-

African star Girmay signs with NSN Cycling Team

African star Girmay signs with NSN Cycling Team

-

Boycott urges England to 'use their brains' in quest to level Ashes

-

Pope prays for peace in Lebanon and the region

Pope prays for peace in Lebanon and the region

-

Trump says will 'look into' reported double-tap strike on alleged drug boat

-

Asia floods death toll tops 1,100 as troops aid survivors

Asia floods death toll tops 1,100 as troops aid survivors

-

Stocks mixed as traders eye US data for Fed signals

-

Italian tennis icon Nicola Pietrangeli dies aged 92

Italian tennis icon Nicola Pietrangeli dies aged 92

-

Groundbreaking HIV prevention shots to begin in Africa

-

Asia floods toll tops 1,000 deaths as troops aid survivors

Asia floods toll tops 1,000 deaths as troops aid survivors

-

Indonesia flood survivors battle mud, trauma

-

Pope prays for peace in Lebanon, region

Pope prays for peace in Lebanon, region

-

Chinese fans lambast Brighton over Imperial Japan soldier post

-

Rapid floods shock Sri Lanka's survivors

Rapid floods shock Sri Lanka's survivors

-

Equity markets mixed as traders eye US data ahead of Fed decision

-

Pope to offer hope on Lebanon visit

Pope to offer hope on Lebanon visit

-

Seoul mayor indicted over alleged illegal polling payments

-

Asia floods toll tops 1,000 as military aid survivors

Asia floods toll tops 1,000 as military aid survivors

-

Hong Kong student urging probe into deadly fire leaves police station

-

Thunder hold off Blazers to avenge lone defeat of NBA season

Thunder hold off Blazers to avenge lone defeat of NBA season

-

Zelensky meets Macron to shore up support for Ukraine as Trump optimistic

-

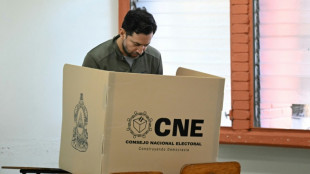

Trump-backed candidate leads Honduras poll

Trump-backed candidate leads Honduras poll

-

Australia ban offers test on social media harm

-

Williamson bolsters New Zealand for West Indies Test series

Williamson bolsters New Zealand for West Indies Test series

-

South Korean religious leader on trial on graft charges

-

Please don't rush: slow changes in Laos 50 years after communist victory

Please don't rush: slow changes in Laos 50 years after communist victory

-

Williamson bolsters New Zealand batting for West Indies Test series

-

How Australia plans to ban under-16s from social media

How Australia plans to ban under-16s from social media

-

Militaries come to aid of Asia flood victims as toll nears 1,000

-

'For him': Australia mum channels grief into social media limits

'For him': Australia mum channels grief into social media limits

-

Thunder down Blazers to avenge lone defeat of season

-

Asian markets mixed as traders eye US data ahead of Fed decision

Asian markets mixed as traders eye US data ahead of Fed decision

-

Migrant domestic workers seek support, solace after Hong Kong fire

-

Experts work on UN climate report amid US pushback

Experts work on UN climate report amid US pushback

-

Spain aim to turn 'suffering' to success in Nations League final second leg

-

Pope to urge unity, bring hope to Lebanese youth on day two of visit

Pope to urge unity, bring hope to Lebanese youth on day two of visit

-

Thousands march in Zagreb against far right

-

Trump confirms call with Maduro, Caracas slams US maneuvers

Trump confirms call with Maduro, Caracas slams US maneuvers

-

Young dazzles as Panthers upset Rams, Bills down Steelers

-

Empress Reports Record Revenue for 2025 Third Quarter Financial Results

Empress Reports Record Revenue for 2025 Third Quarter Financial Results

-

Hemlo Mining Corp. Announces Commencement of Trading on the TSXV at Market-Open on Tuesday, December 2, 2025

-

Altigen Announces Fiscal Year 2025 Earnings Call Information

Altigen Announces Fiscal Year 2025 Earnings Call Information

-

Bausch Health's Aesthetics Business, Solta Medical, Acquires Longtime Distribution Partner, the Shibo Group, to Strengthen Presence in China

-

Datametrex Announces New Walk-In Services at Imagine Health Calgary and Edmonton Clinics

Datametrex Announces New Walk-In Services at Imagine Health Calgary and Edmonton Clinics

-

Eagle Plains Reports up to 29.9 g/t Au over 1.8m at the Bulldog Gold - Silver Project, Golden Triangle, BC

-

Jama Software(R) and Obeo Announce Integration Between Jama Connect(R) and Capella

Jama Software(R) and Obeo Announce Integration Between Jama Connect(R) and Capella

-

Multiples PE Backed QBurst Unveils 'High AI-Q(TM)' Brand, Highlighting AI-Native Enterprise Transformation

-

Northern Dynasty: NMA, AEMA, AMA and the U.S. Chamber of Commerce File Court Documents Against the Illegal Obama/Biden Veto on One of the World’s Largest Undeveloped Copper Projects, located in the U.S.

