-

Bayer proposes class settlement for weedkiller cancer claims

Bayer proposes class settlement for weedkiller cancer claims

-

Gauff, Rybakina cruise into Dubai last 16

-

Greenland entrepreneur gambles on leafy greens

Greenland entrepreneur gambles on leafy greens

-

Father of US school shooter goes on trial on murder charges

-

Iran, US agree on 'guiding principles' for deal at Geneva talks: Iran FM

Iran, US agree on 'guiding principles' for deal at Geneva talks: Iran FM

-

Warner Bros. gives Paramount one week to outbid Netflix

-

Russians, Belarusians allowed to compete under own flags at 2026 Paralympics: IPC tells AFP

Russians, Belarusians allowed to compete under own flags at 2026 Paralympics: IPC tells AFP

-

Ukrainian wife battles blackouts to keep terminally ill husband alive

-

Pollock handed first England start for Ireland visit

Pollock handed first England start for Ireland visit

-

Oil prices fall back as 'hopeful' Tehran responds to Trump

-

Arteta welcomes Madueke and Saka's competition for places

Arteta welcomes Madueke and Saka's competition for places

-

France and India hail growing ties as Modi hosts Macron

-

Warner Bros. says reopening talks with Paramount on its buyout offer

Warner Bros. says reopening talks with Paramount on its buyout offer

-

Slalom showdown Shiffrin's last chance for Milan-Cortina medal

-

Protesters march in Kosovo, as ex-president's war crimes trial nears end

Protesters march in Kosovo, as ex-president's war crimes trial nears end

-

No pressure on India opener Abhishek after two ducks, says coach

-

Sakamoto eyes figure skating gold in Olympic farewell

Sakamoto eyes figure skating gold in Olympic farewell

-

Pereira 'trusts' Forest owner Marinakis despite three sackings this season

-

AI 'arms race' risks human extinction, warns top computing expert

AI 'arms race' risks human extinction, warns top computing expert

-

Israeli bobsleigher dismisses Olympics 'diatribe' by Swiss TV commentator

-

Supreme leader says Iran can sink US warship as Geneva talks conclude

Supreme leader says Iran can sink US warship as Geneva talks conclude

-

Australia, Ireland out of T20 World Cup as Zimbabwe qualify after washout

-

Greece experts to examine Nazi atrocity photos find

Greece experts to examine Nazi atrocity photos find

-

Los Angeles mayor calls for 2028 Olympics chairman to step down over Epstein files

-

Evenepoel takes UAE Tour lead with time-trial win

Evenepoel takes UAE Tour lead with time-trial win

-

Oil prices rise as Trump ramps up Iran threats

-

EU investigates Shein over sale of childlike sex dolls

EU investigates Shein over sale of childlike sex dolls

-

Bangladesh's new PM, political heir Tarique Rahman

-

Rain threatens to knock Australia out of T20 World Cup

Rain threatens to knock Australia out of T20 World Cup

-

US civil rights leader Jesse Jackson dies at 84: family

-

Trump's new envoy arrives in South Africa with relations frayed

Trump's new envoy arrives in South Africa with relations frayed

-

Jesse Jackson: civil rights lion sought 'common ground'

-

Iran, United States hold new talks in Geneva

Iran, United States hold new talks in Geneva

-

Tariq confident Pakistan can bounce back after India drubbing

-

Being back in the USA 'feels amazing', says Vonn

Being back in the USA 'feels amazing', says Vonn

-

New Zealand cruise into Super Eights at T20 World Cup

-

Moscow, Kyiv meet for US-brokered talks after fresh attacks

Moscow, Kyiv meet for US-brokered talks after fresh attacks

-

Exhilarating Italy aim to sign off with giant-killing at T20 World Cup

-

Samra hits 110 for Canada against New Zealand at T20 World Cup

Samra hits 110 for Canada against New Zealand at T20 World Cup

-

'Made in Europe' or 'Made with Europe'? Buy European push splits bloc

-

Slovakia revamps bunkers with Ukraine war uncomfortably close

Slovakia revamps bunkers with Ukraine war uncomfortably close

-

Sydney man jailed for mailing reptiles in popcorn bags

-

'Like a Virgin' songwriter Billy Steinberg dies at 75

'Like a Virgin' songwriter Billy Steinberg dies at 75

-

Who fills Sexton vacuum? Irish fly-half debate no closer to resolution

-

Japan hails 'new chapter' with first Olympic pairs skating gold

Japan hails 'new chapter' with first Olympic pairs skating gold

-

Russian prosthetics workshops fill up with wounded soldiers

-

'Not just props that eat': Extras seek recognition at their own 'Oscars'

