-

Brignone leads charge of veteran women as Italy celebrates record Olympic haul

Brignone leads charge of veteran women as Italy celebrates record Olympic haul

-

Sri Lanka's Nissanka leaves Australia on brink of T20 World Cup exit

-

England match-winner Jacks proud, confident heading into Super Eights

England match-winner Jacks proud, confident heading into Super Eights

-

St Peter's Basilica gets terrace cafe, translated mass for 400th birthday

-

Meillard hails Swiss 'golden era' after slalom win caps Olympic domination

Meillard hails Swiss 'golden era' after slalom win caps Olympic domination

-

Sri Lanka fight back after strong start by Australia's Marsh, Head

-

Kovac calls on Dortmund to carry domestic 'momentum' into Champions League

Kovac calls on Dortmund to carry domestic 'momentum' into Champions League

-

Dutch inventor of hit game 'Kapla' dead at 80: family

-

Benfica's Mourinho plays down Real Madrid return rumour before rematch

Benfica's Mourinho plays down Real Madrid return rumour before rematch

-

St Peter's Basilica gets terrace cafe for 400th anniversary

-

Meillard extends Swiss Olympic strangehold while Gu aims for gold

Meillard extends Swiss Olympic strangehold while Gu aims for gold

-

Meillard crowns Swiss men's Olympic domination with slalom gold

-

German carnival revellers take swipes at Putin, Trump, Epstein

German carnival revellers take swipes at Putin, Trump, Epstein

-

England survive Italy scare to reach T20 World Cup Super Eights

-

Gold rush grips South African township

Gold rush grips South African township

-

'Tehran' TV series producer Dana Eden found dead in Athens

-

Iran FM in Geneva for US talks, as Guards begin drills in Hormuz Strait

Iran FM in Geneva for US talks, as Guards begin drills in Hormuz Strait

-

AI chatbots to face UK safety rules after outcry over Grok

-

Sakamoto fights fatigue, Japanese rivals and US skaters for Olympic women's gold

Sakamoto fights fatigue, Japanese rivals and US skaters for Olympic women's gold

-

'Your success is our success,' Rubio tells Orban ahead of Hungary polls

-

Spain unveils public investment fund to tackle housing crisis

Spain unveils public investment fund to tackle housing crisis

-

African diaspora's plural identities on screen in Berlin

-

Del Toro wins shortened UAE Tour first stage

Del Toro wins shortened UAE Tour first stage

-

German carnival revellers take sidesweep at Putin, Trump, Epstein

-

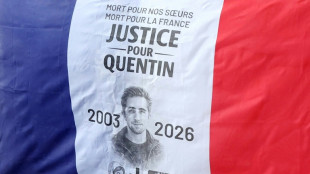

Killing of far-right activist stokes tensions in France

Killing of far-right activist stokes tensions in France

-

Record Jacks fifty carries England to 202-7 in must-win Italy match

-

European stocks, dollar up in subdued start to week

European stocks, dollar up in subdued start to week

-

African players in Europe: Salah hailed after Liverpool FA Cup win

-

Taiwan's cycling 'missionary', Giant founder King Liu, dies at 91

Taiwan's cycling 'missionary', Giant founder King Liu, dies at 91

-

Kyrgyzstan president fires ministers, consolidates power ahead of election

-

McGrath tops Olympic slalom times but Braathen out

McGrath tops Olympic slalom times but Braathen out

-

Greenland's west coast posts warmest January on record

-

South Africa into Super Eights without playing as Afghanistan beat UAE

South Africa into Super Eights without playing as Afghanistan beat UAE

-

Madagascar cyclone death toll rises to 59

-

ByteDance vows to boost safeguards after AI model infringement claims

ByteDance vows to boost safeguards after AI model infringement claims

-

Smith added to Australia T20 squad, in line for Sri Lanka crunch

-

Australian museum recovers Egyptian artefacts after break-in

Australian museum recovers Egyptian artefacts after break-in

-

India forced to defend US trade deal as doubts mount

-

Bitter pill: Taliban govt shakes up Afghan medicine market

Bitter pill: Taliban govt shakes up Afghan medicine market

-

Crunch time for Real Madrid's Mbappe-Vinicius partnership

-

Rio Carnival parades kick off with divisive ode to Lula in election year

Rio Carnival parades kick off with divisive ode to Lula in election year

-

Nepal 'addicted' to the trade in its own people

