-

Malaysia says search for long-missing flight MH370 to resume

Malaysia says search for long-missing flight MH370 to resume

-

McIlroy wants more big trophies, Ryder Cups, starting in Australia

-

YouTube says Australia social media ban makes children 'less safe'

YouTube says Australia social media ban makes children 'less safe'

-

Chinese smart glasses firms eye overseas conquest

-

New Zealand strike as West Indies lose brave Hope to be 120-5

New Zealand strike as West Indies lose brave Hope to be 120-5

-

Most Asian markets rise as traders await key US data

-

Tens of thousands of Gazans need medical evacuation: MSF

Tens of thousands of Gazans need medical evacuation: MSF

-

Stokes prefers media heat in Australia to 'miserable, cold' England

-

Italy's luxury brands shaken by sweatshop probes

Italy's luxury brands shaken by sweatshop probes

-

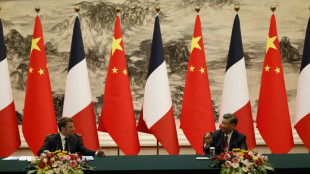

France's Macron visits China with Ukraine on the agenda

-

In Data Center Alley, AI sows building boom, doubts

In Data Center Alley, AI sows building boom, doubts

-

Women don fake mustaches in LinkedIn 'gender bias' fight

-

Doctor to be sentenced for supplying Matthew Perry with ketamine

Doctor to be sentenced for supplying Matthew Perry with ketamine

-

Football world braces for 2026 World Cup draw with Trump presiding

-

What are 'rare earths' for?

What are 'rare earths' for?

-

Honduran ex-president leaves US prison after Trump pardons drug crimes

-

Chanderpaul, Hope see West Indies to 68-2 after New Zealand's 231

Chanderpaul, Hope see West Indies to 68-2 after New Zealand's 231

-

YouTube says children to be 'less safe' under Australia social media ban

-

Polarised South Korea marks martial law anniversary

Polarised South Korea marks martial law anniversary

-

US, Russia find 'no compromise' on key territory issue after Ukraine talks

-

Family voices new alarm for Hong Kong's jailed Jimmy Lai

Family voices new alarm for Hong Kong's jailed Jimmy Lai

-

San Francisco sues producers over ultra-processed food

-

Honduras' Hernandez: Convicted drug trafficker pardoned by Trump

Honduras' Hernandez: Convicted drug trafficker pardoned by Trump

-

Romero bicycle kick rescues point for Spurs against Newcastle

-

Barca make Atletico comeback to extend Liga lead

Barca make Atletico comeback to extend Liga lead

-

Leverkusen knock Dortmund out of German Cup

-

Steve Witkoff, neophyte diplomat turned Trump's global fixer

Steve Witkoff, neophyte diplomat turned Trump's global fixer

-

Man City's Haaland makes 'huge' Premier League history with 100th goal

-

Sabrina Carpenter condemns 'evil' use of her music in White House video

Sabrina Carpenter condemns 'evil' use of her music in White House video

-

Tech boss Dell gives $6.25bn to 'Trump accounts' for kids

-

Trump hints economic adviser Hassett may be Fed chair pick

Trump hints economic adviser Hassett may be Fed chair pick

-

US stocks resume upward climb despite lingering valuation worries

-

Haaland century makes Premier League history in Man City's nine-goal thriller

Haaland century makes Premier League history in Man City's nine-goal thriller

-

Serena Williams denies she plans tennis return despite registering for drug tests

