-

Pentagon chief refuses to rule out 'boots on ground' in Iran

Pentagon chief refuses to rule out 'boots on ground' in Iran

-

Saudi military raises readiness levels after attacks

-

Iran war spreads with strikes across Middle East and beyond

Iran war spreads with strikes across Middle East and beyond

-

Barca must 'make the impossible possible': coach Flick on Atletico cup challenge

-

Furry, frayed & freezing on Milan catwalks: the fashion trends

Furry, frayed & freezing on Milan catwalks: the fashion trends

-

Amsterdam's Rijksmuseum discovers new Rembrandt

-

Olympic comeback queen Brignone ends ski season

Olympic comeback queen Brignone ends ski season

-

Key Gulf air hubs caught up in Iran conflict

-

South Korea outclass Iran in Asian Women's Cup opener

South Korea outclass Iran in Asian Women's Cup opener

-

Liverpool's Slot says his 'football heart' does not like set-piece trend

-

Israel aims fresh attack at Tehran: latest developments in US-Iran war

Israel aims fresh attack at Tehran: latest developments in US-Iran war

-

Energy prices soar, stock markets slide on Iran war fallout

-

'No indication' Iran nuclear installations hit: IAEA

'No indication' Iran nuclear installations hit: IAEA

-

Showdown looms between Tesla and German union

-

Israel vows intensified attacks: latest developments in US-Iran war

Israel vows intensified attacks: latest developments in US-Iran war

-

France arrests activists blocking ship over alleged Russia uranium links

-

Tech sovereignty and AI networks set to dominate mobile meet

Tech sovereignty and AI networks set to dominate mobile meet

-

Indian police clash with pro-Khamenei protesters in Kashmir

-

Israel targets Hezbollah, Iran: latest developments in US-Iran war

Israel targets Hezbollah, Iran: latest developments in US-Iran war

-

Canada and India strike agreements on rare earth, uranium

-

A rough guide to F1 rule changes for 2026

A rough guide to F1 rule changes for 2026

-

At least 25 killed at Pakistan's pro-Iran weekend protests

-

Israel kills 31 in Lebanon, vows to expand strikes after Hezbollah fire

Israel kills 31 in Lebanon, vows to expand strikes after Hezbollah fire

-

Myanmar grants amnesty to over 7,000 convicted of 'terrorist group' support

-

Riyadh's King Fahd stadium to host 2027 Asian Cup final

Riyadh's King Fahd stadium to host 2027 Asian Cup final

-

'Superman Sanju' toast of India after T20 World Cup heroics

-

Travel chaos, but F1 season-opener in Australia 'ready to go'

Travel chaos, but F1 season-opener in Australia 'ready to go'

-

Lunar New Year heartache for Chinese team at Women's Asian Cup

-

El Nino may return in 2026 and make planet even hotter

El Nino may return in 2026 and make planet even hotter

-

Somaliland's Israel deal could put Berbera port at risk

-

Texas primaries launch midterm battle with Trump agenda at stake

Texas primaries launch midterm battle with Trump agenda at stake

-

How a Syrian refugee chef met Britain's King Charles

-

Bangladesh tackle gender barriers to reach Women's Asian Cup

Bangladesh tackle gender barriers to reach Women's Asian Cup

-

Argentina's Milei says wants US 'strategic alliance' to be state policy

-

'Sinners' wins top prize at Screen Actors Guild awards

'Sinners' wins top prize at Screen Actors Guild awards

-

New rules, same old suspects as F1 revs up for 2026 season

-

World Cup tickets: Huge demand and sky-high prices

World Cup tickets: Huge demand and sky-high prices

-

List of key Actor Award winners

-

Trump hunkers down after Iran strikes

Trump hunkers down after Iran strikes

-

China's leaders gather for key strategy session as challenges grow

-

UK toughens asylum rules to discourage migration

UK toughens asylum rules to discourage migration

-

Israel hits Lebanon after Hezbollah fire, expanding Iran war

-

CBS in turmoil as US media feels pressure under Trump

CBS in turmoil as US media feels pressure under Trump

-

Messi bags double as Miami battle back to down Orlando

-

Greenland is 'open for business' -- kind of, says business leader

Greenland is 'open for business' -- kind of, says business leader

-

Canada's Carney to mend rift, boost trade as he meets India's Modi

-

Crude soars, stocks drop after US strikes on Iran

Crude soars, stocks drop after US strikes on Iran

-

Iran war spreads across region as US, Israel suffer losses

-

Miriam Margolyes tackles aging in Oscar-nominated short

Miriam Margolyes tackles aging in Oscar-nominated short

-

Recognition, not competition, for Oscar-nominated foreign filmmakers

Germany and its outdated pension system

Germany must reform its pension system!

In the midst of an ageing society and changing labour markets, the Federal Republic of Germany is facing one of its greatest socio-political challenges: the urgent need to reform its pension system. Without timely and well-thought-out adjustments, there is a risk of financial bottlenecks and social injustices that could endanger the stability of the social system.

