-

Fresh Pakistan monsoon rains kill 20, halt rescue efforts

Fresh Pakistan monsoon rains kill 20, halt rescue efforts

-

Forest sign French forward Kalimuendo

-

Zelensky warns against 'rewarding' Russia after Trump urges concessions

Zelensky warns against 'rewarding' Russia after Trump urges concessions

-

FIFA boss condemns racial abuse in German Cup games

-

Stocks diverge ahead of Trump-Zelensky talks

Stocks diverge ahead of Trump-Zelensky talks

-

Spain and Portugal battle wildfires as death toll mounts

-

Joao Felix says late Jota 'will forever be part of football history'

Joao Felix says late Jota 'will forever be part of football history'

-

Javelin star Kitaguchi finds new home in small Czech town

-

Rain halts rescue operation after Pakistan floods kill hundreds

Rain halts rescue operation after Pakistan floods kill hundreds

-

Zelensky says Russia must end war, after Trump pressures Ukraine

-

China slams Germany for 'hyping' regional tensions in Asia

China slams Germany for 'hyping' regional tensions in Asia

-

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

-

Asia stocks up before Trump-Zelensky talks

Asia stocks up before Trump-Zelensky talks

-

Fight to save last forests of the Comoros unites farmers, NGOs

-

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

-

Five killed in Russian drone attack on Ukraine apartment block

-

Myanmar junta sets December 28 poll date despite raging civil war

Myanmar junta sets December 28 poll date despite raging civil war

-

German minister says China 'increasingly aggressive'

-

Singapore key exports slip in July as US shipments tumble 42.7 pct

Singapore key exports slip in July as US shipments tumble 42.7 pct

-

German great Mueller has goal ruled out on MLS debut for Vancouver

-

Zelensky, European leaders head to US for talks on peace deal terms

Zelensky, European leaders head to US for talks on peace deal terms

-

Tourism deal puts one of Egypt's last wild shores at risk

-

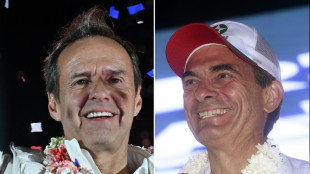

Two right-wing candidates headed to Bolivia presidential run-off

Two right-wing candidates headed to Bolivia presidential run-off

-

Australian court fines Qantas US$59 million for illegal layoffs

-

Games industry in search of new winning combo at Gamescom 2025

Games industry in search of new winning combo at Gamescom 2025

-

Rooms of their own: women-only communities thrive in China

-

Social media hit Ilona Maher takes women's rugby onto new plane

Social media hit Ilona Maher takes women's rugby onto new plane

-

Asia stocks up, oil down before Trump-Zelensky talks

-

Zelensky returns to site of stunning Oval Office shouting match

Zelensky returns to site of stunning Oval Office shouting match

-

Two right-wing candidates headed to Bolivia presidential run-off: projection

-

New to The Street's Esteemed Client Synergy CHC Corp. (NASDAQ: SNYR) Announces Nationwide EG America Rollout for FOCUSfactor(R) Focus + Energy EG America, 6th Largest U.S. Convenience Chain, Expands Distribution Across 1,600+ High-Traffic Locations

New to The Street's Esteemed Client Synergy CHC Corp. (NASDAQ: SNYR) Announces Nationwide EG America Rollout for FOCUSfactor(R) Focus + Energy EG America, 6th Largest U.S. Convenience Chain, Expands Distribution Across 1,600+ High-Traffic Locations

-

MDCE Subsidiary Infinite Auctions Soars with 2,500% YoY Revenue Growth in Q2 2025

-

Waste Energy Corp Closes Deal to Reduce its Debt by $1 Million

Waste Energy Corp Closes Deal to Reduce its Debt by $1 Million

-

Aeluma to Participate in Upcoming Investor Conferences

-

Form Bio Appoints Michelle Chen, Ph.D. as President and Chief Executive Officer

Form Bio Appoints Michelle Chen, Ph.D. as President and Chief Executive Officer

-

WidePoint to Participate in the Lytham Partners 2025 Consumer & Technology Investor Summit on August 19, 2025

-

Ondas Enters into Definitive Agreement to Strengthen Multi-Domain Autonomy Leadership with Strategic Acquisition of Robotics Innovator Apeiro Motion

Ondas Enters into Definitive Agreement to Strengthen Multi-Domain Autonomy Leadership with Strategic Acquisition of Robotics Innovator Apeiro Motion

-

A Drug that Could Reduce Metastatic Cancer Resurgence due to Its Anti-Inflammatory Effects in Viral Infections is in Clinical Trials

-

Aspire Biopharma Announces Positive Top-Line Results from Clinical Trial of Investigational New Sublingual Aspirin Product for Treatment of Suspected Acute Myocardial Infarction (Heart Attack)

Aspire Biopharma Announces Positive Top-Line Results from Clinical Trial of Investigational New Sublingual Aspirin Product for Treatment of Suspected Acute Myocardial Infarction (Heart Attack)

