-

ByteDance vows to boost safeguards after AI model infringement claims

ByteDance vows to boost safeguards after AI model infringement claims

-

Smith added to Australia T20 squad, in line for Sri Lanka crunch

-

Australian museum recovers Egyptian artefacts after break-in

Australian museum recovers Egyptian artefacts after break-in

-

India forced to defend US trade deal as doubts mount

-

Bitter pill: Taliban govt shakes up Afghan medicine market

Bitter pill: Taliban govt shakes up Afghan medicine market

-

Crunch time for Real Madrid's Mbappe-Vinicius partnership

-

Rio Carnival parades kick off with divisive ode to Lula in election year

Rio Carnival parades kick off with divisive ode to Lula in election year

-

Nepal 'addicted' to the trade in its own people

-

Asian markets sluggish as Lunar New Year holiday looms

Asian markets sluggish as Lunar New Year holiday looms

-

'Pure extortion': foreign workers face violence and exploitation in Croatia

-

Nepal launches campaigns for first post-uprising polls

Nepal launches campaigns for first post-uprising polls

-

What to know as South Korea ex-president Yoon faces insurrection verdict

-

'Train Dreams,' 'The Secret Agent' nab Spirit wins to boost Oscars campaigns

'Train Dreams,' 'The Secret Agent' nab Spirit wins to boost Oscars campaigns

-

Rubio visits Trump's 'friend' Orban ahead of Hungary polls

-

Kim unveils housing block for North Korean troops killed aiding Russia: KCNA

Kim unveils housing block for North Korean troops killed aiding Russia: KCNA

-

Accused Bondi killer Naveed Akram appears in court by video link

-

Art and the deal: market slump pushes galleries to the Gulf

Art and the deal: market slump pushes galleries to the Gulf

-

Job threats, rogue bots: five hot issues in AI

-

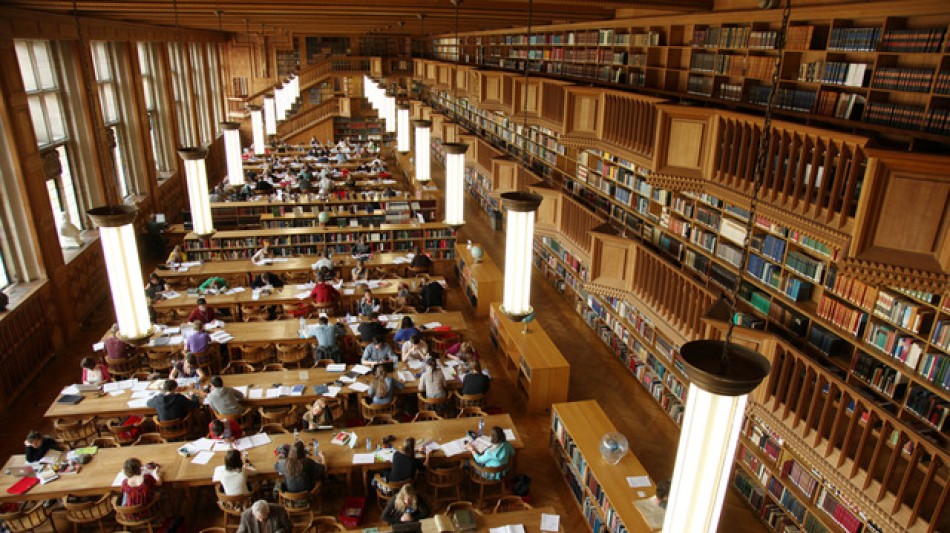

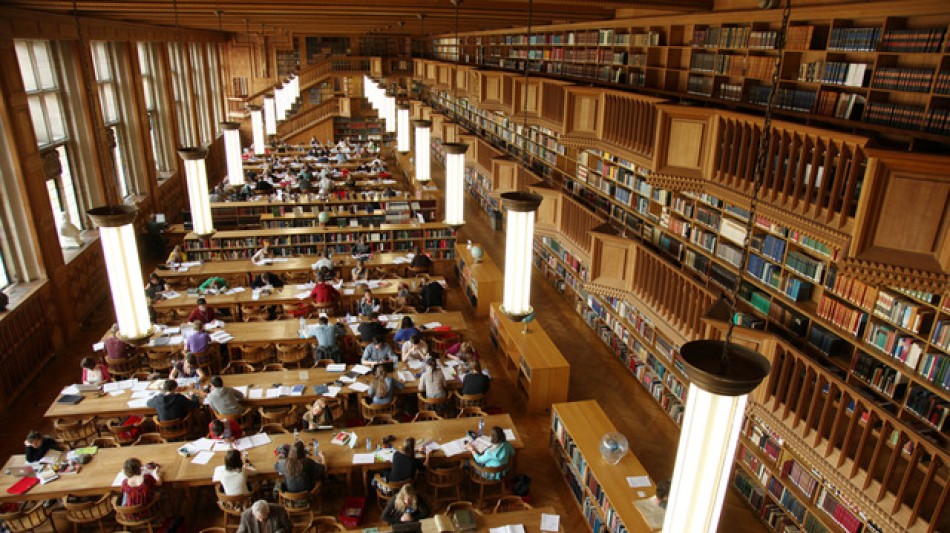

India hosts AI summit as safety concerns grow

India hosts AI summit as safety concerns grow

-

'Make America Healthy' movement takes on Big Ag, in break with Republicans

-

Tech is thriving in New York. So are the rents

Tech is thriving in New York. So are the rents

-

Young USA Stars beat Stripes in NBA All-Star tourney final

-

New anti-government chants in Tehran after giant rallies abroad: reports

New anti-government chants in Tehran after giant rallies abroad: reports

-

'The Secret Agent' nabs Spirit Awards win in boost to Oscars campaign

-

Pantheon Resources PLC Announces AGM Arrangements & Corporate Update

Pantheon Resources PLC Announces AGM Arrangements & Corporate Update

-

Brignone wins second Milan-Cortina gold as Klaebo claims record ninth Olympic crown

-

Morikawa wins at Pebble Beach despite Scheffler heroics

Morikawa wins at Pebble Beach despite Scheffler heroics

