-

Swedish ex-govt adviser goes on trial over mislaid documents

Swedish ex-govt adviser goes on trial over mislaid documents

-

Injured Springboks captain Kolisi out for four weeks

-

Irish literary star Sally Rooney pledges UK TV fees to banned pro-Palestine group

Irish literary star Sally Rooney pledges UK TV fees to banned pro-Palestine group

-

Stocks mixed ahead of Trump-Zelensky talks

-

Son of Norway princess charged with four rapes

Son of Norway princess charged with four rapes

-

Fresh Pakistan monsoon rains kill 20, halt rescue efforts

-

Forest sign French forward Kalimuendo

Forest sign French forward Kalimuendo

-

Zelensky warns against 'rewarding' Russia after Trump urges concessions

-

FIFA boss condemns racial abuse in German Cup games

FIFA boss condemns racial abuse in German Cup games

-

Stocks diverge ahead of Trump-Zelensky talks

-

Spain and Portugal battle wildfires as death toll mounts

Spain and Portugal battle wildfires as death toll mounts

-

Joao Felix says late Jota 'will forever be part of football history'

-

Javelin star Kitaguchi finds new home in small Czech town

Javelin star Kitaguchi finds new home in small Czech town

-

Rain halts rescue operation after Pakistan floods kill hundreds

-

Zelensky says Russia must end war, after Trump pressures Ukraine

Zelensky says Russia must end war, after Trump pressures Ukraine

-

China slams Germany for 'hyping' regional tensions in Asia

-

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

US envoy says Israel's turn to 'comply' as Lebanon moves to disarm Hezbollah

-

Asia stocks up before Trump-Zelensky talks

-

Fight to save last forests of the Comoros unites farmers, NGOs

Fight to save last forests of the Comoros unites farmers, NGOs

-

Hong Kong court hears closing arguments in tycoon Jimmy Lai's trial

-

Five killed in Russian drone attack on Ukraine apartment block

Five killed in Russian drone attack on Ukraine apartment block

-

Myanmar junta sets December 28 poll date despite raging civil war

-

German minister says China 'increasingly aggressive'

German minister says China 'increasingly aggressive'

-

Singapore key exports slip in July as US shipments tumble 42.7 pct

-

German great Mueller has goal ruled out on MLS debut for Vancouver

German great Mueller has goal ruled out on MLS debut for Vancouver

-

Zelensky, European leaders head to US for talks on peace deal terms

-

Tourism deal puts one of Egypt's last wild shores at risk

Tourism deal puts one of Egypt's last wild shores at risk

-

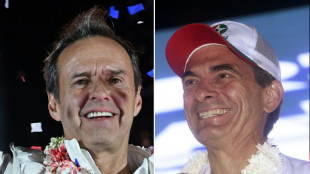

Two right-wing candidates headed to Bolivia presidential run-off

-

Australian court fines Qantas US$59 million for illegal layoffs

Australian court fines Qantas US$59 million for illegal layoffs

-

Games industry in search of new winning combo at Gamescom 2025

-

Rooms of their own: women-only communities thrive in China

Rooms of their own: women-only communities thrive in China

-

Social media hit Ilona Maher takes women's rugby onto new plane

-

Asia stocks up, oil down before Trump-Zelensky talks

Asia stocks up, oil down before Trump-Zelensky talks

-

Zelensky returns to site of stunning Oval Office shouting match

-

Two right-wing candidates headed to Bolivia presidential run-off: projection

Two right-wing candidates headed to Bolivia presidential run-off: projection

-

Ambience Healthcare Unveils Chart Chat: The First AI Copilot Built Into the EHR

-

Fast Finance Pay Corp Reports Second Quarter 2025 Financial Results and Provides a Business Update

Fast Finance Pay Corp Reports Second Quarter 2025 Financial Results and Provides a Business Update

-

SonicStrategy Expands Exposure to 38.8 Million S Tokens Across Staking, Delegation, and DeFi Holdings, Reinforcing Institutional Alignment and Long-Term Yield Strategy

-

New to The Street's Esteemed Client Synergy CHC Corp. (NASDAQ: SNYR) Announces Nationwide EG America Rollout for FOCUSfactor(R) Focus + Energy EG America, 6th Largest U.S. Convenience Chain, Expands Distribution Across 1,600+ High-Traffic Locations