-

Defense challenge evidence in killing of US health insurance CEO

Defense challenge evidence in killing of US health insurance CEO

-

Man City's Haaland makes Premier League history with 100th goal

-

Putin and US negotiators hold high-stakes Ukraine talks in Moscow

Putin and US negotiators hold high-stakes Ukraine talks in Moscow

-

Spain overpower Germany to win second women's Nations League

-

'HIV-free generations': prevention drug rollout brings hope to South Africa

'HIV-free generations': prevention drug rollout brings hope to South Africa

-

US medical agency will scale back testing on monkeys

-

Faberge's rare Winter Egg fetches record £22.9 mn at auction

Faberge's rare Winter Egg fetches record £22.9 mn at auction

-

Snooker great O'Sullivan loses to Zhou in UK Championship first round

-

Pentagon chief says US has 'only just begun' striking alleged drug boats

Pentagon chief says US has 'only just begun' striking alleged drug boats

-

Putin receives top US negotiators in high-stakes Ukraine talks

-

Under Trump pressure, Honduras vows accurate vote count

Under Trump pressure, Honduras vows accurate vote count

-

O'Neill salutes Celtic players for 'terrific' response

-

Pope urges halt to attacks in Lebanon as first voyage abroad ends

Pope urges halt to attacks in Lebanon as first voyage abroad ends

-

Amazon unveils new AI chip in battle against Nvidia

-

Pope plans trip to Africa, starting with Algeria

Pope plans trip to Africa, starting with Algeria

-

Woods recovery 'not as fast as I'd like', no timetable for return

Most Asian markets rise as traders await key US data

Markets mostly rose Wednesday, following a resumption of Wall Street's rally, but gains were muted as investors await the last tranche of US data before next week's Federal Reserve meeting.

With a third successive interest rate cut already priced in, trading has softened ahead of key indicators this week that could still play a role in the central bank's planning over the next year.

Most in focus are the private jobs report from payrolls firm ADP, which is due later Wednesday, and Friday's personal consumption expenditure (PCE) index, which is the Fed's preferred gauge of inflation.

Money markets have put the chances of a December 10 cut at around 90 percent, with another three forecast by the end of next year.

The optimism has also been boosted by reports that President Donald Trump's top economic adviser Kevin Hassett -- a proponent of more reductions -- is the frontrunner to take the helm at the Fed when Jerome Powell's tenure ends in May.

But while a number of bank decision-makers have thrown their hat in the ring for a reduction, observers said there appeared to still be some differences on the policy board about the need to target the soft labour market or stubbornly high inflation.

And Andrew Brenner at NatAlliance Securities said this could lead to a "hawkish cut".

IG market analyst Fabien Yip wrote: "Friday's core PCE index represents the final major inflation gauge before the Fed's December policy meeting.

"Any deviation could alter expectations regarding the Fed's policy stance, particularly as the central bank weighs inflation persistence against a softening labour market. The release of personal income and spending data alongside the PCE will provide additional perspective on consumer resilience."

While calls for a rate cut have been driven by worries over the jobs outlook and signs the world's top economy was slowing, the National Retail Federation provided some early festive cheer by releasing an upbeat appraisal of the "Black Friday" holiday shopping weekend.

A record 202.9 million consumers shopped over the five-day stretch, topping estimates, the NRF said, adding that the reading "reflects a highly engaged consumer".

All three main indexes on Wall Street ended in the green, and most of Asia followed suit.

Tokyo piled on more than one percent with Seoul, while Sydney, Singapore, Wellington, Taipei and Jakarta were also up.

Hong Kong, Shanghai and Manila dipped.

Bitcoin climbed back above $90,000, recovering from this week's swoon that saw it lose almost 10 percent amid a risk-off start to the week for risk assets.

However, sentiment in the crypto sector remains soft after the unit plunged last month to as low as $80,550, having hit a record above $126,250 in October.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 1.1 percent at 49,862.94 (break)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 25,922.79

Shanghai - Composite: DOWN 0.1 percent at 3,895.81

Dollar/yen: DOWN at 155.79 yen from 155.86 yen on Tuesday

Euro/dollar: UP at $1.1636 from $1.1622

Pound/dollar: UP at $1.3225 from $1.3209

Euro/pound: DOWN at 87.98 pence from 88.00 pence

West Texas Intermediate: DOWN 0.2 percent at $58.53 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $62.33 per barrel

New York - Dow: UP 0.4 percent at 47,474.46 (close)

London - FTSE 100: FLAT at 9,701.80 (close)

L.Davis--AMWN