-

Kenya athletics trials under shadow of Chepngetich suspension

Kenya athletics trials under shadow of Chepngetich suspension

-

Stocks mixed with trade and earnings in focus

-

Pakistan landslide after heavy rain kills 3, with 15 missing

Pakistan landslide after heavy rain kills 3, with 15 missing

-

UK gives green light to £38 bn Sizewell C nuclear plant

-

AstraZeneca says to invest $50 bn in the US

AstraZeneca says to invest $50 bn in the US

-

New-look Australia swim team use worlds to build towards LA 2028

-

Kurdish farmers return to mountains in peace as PKK tensions calm

Kurdish farmers return to mountains in peace as PKK tensions calm

-

Bangladesh mourns as toll from jet crash at school hits 27

-

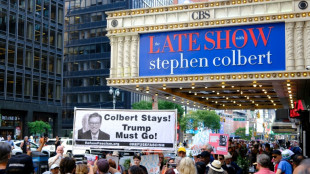

'Gloves are off': cancelled Late Show host comes out swinging for Trump

'Gloves are off': cancelled Late Show host comes out swinging for Trump

-

India face Bumrah dilemma as England search for top order stability

-

MAGA-style 'anti-globalist' politics arrives in Japan

MAGA-style 'anti-globalist' politics arrives in Japan

-

Anxiety and pride among Cambodia's future conscripts

-

Philippines flooding displaces thousands, two missing

Philippines flooding displaces thousands, two missing

-

Stocks mixed with trade and earnings in focus; Tokyo reopens with gains

-

Brazilian judge threatens Bolsonaro over speech shared on social media

Brazilian judge threatens Bolsonaro over speech shared on social media

-

Without papers: Ghost lives of millions of Pakistanis

-

A month after ceasefire with Israel, Iranians fear another war

A month after ceasefire with Israel, Iranians fear another war

-

Anxious parents face tough choices on AI

-

The eye-opening science of close encounters with polar bears

The eye-opening science of close encounters with polar bears

-

Iran says will not halt nuclear enrichment ahead of European talks

-

Del Castillo and Spain 'full of hope' ahead of Germany Euro 2025 semi

Del Castillo and Spain 'full of hope' ahead of Germany Euro 2025 semi

-

Tiger watches son Charlie's tough start at US Junior Amateur

-

Judge presses Trump admin on Harvard funding cuts

Judge presses Trump admin on Harvard funding cuts

-

France jails three in champagne 'slaves' case

-

Venus Williams returns with doubles win at DC Open

Venus Williams returns with doubles win at DC Open

-

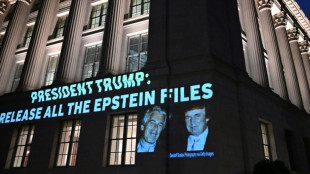

White House restricts WSJ access to Trump over Epstein story

-

Star Copper Expands Existing Footprint of Star Project and Confirms Broad Mineralized System

Star Copper Expands Existing Footprint of Star Project and Confirms Broad Mineralized System

-

Apex Critical Metals Mobilizes for Fully Funded Drill Program at Cap Project in Central British Columbia

-

Ex-US policeman in Breonna Taylor killing sentenced to 33 months

Ex-US policeman in Breonna Taylor killing sentenced to 33 months

-

Venezuela says migrants were tortured in Salvadoran prison

-

WHO says Gaza facilities attacked as Israel expands operations

WHO says Gaza facilities attacked as Israel expands operations

-

Alcaraz withdraws from Montreal event for Wimbledon recovery

-

Leftist leaders gather in Chile with democracy 'under threat'

Leftist leaders gather in Chile with democracy 'under threat'

-

Hunter Biden slams Clooney on anniversary of father's campaign exit

-

Stocks mostly rise as markets weigh earnings optimism and tariff fears

Stocks mostly rise as markets weigh earnings optimism and tariff fears

-

Hunter Biden angrily slams Clooney on anniversary of father's campaign exit

-

'Cosby Show' actor Malcolm-Jamal Warner dies in drowning in Costa Rica

'Cosby Show' actor Malcolm-Jamal Warner dies in drowning in Costa Rica

-

Olympic champion Marchand to focus on medleys at worlds

-

Trump adds pressure on new stadium deal for NFL Commanders

Trump adds pressure on new stadium deal for NFL Commanders

-

Childhood fan Mbeumo joins Man Utd re-build

-

NBA Clippers reach one-year deal with star guard Paul: reports

NBA Clippers reach one-year deal with star guard Paul: reports

-

Leftist leaders gather in Chile warning democracy 'under threat'