Demographic change as the main driver

Demographic change is indisputably the main factor putting pressure on the German pension system. The birth rate has been low for decades, while life expectancy continues to rise. This trend is leading to an ever-widening imbalance between contributors and pension recipients. According to forecasts, by 2035 almost one in three Germans will be over 65 years old. This ratio calls into question the financial viability of the pay-as-you-go pension system.

Financial sustainability at risk

The growing number of pensioners means higher expenditure for the pension funds, while income from contributions could stagnate or even fall. Without reforms, either contributions would have to be increased significantly or pension benefits cut – both scenarios that could cause social tensions. In addition, the burden on the federal budget is growing, as it already provides significant subsidies for pension insurance.

Changes in the world of work

Digitalisation and globalisation have fundamentally changed the world of work. Permanent full-time jobs are becoming rarer, while part-time jobs, solo self-employment and fixed-term contracts are on the rise. These forms of employment often lead to lower pension entitlements and increase the risk of poverty in old age. The current pension system is not sufficiently prepared for these new realities.

Intergenerational justice

Without adjustments, future generations could face a disproportionate burden. Today's young workers are financing the pensions of today's pensioners, while it is unclear whether they themselves can count on a comparable level of pensions in old age. Reform is therefore also a matter of intergenerational fairness.

Necessary reform approaches

- Increasing the retirement age

A gradual increase in the retirement age, adjusted for rising life expectancy, could relieve the pension funds. Strengthening private and occupational pension provision: Additional pension provision could be encouraged through tax incentives and information campaigns.

- Making retirement more flexible

More individual models could enable employees to retire earlier or later depending on their life situation. Integrating new forms of employment: Adjustments are needed to provide better protection for the self-employed and those in atypical employment.

- Promoting female employment

By making it easier to reconcile family and career, the employment rate can be increased, thereby attracting more contributors.

Conclusion:

Reforming the pension system is no easy task and requires courageous political decisions and a broad social consensus. However, it is indispensable to ensure financial stability and social justice in Germany. Now is the time to act in order to guarantee future generations a reliable and fair pension system.

Cuba's golden Goose dies

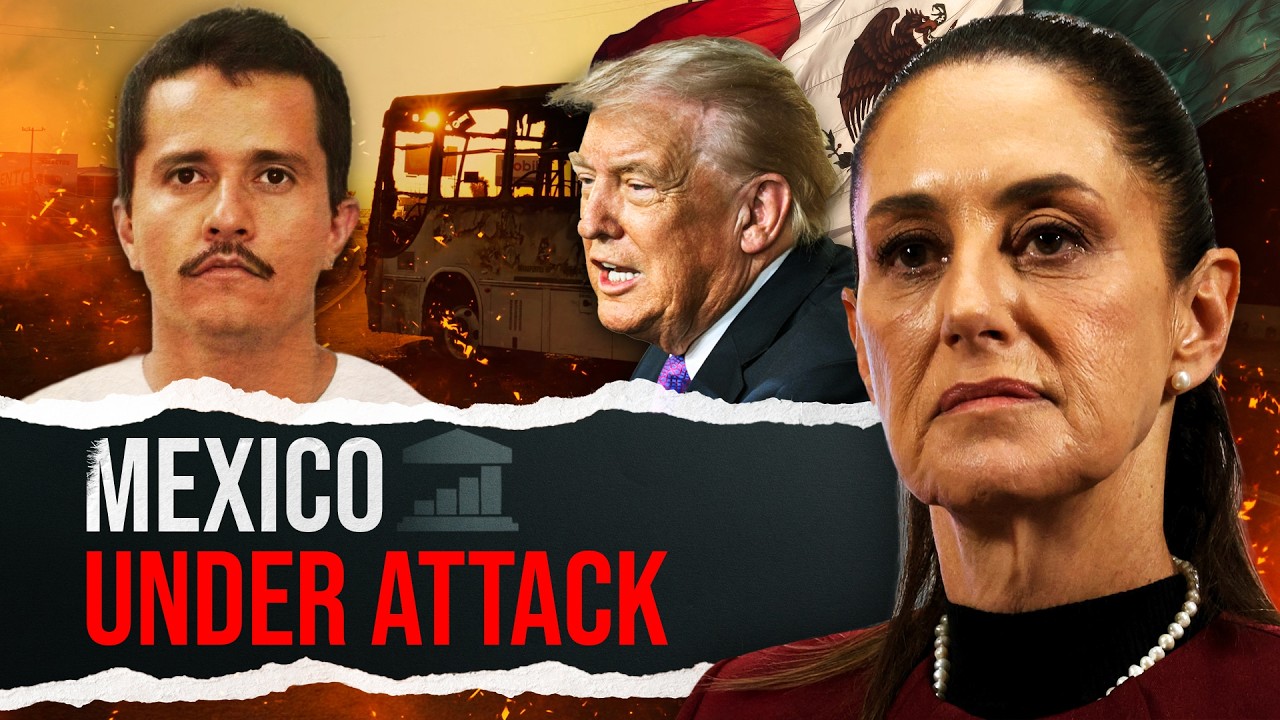

Mexico after El Mencho falls

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled

AI sparks Wall Street panic

India defies U.S. tariffs

EU misstep on mercosur Deal