'Not just props that eat': Extras seek recognition at their own 'Oscars'

-

Bangladesh PM-to-be Tarique Rahman and lawmakers sworn into parliament

-

At least 14 killed in spate of attacks in northwest Pakistan

At least 14 killed in spate of attacks in northwest Pakistan

-

Peru Congress to debate impeachment of interim president

Guardian Metal Resources PLC Announces Final Results

Audited Financial Results for the Year Ended 30 June 2025

LONDON, UK / ACCESS Newswire / October 29, 2025 / Guardian Metal Resources plc (LON:GMET)(OTCQB:GMTLF), a tungsten exploration and development company focused on Nevada, U.S. is pleased to announce its consolidated audited results for the year ended 30 June 2025, for the Company and its subsidiaries (together, the "Group").

The full financial report will be available online immediately on the Company's website, and should be read in conjunction with this announcement.

Highlights from the year under review:

Pilot Mountain Project Pilot Mountain remained the central focus of our project development efforts during the year. Guardian Metal advanced multiple workstreams critical to the ongoing pre-feasibility study. Resource and geotechnical drilling programmes were advanced to support pit design and mine planning, while baseline studies were completed across environmental and technical disciplines to underpin key permitting next steps. Amongst intense ongoing reshoring efforts, Pilot Mountain's strategic importance within the U.S. critical metals landscape increased substantially over the period | |

Tempiute Project During the year, Guardian Metal added a second co-flagship project through the acquisition of the option to purchase the historical Tempiute (Emerson) tungsten mine in Lincoln County, Nevada. A Letter of Intent was signed on 31 October 2024, with the definitive agreement completed on 27 January 2025. Since the acquisition, Guardian Metal advanced preparatory workstreams at Tempiute in support of a drilling programme that started late summer 2025. The combination of historical production, existing infrastructure, and new exploration potential establishes Tempiute as a highly complementary asset to Pilot Mountain, further strengthening Guardian Metal's ability to deliver scale within a Nevada-based tungsten production hub. | |

US Market Presence Guardian Metal continued to build its profile in the United States during the period. Following the upgrade to the OTCQX Market in June 2024, the Company benefited from improved liquidity and visibility amongst U.S. investors. Institutional awareness of Guardian Metal also grew further during the year, with Maxim Group initiating research coverage and increased engagement from U.S. funds and stakeholders. Together, these steps advance Guardian Metal's strategy of aligning its capital markets presence with its U.S.-based operating footprint. | |

Corporate Growth & Strategic Positioning On 8 July 2024, the Company rebranded as Guardian Metal Resources Plc, a name that reflects our sharpened focus on tungsten and our commitment to the U.S. defence metal reshoring effort. This corporate evolution was matched by growth in institutional support. On 15 August 2024, Guardian Metal announced a North American strategic financing, followed by an institutional raise completed on 6 January 2025 and a further strategic investment by UCAM LLP on 20 February 2025. The continued ability to attract institutional capital is a strong endorsement of Guardian Metal's positioning within the U.S. critical metals landscape. Finally, in June 2025, Guardian Metal was invited to join the DARPA-sponsored Critical Minerals Forum, a platform that underscores the growing recognition of the Company as a strategic participant in securing America's future mineral supply. | |