-

England's Carter tipped to perform in Euro 2025 semi despite 'disgusting' abuse

England's Carter tipped to perform in Euro 2025 semi despite 'disgusting' abuse

-

How Trump turned his Truth Social app into a megaphone

-

Alaska Airlines resumes service after IT outage grounds planes

Alaska Airlines resumes service after IT outage grounds planes

-

Vatican hardens tone on Israel after Gaza parish strike

-

German govt looks to roll back tax hike on flights

German govt looks to roll back tax hike on flights

-

Markets caught between earnings optimism and tariff fears

-

Pogacar 'ready to fight Vingegaard' for Tour de France title

Pogacar 'ready to fight Vingegaard' for Tour de France title

-

Western nations call for immediate end to Gaza war as Israel expands offensive

Stocks mixed with trade and earnings in focus; Tokyo reopens with gains

Asian markets were mixed Thursday as traders kept an eye on earnings from Wall Street titans this week while tracking US trade talks just over a week before the deadline for a deal.

Japanese stocks edged up and the yen held gains after Prime Minister Shigeru Ishiba said he will stay in power despite the weekend election debacle.

Investors took a more cautious path after a largely positive day on Wall Street, where the S&P ended above 6,300 points for the first time and the Nasdaq chalked up yet another record.

Equities continue to rally on expectations key trading partners will strike agreements with Washington before August 1 to avoid Donald Trump's sky-high tariffs, with the US president saying several deals were close. Just three have been struck so far.

His press secretary Karoline Leavitt said more could be reached before next Friday but also warned the president could unveil fresh unilateral tolls in that time.

While Trump's initial tariff bombshell on April 2 rattled global markets before he delayed introducing the measures twice, they have seen more muted reactions to successive threats as traders expect him to eventually row back again.

That optimism has been helped by data indicating the US economy remained healthy despite the imposition of other levies that are beginning to be felt on Main Street.

And SPI Asset Management's Stephen Innes warned traders could be in for a shock next week.

"The new tariff regime isn't being priced -- full stop," he wrote.

"Markets have seen this movie before: tough talk, last-minute extensions, and deal-making in overtime. But this time, Trump isn't bluffing. He's already posted 'No extensions will be granted'.

"The new rates -- 30 percent on the EU, 35 percent on Canada, 50 percent on Brazil -- are politically loaded and economically radioactive. If they go live, there's no soft landing."

Hong Kong has been the standout in Asia this year, piling on around a quarter thanks to a rally in Chinese tech firms and a fresh flow of cash from mainland investors.

And the Hang Seng Index continued its advance Tuesday, with Shanghai, Sydney and Taipei also up.

There were losses in Singapore, Seoul, Wellington and Manila.

Tokyo rose as investors returned from a long weekend to news that Ishiba would remain in power even after his ruling coalition lost its majority in Japan's lower house elections Sunday, months after it suffered a similar fate in the upper house.

His refusal to leave helped the yen push higher against the dollar and other peers, though observers warned the government's tenure remained fragile and investors remained nervous.

The yen strengthened to 147.08 Tuesday before paring some of the gains. That compares with 148.80 Friday.

But Franklin Templeton Institute's Christy Tan said that "Ishiba now faces heightened political headwinds, including pressure over inflation, taxes, and US trade talks".

Focus also turns this week to earnings from some of the world's biggest names, including Tesla, Google-parent Alphabet, General Motors, Intel and Coca-Cola.

While there will be plenty of attention given to the results, the firms' guidance will be key as investors try to gauge companies' pulses in light of Trump's trade war.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.2 percent at 39,892.81 (break)

Hong Kong - Hang Seng Index: UP 0.3 percent at 25,074.15

Shanghai - Composite: UP 0.1 percent at 3,563.59

Dollar/yen: UP at 147.50 yen from 147.42 yen on Monday

Euro/dollar: UP at $1.1690 from $1.1688

Pound/dollar: DOWN at $1.3484 from $1.3485

Euro/pound: UP at 86.69 pence from 86.68 pence

West Texas Intermediate: DOWN 0.7 percent at $66.70 per barrel

Brent North Sea Crude: DOWN 0.9 percent at $68.62 per barrel

New York - Dow: FLAT at 44,323.07 (close)

London - FTSE 100: UP 0.2 percent at 9,012.99 (close)

F.Schneider--AMWN