-

ICC to begin pre-trial hearing for Philippines' Duterte

ICC to begin pre-trial hearing for Philippines' Duterte

-

After two convictions, France's Sarkozy seeks to merge sentences

-

Bridgeman hangs on to claim first PGA Tour title at Riviera

Bridgeman hangs on to claim first PGA Tour title at Riviera

-

Hong Kong appeals court to rule on jailed democracy campaigners

-

Blizzard blows New Yorkers' plans off course

Blizzard blows New Yorkers' plans off course

-

More than 200 political prisoners in Venezuela launch hunger strike

-

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

-

Thunder strike from long range to halt Cavs' seven-game win streak

-

Strasbourg snap Lyon winning run in Ligue 1

Strasbourg snap Lyon winning run in Ligue 1

-

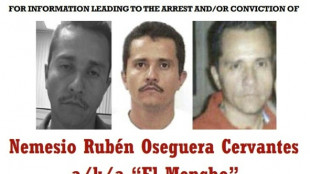

Top Mexican drug cartel leader killed

-

'One Battle' triumphs at BAFTAs that honour British talent

'One Battle' triumphs at BAFTAs that honour British talent

-

New Nissan Leaf 2026 review

-

Giroud penalty ends Lille's winless run in Ligue 1

Giroud penalty ends Lille's winless run in Ligue 1

-

Thrashing Spurs dragged Arsenal out of title hell: Arteta

-

Iran-US talks expected Thursday despite fears of strikes

Iran-US talks expected Thursday despite fears of strikes

-

Milan beaten by Parma, Napoli rage at officials

-

Hughes looses teeth then scores Olympic gold-winning goal for USA

Hughes looses teeth then scores Olympic gold-winning goal for USA

-

Eze and Gyokeres destroy Spurs to boost Arsenal title bid

-

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

-

Galthie praises France lock Meafou and defence

-

'Nothing was good', says Mac Allister despite Liverpool win

'Nothing was good', says Mac Allister despite Liverpool win

-

USA defeat Canada for Olympic men's ice hockey gold, Trump celebrates

-

EU 'expects' US to honour trade deal as Trump hikes tariffs

EU 'expects' US to honour trade deal as Trump hikes tariffs

-

'GOAT' battles to top of N. America box office

-

South Africa thrash India to end 12-match T20 World Cup win streak

South Africa thrash India to end 12-match T20 World Cup win streak

-

Bielle-Biarrey breaks record as France beat Italy in Six Nations

-

US says trade deals in force despite court ruling on tariffs

US says trade deals in force despite court ruling on tariffs

-

Barcelona back top of La Liga with Levante win

-

Gu strikes gold, USA beat Canada in men's ice hockey

Gu strikes gold, USA beat Canada in men's ice hockey

-

What's behind England's Six Nations slump?

-

Napoli rage at officials after loss at Atalanta

Napoli rage at officials after loss at Atalanta

-

Liverpool late show floors Nottingham Forest

-

Rimac Nevera R: Beyond imagination

Rimac Nevera R: Beyond imagination

-

USA beat Canada to win men's Olympic ice hockey gold

-

Samardzic seals comeback win for Atalanta over Napoli

Samardzic seals comeback win for Atalanta over Napoli

-

Eileen Gu switches slopes for catwalk after Olympic flourish

-

Luce: Ferrari's ingenious electric revolution

Luce: Ferrari's ingenious electric revolution

-

Miller guides South Africa to 187-7 against India

-

Scotland boss 'proud' of comeback Six Nations win over Wales

Scotland boss 'proud' of comeback Six Nations win over Wales

-

Iranian students rally for second day as fears of war with US mount

-

US Secret Service kills man trying to access Trump Florida estate

US Secret Service kills man trying to access Trump Florida estate

-

Coventry 'let the Games do their magic': former IOC executives

-

Cayenne Turbo Electric 2026

Cayenne Turbo Electric 2026

-

Sri Lanka have to qualify 'the hard way' after England drubbing

-

Doris says Six Nations rout of England is sparking Irish 'belief'

Doris says Six Nations rout of England is sparking Irish 'belief'

-

Thousands of pilgrims visit remains of St Francis

-

Emotional Gu makes history with Olympic freeski halfpipe gold

Emotional Gu makes history with Olympic freeski halfpipe gold

-

Impressive Del Toro takes statement victory in UAE

-

Gu wins triumphant gold of Milan-Cortina Olympics before ice hockey finale

Gu wins triumphant gold of Milan-Cortina Olympics before ice hockey finale

-

England rout Sri Lanka for 95 to win Super Eights opener

Japan's financial precipice

Japan is grappling with a dire financial crisis as interest rates have surged, doubling to a staggering 0.50%—the highest level since the 2008 global financial crisis. This dramatic shift, orchestrated by the Bank of Japan, marks the end of a prolonged era of ultra-low borrowing costs, leaving the nation teetering on the edge of economic ruin. The people, long accustomed to near-zero rates, now face unprecedented financial pressure as the cost of living soars and debt burdens mount.

For decades, Japan wrestled with stagnation and deflation, a period often dubbed the "Lost Decades." Ultra-low interest rates were a lifeline, keeping borrowing affordable and sustaining a fragile economy. But that lifeline has been severed. Inflation has climbed past the central bank's 2% target, fueled by a tight labor market and rising wages. Emboldened by these signs of economic vigor, the Bank of Japan has pushed forward with its rate hikes, aiming to normalize monetary policy after years of caution.

Yet, this bold move comes at a steep cost. Japan's public debt, one of the largest in the world, now looms larger as servicing costs rise with the higher rates. Households, once shielded by cheap loans, are buckling under increased mortgage and credit payments. Businesses, too, face a reckoning—many small firms, the backbone of the economy, fear they won't survive the tightened conditions. "The shift is too sudden," one economic observer noted, echoing widespread unease. "Families and companies need time to adjust, but time is a luxury we don’t have."

The timing couldn’t be worse. Global uncertainties, from trade disruptions to geopolitical tensions, cast a shadow over Japan’s recovery. Some experts caution that the rate hike could choke off growth just as the economy begins to stir, plunging the nation back into the stagnation it fought so hard to escape. "We’re walking a tightrope," another voice warned, highlighting the delicate balance between curbing inflation and preserving stability.

As Japan stands at this financial precipice, the Bank of Japan faces mounting pressure to monitor the fallout closely. The path ahead is fraught with risk—too aggressive, and the economy could collapse under the weight of debt; too lenient, and inflation could spiral out of control. For now, the people of Japan brace for hardship, their resilience tested once more as the nation navigates this perilous turning point.

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled

AI sparks Wall Street panic

India defies U.S. tariffs

EU misstep on mercosur Deal

Argentina reshapes oil

Power at the Heart of Iran