-

Five-wicket Duffy puts New Zealand on top against West Indies

Five-wicket Duffy puts New Zealand on top against West Indies

-

US, Russia find 'no compromise' on territory after Ukraine talks

-

Sri Lanka counts cyclone cost as toll hits 465

Sri Lanka counts cyclone cost as toll hits 465

-

Inglis to get nod for second Ashes Test as Cummins comeback rumours grow

-

Opium poppy farming hits 10-year high in war-torn Myanmar

Opium poppy farming hits 10-year high in war-torn Myanmar

-

South Korean leader says country overcame 'crisis' on martial law anniversary

-

Frustration in Indonesia as flood survivors await aid

Frustration in Indonesia as flood survivors await aid

-

Brown scores 42 as Celtics hold off Knicks

-

Malaysia says search for long-missing flight MH370 to resume

Malaysia says search for long-missing flight MH370 to resume

-

McIlroy wants more big trophies, Ryder Cups, starting in Australia

-

YouTube says Australia social media ban makes children 'less safe'

YouTube says Australia social media ban makes children 'less safe'

-

Chinese smart glasses firms eye overseas conquest

-

New Zealand strike as West Indies lose brave Hope to be 120-5

New Zealand strike as West Indies lose brave Hope to be 120-5

-

Most Asian markets rise as traders await key US data

-

Tens of thousands of Gazans need medical evacuation: MSF

Tens of thousands of Gazans need medical evacuation: MSF

-

Stokes prefers media heat in Australia to 'miserable, cold' England

-

Italy's luxury brands shaken by sweatshop probes

Italy's luxury brands shaken by sweatshop probes

-

France's Macron visits China with Ukraine on the agenda

-

In Data Center Alley, AI sows building boom, doubts

In Data Center Alley, AI sows building boom, doubts

-

Women don fake mustaches in LinkedIn 'gender bias' fight

-

Doctor to be sentenced for supplying Matthew Perry with ketamine

Doctor to be sentenced for supplying Matthew Perry with ketamine

-

Football world braces for 2026 World Cup draw with Trump presiding

-

What are 'rare earths' for?

What are 'rare earths' for?

-

Honduran ex-president leaves US prison after Trump pardons drug crimes

-

Chanderpaul, Hope see West Indies to 68-2 after New Zealand's 231

Chanderpaul, Hope see West Indies to 68-2 after New Zealand's 231

-

YouTube says children to be 'less safe' under Australia social media ban

-

Polarised South Korea marks martial law anniversary

Polarised South Korea marks martial law anniversary

-

US, Russia find 'no compromise' on key territory issue after Ukraine talks

-

Family voices new alarm for Hong Kong's jailed Jimmy Lai

Family voices new alarm for Hong Kong's jailed Jimmy Lai

-

San Francisco sues producers over ultra-processed food

-

Honduras' Hernandez: Convicted drug trafficker pardoned by Trump

Honduras' Hernandez: Convicted drug trafficker pardoned by Trump

-

Romero bicycle kick rescues point for Spurs against Newcastle

-

Barca make Atletico comeback to extend Liga lead

Barca make Atletico comeback to extend Liga lead

-

Leverkusen knock Dortmund out of German Cup

-

Steve Witkoff, neophyte diplomat turned Trump's global fixer

Steve Witkoff, neophyte diplomat turned Trump's global fixer

-

Man City's Haaland makes 'huge' Premier League history with 100th goal

-

Sabrina Carpenter condemns 'evil' use of her music in White House video

Sabrina Carpenter condemns 'evil' use of her music in White House video

-

Tech boss Dell gives $6.25bn to 'Trump accounts' for kids

-

Trump hints economic adviser Hassett may be Fed chair pick

Trump hints economic adviser Hassett may be Fed chair pick

-

US stocks resume upward climb despite lingering valuation worries

-

Haaland century makes Premier League history in Man City's nine-goal thriller

Haaland century makes Premier League history in Man City's nine-goal thriller

-

Serena Williams denies she plans tennis return despite registering for drug tests

