-

US hit by first extreme heat wave of the year

US hit by first extreme heat wave of the year

-

Holders Thailand among seven set for LPGA International Crown

-

England set 371 to win India series opener after Pant heroics

England set 371 to win India series opener after Pant heroics

-

UK and Ukraine agree to deepen ties as Zelensky meets Starmer

-

New York state to build nuclear power plant

New York state to build nuclear power plant

-

Syria announces arrests over Damascus church attack

-

Bradley eyes playing captain role at Ryder Cup after win

Bradley eyes playing captain role at Ryder Cup after win

-

US existing home sales little-changed on sluggish market

-

Top US court takes case of Rastafarian whose hair was cut in prison

Top US court takes case of Rastafarian whose hair was cut in prison

-

Greece declares emergency on Chios over wildfires

-

Embattled Thai PM reshuffles cabinet as crisis rages

Embattled Thai PM reshuffles cabinet as crisis rages

-

Killer whales spotted grooming each other with seaweed

-

Where is Iran's uranium? Questions abound after US strikes

Where is Iran's uranium? Questions abound after US strikes

-

EU approves MotoGP takeover by F1 owner Liberty Media

-

Duplantis says vaulting 6.40m is within the 'realm of possibility'

Duplantis says vaulting 6.40m is within the 'realm of possibility'

-

Pant piles on agony for England with record-breaking century

-

NATO to take 'quantum leap' with 5% summit pledge: Rutte

NATO to take 'quantum leap' with 5% summit pledge: Rutte

-

Textor sells Crystal Palace stake to boost hopes of European competition

-

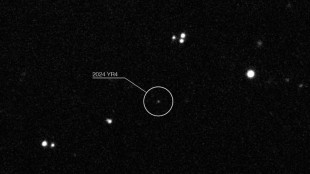

Earth's satellites at risk if asteroid smashes into Moon: study

Earth's satellites at risk if asteroid smashes into Moon: study

-

Syria president vows those involved in church attack will face justice

-

Russian barrage kills 10 in Kyiv, including 11-year-old girl

Russian barrage kills 10 in Kyiv, including 11-year-old girl

-

Military bases or vital waterway: Iran weighs response to US strikes

-

Italian sculptor Arnaldo Pomodoro dies aged nearly 99

Italian sculptor Arnaldo Pomodoro dies aged nearly 99

-

Rahul and Pant build India lead against England

-

UK probes maternity services after scandals

UK probes maternity services after scandals

-

Asian countries most vulnerable to Strait of Hormuz blockade

-

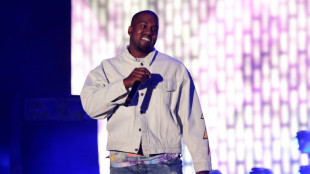

Anger as Kanye West to perform in Slovakia after Hitler song

Anger as Kanye West to perform in Slovakia after Hitler song

-

Israel targets Iran Guards, Tehran prison in fresh wave of strikes

-

Star-packed, Covid-shaped 'Death Stranding 2' drops this week

Star-packed, Covid-shaped 'Death Stranding 2' drops this week

-

IOC is in 'best of hands', says Bach as he hands over to Coventry

-

Oil prices seesaw as investors await Iran response to US strikes

Oil prices seesaw as investors await Iran response to US strikes

-

Beijing issues weather warning for hottest days of year

-

Tehran hit by Israeli attacks, vows response to US strikes

Tehran hit by Israeli attacks, vows response to US strikes

-

New CEO of Jeep owner Stellantis starts with leadership shake-up

-

Russian drone and missile barrage kills eight in Kyiv

Russian drone and missile barrage kills eight in Kyiv

-

Oil dips, dollar firms after US strikes in Iran

-

Paris Olympics and Paralympics cost taxpayer nearly 6 bn euros: state body

Paris Olympics and Paralympics cost taxpayer nearly 6 bn euros: state body

-

Eurozone business activity almost flat again in June

-

In Norway's Arctic, meteorologists have a first-row seat to climate change

In Norway's Arctic, meteorologists have a first-row seat to climate change

-

Iran vows retaliation for US strikes as Israel keeps up attacks

-

Russian drone and missile barrage on Kyiv kills seven

Russian drone and missile barrage on Kyiv kills seven

-

Oil rises, dollar firms after US strikes in Iran

-

'Noble to attend': Budapest prepares for 'banned' Pride march

'Noble to attend': Budapest prepares for 'banned' Pride march

-

Art market banking on new generation of collectors

-

Turning 80, UN faces fresh storm of doubts

Turning 80, UN faces fresh storm of doubts

-

'A great start': NBA crown just the beginning for Shai

-

Man City hit six to reach Club World Cup last 16, Real Madrid win with 10 men

Man City hit six to reach Club World Cup last 16, Real Madrid win with 10 men

-

Iran vows retaliation after US strikes on nuclear sites

-

'Massive' Russian attack on Kyiv kills at least five: Ukraine

'Massive' Russian attack on Kyiv kills at least five: Ukraine

-

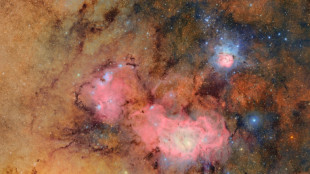

Groundbreaking Vera Rubin Observatory reveals first images

Aptevo Therapeutics Announces 1-for-20 Reverse Stock Split as part of Nasdaq Compliance Plan

