-

Australian museum recovers Egyptian artefacts after break-in

Australian museum recovers Egyptian artefacts after break-in

-

India forced to defend US trade deal as doubts mount

-

Bitter pill: Taliban govt shakes up Afghan medicine market

Bitter pill: Taliban govt shakes up Afghan medicine market

-

Crunch time for Real Madrid's Mbappe-Vinicius partnership

-

Rio Carnival parades kick off with divisive ode to Lula in election year

Rio Carnival parades kick off with divisive ode to Lula in election year

-

Nepal 'addicted' to the trade in its own people

-

Asian markets sluggish as Lunar New Year holiday looms

Asian markets sluggish as Lunar New Year holiday looms

-

'Pure extortion': foreign workers face violence and exploitation in Croatia

-

Nepal launches campaigns for first post-uprising polls

Nepal launches campaigns for first post-uprising polls

-

What to know as South Korea ex-president Yoon faces insurrection verdict

-

'Train Dreams,' 'The Secret Agent' nab Spirit wins to boost Oscars campaigns

'Train Dreams,' 'The Secret Agent' nab Spirit wins to boost Oscars campaigns

-

Rubio visits Trump's 'friend' Orban ahead of Hungary polls

-

Kim unveils housing block for North Korean troops killed aiding Russia: KCNA

Kim unveils housing block for North Korean troops killed aiding Russia: KCNA

-

Accused Bondi killer Naveed Akram appears in court by video link

-

Art and the deal: market slump pushes galleries to the Gulf

Art and the deal: market slump pushes galleries to the Gulf

-

Job threats, rogue bots: five hot issues in AI

-

India hosts AI summit as safety concerns grow

India hosts AI summit as safety concerns grow

-

'Make America Healthy' movement takes on Big Ag, in break with Republicans

-

Tech is thriving in New York. So are the rents

Tech is thriving in New York. So are the rents

-

Young USA Stars beat Stripes in NBA All-Star tourney final

-

New anti-government chants in Tehran after giant rallies abroad: reports

New anti-government chants in Tehran after giant rallies abroad: reports

-

'The Secret Agent' nabs Spirit Awards win in boost to Oscars campaign

-

Brignone wins second Milan-Cortina gold as Klaebo claims record ninth Olympic crown

Brignone wins second Milan-Cortina gold as Klaebo claims record ninth Olympic crown

-

Morikawa wins at Pebble Beach despite Scheffler heroics

-

Germany's Hase and Volodin tango to Olympic pairs figure skating lead

Germany's Hase and Volodin tango to Olympic pairs figure skating lead

-

Rayo thrash Atletico who 'deserved to lose' as Betis cut gap

-

Napoli salvage point after Malen twice puts Roma ahead

Napoli salvage point after Malen twice puts Roma ahead

-

Lyon down Nice to boost Ligue 1 title bid with 13th straight win

-

LeBron still unclear on NBA future: 'I have no idea'

LeBron still unclear on NBA future: 'I have no idea'

-

Shelton battles back from brink to beat Fritz, take Dallas crown

-

Great Britain celebrate best-ever Winter Olympics

Great Britain celebrate best-ever Winter Olympics

-

Brignone wins second Milan-Cortina gold as Klaebo claims record ninth

-

Arteta concerned over Arsenal's mounting injury list

Arteta concerned over Arsenal's mounting injury list

-

In fuel-starved Cuba, the e-tricycle is king

-

Shaidorov still spinning after outshining Malinin for Olympic gold

Shaidorov still spinning after outshining Malinin for Olympic gold

-

Late Gruda goal grabs Leipzig draw versus Wolfsburg

-

'Ultra-left' blamed for youth's killing that shocked France

'Ultra-left' blamed for youth's killing that shocked France

-

Canada wrap up perfect Olympic ice hockey preliminary campaign

-

Historical queer film 'Rose' shown at Berlin with call to action

Historical queer film 'Rose' shown at Berlin with call to action

-

Wales' Tandy tips hat to France after Six Nations hammering

-

Quadruple chasing Arsenal rout Wigan to reach FA Cup fifth round

Quadruple chasing Arsenal rout Wigan to reach FA Cup fifth round

-

2026 S-Class starry facelift

-

What they said as India beat Pakistan at T20 World Cup - reaction

What they said as India beat Pakistan at T20 World Cup - reaction

-

Away-day blues: England count cost of Scotland Six Nations defeat

-

'Wuthering Heights' debuts atop North America box office

'Wuthering Heights' debuts atop North America box office

-

Rayo thrash Atletico who 'deserved to lose'

