-

Boulbina extra-time stunner takes Algeria through to AFCON quarter-finals

Boulbina extra-time stunner takes Algeria through to AFCON quarter-finals

-

Doncic, Giannis lead NBA All-Star voting

-

NASCAR commissioner Phelps steps down

NASCAR commissioner Phelps steps down

-

Domen Prevc secures Four Hills ski jump title to emulate brother

-

Fletcher says Man Utd coaching job was not in 'wildest dreams'

Fletcher says Man Utd coaching job was not in 'wildest dreams'

-

US forces killed 55 Venezuelan, Cuban military personnel in Maduro raid: tolls

-

Maduro lawyer previously defended WikiLeaks' Julian Assange

Maduro lawyer previously defended WikiLeaks' Julian Assange

-

O'Neill not sure he has 'energy' for long Celtic stay

-

Como sweep past Pisa to go fourth in Serie A

Como sweep past Pisa to go fourth in Serie A

-

Iran security forces use tear gas in Tehran bazaar as toll rises

-

Man Utd speculation 'wasted time', says Palace boss Glasner

Man Utd speculation 'wasted time', says Palace boss Glasner

-

Somalia calls Israeli FM visit to Somaliland an 'incursion'

-

New Venezuelan leader walks tightrope with US, Maduro loyalists

New Venezuelan leader walks tightrope with US, Maduro loyalists

-

US Capitol riot anniversary exposes a country still divided

-

Six dead in weather accidents as cold snap grips Europe

Six dead in weather accidents as cold snap grips Europe

-

Repeating Super Cup success will give Barca 'energy': Flick

-

Dias, Gvardiol sidelined as Man City face defensive crisis

Dias, Gvardiol sidelined as Man City face defensive crisis

-

Newcastle's Howe rules himself out of Man Utd job

-

Five dead in weather accidents as cold snap grips Europe

Five dead in weather accidents as cold snap grips Europe

-

US would lead Ukraine ceasefire monitoring, back multinational force: draft statement

-

UK electric car sales hit record high in 2025: industry

UK electric car sales hit record high in 2025: industry

-

Hungarian filmmaker Bela Tarr dies aged 70

-

Canadian Gee joins Lidl-Trek, resolves dispute with ex-team

Canadian Gee joins Lidl-Trek, resolves dispute with ex-team

-

'Demon' drags hosts Australia into United Cup quarters

-

EV sales rebound in Germany as Chinese brands make inroads

EV sales rebound in Germany as Chinese brands make inroads

-

Swiss officials admit inspections failure at inferno bar

-

Taylor's endorsement prompts Swift sell-out for Sancerre wine

Taylor's endorsement prompts Swift sell-out for Sancerre wine

-

Chelsea appoint inexperienced Rosenior as new boss

-

IOC confident of Winter Olympics preparation despite delays

IOC confident of Winter Olympics preparation despite delays

-

Ukraine's European, US allies meet in Paris on security guarantees

-

Oil prices gain, as equities extend record run higher

Oil prices gain, as equities extend record run higher

-

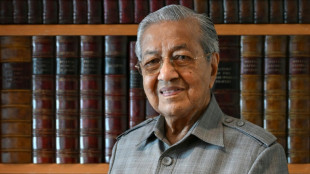

Malaysia's ex-PM Mahathir hospitalised with hip fracture after fall at home

-

'Sad' Sabalenka says Battle of the Sexes 'brought eyes on tennis'

'Sad' Sabalenka says Battle of the Sexes 'brought eyes on tennis'