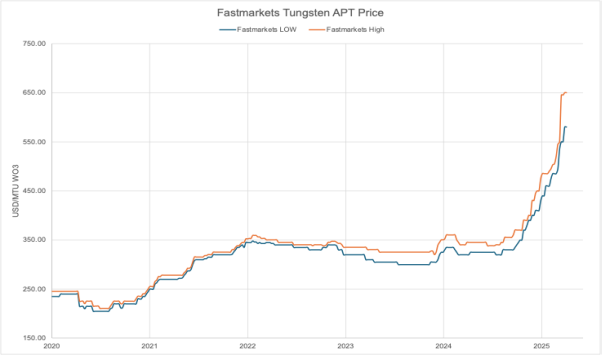

Tungsten Market The strategic importance of tungsten has increased materially during the year. On 4 February 2025, China implemented export restrictions on certain tungsten products, further tightening global supply and driving prices higher. At the same time, recognition of tungsten's critical role in defence, energy transition, and advanced technologies has grown significantly across U.S. government and industry stakeholders. Against this backdrop, Guardian Metal is positioned in the right metal, at the right time, and in the right jurisdiction to play a leading role in re-establishing secure Western supply chains. |

Corporate Developments

Financial Highlights

The Group incurred a loss for the year to 30 June 2025 of $2,711,000 (2024 - loss of $1,376,000). The loss mainly arose from salaries, consulting and professional fees along with general regulatory and administration expenses.

Cash used in operations totalled $1,122,000 and investment in its mining assets totalled $8,038,000 (2024 - $1,496,000). As at 30 June 2025, the Group had a cash balance of $1,873,000 (2024 - $3,033,000). At the date of this announcement, the Group's cash balance was $14,720,000.

Funding Activities

During the year under review a total of 18,908,700 warrants over new ordinary shares were exercised raising $4,455,305 (£3,414,479) for the Company. The Company also completed strategic fundraises issuing in total 10,478,054 new ordinary shares, raising $3,677,988 (£2,904,075) before costs for the Company.

Subsequent to reporting date on 23 July 2025, the Company completed a fundraise of $21,000,000 (approximately £15,600,000) before costs through the issue of 25,945,000 new ordinary shares to new and existing shareholders. On the same date the Company also announced that its wholly owned subsidiary Golden Metal Resources (USA) LLC had been awarded $6.2 million from the U.S. Department of War (DoW) to accelerate the development of its Pilot Mountain Project.

Board of Directors

We welcomed Ben Hodges who joined the Company as Finance Director on 12 December 2024. David Ovadia, Non-Executive Chairman, resigned from the Board on 11 December 2024. The Board takes this opportunity to thank David for his contribution to the Company over his tenure. Non-Executive Director J.T. Starzecki assumed the position of Non-Executive Chairman with effect from 11 December 2024, and in June 2025 Mr. Starzecki accepted the role of Executive Chairman.

Events after the year end

For information regarding events after the reporting date see note 19 to the financial statements.

Outlook:

Looking ahead, Guardian Metal's priorities are clear: advance Pilot Mountain and Tempiute through the next stage of technical and economic studies, supported by the financing, partnerships, and contractor base secured this year. With two co-flagship assets in Nevada, an increasingly engaged U.S. investor base and growing recognition across industry and government, Guardian Metal is well positioned to deliver on its ambition of becoming America's next tungsten producer. We also have announced that we plan to pursue a USA listing.

I would like to thank our shareholders, partners, and team for their ongoing support and commitment. Together, we are building a company that can play a pivotal role in delivering secure domestic supply of this critical mineral for defence, energy transition, and high-technology applications.

Oliver Friesen, Chief Executive Officer

28 October 2025

Click on, or paste the following link into your web browser, to view the full announcement.

http://www.rns-pdf.londonstockexchange.com/rns/1923F_1-2025-10-28.pdf

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR.

For further information visit www.guardianmetalresources.com or contact the following:

Guardian Metal Resources plc Oliver Friesen (CEO) | Tel: +44 (0) 20 7583 8304 |

Cairn Financial Advisers LLP (Nominated Adviser) Sandy Jamieson/Jo Turner/Louise O'Driscoll | Tel: +44 (0) 20 7213 0880 |

Tamesis Partners LLP (Lead Broker) Charlie Bendon/ Richard Greenfield | Tel: +44 (0) 20 3882 2868 |

Tavistock (Financial PR) Emily Moss/Josephine Clerkin | Tel: +44 (0) 7920 3150/ +44 (0) 7788 554035 |

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

SOURCE: Guardian Metal Resources PLC

View the original press release on ACCESS Newswire

G.Stevens--AMWN