-

Kok beats Leerdam in Olympic rematch of Dutch speed skaters

Kok beats Leerdam in Olympic rematch of Dutch speed skaters

-

India rout bitter rivals Pakistan by 61 runs at T20 World Cup

-

France run rampant to thrash sorry Wales 54-12 in Six Nations

France run rampant to thrash sorry Wales 54-12 in Six Nations

-

Rio to kick off Carnival parade with ode to Lula in election year

Mako Mining Reports Second Quarter 2025 Financial Results, Including Record Adjusted EBITDA of US$21.3 million, a Record Increase In Cash of US$18.2 million and EPS of US$0.11/share from 11,476 oz Gold Sold at US$3,323/oz

VANCOUVER, BRITISH COLUMBIA / ACCESS Newswire / August 22, 2025 / Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide financial results for the three and six months ended June 30, 2025 ("Q2 2025"). All dollar amounts referred to herein are expressed in United States dollars unless otherwise stated.

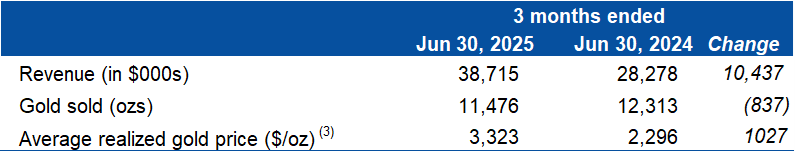

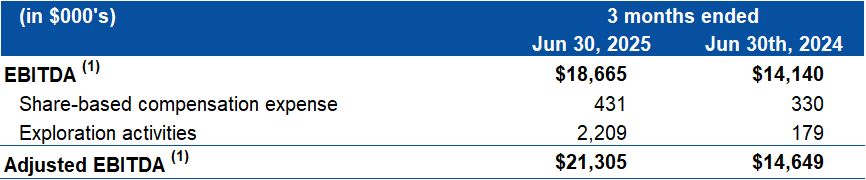

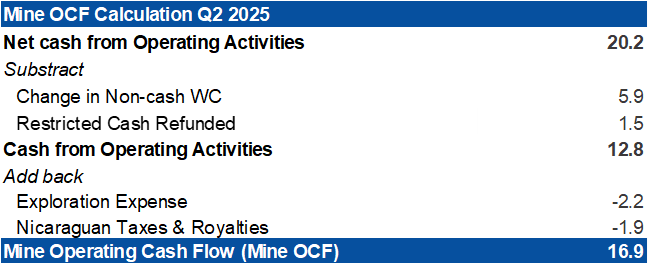

The Company's financial results for Q2 2025 reflect record gold sales from its San Albino and Moss Mine of $38.7 million (vs. $28.3 million in Q2 2024), which generated $16.9 million in Mine Operating Cash Flow (1) (4), $21.3 million in Adjusted EBITDA(1), and $8.8 million in Net Income. The Company sold 11,476 oz of gold at an average price of $3,323/oz with a $1,509 Cash Cost and $1,668 All-In Sustaining Cost ("AISC") ($/oz sold). (1) (2)

Q2 2025 Mako Mining Highlights

Financial

$38.7 million in Revenue

$16.9 million in Mine Operating Cash Flow ("MineOCF") (1) (4)

$21.3 million in Adjusted EBITDA (1)

$18.2 million increase in cash

$8.8 million Net Income

$1,509 Cash Costs ($/oz sold) (1) (2)

$1,668 All-In Sustaining Costs ("AISC") ($/oz sold) (1) (2)

Twelve Trailing Months ("TTM") Return on Equity ("ROE") (1) of 33.9% and Return on Assets ("ROA") of 23.5% (1)

Delivered final installment of 13,500 oz of silver in Q2 2025 to the Sailfish Silver Loan

Growth

$2.2 million in exploration and evaluation expenses ($0.4 million San Albino and Las Conchitas, $0.5 million exploration in El Jicaro Concession in Nicaragua and, approximately, $1.1 million at Eagle Mountain, Guyana)

Subsequent to June 30th, 2025

The Company made interest payments of $0.3 million on the Revised Wexford Loan.

On July 2, 2025, the Company acquired for $1.8 million the secured indebtedness of Elevation Gold Mining Corporation from Maverix Metals Inc. under Elevation's ongoing CCAA proceedings As principal secured creditor, Mako is now entitled to distributions under the CCAA process, though expected recoveries will be significantly below the debt's face value.