-

Climate-driven tree deaths speeding up in Australia: study

-

Unheralded Rosenior has 'agreed verbally' to become Chelsea manager

Unheralded Rosenior has 'agreed verbally' to become Chelsea manager

-

Last 'holy door' at St Peter's closes to end Catholic jubilee year

-

US Justice Dept says millions of Epstein files still not released

US Justice Dept says millions of Epstein files still not released

-

Rosenior says has 'agreed verbally' to become Chelsea manager

-

Kyrgios admits glory days behind him after losing on comeback

Kyrgios admits glory days behind him after losing on comeback

-

Australia's Head set to remain opener after sensational Ashes

-

'Battle of the Sexes' rivals have mixed fortunes in Brisbane

'Battle of the Sexes' rivals have mixed fortunes in Brisbane

-

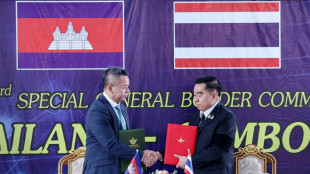

Thailand says Cambodia violated truce with cross-border 'accident'

-

Nigeria's 'Kannywood' tiptoes between censor boards and modernity

Nigeria's 'Kannywood' tiptoes between censor boards and modernity

-

'Nobody is going to run home': Venezuelan diaspora in wait-and-see mode

-

Sabalenka says 'Battle of the Sexes' pays off after ruthless win

Sabalenka says 'Battle of the Sexes' pays off after ruthless win

-

Venus Williams ousted in first round of Australian Open warm-up

-

Landmines destroy limbs and lives on Bangladesh-Myanmar border

Landmines destroy limbs and lives on Bangladesh-Myanmar border

-

Australian Open winners to get $2.79mn as prize money hits new high

-

Markets extend global rally amid optimistic outlook, oil dips

Markets extend global rally amid optimistic outlook, oil dips

-

Australian PM to tour outback flood disaster zone

| RBGPF | 2.78% | 82.5 | $ | |

| CMSC | -0.03% | 22.982 | $ | |

| RYCEF | 1.65% | 16.92 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| BTI | -2.23% | 54.29 | $ | |

| NGG | 1.47% | 79.425 | $ | |

| RIO | 2.3% | 85.17 | $ | |

| RELX | -1.03% | 41.68 | $ | |

| CMSD | -0.47% | 23.54 | $ | |

| BCC | 2.12% | 77.24 | $ | |

| VOD | -0.26% | 13.535 | $ | |

| JRI | 0.37% | 13.69 | $ | |

| GSK | 3.53% | 50.815 | $ | |

| BCE | -1.4% | 23.393 | $ | |

| BP | -4.86% | 34.445 | $ | |

| AZN | 3.37% | 94.4 | $ |

Guan Huat Seng Holdings Berhad Launches IPO Prospectus To Drive Next Phase Of Growth

KUALA LUMPUR, MY / ACCESS Newswire / January 5, 2026 / Guan Huat Seng Holdings Berhad ("GHS Holdings" or the "Company") and its subsidiaries (the "Group"), a distributor and retailer of food products and manufacturer of flavouring products based in Melaka, is pleased to announce the official launch of its prospectus in conjunction with its listing on the ACE Market of Bursa Malaysia Securities Berhad ("Bursa Securities").

From L-R: Mr. Lee Chee Kian, Executive Director of Guan Huat Seng Holdings Berhad; Mr. Yeo Tian Seng, Executive Director of Guan Huat Seng Holdings Berhad; Mr. Yeo Tien Ee, Managing Director of Guan Huat Seng Holdings Berhad; Mr. Tah Heong Beng, Executive Director of Operations of TA Securities Holdings Berhad; Mr. Ku Mun Fong, Head of Corporate Finance of TA Securities Holdings Berhad; Mr. Chin Wai Kit, Assistant Vice President of Corporate Finance of TA Securities Holdings Berhad

With the "Guan Huat Seng" brand existence tracing back to the 1930s and an established track record of approximately 46 years since the establishment of Guan Huat Seng (Heng Kee) Sdn. Bhd, GHS Holdings has grown from a traditional food retailer into a diversified distributor and retailer of food products, with in-house manufacturing capabilities. Through its subsidiaries, Guan Huat Seng (Heng Kee) Sdn. Bhd. and GHS Food Industries Sdn. Bhd., the Group distributes and retails a wide range of food products including shelf-stable and frozen seafood, flavouring products, dried food and snacks and general grocery products, supported by in-house manufacturing of flavouring products which are certified Halal as well as HACCP and MeSTI certifications for the production of sauces, pastes, and dried seasoning powder.