-

Kingsway Announces Acquisition of Southside Plumbing

-

IRS Targets Gambling Winnings and Online Betting - Clear Start Tax Shares What Winners Often Overlook

IRS Targets Gambling Winnings and Online Betting - Clear Start Tax Shares What Winners Often Overlook

-

Florida Small Business Owner Stays Afloat When Lender and Community Business Organization Join Forces

-

MEDevice Boston Partnerships Highlighting Strategic Alliances and MedTech Catalyst

MEDevice Boston Partnerships Highlighting Strategic Alliances and MedTech Catalyst

-

New to The Street Signs SAGTEC GLOBAL LTD (NASDAQ:SAGT) to Yearlong Media Awareness Campaign

-

Capstone to Acquire Carolina Stone Products-Immediately Accretive to Revenue and EBITDA; Closing Targeted by August 22, 2025

Capstone to Acquire Carolina Stone Products-Immediately Accretive to Revenue and EBITDA; Closing Targeted by August 22, 2025

-

Aehr Test Systems to Participate in the Needham Virtual Semiconductor and SemiCap 1x1 Conference on August 20

-

Arrive AI Secures Ninth U.S. Patent, Solidifying Leadership in Autonomous Delivery Innovation

Arrive AI Secures Ninth U.S. Patent, Solidifying Leadership in Autonomous Delivery Innovation

-

Thornhill Skin Clinic Receives 2025 Consumer Choice Award for Cosmetic Procedures in York Region

-

Eagle Plains Highlights Intrusion Related Gold Potential at Dragon Lake Project, YT

Eagle Plains Highlights Intrusion Related Gold Potential at Dragon Lake Project, YT

-

AmeriTrust Further Enhances its Management Team

Oil dips, dollar firms after US strikes in Iran

Oil prices gave up most of their early gains on Monday and the dollar strengthened after the United States struck Iran's nuclear facilities at the weekend.

Asian markets mostly retreated while European bourses were marginally higher as traders wait to see how Tehran could respond.

"Everything hinges on Iran's response -- and whether it's a symbolic jab or a haymaker that knocks the Strait of Hormuz offline," said Stephen Innes at SPI Asset Management.

One option on the table would be to potentially create economic havoc by seeking to close the strategic Strait of Hormuz -- which carries one-fifth of global oil output.

Iran is the world's ninth-biggest oil-producing country, with output of about 3.3 million barrels per day. It exports just under half of that amount and consumes the rest.

When trading opened on Monday, Brent and the main US crude contract WTI both jumped more than four percent to hit their highest price since January.

They pared these gains however and briefly dipped into the red before recovering to trade slightly higher.

"So far, satellite images reportedly suggest that oil continues to flow through the Strait, which may explain the muted market reaction to the news," said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

"Many remain optimistic that Iran will avoid a full-blown retaliation and regional chaos, to prevent its own oil facilities from becoming targets and to avoid a widening conflict that could hurt China -- its biggest oil customer."

But "if things get uglier" the price of US crude could even spike beyond $100 per barrel, she said. WTI was trading around $74 per barrel on Monday.

- 'Extreme route' -

"An oil price shock would create a real negative impact on most Asian economies" as many are big net energy importers, economists at MUFG warned.

Tokyo, Seoul, Sydney, Singapore, Taipei, Manila, Bangkok and Jakarta were all lower.

Hong Kong, Shanghai and Kuala Lumpur were the only gainers in Asia. In European markets London and Frankfurt ticked marginally higher while Paris was flat.

The dollar rose against other currencies but analysts questioned to what extent this would hold out.

"If the increase proves to be just a knee-jerk reaction to what is perceived as short-lived US involvement in the Middle-East conflict, the dollar's downward path is likely to resume," said Sebastian Boyd, markets live blog strategist at Bloomberg.

Chris Weston at Pepperstone said Iran would be able to inflict economic damage on the world without taking the "extreme route" of trying to close the Strait of Hormuz.

"By planting enough belief that they could disrupt this key logistical channel, maritime costs could rise to the point that it would have a significant impact on the supply of crude and gas," he wrote.

At the same time, "while Trump's primary focus will be on the Middle East, headlines on trade negotiations could soon start to roll in and market anxieties could feasibly build".

- Key figures at around 0900 GMT -

Brent North Sea Crude: UP 0.2 percent at $77.14 per barrel

West Texas Intermediate: UP 0.1 percent at $73.94 per barrel

Tokyo - Nikkei 225: DOWN 0.1 percent at 38,354.09 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 23,689.13 (close)

Shanghai - Composite: UP 0.7 percent at 3,381.58 (close)

London - FTSE 100: UP 0.1 percent at 8,800.5

Euro/dollar: DOWN at $1.1458 from $1.1516 on Friday

Pound/dollar: UP at $1.3445 from $1.3444

Dollar/yen: UP at 147.94 yen from 146.13 yen

Euro/pound: DOWN at 85.65 pence from 85.66 pence

New York - Dow: UP 0.1 percent at 42,206.82 (close)

D.Moore--AMWN