-

China issues 73 life bans, punishes top football clubs for match-fixing

China issues 73 life bans, punishes top football clubs for match-fixing

-

Ghana moves to rewrite mining laws for bigger share of gold revenues

-

South Africa drops 'Melania' just ahead of release

South Africa drops 'Melania' just ahead of release

-

Russia's sanctioned oil firm Lukoil to sell foreign assets to Carlyle

-

Australian Open chief Tiley says 'fine line' after privacy complaints

Australian Open chief Tiley says 'fine line' after privacy complaints

-

Trump-era trade stress leads Western powers to China

-

Gold soars towards $5,600 as Trump rattles sabre over Iran

Gold soars towards $5,600 as Trump rattles sabre over Iran

-

Russia's Petrosian skates in Valieva shadow at Milan-Cortina Olympics

-

China executes 11 linked to Myanmar scam compounds

China executes 11 linked to Myanmar scam compounds

-

Germany to harden critical infrastructure as Russia fears spike

-

Colombia plane crash investigators battle poor weather to reach site

Colombia plane crash investigators battle poor weather to reach site

-

Serena Williams refuses to rule out return to tennis

-

New glove, same fist: Myanmar vote ensures military's grip

New glove, same fist: Myanmar vote ensures military's grip

-

Deutsche Bank logs record profits, as new probe casts shadow

-

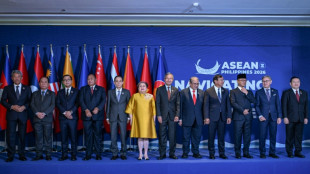

Thai foreign minister says hopes Myanmar polls 'start of transition' to peace

Thai foreign minister says hopes Myanmar polls 'start of transition' to peace

-

No white flag from Djokovic against Sinner as Alcaraz faces Zverev threat

-

Vietnam and EU upgrade ties as EU chief visits Hanoi

Vietnam and EU upgrade ties as EU chief visits Hanoi

-

Senegal coach Thiaw gets five-match ban after AFCON final chaos

-

Phan Huy: the fashion prodigy putting Vietnam on the map

Phan Huy: the fashion prodigy putting Vietnam on the map

-

Hongkongers snap up silver as gold becomes 'too expensive'

-

Britain's Starmer meets China's Xi for talks on trade, security

Britain's Starmer meets China's Xi for talks on trade, security

-

Chinese quadriplegic runs farm with just one finger

-

Gold soars past $5,500 as Trump sabre rattles over Iran

Gold soars past $5,500 as Trump sabre rattles over Iran

-

China's ambassador warns Australia on buyback of key port

-

'Bombshell': What top general's fall means for China's military

'Bombshell': What top general's fall means for China's military

-

As US tensions churn, new generation of protest singers meet the moment

-

Venezuelans eye economic revival with hoped-for oil resurgence

Venezuelans eye economic revival with hoped-for oil resurgence

-

Online platforms offer filtering to fight AI slop

-

With Trump allies watching, Canada oil hub faces separatist bid

With Trump allies watching, Canada oil hub faces separatist bid

-

Samsung Electronics posts record profit on AI demand

-

Linear Minerals Corp Announces Exploration Program at Lac Marion Property

Linear Minerals Corp Announces Exploration Program at Lac Marion Property

-

Formation Metals Mobilizes Second Rig to Accelerate 14,000 Metre Drill Program at its Advanced N2 Gold Project

-

Strategic Friction: Turning Diversity into a Competitive Moat

Strategic Friction: Turning Diversity into a Competitive Moat

-

Rockets veteran Adams out for rest of NBA season

-

Holders PSG happy to take 'long route' via Champions League play-offs

Holders PSG happy to take 'long route' via Champions League play-offs

-

French Senate adopts bill to return colonial-era art

-

Allrounder Molineux named Australian women's cricket captain

Allrounder Molineux named Australian women's cricket captain

-

Sabalenka faces Svitolina roadblock in Melbourne final quest

-

Tesla profits tumble on lower EV sales, AI spending surge

Tesla profits tumble on lower EV sales, AI spending surge

-

Joao Pedro fires Chelsea into Champions League last 16, dumps out Napoli

-

LA mayor urges US to reassure visiting World Cup fans

LA mayor urges US to reassure visiting World Cup fans

-

Madrid condemned to Champions League play-off after Benfica loss

-

Meta shares jump on strong earnings report

Meta shares jump on strong earnings report

-

Haaland ends barren run as Man City reach Champions League last 16

-

PSG and Newcastle drop into Champions League play-offs after stalemate

PSG and Newcastle drop into Champions League play-offs after stalemate

-

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

-

Barca rout Copenhagen to reach Champions League last 16

Barca rout Copenhagen to reach Champions League last 16

-

Arsenal complete Champions League clean sweep for top spot

-

Kolo Muani and Solanke send Spurs into Champions League last 16

Kolo Muani and Solanke send Spurs into Champions League last 16

-

Bayern inflict Kane-ful Champions League defeat on PSV

A$40 Million Institutional Placement to Support 30% Expansion of Phase 1 Hombre Muerto West (HMW)