-

Germany's Hase and Volodin tango to Olympic pairs figure skating lead

-

Rayo thrash Atletico who 'deserved to lose' as Betis cut gap

Rayo thrash Atletico who 'deserved to lose' as Betis cut gap

-

Napoli salvage point after Malen twice puts Roma ahead

-

Lyon down Nice to boost Ligue 1 title bid with 13th straight win

Lyon down Nice to boost Ligue 1 title bid with 13th straight win

-

LeBron still unclear on NBA future: 'I have no idea'

-

Shelton battles back from brink to beat Fritz, take Dallas crown

Shelton battles back from brink to beat Fritz, take Dallas crown

-

Great Britain celebrate best-ever Winter Olympics

-

Brignone wins second Milan-Cortina gold as Klaebo claims record ninth

Brignone wins second Milan-Cortina gold as Klaebo claims record ninth

-

Arteta concerned over Arsenal's mounting injury list

-

In fuel-starved Cuba, the e-tricycle is king

In fuel-starved Cuba, the e-tricycle is king

-

Shaidorov still spinning after outshining Malinin for Olympic gold

-

Late Gruda goal grabs Leipzig draw versus Wolfsburg

Late Gruda goal grabs Leipzig draw versus Wolfsburg

-

'Ultra-left' blamed for youth's killing that shocked France

-

Canada wrap up perfect Olympic ice hockey preliminary campaign

Canada wrap up perfect Olympic ice hockey preliminary campaign

-

Historical queer film 'Rose' shown at Berlin with call to action

-

Wales' Tandy tips hat to France after Six Nations hammering

Wales' Tandy tips hat to France after Six Nations hammering

-

Quadruple chasing Arsenal rout Wigan to reach FA Cup fifth round

-

2026 S-Class starry facelift

2026 S-Class starry facelift

-

What they said as India beat Pakistan at T20 World Cup - reaction

-

Away-day blues: England count cost of Scotland Six Nations defeat

Away-day blues: England count cost of Scotland Six Nations defeat

-

'Wuthering Heights' debuts atop North America box office

-

Rayo thrash Atletico who 'deserved to lose'

Rayo thrash Atletico who 'deserved to lose'

-

Kok beats Leerdam in Olympic rematch of Dutch speed skaters

Metallic Minerals Announces Closing of Final Private Placement Financing

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC / ACCESS Newswire / August 26, 2025 / Metallic Minerals Corp. (TSX.V:MMG)(OTCQB:MMNGF)(FSE:9MM1)("Metallic Minerals" or the "Company") is pleased to announce the closing of its flow-through share offering of 4,800,000 common shares (the "Flow-Through Shares") at a price of $0.27 per Flow-Through Share for gross proceeds of approximately $1.3 million (the "Flow-Through Offering"). The Flow-Through Offering follows the previously closed brokered and non-brokered offerings on July 30, 2025 and August 25, 2025 for aggregate total gross proceeds of $8 million.