-

Asian markets sluggish as Lunar New Year holiday looms

Asian markets sluggish as Lunar New Year holiday looms

-

'Pure extortion': foreign workers face violence and exploitation in Croatia

-

Nepal launches campaigns for first post-uprising polls

Nepal launches campaigns for first post-uprising polls

-

What to know as South Korea ex-president Yoon faces insurrection verdict

-

'Train Dreams,' 'The Secret Agent' nab Spirit wins to boost Oscars campaigns

'Train Dreams,' 'The Secret Agent' nab Spirit wins to boost Oscars campaigns

-

Rubio visits Trump's 'friend' Orban ahead of Hungary polls

-

Kim unveils housing block for North Korean troops killed aiding Russia: KCNA

Kim unveils housing block for North Korean troops killed aiding Russia: KCNA

-

Accused Bondi killer Naveed Akram appears in court by video link

Initial Closing of Private Placement

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

LONDON, UK / ACCESS Newswire / September 12, 2025 / Gabriel Resources Ltd. (TSXV:GBU) ("Gabriel" or the "Company") is pleased to announce that it has completed an initial closing (the "Initial Closing") of its previously announced non-brokered private placement of up to 37,441,457 units of the Company (each, a "Unit") at a price of C$0.105 per Unit (the "Offering"). For more information on the Offering, please see the Company's press releases dated August 29, 2025 and September 2, 2025, which are available under the Company's SEDAR+ profile at www.sedarplus.ca.

Pursuant to the Initial Closing, the Company has issued a total of 26,659,886 Units for aggregate gross proceeds of US$2.04 million (approximately C$2.8 million).

Each Unit will consist of one common share in the capital of the Company (each, a "Common Share") and one Common Share purchase warrant (each, a "Warrant"). Each Warrant will entitle the holder to purchase one Common Share in the capital of the Company for a period of five (5) years from the date of closing of the Offering at an exercise price of C$0.14 per Common Share.

The securities issued in connection with the Initial Closing are subject to a statutory four-month hold period, which will expire on January 13, 2026. Completion of the Offering is subject to receipt of final approval of the TSX Venture Exchange. The Company intends to complete additional closings of the Offering during the course of September 2025.

The net proceeds of the Offering will be used for general corporate purposes, including, without limitation, the costs and expenses of pursuing the Company's ICSID annulment application and for critical operational expenses.

The Company will not pay any finders' fees in respect of the procurement of arm's length subscribers in connection with the Offering.

The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and accordingly may not be offered or sold within the United States or to "U.S. persons", as such term is defined in Regulation S promulgated under the U.S. Securities Act ("U.S. Persons"), except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the Company's securities to, or for the account or benefit of, persons in the United States or U.S. Persons.

For information on this press release, please contact:

Dragos Tanase President & CEO +1 425 414 9256 | Simon Lusty Group General Counsel +44 782 599 3401 |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Further Information

About Gabriel

Gabriel is a Canadian resource company listed on the TSX Venture Exchange. The Company's principal business has been the exploration and development of the Roșia Montană gold and silver project in Romania, one of the largest undeveloped gold deposits in Europe. Upon obtaining the License in June 1999, the Group focused substantially all of their management and financial resources on the exploration, feasibility and subsequent development of the Roşia Montană Project. An extension of the exploitation license for the Roşia Montană Project (held by Roșia Montană Gold Corporation S.A., a Romanian company in which Gabriel owns an 80.69% equity interest, with the 19.31% balance held by Minvest Roșia Montană S.A., a Romanian state-owned mining company) was rejected by the competent authority in late June 2024.

