-

Taiwan star Shu Qi channels her childhood trauma into directorial debut

Taiwan star Shu Qi channels her childhood trauma into directorial debut

-

France's Ozon under the gun with big screen take on Camus classic

-

Zelensky meets European leaders on Ukraine security guarantees

Zelensky meets European leaders on Ukraine security guarantees

-

Kolisi returns but won't captain Springboks against All Blacks

-

French women's boxing team barred from world champs over late gender test results

French women's boxing team barred from world champs over late gender test results

-

Asia markets mixed as Chinese stocks lose steam

-

'Biggest' Women's Asian Cup can help drive change, says top official

'Biggest' Women's Asian Cup can help drive change, says top official

-

Searchers retrieve bodies as Afghan quake toll expected to rise

-

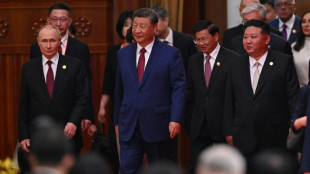

China's Xi at centre of world stage after days of high-level hobnobbing

China's Xi at centre of world stage after days of high-level hobnobbing

-

Australia's Schmidt warns of 'super tough' Argentina test

-

Daniel Craig leads Hollywood stars to Toronto for 50th film fest

Daniel Craig leads Hollywood stars to Toronto for 50th film fest

-

Trump admin asks Supreme Court for 'expedited' ruling on tariffs

-

Digital loan sharks prey on inflation-hit Nigerians

Digital loan sharks prey on inflation-hit Nigerians

-

Climate change made heat behind deadly Iberian fires 40 times more likely: study

-

Campaign event for Argentina's Milei ends with skirmishes

Campaign event for Argentina's Milei ends with skirmishes

-

Open mic caught Xi, Putin discussing immortality

-

Olympic champ Kennedy, Gout Gout headline Australia worlds squad

Olympic champ Kennedy, Gout Gout headline Australia worlds squad

-

Skipper Wilson back as Wallabies face Argentina threat

-

Sinner powers into US Open semis, Anisimova gains Swiatek revenge

Sinner powers into US Open semis, Anisimova gains Swiatek revenge

-

'Blood Moon' to rise during total lunar eclipse Sunday night

-

Sinner tames Musetti to march into US Open semi-finals

Sinner tames Musetti to march into US Open semi-finals

-

Gattuso begins Italy salvage operation with World Cup on the line

-

Sabalenka in Pegula US Open rematch as Osaka faces Anisimova

Sabalenka in Pegula US Open rematch as Osaka faces Anisimova

-

Immigration opposition fuels English national flag frenzy

-

Asia markets tick up after Wall Street rebound

Asia markets tick up after Wall Street rebound

-

Zelensky to meet European leaders after Putin vows to fight on

-

'Pink and green' protests call for a reset in Indonesia

'Pink and green' protests call for a reset in Indonesia

-

Peruvian ex-presidents face courts in separate corruption trials

-

Wimbledon rewatch inspires Anisimova to US Open revenge

Wimbledon rewatch inspires Anisimova to US Open revenge

-

Ecuador eyes US security accords during Rubio's visit

-

Kyrgios predicts easy win over Sabalenka in 'Battle of the Sexes'

Kyrgios predicts easy win over Sabalenka in 'Battle of the Sexes'

-

Osaka downs Muchova to reach US Open semi-final

-

Anisimova gains Swiatek revenge, faces Osaka in US Open semis

Anisimova gains Swiatek revenge, faces Osaka in US Open semis

-

Colombia coal exports plummet after ban on Israel sales

-

Guyana's President Irfaan Ali: oil industry 'puppet' or visionary?

Guyana's President Irfaan Ali: oil industry 'puppet' or visionary?

-

Australia skipper Cummins to do 'whatever it takes' to play Ashes

-

Car-crash season with Ferrari weighing on Hamilton ahead of Monza homecoming

Car-crash season with Ferrari weighing on Hamilton ahead of Monza homecoming

-

Guyanese President Irfaan Ali claims election victory

-

Jury tells Google to pay $425 mn over app privacy

Jury tells Google to pay $425 mn over app privacy

-

Made in China? The remarkable tale of Venice's iconic winged lion

-

Guyanese President Irfaan Ali claims reelection

Guyanese President Irfaan Ali claims reelection

-

At least 15 dead after Lisbon funicular derails

-

GenXys joins Innovators' Network at American Heart Association Center for Health Technology & Innovation

GenXys joins Innovators' Network at American Heart Association Center for Health Technology & Innovation

-

American Critical Minerals Announces Private Placement

-

DEA Marijuana Decision Showtime: MMJ Issues Demand Letter on DEA

DEA Marijuana Decision Showtime: MMJ Issues Demand Letter on DEA

-

Sadot Group Inc. Engages Bitcoin Bancorp Inc. to Develop Bitcoin Treasury Strategy

