-

Markets boosted by hopes for deal to end US shutdown

Markets boosted by hopes for deal to end US shutdown

-

Amazon poised to host toughest climate talks in years

-

Ex-jihadist Syrian president due at White House for landmark talks

Ex-jihadist Syrian president due at White House for landmark talks

-

Saudi belly dancers break taboos behind closed doors

-

The AI revolution has a power problem

The AI revolution has a power problem

-

Big lips and botox: In Trump's world, fashion and makeup get political

-

NBA champion Thunder rally to down Grizzlies

NBA champion Thunder rally to down Grizzlies

-

US senators reach deal that could end record shutdown

-

Weakening Typhoon Fung-wong exits Philippines after displacing 1.4 million

Weakening Typhoon Fung-wong exits Philippines after displacing 1.4 million

-

Lenny Wilkens, Basketball Hall of Famer as player and coach, dies

-

Griffin wins PGA Mexico title for third victory of the year

Griffin wins PGA Mexico title for third victory of the year

-

NFL makes successful return to Berlin, 35 years on

-

Lewandowski hat-trick helps Barca punish Real Madrid slip

Lewandowski hat-trick helps Barca punish Real Madrid slip

-

George warns England against being overawed by the All Blacks

-

Lewandowski treble helps Barca beat Celta, cut gap on Real Madrid

Lewandowski treble helps Barca beat Celta, cut gap on Real Madrid

-

Neves late show sends PSG top of Ligue 1, Strasbourg down Lille

-

Inter go top of Serie A after Napoli slip-up

Inter go top of Serie A after Napoli slip-up

-

Bezos's Blue Origin postpones rocket launch over weather

-

Hamilton upbeat despite 'nightmare' at Ferrari

Hamilton upbeat despite 'nightmare' at Ferrari

-

Taylor sparks Colts to Berlin win, Pats win streak hits seven

-

Alcaraz and Zverev make winning starts at ATP Finals

Alcaraz and Zverev make winning starts at ATP Finals

-

Protests suspend opening of Nigeria heritage museum

-

Undav brace sends Stuttgart fourth, Frankfurt win late in Bundesliga

Undav brace sends Stuttgart fourth, Frankfurt win late in Bundesliga

-

Roma capitalise on Napoli slip-up to claim Serie A lead

-

Liverpool up for the fight despite Man City masterclass, says Van Dijk

Liverpool up for the fight despite Man City masterclass, says Van Dijk

-

Two MLB pitchers indicted on manipulating bets on pitches

-

Wales rugby captain Morgan set to be sidelined by shoulder injury

Wales rugby captain Morgan set to be sidelined by shoulder injury

-

After storming Sao Paulo podium, 'proud' Verstappen aims to keep fighting

-

US flights could 'slow to a trickle' as shutdown bites: transport secretary

US flights could 'slow to a trickle' as shutdown bites: transport secretary

-

Celtic close on stumbling Scottish leaders Hearts

-

BBC chief resigns after row over Trump documentary

BBC chief resigns after row over Trump documentary

-

Norris extends title lead in Sao Paulo, Verstappen third from pit-lane

-

Norris wins in Sao Paulo to extend title lead over Piastri

Norris wins in Sao Paulo to extend title lead over Piastri

-

Man City rout Liverpool to mark Guardiola milestone, Forest boost survival bid

-

Man City crush Liverpool to mark Guardiola's 1,000 match

Man City crush Liverpool to mark Guardiola's 1,000 match

-

Emegha fires Strasbourg past Lille in Ligue 1

-

Howe takes blame for Newcastle's travel sickness

Howe takes blame for Newcastle's travel sickness

-

Pumas maul Wales as Tandy's first game in charge ends in defeat

-

'Predator: Badlands' conquers N. American box office

'Predator: Badlands' conquers N. American box office

-

Liga leaders Real Madrid drop points in Rayo draw

-

'Killed on sight': Sudanese fleeing El-Fasher recall ethnic attacks

'Killed on sight': Sudanese fleeing El-Fasher recall ethnic attacks

-

Forest boost survival bid, Man City set for crucial Liverpool clash

-

US air travel could 'slow to a trickle' as shutdown bites: transport secretary

US air travel could 'slow to a trickle' as shutdown bites: transport secretary

-

Alcaraz makes winning start to ATP Finals

-

'I miss breathing': Delhi protesters demand action on pollution

'I miss breathing': Delhi protesters demand action on pollution

-

Just-married Rai edges Fleetwood in Abu Dhabi playoff

-

All aboard! Cruise ships ease Belem's hotel dearth

All aboard! Cruise ships ease Belem's hotel dearth

-

Kolo Muani drops out of France squad with broken jaw

-

Israel receives remains believed to be officer killed in 2014 Gaza war

Israel receives remains believed to be officer killed in 2014 Gaza war

-

Dominant Bezzecchi wins Portuguese MotoGP

Resource Upgrade Drilling Begins on Tunkillia ‘Starter Pits’

Targeting Ore Reserves, PFS and ML application by the end of 2026

HIGHLIGHTS

May 2025 Optimised Scoping Study (OSS) outlined a compelling Tunkillia development project: 1

Annual production: ~120,000oz gold + ~250,000oz silver

Total LoM operating cash: ~A$2.7 billion (unlevered, pre-tax)

Net Present Value (NPV 7.5% ): ~A$1.4 billion (unlevered, pre-tax)

Internal Rate of Return (IRR): ~73.2% (unlevered, pre-tax); and

Payback period: ~0.8 years (unlevered, pre-tax)

~18,000m reverse circulation (RC) drilling on high value 'Starter Pits', which are modelled to yield 365koz Au and A$1.3bn cash in first ~2 years, paying back development cost ~3x over 1

