-

England survive Italy scare to reach T20 World Cup Super Eights

England survive Italy scare to reach T20 World Cup Super Eights

-

Gold rush grips South African township

-

'Tehran' TV series producer Dana Eden found dead in Athens

'Tehran' TV series producer Dana Eden found dead in Athens

-

Iran FM in Geneva for US talks, as Guards begin drills in Hormuz Strait

-

AI chatbots to face UK safety rules after outcry over Grok

AI chatbots to face UK safety rules after outcry over Grok

-

Sakamoto fights fatigue, Japanese rivals and US skaters for Olympic women's gold

-

'Your success is our success,' Rubio tells Orban ahead of Hungary polls

'Your success is our success,' Rubio tells Orban ahead of Hungary polls

-

Spain unveils public investment fund to tackle housing crisis

-

African diaspora's plural identities on screen in Berlin

African diaspora's plural identities on screen in Berlin

-

Del Toro wins shortened UAE Tour first stage

-

German carnival revellers take sidesweep at Putin, Trump, Epstein

German carnival revellers take sidesweep at Putin, Trump, Epstein

-

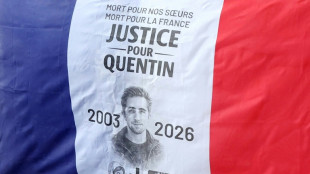

Killing of far-right activist stokes tensions in France

-

Record Jacks fifty carries England to 202-7 in must-win Italy match

Record Jacks fifty carries England to 202-7 in must-win Italy match

-

European stocks, dollar up in subdued start to week

-

African players in Europe: Salah hailed after Liverpool FA Cup win

African players in Europe: Salah hailed after Liverpool FA Cup win

-

Taiwan's cycling 'missionary', Giant founder King Liu, dies at 91

-

Kyrgyzstan president fires ministers, consolidates power ahead of election

Kyrgyzstan president fires ministers, consolidates power ahead of election

-

McGrath tops Olympic slalom times but Braathen out

-

Greenland's west coast posts warmest January on record

Greenland's west coast posts warmest January on record

-

South Africa into Super Eights without playing as Afghanistan beat UAE

-

Madagascar cyclone death toll rises to 59

Madagascar cyclone death toll rises to 59

-

ByteDance vows to boost safeguards after AI model infringement claims

-

Smith added to Australia T20 squad, in line for Sri Lanka crunch

Smith added to Australia T20 squad, in line for Sri Lanka crunch

-

Australian museum recovers Egyptian artefacts after break-in

-

India forced to defend US trade deal as doubts mount

India forced to defend US trade deal as doubts mount

-

Bitter pill: Taliban govt shakes up Afghan medicine market

-

Crunch time for Real Madrid's Mbappe-Vinicius partnership

Crunch time for Real Madrid's Mbappe-Vinicius partnership

-

Rio Carnival parades kick off with divisive ode to Lula in election year

-

Nepal 'addicted' to the trade in its own people

Nepal 'addicted' to the trade in its own people

-

Asian markets sluggish as Lunar New Year holiday looms

-

'Pure extortion': foreign workers face violence and exploitation in Croatia

'Pure extortion': foreign workers face violence and exploitation in Croatia

-

Nepal launches campaigns for first post-uprising polls

-

What to know as South Korea ex-president Yoon faces insurrection verdict

What to know as South Korea ex-president Yoon faces insurrection verdict

-

'Train Dreams,' 'The Secret Agent' nab Spirit wins to boost Oscars campaigns

-

Rubio visits Trump's 'friend' Orban ahead of Hungary polls

Rubio visits Trump's 'friend' Orban ahead of Hungary polls

-

Kim unveils housing block for North Korean troops killed aiding Russia: KCNA

-

Accused Bondi killer Naveed Akram appears in court by video link

Accused Bondi killer Naveed Akram appears in court by video link

-

Art and the deal: market slump pushes galleries to the Gulf

-

Job threats, rogue bots: five hot issues in AI

Job threats, rogue bots: five hot issues in AI

-

India hosts AI summit as safety concerns grow

-

'Make America Healthy' movement takes on Big Ag, in break with Republicans

'Make America Healthy' movement takes on Big Ag, in break with Republicans

-

Tech is thriving in New York. So are the rents

-

Young USA Stars beat Stripes in NBA All-Star tourney final

Young USA Stars beat Stripes in NBA All-Star tourney final

-

New anti-government chants in Tehran after giant rallies abroad: reports

-

'The Secret Agent' nabs Spirit Awards win in boost to Oscars campaign

'The Secret Agent' nabs Spirit Awards win in boost to Oscars campaign

-

CAVU Resources, Inc. Updates Corporate Website to Reflect Long-Term Direction and Ownership Mindset