-

Defense challenge evidence in killing of US health insurance CEO

Defense challenge evidence in killing of US health insurance CEO

-

Man City's Haaland makes Premier League history with 100th goal

-

Putin and US negotiators hold high-stakes Ukraine talks in Moscow

Putin and US negotiators hold high-stakes Ukraine talks in Moscow

-

Spain overpower Germany to win second women's Nations League

-

'HIV-free generations': prevention drug rollout brings hope to South Africa

'HIV-free generations': prevention drug rollout brings hope to South Africa

-

US medical agency will scale back testing on monkeys

-

Faberge's rare Winter Egg fetches record £22.9 mn at auction

Faberge's rare Winter Egg fetches record £22.9 mn at auction

-

Snooker great O'Sullivan loses to Zhou in UK Championship first round

5 Banking Features Every Entrepreneur Needs to Scale Faster

NEW YORK CITY, NEW YORK / ACCESS Newswire / November 18, 2025 / Growing a business takes more than drive and a good idea. Business owners also need systems that keep up with their ambitions. When entrepreneurs work with a business bank that links accounts, payment processing, and planning tools into a single, connected system, daily management becomes easier - and scaling becomes far more achievable.

Business checking as the foundation

A business checking account is more than a place to deposit funds. Every payment, deposit, credit advance, and transfer flows through it, creating the data that powers other banking tools and automations.

Because checking accounts record the inflow and outflow of cash, they can be used as an early warning system for upcoming cash needs. Many banks offer dashboards that help business owners visualize spending trends and improve forecasting accuracy.

The key, however, is to have a dedicated business checking account. Separating business and personal funds not only makes it easier to monitor a business's financial health, but it also enables seamless connections to features that help owners manage growth efficiently, such as bill pay, payroll, and automatic transfers.

Payments and invoicing that keep cash flowing

With a business checking account in place, entrepreneurs can make full use of their bank's digital invoicing and payment tools. Together, these features create a single system that records every transaction - essential for bookkeeping, tax preparation, and cash flow management.

Linking payments and invoicing to a business checking account can also reduce gaps between work completed and payment received. Some banks offer next-day or even same-day deposits when merchant services and checking accounts are linked. That efficiency gives business owners faster access to funds and keeps daily operations running smoothly.

Automation also reduces manual work and minimizes errors, which frees up time for strategy and customer relationships. With reliable systems and steady cash flow, entrepreneurs can expand confidently without adding extra administrative strain.

A line of credit to build a safety net

Even with strong cash flow management, scaling a business often brings uneven seasons. A line of credit linked to a business checking account can automatically cover slow periods while automated transfers move surplus funds to interest-bearing accounts when revenue picks back up. Connecting accounts and credit this way creates a flexible financial safety net that adjusts to a scaling business's changing needs.

A safety net makes a business more resilient, but it also lets entrepreneurs move quickly on opportunities. Ready access to working capital and clear visibility into their cash position lets business owners act decisively, whether that means expanding their team, investing in new equipment, or taking on a larger client project.

