-

South Korean Lee So-mi grabs LPGA Tour Championship lead

South Korean Lee So-mi grabs LPGA Tour Championship lead

-

Fire breaks out at UN climate talks, forcing delay at critical phase

-

Carpenter strikes for Chelsea but Barca hold on for draw in Women's Champions League

Carpenter strikes for Chelsea but Barca hold on for draw in Women's Champions League

-

Rams-Bucs and Steelers-Bears match NFL division leaders

-

ExxonMobil relaunches natural gas project in Mozambique

ExxonMobil relaunches natural gas project in Mozambique

-

Colombia's Petro in hot water as records reveal Lisbon strip club visit

-

Stocks lose steam on AI concerns as jobs data cloud rate cut hopes

Stocks lose steam on AI concerns as jobs data cloud rate cut hopes

-

Messi's Inter to open Miami stadium in April against Austin

-

US health agency edits website to reflect anti-vax views

US health agency edits website to reflect anti-vax views

-

US denies ending South Africa G20 boycott

-

Iniesta's company rebranding Israel Premier Tech cycling team

Iniesta's company rebranding Israel Premier Tech cycling team

-

US plan 'good' for Russia, Ukraine: White House

-

Piastri ready to forget struggles and enjoy Vegas GP

Piastri ready to forget struggles and enjoy Vegas GP

-

US peace plan 'good' for Russia, Ukraine: White House

-

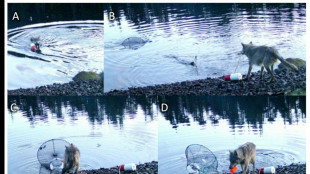

Researchers stunned by wolf's use of crab traps to feed

Researchers stunned by wolf's use of crab traps to feed

-

Colombia shows first treasures recovered from 300-year-old shipwreck

-

England's Daly ready for aerial challenge against Argentina

England's Daly ready for aerial challenge against Argentina

-

Covid inquiry finds UK inaction cost thousands of lives

-

Italy probes Tod's executives over labour exploitation

Italy probes Tod's executives over labour exploitation

-

Trump floats death penalty for 'seditious' Democrats

-

Fire forces evacuation at UN climate talks

Fire forces evacuation at UN climate talks

-

South Africa says US asks to join G20 summit, ending boycott

-

Montpellier deny 'racism' allegations in Fowler's book

Montpellier deny 'racism' allegations in Fowler's book

-

UK Covid inquiry says thousands of lives could have been saved

-

UK Covid inuiry says thousands of lives could have been saved

UK Covid inuiry says thousands of lives could have been saved

-

Erasmus wants to 'fix' his Lansdowne Road jinx

-

US breaks its boycott of South Africa's G20 summit

US breaks its boycott of South Africa's G20 summit

-

Stocks climb tracking US jobs, Nvidia

-

Ukraine 'ready' to work with US on plan to end war

Ukraine 'ready' to work with US on plan to end war

-

Wales rugby to take inspiration from round-ball cousin, says skipper Lake

-

Germany says China promised 'reliable' rare earth supply

Germany says China promised 'reliable' rare earth supply

-

Spanish PM urges defence of democracy, 50 years after Franco death

-

Israel launches fresh strikes on Gaza as Qatar fears for truce

Israel launches fresh strikes on Gaza as Qatar fears for truce

-

UN celebrates youth activists using tech for good

-

AI's blind spot: tools fail to detect their own fakes

AI's blind spot: tools fail to detect their own fakes

-

US health agency edits official website to reflect anti-vax views

-

US unemployment up even as hiring beat expectations in delayed report

US unemployment up even as hiring beat expectations in delayed report

-

US honors conservative titan Cheney, with Trump off guest list

-

Nigerian court jails Biafran separatist leader Kanu for life for 'terrorism'

Nigerian court jails Biafran separatist leader Kanu for life for 'terrorism'