Northern Dynasty: NMA, AEMA, AMA and the U.S. Chamber of Commerce File Court Documents Against the Illegal Obama/Biden Veto on One of the World’s Largest Undeveloped Copper Projects, located in the U.S.

-

Jaguar Mining Inc. Commences Drilling at High-Potential Chame Target - Advancing Five-Year Exploration Plan

-

Deep Sea Rare Minerals, Inc. Enters Into Engineering and Design Agreement with Consortium of Subsea Equipment Providers

Deep Sea Rare Minerals, Inc. Enters Into Engineering and Design Agreement with Consortium of Subsea Equipment Providers

-

NESR Celebrates Signing of Unconventional Frac Contract During Saudi-United States Investment Forum

Stocks mixed as traders eye US data for Fed signals

Stock markets diverged Monday as investors awaited key US data that could play a role in Federal Reserve deliberations ahead of an expected cut to US interest rates next week.

Frankfurt led declines in Europe, while Paris and London also slid after a mixed session in Asia.

Bitcoin extended its decline during European trading, sliding five percent to around $86,580 amid weaker risk appetite.

The cryptocurrency remains well below its record high above $126,200 struck in early October.

"Bitcoin tends to be a leading indicator for overall risk sentiment right now, and its slide does not bode well for stocks at the start of this month," said Kathleen Brooks, research director at trading group XTB.

Expectations that the Federal Reserve would continue easing monetary policy into the new year have recently helped equities mitigate lingering concerns about an AI-fuelled bubble.

Markets see a 90-percent chance of a third successive US rate cut on December 10, with traders closely watching this week's American data on private jobs creation, services activity and personal consumption expenditure -- the Fed's preferred gauge of inflation.

Bets on a cut surged in late November after several Fed policymakers signalled greater concern over a weakening labour market than stubbornly high inflation.

Reports that US President Donald Trump's top economic adviser Kevin Hassett -- a proponent of rate cuts -- is the frontrunner to take the helm at the Fed next year added to the upbeat mood.

After last week's healthy gains and Wall Street's strong Thanksgiving rally, Asian equities closed mixed on Monday.

Hong Kong, Shanghai, Singapore and Bangkok rose, but Sydney, Seoul, Wellington, Manila, Mumbai and Taipei dipped.

Tokyo sank 1.9 percent as the yen strengthened on expectations the Bank of Japan (BoJ) will lift interest rates this month.

Governor Kazuo Ueda said it would "consider the pros and cons of raising the policy interest rate and make decisions as appropriate", fuelling bets on a hike no later than January.

Masamichi Adachi, UBS Securities chief economist for Japan, wrote: "The BoJ is likely to hike its policy rate at the December 19 meeting. Recent remarks and reports... suggest groundwork for a rate hike is underway."

"This provided a rare rise for the yen, it also saw yields spike, with the 2-year hitting the highest level since 2008," said Joshua Mahony, chief market analyst at Scope Markets.

Oil prices surged 1.5 percent after OPEC+ confirmed it would not hike output in the first three months of 2026, citing lower seasonal demand.

The decision comes amid uncertainty over the outlook for crude as traders look for indications of progress in Ukraine peace talks, which could lead to the return of Russian crude to markets.

- Key figures at around 1100 GMT -

London - FTSE 100: DOWN 0.1 percent at 9,712.86 points

Paris - CAC 40: DOWN 0.7 percent at 8,067.78

Frankfurt - DAX: DOWN 1.3 percent at 23,529.77

Tokyo - Nikkei 225: DOWN 1.9 percent at 49,303.28 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 26,033.26 (close)

Shanghai - Composite: UP 0.7 percent at 3,914.01 (close)

New York - Dow: UP 0.6 percent at 47,716.42 (close)

Euro/dollar: UP at $1.1629 from $1.1604 on Friday

Pound/dollar: DOWN at $1.3225 from $1.3245

Dollar/yen: DOWN at 155.26 yen from 156.10 yen

Euro/pound: UP at 87.92 pence from 87.60 pence

Brent North Sea Crude: UP 1.5 percent at $63.28 per barrel

West Texas Intermediate: UP 1.5 percent at $59.44 per barrel

O.M.Souza--AMWN