-

Springbok captain Kolisi to rejoin Stormers

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

-

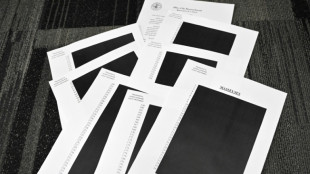

Thousands of new Epstein-linked documents released by US Justice Dept

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Laser Photonics Reports Q3 2025 Revenue Growth of 28% Year-Over-Year

Laser Photonics Reports Q3 2025 Revenue Growth of 28% Year-Over-Year

-

BeMetals Announces Settlement of All Outstanding Debt

-

Who Does the Best Mommy Makeover in Bellevue?

Who Does the Best Mommy Makeover in Bellevue?

-

Zenwork Joins CERCA to Support IRS Modernization and Strengthen National Information Reporting Infrastructure

-

Cellbxhealth PLC Announces Holding(s) in Company

Cellbxhealth PLC Announces Holding(s) in Company

-

Top Gold IRA Companies 2026 Ranked (Augusta Precious Metals, Lear Capital and More Reviewed)

-

Karviva Announces Launch of Energy and ACE Collagen Juices at Gelson's Stores This December

Karviva Announces Launch of Energy and ACE Collagen Juices at Gelson's Stores This December

-

MindMaze Therapeutics: Consolidating a Global Approach to Reimbursement for Next-Generation Therapeutics

-

Decentralized Masters Announced as the Best Crypto Course of 2025 (Courses on Cryptocurrency Ranked)

Decentralized Masters Announced as the Best Crypto Course of 2025 (Courses on Cryptocurrency Ranked)

-

Trump says would be 'smart' for Venezuela's Maduro to step down

-

Steelers' Metcalf suspended two games over fan outburst

Steelers' Metcalf suspended two games over fan outburst

-

Salah, Foster take Egypt and South Africa to AFCON Group B summit

-

Napoli beat Bologna to lift Italian Super Cup

Napoli beat Bologna to lift Italian Super Cup

-

Salah snatches added-time winner for Egypt after Zimbabwe scare

-

Penalty king Jimenez strikes for Fulham to sink Forest

Penalty king Jimenez strikes for Fulham to sink Forest

-

Kansas City Chiefs confirm stadium move

-

Liverpool rocked by Isak blow after surgery on ankle injury

Liverpool rocked by Isak blow after surgery on ankle injury

-

US stocks push higher while gold, silver notch fresh records

Bausch Health to Reduce Debt by Approximately $900 Million Using Cash On Hand

LAVAL, QC / ACCESS Newswire / July 28, 2025 / Bausch Health Companies Inc. (NYSE: BHC)(TSX: BHC) ("Bausch Health" or the "Company") today announced that its subsidiary, Bausch Health Americas, Inc., has issued an irrevocable notice of redemption pursuant to which it will redeem approximately $602 million of aggregate principal amount of its outstanding 9.25% Senior Notes due 2026, CUSIP Nos. 91911XAV6 and U9098VAN2 (the "Notes"), using cash on hand. The redemption date is August 28, 2025. The notice of redemption has been issued to the record holders of such Notes. Nothing contained herein shall constitute a notice of redemption of the Notes. Payment of the redemption price and surrender of the Notes for redemption will be made through the facilities of the Depository Trust Company in accordance with the applicable procedures of the Depository Trust Company. The name and address of the U.S. paying agent are as follows: The Bank of New York Mellon, 240 Greenwich Street, Floor 7E, New York, New York 10286; Attn: Corporate Trust Administration. In connection with the redemption, the indenture pursuant to which the Notes were issued will be terminated.

In addition, the Company today announced that its subsidiary, Bausch Receivables Funding LP, has given notice to the administrative agent under its Credit and Security Agreement, dated as of June 30, 2023, as amended, of its intention to repay all outstanding amounts in respect of the receivables financing facility thereunder (the "Receivables Facility"), and to terminate the Receivables Facility and the related agreements as of October 27, 2025. As of July 28, 2025, the aggregate principal amount outstanding under the Receivables Facility was $300 million.

These measures are consistent with the Company's focus on optimizing its capital structure.

About Bausch Health

Bausch Health Companies Inc. (NYSE: BHC)(TSX: BHC), is a global, diversified pharmaceutical company enriching lives through our relentless drive to deliver better health care outcomes. We develop, manufacture and market a range of products primarily in gastroenterology, hepatology, neurology, dermatology, dentistry, aesthetics, international pharmaceuticals and eye health, through our controlling interest in Bausch + Lomb Corporation. Our ambition is to be a globally integrated healthcare company, trusted and valued by patients, HCPs, employees and investors. For more information about Bausch Health, visit www.bauschhealth.com and connect with us on LinkedIn.

Forward-looking Statements

This news release may contain forward-looking statements within the meaning of applicable securities laws, including the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements may generally be identified by the use of the words "will," "anticipates," "hopes," "expects," "intends," "plans," "should," "could," "would," "may," "believes," "subject to" and variations or similar expressions. These statements are neither historical facts nor assurances of future performance, are based upon the current expectations and beliefs of management and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Actual results are subject to other risks and uncertainties that relate more broadly to Bausch Health's overall business, including those more fully described in Bausch Health's most recent annual and quarterly reports and detailed from time to time in Bausch Health's other filings with the U.S. Securities and Exchange Commission and the Canadian Securities Administrators, which factors are incorporated herein by reference. Readers are cautioned not to place undue reliance on any of these forward-looking statements. These forward-looking statements speak only as of the date hereof. The Company undertakes no obligation to update any of these forward-looking statements to reflect events, information or circumstances after the date of this news release or to reflect actual outcomes, unless required by law.

Investor Contact: | Media Contact: |

Garen Sarafian | Katie Savastano |

(877) 281-6642 (toll free) | (908) 569-3692 |

SOURCE: Bausch Health Companies Inc.

View the original press release on ACCESS Newswire

G.Stevens--AMWN