Following the IPO exercise, GHS Holdings is expected to raise RM30.00 million via the issuance of 120.00 million new shares at an issue price of RM0.25 per share. The proceeds will be utilised as follows:

· RM12.00 million to part finance the setup of a New Integrated Complex;

· RM9.00 million to part finance the setup of a New Krubong Facility;

· RM3.00 million for working capital;

· RM1.50 million for marketing expenses; and

· RM4.50 million for estimated listing expenses.

Mr. Yeo Tien Ee, Managing Director of Guan Huat Seng Holdings Berhad said: "The launch of our prospectus represents a significant milestone in our transformation from a traditional food retailer into a diversified distributor and retailer of food products, with in-house manufacturing capabilities. The IPO will enable us to accelerate our expansion plans, increase production and storage capacity through our new facilities in Melaka, and strengthen our presence in both distribution and retail segments. We are committed to building on our legacy of trust and quality while driving long-term sustainable growth for our stakeholders."

Mr. Ku Mun Fong, Head of Corporate Finance of TA Securities Holdings Berhad said, "GHS Holdings has an established track record in Malaysia's distributive trade of food and beverage ("F&B") product industry and a wide distribution network, supported by an experienced management team that position it well to capture opportunities in the industry. We are delighted to support GHS Holdings' IPO journey. The Company's strategic direction will enable it to seize opportunities driven by the continued growth of Malaysia's distributive trade of F&B product industry."

The distributive trade of F&B product industry in Malaysia recorded a compound annual growth rate ("CAGR") of 7.6% between 2022 and 2024, with growth for 2026 projected at 5.0%, driven primarily by the retail segment fuelled by seasonal sales and promotions across physical stores, social media and online shopping platforms. In 2026, the food, beverages and accommodation subsector is expected to grow by 6.6%. This is supported by an anticipated increase in tourist arrivals for business and leisure, as well as meetings, incentives, conferences, and exhibitions (MICE) activities, in line with the Malaysia Government's Visit Malaysia 2026 campaign.

Applications for the Public Issue are open from today, 5 January 2026 and will close on 9 January 2026. GHS Holdings is scheduled to be listed on the ACE Market of Bursa Securities on 22 January 2026.

Upon listing, the Group will have a market capitalisation of approximately RM118.38 million, based on the issue price of RM0.25 per share and an enlarged total number of 473,500,100 shares.

TA Securities Holdings Berhad is the Principal Adviser, Sponsor, Underwriter, and Placement Agent for this IPO.

###

ABOUT GUAN HUAT SENG HOLDINGS BERHAD

Guan Huat Seng Holdings Berhad ("GHS Holdings" or the "Company") is principally involved in the distribution and retail of food products with more than four decades of established track record in Melaka, Malaysia. Through its subsidiaries, Guan Huat Seng (Heng Kee) Sdn. Bhd. and GHS Food Industries Sdn. Bhd. ("Group"), the Group distributes and retails a wide range of food products including shelf-stable and frozen seafood, flavouring products, dried food and snacks, and general grocery products, and is supported by in-house manufacturing facilities. The Group holds HACCP and MeSTI certifications for the production of, among others, sauces, pastes and dried seasoning powder. Serving wholesalers, retailers, food service operators, end consumers and food manufacturers across both domestic and foreign markets, GHS Holdings is committed to enhancing operational efficiency, expanding its production and storage capacity through the construction of its New Integrated Complex and New Krubong Facility, and driving sustainable growth within Malaysia's distributive trade of food and beverage (F&B) product industry.

Issued By: Swan Consultancy Sdn. Bhd. on behalf of Guan Huat Seng Holdings Berhad

For more information, please contact:

Jazmin Wan

Email: [email protected]

SOURCE: Guan Huat Seng Holdings Berhad

View the original press release on ACCESS Newswire

J.Williams--AMWN