-

German court rules against OpenAI in copyright case

German court rules against OpenAI in copyright case

-

Calls for 'mano dura' as crime-rattled Chile votes for president

-

Pakistani Taliban claim deadly suicide attack in Islamabad

Pakistani Taliban claim deadly suicide attack in Islamabad

-

BBC grapples with response to Trump legal threat

-

Cristiano Ronaldo says 2026 World Cup 'definitely' his last

Cristiano Ronaldo says 2026 World Cup 'definitely' his last

-

Trump says 'we've had a lot of problems' with France

-

Stocks mostly rise as end to US shutdown appears closer

Stocks mostly rise as end to US shutdown appears closer

-

'Splinternets' threat to be avoided, says web address controller

-

Yamal released from World Cup qualifiers by 'upset' Spanish federation

Yamal released from World Cup qualifiers by 'upset' Spanish federation

-

China's 'Singles Day' shopping fest loses its shine for weary consumers

-

Suicide bombing in Islamabad kills 12, wounds 27

Suicide bombing in Islamabad kills 12, wounds 27

-

Philippines digs out from Typhoon Fung-wong as death toll climbs

-

Iraqis vote in general election at a crucial regional moment

Iraqis vote in general election at a crucial regional moment

-

Asian stocks wobble as US shutdown rally loses steam

-

UK unemployment jumps to 5% before key govt budget

UK unemployment jumps to 5% before key govt budget

-

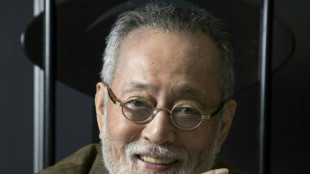

Japanese 'Ran' actor Tatsuya Nakadai dies at 92

-

AI stock boom delivers bumper quarter for Japan's SoftBank

AI stock boom delivers bumper quarter for Japan's SoftBank

-

Asian stocks struggle as US shutdown rally loses steam

-

India probes deadly Delhi blast, vows those responsible will face justice

India probes deadly Delhi blast, vows those responsible will face justice

-

Pistons win streak hits seven on night of NBA thrillers

-

US state leaders take stage at UN climate summit -- without Trump

US state leaders take stage at UN climate summit -- without Trump

-

Burger King to enter China joint venture, plans to double stores

-

Iraqis vote in general election in rare moment of calm

Iraqis vote in general election in rare moment of calm

-

Philippines digs out from Typhoon Fung-wong as death toll climbs to 18

-

'Demon Slayer' helps Sony hike profit forecasts

'Demon Slayer' helps Sony hike profit forecasts

-

Who can qualify for 2026 World Cup in next round of European qualifiers

-

Ireland's climate battle is being fought in its fields

Ireland's climate battle is being fought in its fields

-

Sony hikes profit forecasts on strong gaming, anime sales

-

End to US government shutdown in sight as stopgap bill advances to House

End to US government shutdown in sight as stopgap bill advances to House

-

'Western tech dominance fading' at Lisbon's Web Summit

-

Asian stocks rise as record US shutdown nears end

Asian stocks rise as record US shutdown nears end

-

'Joy to beloved motherland': N.Korea football glory fuels propaganda

-

Taiwan coastguard faces China's might near frontline islands

Taiwan coastguard faces China's might near frontline islands

-

Concentration of corporate power a 'huge' concern: UN rights chief

-

Indian forensic teams scour deadly Delhi car explosion

Indian forensic teams scour deadly Delhi car explosion

-

Trump says firebrand ally Greene has 'lost her way' after criticism

-

Show shines light on Mormons' unique place in US culture

Show shines light on Mormons' unique place in US culture

-

Ukraine, China's critical mineral dominance, on agenda as G7 meets

-

AI agents open door to new hacking threats

AI agents open door to new hacking threats

-

Syria joins alliance against Islamic State after White House talks

-

As COP30 opens, urban Amazon residents swelter

As COP30 opens, urban Amazon residents swelter

-

NHL unveils new Zurich office as part of global push

-

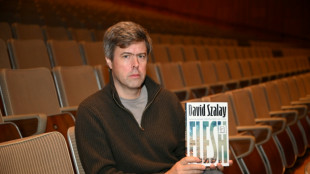

Szalay wins Booker Prize for tortured tale of masculinity

Szalay wins Booker Prize for tortured tale of masculinity

-

American College of Education Launches Redesigned Business Degree Program in Organizational Leadership