Highlights:

Galan has received firm commitments to raise A$40 million (before costs) via an institutional placement at A$0.41 per share, a 2% premium to the 5-day VWAP

Directors of the Company have separately committed to subscribe for an additional A$1 million subject to shareholder approval

Placement was strongly supported by existing substantial shareholder Clean Elements as well as global institutional and sophisticated investors

Proceeds of the capital raising will be used to expand production at HMW from current planned 4 ktpa LCE to 5.2 ktpa LCE, fund exploration activities at Greenbushes South and for working capital

Phase 1 construction works at HMW continue to progress with first production targeted for H1 2026

PERTH, AU / ACCESS Newswire / January 28, 2026 / Galan Lithium Limited (ASX:GLN) (Galan or the Company) is pleased to announce it has received firm commitments from institutional and sophisticated investors, including major shareholder the Clean Elements Fund (Clean Elements) for a placement of A$40 million at an issue price of A$0.41 per share (Institutional Placement). Directors of the Company have also committed to subscribe for an additional $1 million on the same terms as the Institutional Placement, subject to shareholder approval (Director Placement).

Together with existing cash reserves, the proceeds from the equity raising will be used to complete Phase 1 construction activities, expand Phase 1 production capacity from 4 ktpa LCE to 5.2 ktpa LCE, undertake exploration activities at Greenbushes South and for working capital purposes.

First lithium chloride concentrate production to come out of a current inventory of circa 9,500 t LCE in evaporation ponds remains targeted for 1H 2026.

Galan's Managing Director, Juan Pablo (JP) Vargas de la Vega, commented:

"An accelerated recovery in lithium prices has provided Galan with an opportunity to expand HMW Phase 1 production capacity by 30%. Undertaking a Phase 1 expansion at this time will realise operational synergies for Galan, specifically saving on equipment and contractor mobilisation costs and cost savings in procurement.

"The equity raising has been very well supported with pricing at a premium to 5, 10 and 15 day VWAPs, which reflects that investors have recognised that Galan is well placed to take advantage of a higher lithium pricing environment, with first lithium chloride production targeted for the first half of 2026.

"On behalf of the Board of Directors, I would like to thank our shareholders for their ongoing support, which includes Clean Elements, and to welcome new high-caliber institutional investors from around the world to our register."

Details of the Equity Raising

Galan has received firm commitments to raise a total of $40 million under the Institutional Placement and an additional $1 million under the Director Placement (together the "Equity Raising"), at an issue price of $0.41 per share.

The Equity Raising will be undertaken in two tranches:

Tranche 1: Comprising the issue of approximately 86.6 million new fully paid ordinary share ("New Shares") to institutional, professional and sophisticated investors under Galan's placement capacity under ASX Listing Rules 7.1 and 7.1A.

Tranche 2: Comprising the issue of 13.4 million New Shares to Clean Elements and Directors of Galan, subject to shareholder approval under ASX Listing Rule 10.11 which will be sought at an Extraordinary General Meeting (EGM) to be held in Mid-March 2026. The date and details of the EGM will be communicated to shareholders on the ASX platform in due course.

The Equity Raising issue price of A$0.41 per New Share represents a:

13% discount to the last closing price of A$0.470;

2% premium to the 5-day VWAP of A$0.403;

4% premium to the 10-day VWAP of A$0.395; and

6% premium to the 15-day VWAP of A$0.386;

The New Shares will rank equally with existing Galan shares. The Institutional Placement is not underwritten.

Canaccord Genuity acted as Lead Manager and Bookrunner to the Placement.

Indicative Timetable 1,2

Event | Time / Date (2026) |

Trading Halt | Tuesday, 27 January |

Announcement of results of Equity Raising and trading halt lifted | Thursday, 29 January |

DvP Settlement of New Shares issued under Tranche 1 of the Equity Raising | Tuesday, 3 February |

Allotment of New Shares issued under Tranche 1 of the Equity Raising | Wednesday, 4 February |

General Meeting to approve issue of New Shares under Tranche 2 of Equity Raising | Mid-March |

Settlement of New Shares issued under Tranche 2 of the Equity Raising | Mid-March |

Allotment of New Shares issued under Tranche 2 of the Equity Raising | Mid-March |

| |

The Galan Board has authorised this release.

For further information contact:

COMPANY | MEDIA |

Juan Pablo ("JP") Vargas de la Vega | Matt Worner |

Managing Director | Vector Advisors |

+ 61 8 9214 2150 | +61 429 522 924 |

SOURCE: Galan Lithium Limited

View the original press release on ACCESS Newswire

Ch.Havering--AMWN