local court of Düsseldorf in Germany (the "Court").

As previously disclosed, on March 17, 2025, Heramba received a delinquency notification letter from the Listing Qualifications Department of The Nasdaq Stock Market LLC, indicating that the Company is not currently in compliance with the minimum bid price requirement set forth in Nasdaq's Listing Rules for continued listing on the Nasdaq Capital Market as the closing bid price for the Company's ordinary shares was below $1.00 per share for 30 consecutive business days. The Company has until September 8, 2025, to regain compliance with the minimum bid price requirement.

Heramba Electric plc (NASDAQ:PITA) ("Heramba Electric" or the "Company"), today announced that on March 19, 2025, it received a notification letter (the "Notice") from the Listing Qualifications Department of the Nasdaq Stock Market LLC ("Nasdaq"), indicating that the Company is currently not in compliance with the minimum Market Value of Listed Securities (MVLS) of $35 million set forth in Nasdaq's Listing Rules.

Nasdaq Listing Rule 5550(b)(2) MVLS requires listed securities to maintain a minimum Market Value of $35 million, and Nasdaq Listing Rule 5810(c)(3)(C) provides that require a Company to satisfy the applicable Price-based Requirement for a period in excess of ten consecutive business days, but generally no more than 20 consecutive business days, before determining that the Company has demonstrated an ability to maintain long-term compliance.

The Rules provide the Company a compliance period of 180 calendar days in which to regain compliance. If at anytime during this compliance period the Company's MVLS closes at $35 million or more for a minimum of ten consecutive business days, written confirmation of compliance will be send to the Company and this matter will be closed.

In the event that the Company does not regain compliance by September 17, 2025, the Company may be eligible for additional time to regain compliance. If the Company cannot demonstrate compliance by the allotted compliance period(s), Nasdaq's staff will notify the Company that its ordinary shares are subject to delisting.

Contact information: Michele Molinari, CEO, [email protected]

SOURCE: Heramba Electric plc

View the original press release on ACCESS Newswire

P.Martin--AMWN