New to The Street's Esteemed Client Synergy CHC Corp. (NASDAQ: SNYR) Announces Nationwide EG America Rollout for FOCUSfactor(R) Focus + Energy EG America, 6th Largest U.S. Convenience Chain, Expands Distribution Across 1,600+ High-Traffic Locations

-

MDCE Subsidiary Infinite Auctions Soars with 2,500% YoY Revenue Growth in Q2 2025

-

Waste Energy Corp Closes Deal to Reduce its Debt by $1 Million

Waste Energy Corp Closes Deal to Reduce its Debt by $1 Million

-

Aeluma to Participate in Upcoming Investor Conferences

-

Form Bio Appoints Michelle Chen, Ph.D. as President and Chief Executive Officer

Form Bio Appoints Michelle Chen, Ph.D. as President and Chief Executive Officer

-

WidePoint to Participate in the Lytham Partners 2025 Consumer & Technology Investor Summit on August 19, 2025

-

Ondas Enters into Definitive Agreement to Strengthen Multi-Domain Autonomy Leadership with Strategic Acquisition of Robotics Innovator Apeiro Motion

Ondas Enters into Definitive Agreement to Strengthen Multi-Domain Autonomy Leadership with Strategic Acquisition of Robotics Innovator Apeiro Motion

-

A Drug that Could Reduce Metastatic Cancer Resurgence due to Its Anti-Inflammatory Effects in Viral Infections is in Clinical Trials

-

Aspire Biopharma Announces Positive Top-Line Results from Clinical Trial of Investigational New Sublingual Aspirin Product for Treatment of Suspected Acute Myocardial Infarction (Heart Attack)

Aspire Biopharma Announces Positive Top-Line Results from Clinical Trial of Investigational New Sublingual Aspirin Product for Treatment of Suspected Acute Myocardial Infarction (Heart Attack)

-

Kingsway Announces Acquisition of Southside Plumbing

-

IRS Targets Gambling Winnings and Online Betting - Clear Start Tax Shares What Winners Often Overlook

IRS Targets Gambling Winnings and Online Betting - Clear Start Tax Shares What Winners Often Overlook

-

Florida Small Business Owner Stays Afloat When Lender and Community Business Organization Join Forces

IRS Targets Gambling Winnings and Online Betting - Clear Start Tax Shares What Winners Often Overlook

Tax experts warn that both casual bettors and high rollers could face unexpected tax bills under increased IRS scrutiny in 2025.

IRVINE, CALIFORNIA / ACCESS Newswire / August 18, 2025 / The Internal Revenue Service is stepping up enforcement on gambling-related income, including online sports betting, casino jackpots, and fantasy sports winnings. Industry experts say many Americans are unaware that even small gambling wins - whether from a Las Vegas slot machine or a mobile betting app - must be reported to the IRS, regardless of whether the casino or platform issues a tax form.

"People tend to think that if they don't get a W-2G from a casino or a 1099 from an online betting site, they don't have to report the income," said a spokesperson for Clear Start Tax, a nationwide tax resolution and relief firm. "That's simply not true. All gambling winnings are taxable, and failing to report them can lead to penalties, interest, or even an audit."

The IRS requires taxpayers to report gambling income from all sources, including raffles, lotteries, poker tournaments, horse racing, and sports betting apps. Losses can be deducted, but only up to the amount of winnings - and only if properly documented.

Clear Start Tax warns that the rapid growth of online betting platforms has made it easier for the IRS to track wagers and payouts.

"Betting apps keep detailed transaction records, and those can be obtained by the IRS during an audit," the spokesperson added. "The days of assuming gambling income will fly under the radar are over."

To avoid costly mistakes, Clear Start Tax advises winners to:

Keep detailed records of all bets, wins, and losses.

Save receipts, tickets, and account statements from betting platforms.

Report winnings accurately on their tax return, even without an official tax form.

Consult a tax professional if winnings are substantial or occur in multiple states.

"Winning can be exciting, but ignoring the tax side of it can turn a lucky streak into a financial headache," the spokesperson said. "The best time to address gambling taxes is before the IRS contacts you - not after."

By answering a few simple questions, taxpayers can find out if they're eligible for the IRS Fresh Start Program and take the first step toward resolving their tax debt.

About Clear Start Tax

Clear Start Tax is a national tax resolution and relief firm dedicated to helping individuals and businesses address IRS and state tax issues. With a team of experienced professionals, the company provides strategies for resolving back taxes, negotiating settlements, and achieving compliance. For more information, visit www.clearstarttax.com.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

(888) 710-3533

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 800-4011

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

A.Jones--AMWN