Barton approached by several prospective development and finance partners following OSS; expediting development drilling programs to support conversion of JORC Mineral Resources to JORC (2012) Ore Reserves, feasibility studies, and a Mining Lease application by end of 2026

ADELAIDE, AU / ACCESS Newswire / September 10, 2025 / Barton Gold Holdings Limited (ASX:BGD)(OTCQB:BGDFF)(FRA:BGD3) (Barton or Company) is pleased to announce the start of JORC upgrade drilling for its South Australian Tunkillia Gold Project (Tunkillia). An initial round of ~18,000m RC drilling is designed to convert Tunkillia's high value 'Stage 1' and 'Stage 2' optimised open pits to JORC (2012) 'Measured' and 'Indicated' categories, supporting expedited project financing discussions. 1

The current 1 st stage ~18,000m RC drilling program will:

target conversion of all of 'Stage 1' and 'Stage 2' pit materials to JORC 'Indicated' category; and

target conversion of a high-value subset of 'Stage 1' pit materials to JORC 'Measured' category.

A 2 nd stage RC and diamond drilling ( DD ) program planned for March to June 2026 will then:

target conversion of all other Tunkillia OSS mineralisation JORC 'Indicated' category;

expand Tunkillia's geotechnical database for further open pit design optimisation; and

expand Tunkillia's metallurgical database for detailed recovery and production modelling.

Commenting on Tunkillia's upgrade drilling programs, Barton Managing Director Alex Scanlon said :

"The Tunkillia OSS demonstrated the financial and capital leverage available to large-scale bulk processing operations, with the major advantage of a higher-grade 'Starter Pit' that can pay back development costs 2x over in the first year.

"Having been approached by multiple prospective development and finance partners, upgrade drilling on Tunkillia's 'Starter Pits' will expedite development and financing discussions while Barton evaluates the optimal path forward.

"We are aiming to generate maximum optionality for Tunkillia's development, and plan to convert Mineral Resources to Ore Reserves, complete a Pre-Feasibility Study, and submit a Mining Lease application by the end of 2026."

Program background

Tunkillia's May 2025 OSS outlined a compelling development profile, with 'Starter Pits' modelled to produce: 2

'Stage 1': ~206,000oz gold and ~491,000oz silver during the first ~13 months of operation; and

'Stage 2': ~159,000oz gold and ~432,000oz silver during the next ~14 months of operation.

These 'Starter Pits' are therefore modelled to return: 2

~$825 million operating free cash during the first ~13 months at a cash cost of only A$997/oz Au, paying back up-front capital cost more than 2x over during this time; and

a total ~$1.3 billion operating free cash during the first ~27 months at an average cash cost of only A$1,429/oz Au, paying back up-front capital cost more than 3x over during this time.

Figure 1 below shows Tunkillia's key 'Stage 1' and 'Stage 2' Starter Pits, with the location of new drill hole collars planned for the initial September to December 2025 JORC Mineral Resource upgrade program.

This stage of development drilling will comprise ~18,270m RC drilling across 209 planned drill holes. The objective is to increase confidence in 'Stage 1' and 'Stage 2' mineralisation, validate deposit geostatistics, and test the drill hole spacing required for future upgrade drilling in other Tunkillia mineralisation zones.

The drilling shown below is complementary to a significant number of existing surrounding drill holes, and is expected to convert all 'Stage 1' and 'Stage 2' mineralisation to JORC 'Indicated' category, with the highest-value subset of the 'Stage 1 Starter Pit' mineralisation converted to JORC 'Measured' category.

Figure 1 - Tunkillia OSS Optimised Open Pits with planned Stage 1 upgrade drilling

Authorised by the Board of Directors of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Jade Cook |

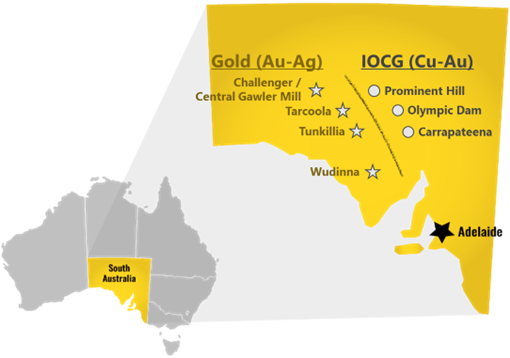

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000ozpa with 2.2Moz Au & 3.1Moz Ag JORC Mineral Resources (79.9Mt @ 0.87g/t Au), brownfield mines, and 100% ownership of the region's only gold mill in the renowned Gawler Craton of South Australia. *

Challenger Gold Project

Tarcoola Gold Project

Tunkillia Gold Project

Wudinna Gold Project

|  |

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource (above 215mRL) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource (below 90mRL) | Mr Dale Sims | AusIMM / AIG | Fellow / Member |

Wudinna Mineral Resource (Clarke Deposit) | Ms Justine Tracey | AusIMM | Member |

Wudinna Mineral Resource (all other Deposits) | Mrs Christine Standing | AusIMM / AIG | Member / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

1 Refer to ASX announcement dated 5 May 2025

2 Refer to ASX announcement dated 5 May 2025

* Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 8 September 2025. Total Barton JORC (2012) Mineral Resources include 1,049koz Au (39.7Mt @ 0.82 g/t Au) in Indicated category and 1,186koz Au (40.2Mt @ 0.92 g/t Au) in Inferred category, and 3,070koz Ag (34.5Mt @ 2.80 g/t Ag) in Inferred category as a subset of Tunkillia gold JORC (2012) Mineral Resources.

SOURCE: Barton Gold Holdings Limited

View the original press release on ACCESS Newswire

O.M.Souza--AMWN