-

Spain fight back against Czech Republic to reach Davis Cup semis

-

UN chief calls for 'ambitious compromise' at climate talks

UN chief calls for 'ambitious compromise' at climate talks

-

Comet sparks scientific fascination, online furor over 'alien' origins

-

German Christmas market opens year after deadly car attack

German Christmas market opens year after deadly car attack

-

Stocks rise as Nvidia overshadows US jobs report

-

Irish veterans Ringrose and van der Flier return for South Africa Test

Irish veterans Ringrose and van der Flier return for South Africa Test

-

Vietnam flooding submerges homes, kills 41, after relentless rain

-

Nigeria convicts Biafran separatist leader Kanu for 'terrorism'

Nigeria convicts Biafran separatist leader Kanu for 'terrorism'

-

Varney misses Italy's Chile Test with rib fracture

-

'Exciting prospect' Gordon recalled by Australia coach Schmidt

'Exciting prospect' Gordon recalled by Australia coach Schmidt

-

US unemployment up even as hiring beats expectations in delayed report

Stocks lose steam on AI concerns as jobs data cloud rate cut hopes

Stock markets were mixed Thursday as a rally lost momentum after US jobs data clouded hopes of further interest rate cuts and fears of an AI bubble persisted.

Europe's main equity indices closed higher but Wall Street slumped following a strong open. Asia's leading stock markets were mixed.

Investors cheered an earnings report released late Wednesday by AI bellwether Nvidia, which topped expectations on fierce demand for its advanced chips.

Chief executive Jensen Huang brushed off fears of an artificial intelligence bubble that has caused global equities to wobble.

Jim Reid, managing director at Deutsche Bank, said Nvidia's results had temporarily stalled some fears.

But Adam Sarhan of 50 Park Investments warned: "When you have valuations that are this high, they're not sustainable."

Shares in the chip giant -- which last month hit a $5 trillion valuation -- slipped after rallying at the start of Wall Street trading Thursday. They closed 3.2 percent down.

The upbeat earnings were offset by data showing the US jobless rate crept higher in September, even as hiring exceeded analyst expectations.

"This report is unlikely to massively shift the needle for the December Fed meeting which looks like a pause," said Joshua Mahony, chief market analyst at traders Scope Markets. He was referring to the Federal Reserve's next interest rate decision due in December.

The dollar traded mixed against its main rivals following the update.

Thursday's jobs publication marked the first official snapshot of the labor market's health in more than two months, owing to a 43-day US government shutdown that ended last week.

The report is set to deepen divisions within the Fed, with underlying job market weakness adding to the case for another rate cut -- but solid hiring potentially encouraging some officials to hold off for longer.

Oil prices ticked down, and a US Treasury official told reporters that Chinese and Indian refineries and banks were moving to comply with recently announced US sanctions on Russia's two biggest oil producers -- Lukoil and Rosneft.

China and India are key buyers of Russian oil, and the sanctions were aimed at cutting off revenues fueling war in Ukraine.

The US official, speaking on condition of anonymity, said many such institutions are conscious of these sanctions and risk averse, while recognizing the importance of relationships with the West.

- Key figures at around 2110 GMT -

New York - Dow: DOWN 0.8 percent at 45,752.26 points (close)

New York - S&P 500: DOWN 1.6 percent at 6,538.76 (close)

New York - Nasdaq Composite: DOWN 2.2 percent at 22,078.05 (close)

London - FTSE 100: UP 0.2 percent at 9,527.65 (close)

Paris - CAC 40: UP 0.3 percent at 7,981.07 (close)

Frankfurt - DAX: UP 0.5 percent at 23,278.85 (close)

Tokyo - Nikkei 225: UP 2.7 percent at 49,823.94 (close)

Hong Kong - Hang Seng Index: FLAT at 25,835.57 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,931.05 (close)

Euro/dollar: DOWN at $1.1525 from $1.1526 on Wednesday

Pound/dollar: UP at $1.3070 from $1.3048

Dollar/yen: UP at 157.55 yen from 157.01 yen

Euro/pound: DOWN at 88.18 from 88.33 pence

Brent North Sea Crude: DOWN 0.2 percent at $63.38 per barrel

West Texas Intermediate: DOWN 0.6 percent at $59.14 per barrel

burs-ajb-bys/jgc

Y.Nakamura--AMWN