Akiba Leisman, Chief Executive Officer, states that "Q2 was another strong quarter for Mako, with record Adjusted EBITDA of US$21.3 million, a record increase in cash of US$18.2 million, and EPS of US$0.11/share while generating industry leading ROE and ROA of 33.9% and 23.5%, despite only having one of our three assets in commercial production. We sold a total of 11,476 ounces for the quarter, and 22,293 ounces for the first half of 2025, of which 19,985 ounces were attributable to San Albino. The second half of 2025 will have similar production rates for San Albino, weighted towards Q4 2025, which is currently scheduled to be a record for the Company. Additionally, mining will recommence at Moss at the end of August now that previously delayed equipment from our mining contractor has started to arrive at site. Therefore, the second half of 2025 will be heavily weighted towards Q4. Meanwhile, we continue to advance the Eagle Mountain project in Guyana so that we can submit our Environmental Impact Assessment early in Q1 2025 in preparation for a construction decision."

Table 1 - Revenue Mako Mining Corp.

Table 2 - Operating San Albino and Financial Data Mako Mining Corp.

Table 3 - EBITDA Reconciliation

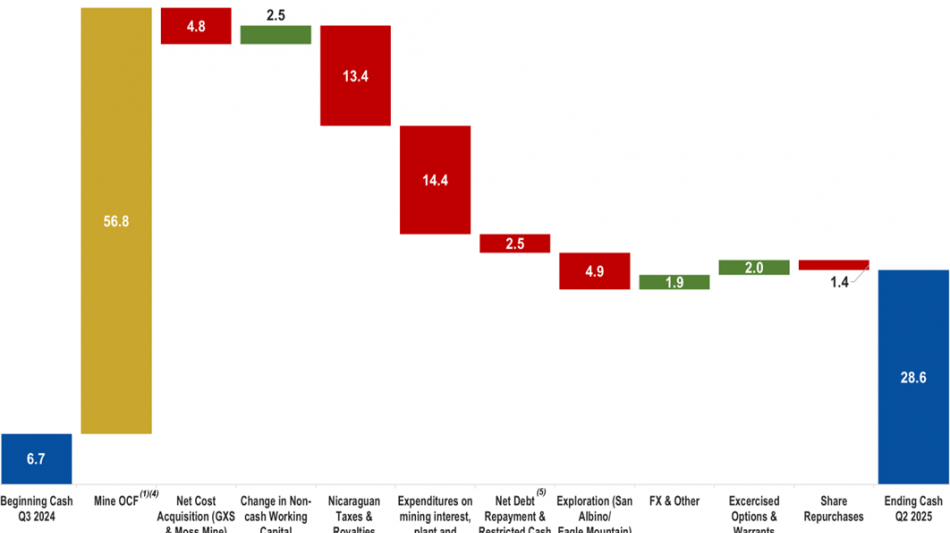

Chart 1

Q2 2025 - Mine OCF Calculation and Cash Reconciliation (in $ million)

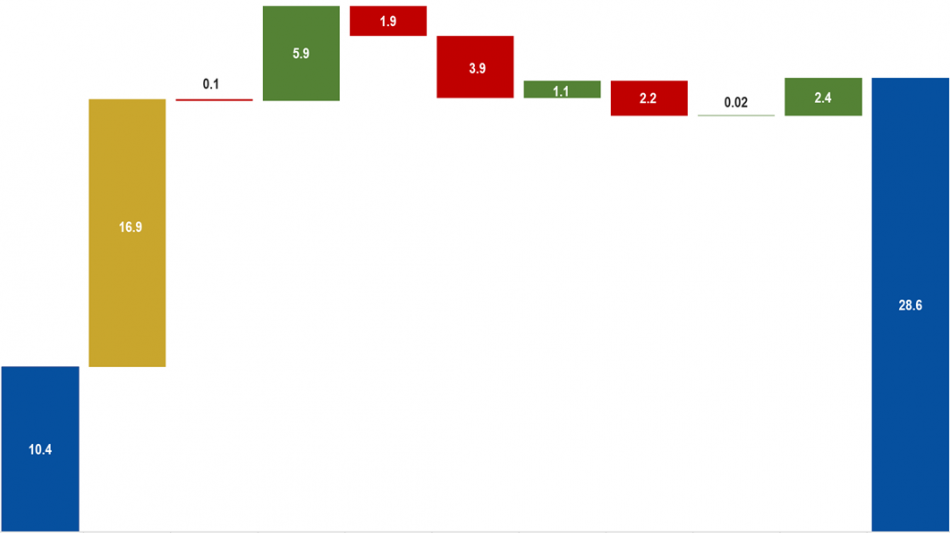

Chart 2

Twelve Trailing Months (TTM) - Mine OCF Calculation and Cash Reconciliation (in $ million)

End Notes

Refers to a Non-GAAP financial measure within the meaning of National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure ("NI 52-112"). Refer to information under the heading "Non-GAAP Measures" as well as the reconciliations later in this press release.