SEATTLE, WA / ACCESS Newswire / May 22, 2025 / Aptevo Therapeutics Inc. (NASDAQ:APVO) ("Aptevo" or the "Company"), today announced that it will conduct a reverse stock split of its outstanding shares of common stock, par value $0.001 per share ("Common Stock"), at a ratio of 1-for-20 (the "Reverse Stock Split"). The Reverse Stock Split is expected to become effective on May 23, 2025, at 5:01 p.m. Eastern Time (the "Effective Time"), with shares expected to begin trading on the Nasdaq Capital Market, on a split-adjusted basis, at market open on May 27, 2025. In connection with the Reverse Stock Split, every 20 shares of Common Stock issued and outstanding as of the Effective Time will be automatically converted into one share of Common Stock. No change will be made to the trading symbol for the Common Stock, "APVO," in connection with the Reverse Stock Split.

The Reverse Stock Split is part of the Company's plan to maintain compliance with the continued listing standards of The Nasdaq Capital Market, among other benefits.

The Reverse Stock Split was approved by the Company's stockholders at the Company's Special Meeting of Stockholders held on May 14, 2025 (the "Special Meeting") to be effected in the Board's discretion within approved parameters. Following the Special Meeting, the final ratio was approved by the Company's Board on May 21, 2025.

The Reverse Stock Split will reduce the number of shares of outstanding Common Stock from approximately 13.5 million shares (as of the date of this press release) to approximately 0.7 million shares, subject to adjustment for rounding, as discussed below and potential additional issuances through the effective date of the Reverse Stock Split.

The Reverse Stock Split will affect all issued and outstanding shares of Common Stock. All outstanding options, restricted stock units, warrants, and other securities entitling their holders to purchase or otherwise receive shares of Common Stock will be adjusted as a result of the reverse split, as required by the terms of each security. The number of shares available to be awarded under the Company's equity incentive plans will also be appropriately adjusted. Following the reverse split, the par value of the Common Stock will remain unchanged at $0.001 par value per share. The Reverse Stock Split will not change the authorized number of shares of Common Stock or preferred stock. No fractional shares will be issued in connection with the Reverse Stock Split, and stockholders who would otherwise be entitled to receive a fractional share of Common Stock will be entitled to receive a cash payment (without interest).

Additional information regarding the Reverse Stock Split is available in the Company's definitive proxy statement filed with the U.S. Securities and Exchange Commission ("SEC") on April 25, 2025, and a Current Report on Form 8-K which the Company plans to file following the Effective Time.

About Aptevo Therapeutics

Aptevo Therapeutics Inc. is a clinical-stage biotechnology company focused on developing novel bispecific immunotherapies for the treatment of cancer. The company has two clinical candidates. Mipletamig is currently being evaluated in RAINIER, a Phase 1b/2 trial for the treatment of frontline acute myeloid leukemia in combination with standard-of-care venetoclax + azacitidine. Mipletamig has received orphan drug designation ("orphan status") for AML according to the Orphan Drug Act. ALG.APV-527, a bispecific conditional 4-1BB agonist, only active upon simultaneous binding to 4-1BB and 5T4, is being co-developed with Alligator Bioscience and is being evaluated in a Phase 1 clinical trial for the treatment of multiple solid tumor types likely to express 5T4. The Company has three pre-clinical candidates with different mechanisms of action designed to target a range of solid tumors. All pipeline candidates were created from two proprietary platforms, ADAPTIR® and ADAPTIR-FLEX® The Aptevo mission is to improve treatment outcomes and transform the lives of cancer patients. For more information, please visit www.aptevotherapeutics.com.

Forward-Looking Statements

This press release includes "forward-looking statements", including information about management's view of the Company's future expectations, plans and prospects, within the safe harbor provisions provided under federal securities laws, including under The Private Securities Litigation Reform Act of 1995. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," "may," "will," "could," "should," "believes," "predicts," "potential," "continue" and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results and, consequently, you should not rely on these forward-looking statements as predictions of future events. These forward-looking statements and factors that may cause such differences include, without limitation, our ability to continue as a going concern; a deterioration in Aptevo's business or prospects; further assessment of preliminary or interim data or different results from later clinical trials; adverse events and unanticipated problems and adverse developments in clinical development, including unexpected safety issues observed during a clinical trial; and changes in regulatory, social, macroeconomic and political conditions. These risks are not exhaustive, the Company faces known and unknown risks. Additional risks and factors that may affect results of the Company are set forth in the Company's filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and its subsequent reports on Form 10-Q and current reports on Form 8-K. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from the Company's expectations in any forward-looking statement. Readers are cautioned not to place undue reliance upon any forward-looking statements, including but not limited to statements about the effectuation of the Reverse Stock Split. These reports and filings are available at www.sec.gov and are available for download, free of charge, soon after such reports are filed with or furnished to the SEC, on the "Investors" page of the Company's website at www.apvotherapeutics.com. Any forward-looking statement speaks only as of the date of this press release, and, except as required by law, the Company does not assume any obligation to update any forward-looking statement to reflect new information, events, or circumstances.

Contact:

Miriam Weber Miller

Head, Investor Relations & Corporate Communications

Aptevo Therapeutics

Email: [email protected] or [email protected]

Phone: 206-859-6628

SOURCE: Aptevo Therapeutics

View the original press release on ACCESS Newswire

L.Davis--AMWN