-

GREATER THAN Redefines Hydration for Women With New 12oz Cans, Retail Expansion and GoddessLand(TM)

GREATER THAN Redefines Hydration for Women With New 12oz Cans, Retail Expansion and GoddessLand(TM)

-

Leafbuyer Technologies Reports Second Quarter Fiscal 2026 Results

-

Brondell Showcases Cutting-Edge Engineering and Design at KBIS 2026

Brondell Showcases Cutting-Edge Engineering and Design at KBIS 2026

-

Sartorius Sharpens Climate Targets and Receives Validation from Science Based Targets Initiative

European stocks, dollar up in subdued start to week

European stock markets and the dollar advanced Monday following a subdued showing for Asian equities ahead of the Lunar New Year holiday and after Japan reported lacklustre economic growth.

Markets were closed in Shanghai, Seoul and Taipei for the holiday, while Hong Kong and Singapore opened only for half-day sessions.

With US markets also shut for Presidents' Day, "attention will turn to company updates later in the week", said Richard Hunter, head of markets at Interactive Investor.

"Walmart will report annual numbers on Thursday, where sales will need to be at the top end of the expected range to continue to justify a punchy valuation rating which has seen the share price surge, propelling the group to become the first $1 trillion retailer," he said.

Stock markets showed signs of stabilising after a tech-led plunge last week, when traders reacted to growing concern about the hundreds of billions being spent on AI infrastructure and when, if ever, they might see a return on them.

Focus was on the start of a five-day AI Impact Summit in New Delhi, with the likes of OpenAI chief Sam Altman and Google's Sundar Pichai in attendance.

While frenzied demand for generative AI has turbocharged profits and share prices for many technology companies, anxiety is growing over the risks that it poses to society and the environment, and its potential impact on a range of business sectors.

Such concerns were offset slightly by official data Friday showing that consumer inflation in the United States cooled slightly more than expected in January.

Analysts said the data should see the Federal Reserve cut interest rates again later this year to bolster growth in the world's biggest economy.

"US inflation data was good. And the initial response in equities reflected that," said Kyle Rodda, senior financial market analyst at Capital.com.

News of limp economic growth in Japan rattled the country's stocks and yen on Monday, which came after recent record highs for Tokyo equities thanks to Prime Minister Sanae Takaichi's recent landslide win in parliamentary elections.

The world's fourth-biggest economy expanded 0.1 percent in the last three months of 2025, official data showed.

"Sluggish economic activity increases the chances that Takaichi will not only press ahead with suspending the sales tax on food but enact a supplementary budget," said Marcel Thieliant, an analyst at Capital Economics.

- Key figures at around 1100 GMT -

London - FTSE 100: UP 0.2 percent at 10,466.39 points

Paris - CAC 40: UP 0.3 percent at 8,333.73

Frankfurt - DAX: UP 0.1 percent at 24,926.47

Tokyo - Nikkei 225: DOWN 0.2 percent at 56,806.41 (close)

Hong Kong - Hang Seng Index: UP 0.5 percent at 26,705.94 (close)

Shanghai - Composite: market closed for holiday

New York - Dow: UP 0.1 percent at 49,500.93 (close)

Euro/dollar: DOWN at $1.1867 from $1.1876 on Friday

Pound/dollar: DOWN at $1.3650 from $1.3654

Euro/pound: DOWN at 86.95 pence from 86.96 pence

Dollar/yen: UP at 153.53 yen from 152.71 yen

Brent North Sea Crude: UP 0.2 percent at $67.90 per barrel

West Texas Intermediate: UP 0.2 percent at $63.02 per barrel

G.Stevens--AMWN