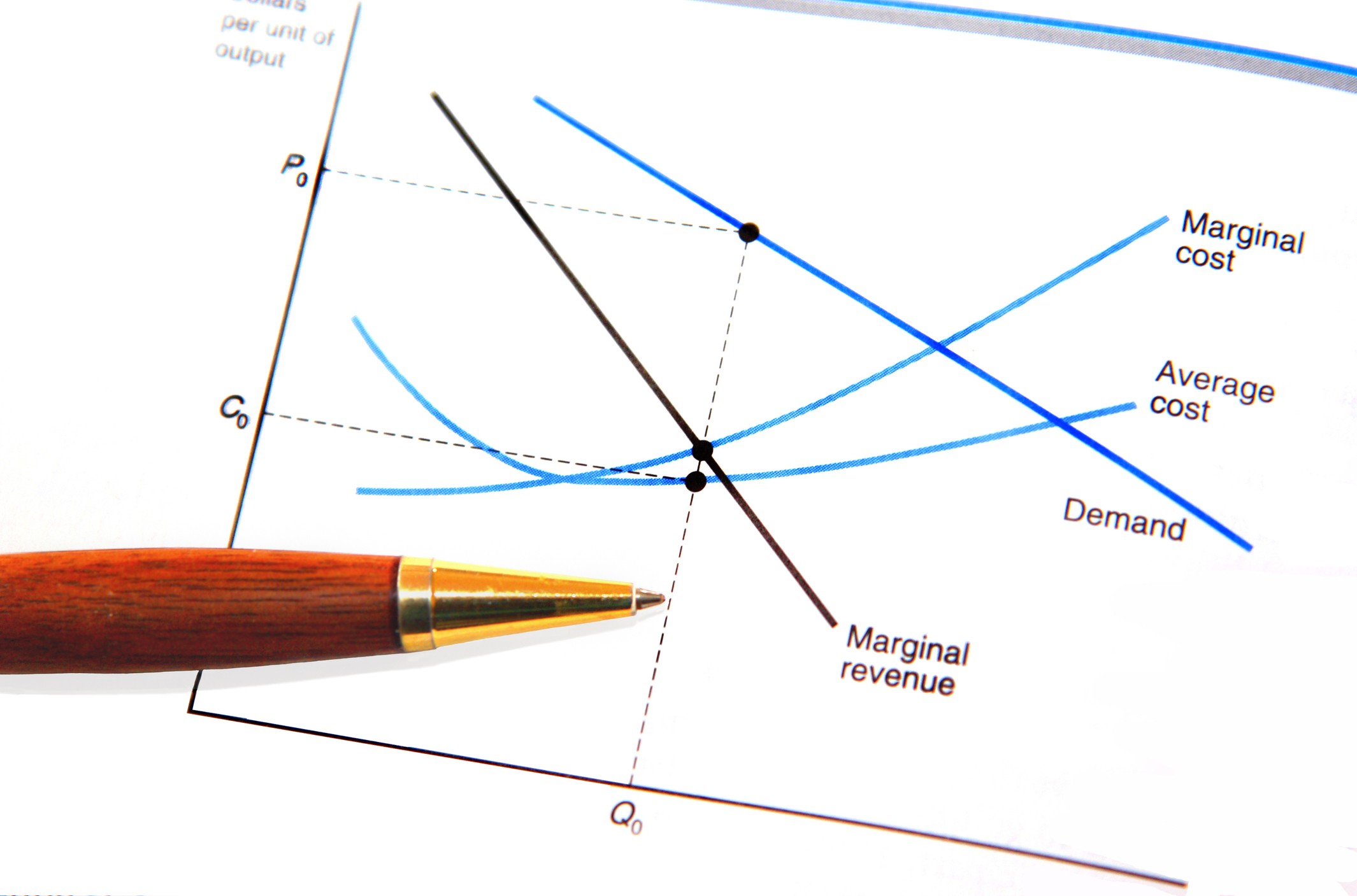

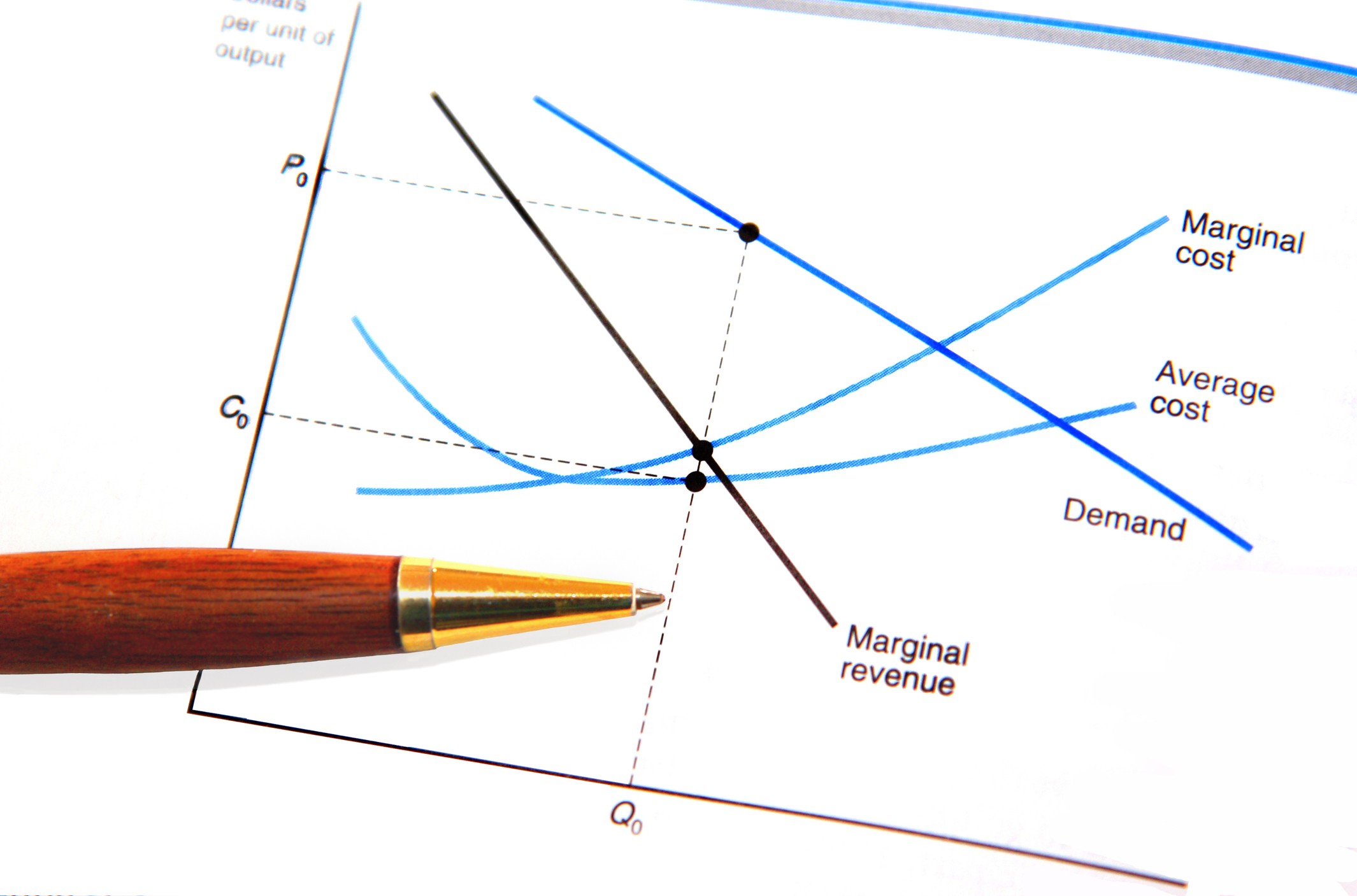

Digital tools that turn cash flow into insight

Every transaction generates data about expenses, revenue patterns, and customer activity that entrepreneurs can use to guide decisions. But those decisions become faster with the help of digital tools that many business banks offer, such as:

Cash flow dashboards that visualize incoming and outgoing funds in real time

Spending and income categorization features that automatically sort transactions

Forecasting tools that project balances based on scheduled payments, invoices, and expected deposits

Alerts and notifications that warn of low balances, large withdrawals, or upcoming cash shortfalls

Integrated reporting and exports for accounting or performance tracking

These tools reveal financial trends that help entrepreneurs spot growth opportunities and direct resources to where they'll have the biggest impact.

Guidance that connects every piece

Perhaps the most helpful - and most overlooked - banking feature for entrepreneurs looking to scale is a dedicated banker. Many banks assign one to business accounts to act as a bridge between data and strategy, to help entrepreneurs anticipate needs, optimize resources, and make informed financial decisions.

One reason the relationship is so valuable is because the banker takes the time to understand the business's goals and challenges. Then they can apply their financial knowledge and advise on any number of concerns, including financing options, cash flow timing, and risk management.

Most importantly, dedicated business bankers provide guidance on long-term planning. Their expertise allows entrepreneurs to make informed decisions that support sustainable growth.

A connected approach to growth

At the heart of scaling a business quickly is a connected financial network that blends digital tools and human expertise to support growth. By working with a bank that offers these integrated features, entrepreneurs can grow their businesses quickly and with confidence.

Contact Information:

Name: Sonakshi Murze

Email: [email protected]

Job Title: Manager

SOURCE: iQuanti

View the original press release on ACCESS Newswire

S.Gregor--AMWN