Forward-looking Statements

This press release contains "forward-looking information" (also referred to as "forward-looking statements") within the meaning of applicable Canadian securities legislation. Forward-looking statements are provided for the purpose of providing information about management's current expectations and plans and allowing investors and others to get a better understanding of the Company's operating environment. All statements, other than statements of historical fact, are forward-looking statements.

In this press release, forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company at this time, are inherently subject to significant business, economic and competitive uncertainties and contingencies that may cause the Company's actual financial results, performance, or achievements to be materially different from those expressed or implied herein.

Some of the material factors or assumptions used to develop forward-looking statements include, without limitation, the uncertainties associated with: (i) the ongoing proceedings (the "ICSID Annulment Proceedings") concerning the Company's application for annulment of the award dated March 8, 2024 (the "Arbitral Decision") issued in its ICSID arbitration case against Romania (ICSID Case No. ARB/15/31); (ii) future actions taken by the Romanian Government, including in relation to the enforcement of the costs order granted under the Arbitral Decision (the "Costs Order"); (iii) conditions or events impacting the Company's ability to fund its operations (including but not limited to the completion of the potential financing referred to in this press release); and (iv) the overall impact of misjudgments made in good faith in the course of preparing forward-looking information.

Forward-looking statements involve risks, uncertainties, assumptions, and other factors including those set out below, that may never materialize, prove incorrect or materialize other than as currently contemplated which could cause the Company's results to differ materially from those expressed or implied by such forward-looking statements.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, identified by words or phrases such as "expects", "is expected", "is of the view", "anticipates", "believes", "plans", "projects", "estimates", "assumes", "intends", "strategy", "goals", "objectives", "potential", "possible", "plans" or variations thereof or stating that certain actions, events, conditions or results "may", "could", "would", "should", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of fact and may be forward-looking statements.

Numerous factors could cause actual results to differ materially from those in the forward-looking statements, including without limitation:

the duration, costs, process and outcome of the ICSID Annulment Proceedings;

the ad hoc committee's decision on whether to maintain the provisional stay of enforcement for the duration of the ICSID Annulment Proceedings;

access to additional funding to support the Group's strategic objectives;

the impact on the Company's financial condition and operations of the rejection of the extension of the Rosia Montana exploitation license and/or any actions taken by Romania to enforce the Costs Order;

the impact on financial condition, business strategy and its implementation in Romania of: any allegations of historic acts of corruption, uncertain fiscal investigations, uncertain legal enforcement both for and against the Group, unpredictable regulatory or agency actions and political and social instability;

changes in the Group's liquidity and capital resources;

equity dilution resulting from the conversion or exercise of new or existing securities in part or in whole to Common Shares;

the ability of the Company to maintain a continued listing on the Exchange or any regulated public market for trading securities;

Romania's actions following inscription of the "Roşia Montană Mining Landscape" as a UNESCO World Heritage site;

regulatory, political and economic risks associated with operating in a foreign jurisdiction including changes in laws, governments and legal and fiscal regimes;

global economic and financial market conditions, including inflation risk;

the geo-political situation and the resulting economic developments arising from the unfolding conflict and humanitarian crisis as a consequence of conflicts such as the Russia-Ukraine war;

volatility of currency exchange rates; and

the availability and continued participation in operational or other matters pertaining to the Group of certain key employees and consultants.

This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements.

Investors are cautioned not to put undue reliance on forward-looking statements, and investors should not infer that there has been no change in the Company's affairs since the date of this press release that would warrant any modification of any forward-looking statement made in this document, other documents periodically filed with or furnished to the relevant securities regulators or documents presented on the Company's website. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by this notice. The Company disclaims any intent or obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of assumptions or factors, whether as a result of new information, future events or otherwise, subject to the Company's disclosure obligations under applicable Canadian securities regulations. Investors are urged to read the Company's filings with Canadian securities regulatory agencies which can be viewed online at www.sedarplus.ca.

ENDS

SOURCE: Gabriel Resources Ltd.

View the original press release on ACCESS Newswire

L.Harper--AMWN