-

AuthX Secure Expands Endpoint Access Security with Availability on IGEL App Portal

AuthX Secure Expands Endpoint Access Security with Availability on IGEL App Portal

-

Dogwood Announces Enrollment of First 100 Patients in Ongoing Halneuron(R) Phase 2b Trial, Interim Sample Size Analysis on Track for December 2025

-

ACCESS Newswire Reports Third Quarter 2025 Results

ACCESS Newswire Reports Third Quarter 2025 Results

-

Nutraceutical Technology Leader, Healthy Extracts, Invited to Present at the Trickle Research Microcap Conference on November 13, 2025

-

Armanino Foods Reports Third Quarter 2025 Financial Results

Armanino Foods Reports Third Quarter 2025 Financial Results

-

NanoViricides Announces Pricing of $6 Million Registered Direct Offering and Concurrent Private Placement Priced at the Market Close

Stocks mostly rise as end to US shutdown appears closer

Europe's main stock markets climbed Tuesday following a largely tepid performance by Asia's top indices as a record-long US government shutdown took a step nearer to ending.

London's top-tier FTSE 100 index led the way, reaching a fresh record high as a weakening pound boosted multi-nationals earning in dollars.

An Asian rally that began Monday on shutdown hopes ran out of steam while US equity futures showed a similar picture ahead of Wall Street reopening.

"Following on from yesterday's US shutdown-fuelled optimism the gains seen in Europe... look to be a separate phenomenon given the weakness seen in US futures thus far," noted Joshua Mahony, chief market analyst at Scope Markets.

Paris won solid gains during a public holiday in France, which tends to exaggerate share price movements owing to lowing trading volumes.

Equities generally started the week on the front foot after US lawmakers reached a deal to reopen the government after more than 40 days, adding to a revival of demand for tech giants despite growing fears of an AI-fuelled bubble.

US senators passed the compromise budget measure on Monday after a group of Democrats broke with their party to side with Republicans on a bill to fund departments through January.

It is hoped the bill will then pass the Republican-held House of Representatives and head to US President Donald Trump's desk, with some suggesting the government could reopen Friday.

Trump told reporters in the Oval Office that "we'll be opening up our country very quickly", adding that "the deal is very good".

Investors had grown increasingly concerned about the impact of severe disruptions of food benefits to low-income households, and of air travel heading into the Thanksgiving holiday.

The shutdown has also meant key official data on a range of things, including inflation and jobs, has not been released, leaving traders to focus on private reports for an idea about the economy.

The lack of crucial data has meant the Federal Reserve has been unable to gauge properly whether or not to cut interest rates at its next meeting in December, keeping investors guessing.

Analysts increasingly expect the Bank of England to cut its main interest rate next month after official data Tuesday showed a bigger-than-expected rise to UK unemployment ahead of the Labour government's annual budget later this month.

The increase to five percent in the third quarter weighed on the pound.

- Key figures at 1145 GMT -

London - FTSE 100: UP 0.9 percent at 9,876.61 points

Paris - CAC 40: UP 0.6 percent at 8,105.80

Frankfurt - DAX: UP 0.1 percent at 23,981.52

Tokyo - Nikkei 225: DOWN 0.1 percent at 50,842.93 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 26,696.41 (close)

Shanghai - Composite: DOWN 0.4 percent at 4,002.76 (close)

New York - Dow: UP 0.8 percent at 47,368.63 (close)

Euro/dollar: UP at $1.1573 from $1.1563 on Monday

Pound/dollar: DOWN at $1.3144 from $1.3182

Dollar/yen: UP at 154.23 yen from 154.03 yen

Euro/pound: UP at 88.03 pence from 88.00 pence

Brent North Sea Crude: UP 0.7 percent at $64.50 per barrel

West Texas Intermediate: UP 0.7 percent at $60.52 per barrel

P.Stevenson--AMWN