Refers to a Non-GAAP ratio within the meaning of NI-52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

Realized price before deductions from Sailfish gold streaming agreement.

Refer to "Chart 1 & 2 - Mine OCF Calculation and Cash Reconciliation (in $ millions)" for a reconciliation of the beginning and ending cash position of the Company, including OCF.

Includes Repayment Silver Loan, Wexford Loan, Wexford Bridge Loan related to Goldsource Acquisition, other lease payments and a release of US$1.5 million from Trisura Guarantee insurance Company held as collateral for various environmental bonds held at the Moss Mine

For complete details, please refer to condensed interim consolidated financial statements and the associated management discussion and analysis for the three and six months ended June 30, 2025, available on SEDAR+ (www.sedarplus.ca) or on the Company's website (www.makominingcorp.com).

Non-GAAP Measures

The Company has included certain non-GAAP financial measures and non-GAAP ratios in this press release such as EBITDA, Adjusted EBITDA, Mine Operating Cash Flow cash cost per ounce sold, total cash cost per ounce sold, AISC per ounce sold. These non-GAAP measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. In the gold mining industry, these are commonly used performance measures and ratios, but do not have any standardized meaning prescribed under IFRS and therefore may not be comparable to other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's underlying performance of its core operations and its ability to generate cash flow.

"EBITDA" represents earnings before interest (including non-cash accretion of financial obligation and lease obligations), income taxes and depreciation, depletion and amortization.

"Adjusted EBITDA" represents EBITDA, adjusted to exclude exploration activities, share-based compensation and change in provision for reclamation and rehabilitation.

"Cash costs per ounce sold" is calculated by deducting revenues from silver sales and dividing the sum of mining, milling and mine site administration cost.

"AISC per ounce sold" includes total cash costs (as defined above) and adds the sum of G&A, sustaining capital and certain exploration and evaluation ("E&E") costs, sustaining lease payments, provision for environmental fees, if applicable, and rehabilitation costs paid, all divided by the number of ounces sold. As this measure seeks to reflect the full cost of gold production from current operations, capital and E&E costs related to expansion or growth projects are not included in the calculation of AISC per ounce. Additionally, certain other cash expenditures, including income and other tax payments, financing costs and debt repayments, are not included in AISC per ounce.

"Mine OCF" represents operating cash flow, excluding Nicaraguan taxes and royalties, changes in non-cash working capital and exploration expense

"ROE" is calculated by dividing the twelve trailing months Net Income by the average shareholder's equity. The average shareholder's equity is calculated by adding the total equity at the end of the period to the total equity at the beginning of the period and dividing by two.

"ROA" is calculated by dividing the twelve trailing months Net Income by the average total assets. The average total assets is calculated by adding the total assets at the end of the period to the total assets at the beginning of the period and dividing by two.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally and offers district-scale exploration potential. In addition, Mako also owns the Moss Mine in Arizona, an open pit gold mine in northwestern Arizona. Mako also holds a 100% interest in the Eagle Mountain Project in Guyana, South America, currently in the PEA-stage and undergoing engineering, environmental studies and mine permitting.

For further information on Mako Mining Corp., contact Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: [email protected] or visit our website at www.makominingcorp.com and the Company's profile on the SEDAR+ website at www.sedarplus.ca.

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation, management's expectation that the Moss mine will be a substantial cash flowing mine when full scale mining operations begin in September 2025 and the expectation that 2025 will show the results from the work performed by the Company in 2024. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company's exploration and development plans and growth parameters and its ability to fund its growth to reach its expected new record production numbers; unanticipated costs; the October 24, 2022 measures having impacts on business operations not currently expected, or new sanctions being imposed by the U.S. Treasury Department or other government entity in Nicaragua in the future; and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR+ at www.sedarplus.ca. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with information regarding the Company's Q2 2025 and full year 2024 financial results and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original press release on ACCESS Newswire

O.Norris--AMWN