Proceeds from the Flow-Through Offering are intended to be used towards eligible Canadian Exploration Expenses, within the meaning of the Income Tax Act of Canada, at the Company's high-grade Keno Silver project adjacent to Hecla Mining's Keno Hill Silver operations, and the company's Klondike Gold Alluvial Royalty portfolio in Canada's Yukon Territory.

Greg Johnson, Chairman and CEO of Metallic Minerals commented, "We are excited to have completed these financings totaling $8 million with strong participation from our existing shareholders and strategic investors, including Newmont Corporation, and many new investors whom we welcome to our register. The full participation of our board and management underscores our collective confidence in the Company's path forward. This funding provides the capital to advance our cornerstone La Plata copper-silver-gold-PGE project and Keno Silver project at a time of strengthening fundamentals and strategic importance of these critical metals, while continuing to build out production on our gold royalty portfolio. With gold, silver and copper at or near record levels, and large-cap producers trading at multi-year highs, we see an exceptional opportunity for venture-stage companies such as Metallic Minerals to deliver outsized returns and compelling leverage to the emerging bull market in U.S. and Canadian critical minerals. We are diligently advancing our active programs, which are designed to deliver multiple milestones and create significant shareholder value in the year ahead."

The Flow-Through Shares will be subject to a holding period of four months and one day from the date of issuance. Finders' fees of $48,000 were payable to Cormark Securities Inc. and Canaccord Genuity Corp. on a portion of the Flow-Through Offering. The Flow-Through Offering remains subject to the final acceptance of the TSX-V.

The Flow-Through Shares have not been, and will not be, registered under the U.S. Securities Act or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent registration or any applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws.

Upcoming Events

Metallic's management team will be available at the following international events in 2025, in addition to other events to be added as the Company continues its marketing plans over the remainder of the year:

Precious Metals Summit - Beaver Creek, Colorado, September 9-12, 2025. For information, click here.

Precious Metals Summit - Zurich, Switzerland, November 10-11, 2025. For information, click here.

AEMA's Annual Meeting - Sparks, Nevada, December 7-12, 2025. For information, click here.

PDAC 2026 - Toronto, Ontario, March 1-4, 2026. For information, click here.

Swiss Mining Institute Conference - Zurich, Switzerland, March 18-19, 2026. For information, click here.

About Metallic Minerals

Metallic Minerals Corp. is a resource-stage mineral exploration company, focused on copper, silver, gold, platinum group elements, and other critical minerals at the La Plata project in southwestern Colorado and the Keno Silver project adjacent to Hecla Mining's Keno Hill silver operations in the Yukon Territory. The Company is also one of the largest holders of alluvial gold claims in the Yukon and is building a production royalty business by partnering with experienced mining operators.

Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits in North America, as well as having large-scale development, permitting and project financing expertise. The Metallic Minerals team is committed to responsible and sustainable resource development and has worked closely with Canadian First Nation groups, U.S. Tribal and Native Corporations, and local communities to support successful project development.

FOR FURTHER INFORMATION, PLEASE CONTACT:

www.metallic-minerals.com and [email protected]

Phone: 604-629-7800 and Toll Free: 1-888-570-4420

Forward-Looking Statements

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, title, expected results of operations, as well as financial position, prospects, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. These assumptions include, inter-alia, the continued interest and strategic alignment of certain investors such as Newmont Corporation ('Newmont'); however, Newmont's participation in the Offering should not be construed as a commitment to future funding, operational involvement, or endorsement of the Company's long-term plans. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, unanticipated environmental impacts on operations and costs to remedy same and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration, development of mines and mining operations is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedarplus.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View the original press release on ACCESS Newswire

D.Moore--AMWN