-

Empire Metals Limited Announces Interim Results

Empire Metals Limited Announces Interim Results

-

HyProMag USA to Commission Scoping Study to Triple Capacity In the United States Expanding Into Nevada and South Carolina

-

IXOPAY Strengthens Customer Experience Leadership with Appointment of Angie Okelberry and Benjamin Canova

IXOPAY Strengthens Customer Experience Leadership with Appointment of Angie Okelberry and Benjamin Canova

-

Green Rain Energy Holdings Inc. (OTC:GREH) Management Says Its Focused On Capturing Significant Part Of California's Estimated 5 Year $50 Billion Dollar Next Clean Energy Wave

Digital loan sharks prey on inflation-hit Nigerians

Cash-strapped and in dire need of 30,000 naira (about $20), Mariam Ogundairo turned to a loan app, downloading it and registering her phone number.

The money was quickly sent over but came with a 21.6 percent interest rate, due in two weeks. Like many in Nigeria, battered by inflation, Ogundairo was too broke to pay back what she owed.

Then came a deluge of harassment -- a tactic that has become the hallmark of many loan apps in Africa's fourth-largest economy.

"They started calling my phone contacts when I couldn't pay back on time, saying I owed them," Ogundairo told AFP. "I lost my security, and it makes me so sad and scared."

Such loan apps in Nigeria, branded "predatory" by campaigners, are texting threats and leaking sensitive photos to their mobile phone contacts when people squeezed by the country's ongoing economic crisis cannot pay up.

Often enticed by false promises of low interest rates, thousands of Nigerians have turned to personal finance apps seeking quick access to short-term loans as galloping prices put pressure on incomes, with inflation standing at 21.8 percent at the end of July.

Ogundairo struggled through the embarrassment for weeks until she was able to pay off her balance.

- 'Quick fix' gone wrong -

"A friend recommended it because I needed a quick fix," another victim, a 24-year-old, who took out a loan two years ago as a university student and asked his name not be used, told AFP.

After spending more than 300,000 naira conducting laboratory investigations for his final thesis and still needing more funds to complete his research and beat submission deadlines, the money seemed like a lifesaver.

He took out 70,000 naira when he was a final-year student in 2023. He was meant to pay back about 110,000 naira within a month, but was too broke.

The loan app then began sending messages to his phone contacts that he was a "ritualist killer". He said he was not aware he had given the app access to his contacts.

"A couple of my coursemates got the messages," he told AFP. "It wasn't the case of unwillingness to pay, it was just a case of impossibility."

An increasing number of Nigerians have turned to personal loans following reforms by President Bola Tinubu to shock the country's moribund economy and remove costly subsidies.

Though some economists have voiced approval for the measures, Tinubu's policies have sent inflation skyrocketing and the value of the naira plunging, hitting many ordinary Nigerians in their pockets.

Even when apps mislead people on interest rates, they can often provide better rates than traditional banks -- with the benchmark interest rate at 27.5 percent, conventional loans can come with interest at 27 to 48 percent.

While there was no breakdown for so-called fintech apps, lenders in the country handed out about 470 billion naira in personal loans in the last quarter of 2024. By December, outstanding personal loans jumped "by 21.27 percent to 3.82 trillion naira compared with the level at end-September 2024", the Central Bank of Nigeria (CBN) said in March.

As of the same month, the Federal Competition and Consumer Protection Commission (FCCPC) approved 408 loan apps, up from 269 in September 2024, with 42 receiving conditional clearance. The CBN approved 23 apps, up from 14 in the third quarter of last year.

Forty-seven were delisted and 88 placed on watchlists for various offences including harassment. The watchdog had said in the past that some loan apps were operating in the country illegally.

- Loan sharks 'thrive' -

Many of the loan apps' ease of access and swift processing create a trap, said Funmi Oderinde, a lawyer at Citizens' Gavel, a civil society organisation that has been pushing back against the lenders.

The organisation has so far received at least 1,300 complaints over "predatory digital loan apps".

"These promises are deceptive, and borrowers soon face unethical recovery practices such as defamation, harassment, threats, breaches of data privacy, arbitrary fines, and excessively high interest rates aimed at pressuring them into repayment," Oderinde said.

Some victims of the harassment have formed different support groups on Facebook. One such group has more than 21,000 members.

A victim told Citizens' Gavel that, after her phone was accessed remotely, a fake obituary and a real nude photo were shared with her contacts by a loan app.

According to Oderinde, two of the people who approached the organisation for legal help "could have died" due to harassment from loan app agents.

The FCCPC, in a note sent to lenders in August, said it would "periodically monitor interest rates for services of consumer lending, and ensure rates are not exploitative".

But despite regulatory moves, dozens of apps continue to operate under new names, and desperate borrowers often do not check approval lists before applying.

The result is that loan sharks "thrive", Oderinde said, "because of weak sanctions and poor enforcement".

P.Stevenson--AMWN