-

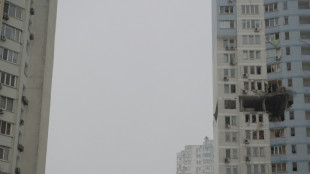

Kyiv mayor calls for temporary evacuation over heating outages

Kyiv mayor calls for temporary evacuation over heating outages

-

Families wait in anguish for prisoners' release in Venezuela

-

Littler signs reported record £20 million darts deal

Littler signs reported record £20 million darts deal

-

'Devastated' Switzerland grieves deadly New Year fire

-

Syria threatens to bomb Kurdish district in Aleppo as fighters refuse to evacuate

Syria threatens to bomb Kurdish district in Aleppo as fighters refuse to evacuate

-

Britain's Princess Catherine 'deeply grateful' after year in cancer remission

-

Russia joins Chinese, Iran warships for drills off South Africa

Russia joins Chinese, Iran warships for drills off South Africa

-

40 white roses: shaken mourners remember Swiss fire victims

-

German trial starts of 'White Tiger' online predator

German trial starts of 'White Tiger' online predator

-

Stocks rise despite mixed US jobs data

-

'Palestine 36' director says film is about 'refusal to disappear'

'Palestine 36' director says film is about 'refusal to disappear'

-

US December hiring misses expectations, capping weak 2025

-

Switzerland 'devastated' by fire tragedy: president

Switzerland 'devastated' by fire tragedy: president

-

Rosenior not scared of challenge at 'world class' Chelsea

-

Polish farmers march against Mercosur trade deal

Polish farmers march against Mercosur trade deal

-

Swiatek wins in 58 minutes as Poland reach United Cup semis

-

Ski great Hirscher pulls out of Olympics, ends season

Ski great Hirscher pulls out of Olympics, ends season

-

'War is back in vogue,' Pope Leo says

-

Storms pummel northern Europe causing travel mayhem and power cuts

Storms pummel northern Europe causing travel mayhem and power cuts

-

France has right to say 'no' to US, Paris says

-

TikTok drives 'bizarre' rush to Prague library's book tower

TikTok drives 'bizarre' rush to Prague library's book tower

-

EU countries override France to greenlight Mercosur trade deal

-

Russia joins Chinese, Iran warships for drills off S.Africa

Russia joins Chinese, Iran warships for drills off S.Africa

-

Stocks rise ahead of US jobs data and key tariffs ruling

-

'All are in the streets': Iranians defiant as protests grow

'All are in the streets': Iranians defiant as protests grow

-

Kurdish fighters refuse to leave Syria's Aleppo after truce

-

Grok turns off AI image generation for non-payers after nudes backlash

Grok turns off AI image generation for non-payers after nudes backlash

-

Germany factory output jumps but exports disappoint

-

Defiant Khamenei insists 'won't back down' in face of Iran protests

Defiant Khamenei insists 'won't back down' in face of Iran protests

-

Russian strikes cut heat to Kyiv, mayor calls for temporary evacuation

-

Switzerland holds day of mourning after deadly New Year fire

Switzerland holds day of mourning after deadly New Year fire

-

Hundreds of thousands without power as storms pummel Europe

-

Man City win race to sign forward Semenyo

Man City win race to sign forward Semenyo

-

Experts say oceans soaked up record heat levels in 2025

-

'Would be fun': Alcaraz, Sinner tease prospect of teaming up in doubles

'Would be fun': Alcaraz, Sinner tease prospect of teaming up in doubles

-

Man City win race to sign Semenyo

-

Chinese AI unicorn MiniMax soars 109 percent in Hong Kong debut

Chinese AI unicorn MiniMax soars 109 percent in Hong Kong debut

-

Iran rocked by night of protests despite internet blackout: videos

-

Swiatek romps to United Cup victory in 58 minutes

Swiatek romps to United Cup victory in 58 minutes

-

Procession of Christ's icon draws thousands to streets of Philippine capital

-

Every second counts for Japan's 'King Kazu' at 58

Every second counts for Japan's 'King Kazu' at 58

-

Syria announces ceasefire with Kurdish fighters in Aleppo

-

Russia hits Ukraine with hypersonic missile after rejecting peacekeeping plan

Russia hits Ukraine with hypersonic missile after rejecting peacekeeping plan

-

Asian stocks mixed ahead of US jobs, Supreme Court ruling

-

Scores without power as Storm Goretti pummels Europe

Scores without power as Storm Goretti pummels Europe

-

Sabalenka gets revenge over Keys in repeat of Australian Open final

-

Fresh from China, South Korea president to visit Japan

Fresh from China, South Korea president to visit Japan

-

Injured Kimmich to miss icy Bundesliga return for Bayern

-

Rybakina has little hope of change to tennis schedule

Rybakina has little hope of change to tennis schedule

-

Osimhen, Nigeria seek harmony with Algeria up next at AFCON

Japan's financial precipice

Japan is grappling with a dire financial crisis as interest rates have surged, doubling to a staggering 0.50%—the highest level since the 2008 global financial crisis. This dramatic shift, orchestrated by the Bank of Japan, marks the end of a prolonged era of ultra-low borrowing costs, leaving the nation teetering on the edge of economic ruin. The people, long accustomed to near-zero rates, now face unprecedented financial pressure as the cost of living soars and debt burdens mount.

For decades, Japan wrestled with stagnation and deflation, a period often dubbed the "Lost Decades." Ultra-low interest rates were a lifeline, keeping borrowing affordable and sustaining a fragile economy. But that lifeline has been severed. Inflation has climbed past the central bank's 2% target, fueled by a tight labor market and rising wages. Emboldened by these signs of economic vigor, the Bank of Japan has pushed forward with its rate hikes, aiming to normalize monetary policy after years of caution.

Yet, this bold move comes at a steep cost. Japan's public debt, one of the largest in the world, now looms larger as servicing costs rise with the higher rates. Households, once shielded by cheap loans, are buckling under increased mortgage and credit payments. Businesses, too, face a reckoning—many small firms, the backbone of the economy, fear they won't survive the tightened conditions. "The shift is too sudden," one economic observer noted, echoing widespread unease. "Families and companies need time to adjust, but time is a luxury we don’t have."

The timing couldn’t be worse. Global uncertainties, from trade disruptions to geopolitical tensions, cast a shadow over Japan’s recovery. Some experts caution that the rate hike could choke off growth just as the economy begins to stir, plunging the nation back into the stagnation it fought so hard to escape. "We’re walking a tightrope," another voice warned, highlighting the delicate balance between curbing inflation and preserving stability.

As Japan stands at this financial precipice, the Bank of Japan faces mounting pressure to monitor the fallout closely. The path ahead is fraught with risk—too aggressive, and the economy could collapse under the weight of debt; too lenient, and inflation could spiral out of control. For now, the people of Japan brace for hardship, their resilience tested once more as the nation navigates this perilous turning point.

Argentina's radical Shift

Hidden Cartel crisis in USA

New York’s lost Luster

Europe’s power shock

Australian economy Crisis

Israel’s Haredi Challenge

Miracle in Germany: VW soars

Pension crisis engulfs France

A new vision for Japan

The Fall of South Korea?

Gaza on the cusp of civil war