-

Maresca blasts 'very poor' Chelsea after damaging Leeds defeat

Maresca blasts 'very poor' Chelsea after damaging Leeds defeat

-

Arteta fears injury woes will hamper Arsenal title charge

-

Trump scraps Biden's fuel-economy standards, sparking climate outcry

Trump scraps Biden's fuel-economy standards, sparking climate outcry

-

'Unbelievable' Merino strikes again to extend Arsenal's Premier League lead

-

Doctor jailed for supplying ketamine to 'Friends' star Matthew Perry

Doctor jailed for supplying ketamine to 'Friends' star Matthew Perry

-

Arsenal extend Premier League lead, Chelsea beaten at Leeds

-

Chelsea's title challenge damaged by defeat at Leeds

Chelsea's title challenge damaged by defeat at Leeds

-

German president gets royal treatment on UK state visit

-

Kane and Bayern keep Union at bay to reach German Cup quarters

Kane and Bayern keep Union at bay to reach German Cup quarters

-

US stocks rise as weak jobs data boosts rate cut odds

-

Arsenal extend Premier League lead, Villa surge up to third

Arsenal extend Premier League lead, Villa surge up to third

-

Merino strikes again to extend Arsenal's Premier League lead

-

Netflix airs Diddy doc despite imprisoned mogul's legal threat

Netflix airs Diddy doc despite imprisoned mogul's legal threat

-

Trump NASA nominee aims to beat China in new Moon race

-

Mbappe double powers Real Madrid to win at Athletic Bilbao

Mbappe double powers Real Madrid to win at Athletic Bilbao

-

'Peter Hujar's Day' tops Spirit Award nominations

-

Celtic appoint Wilfried Nancy as new manager

Celtic appoint Wilfried Nancy as new manager

-

Rights groups warn against US raids during World Cup

-

Crawford stripped of WBC boxing title over unpaid fees

Crawford stripped of WBC boxing title over unpaid fees

-

Brazil police probe plight of near-extinct blue parrot

-

Poor hiring data points to US economic weakness

Poor hiring data points to US economic weakness

-

Russia blocks popular game-creator Roblox over child 'harassment'

-

Oval Invincibles renamed MI London in latest Hundred franchise deal

Oval Invincibles renamed MI London in latest Hundred franchise deal

-

Sleepy Don? Trump's health under fresh scrutiny

-

Paul axed by struggling Clippers

Paul axed by struggling Clippers

-

Kohli ton in vain as Markram-inspired South Africa level ODI series

-

Trump to scrap Biden's fuel-economy standards

Trump to scrap Biden's fuel-economy standards

-

Suspect charged in killing of AFP's Gambia correspondent

-

Markram ton helps South Africa level ODI series against India

Markram ton helps South Africa level ODI series against India

-

US retail giant Costco challenges Trump tariffs in court

-

Stocks struggle as data shows drop in US jobs

Stocks struggle as data shows drop in US jobs

-

Honduras TV host widens lead over Trump-backed rival for president

-

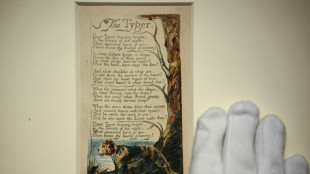

Print of Blake 'Tyger' poem blazes path to auction record

Print of Blake 'Tyger' poem blazes path to auction record

-

Israel says received presumed remains of Gaza hostage

-

Germany to host 2029 women's Euros

Germany to host 2029 women's Euros

-

Family of Colombian killed in boat strike takes US to rights body

-

EU presents plan to use Russian assets for Ukraine as Belgium frets

EU presents plan to use Russian assets for Ukraine as Belgium frets

-

Retail giant Costco challenges US tariffs in court

-

Principal reaction to 2027 Rugby World Cup draw

Principal reaction to 2027 Rugby World Cup draw

-

Man Utd boss Amorim 'protects' himself from abuse

-

Russia says battlefield success strengthening its hand in Ukraine talks

Russia says battlefield success strengthening its hand in Ukraine talks

-

Iran says to attend World Cup draw in apparent U-turn

-

Satellite surge threatens space telescopes, astronomers warn

Satellite surge threatens space telescopes, astronomers warn

-

Germany to host 2029 women's Euros: UEFA

-

Greek govt warns farmers not to escalate subsidy protest

Greek govt warns farmers not to escalate subsidy protest

-

Ski federation 'concerned' about Olympics snowboarding site delays

-

EU moves to break dependence on China for rare earths

EU moves to break dependence on China for rare earths

-

Celebrities back 'Free Marwan' campaign for Palestinian leader

-

Lebanon, Israel hold first direct talks in decades

Lebanon, Israel hold first direct talks in decades

-

FIFA gives clubs an extra week before releasing AFCON stars

US stocks rise as weak jobs data boosts rate cut odds

Wall Street stocks shrugged off early weakness Wednesday and finished with solid gains after poor US hiring data boosted expectations that the Federal Reserve will cut interest rates next week.

The report showed US companies shed 32,000 jobs in November, payroll firm ADP said, in a surprise drop that added to worries about economic weakness while also boosting expectations for Fed monetary policy relief.

"The market is happy with what the weaker than expected jobs report will mean for the Fed's likelihood of cutting rates when they meet on December 9th and 10th," said Sam Stovall of CFRA Research.

"We're back into the optimism surrounding the Fed cutting rates before the year is out."

All three major US indices finished higher, with the S&P 500 up 0.3 percent.

"The modest fall in the ADP payrolls measure in November... should be enough to persuade the (Fed) to vote for another cut next week," said Stephen Brown at Capital Economics.

Futures markets now put the chances of the Fed cutting interest rates on December 10 at nearly 90 percent.

Lower interest rates make it easier for companies and consumers to borrow money, so the prospect of Fed rate cuts tends to boost stocks.

Optimism over US rate cuts won an additional boost from reports that Trump's top economic advisor Kevin Hassett -- a proponent of more rate reductions -- is the frontrunner to take the helm at the Fed when Jerome Powell's tenure ends in May.

The euro hit a seven-week high against the dollar, noted analyst Axel Rudolph at trading platform IG International.

"The US central bank is expected to cut rates in December with a near 89 percent probability whereas the ECB isn't likely to do so for much of next year," he said.

Meanwhile the pound gained around one percent against the dollar, also receiving a boost from data showing stronger than expected activity from the UK services sector.

Stronger sterling weighed on London's benchmark FTSE 100 stock index, which features major companies earning in dollars, and which ended the day down 0.1 percent.

A recovery in Bitcoin has also helped support equity markets.

"A continued bounce in bitcoin and other cryptocurrencies has stoked a renewed speculative bid," said Briefing.com analyst Patrick O'Hare.

Bitcoin is back above $90,000. It plunged below $83,000 last month after having set a record high of $126,251 in October.

Asian stock markets mostly rose Wednesday.

- Key figures at around 2115 GMT -

New York - Dow: UP 0.9 percent at 47,882.90 (close)

New York - S&P 500: UP 0.3 percent at 6,849.72 (close)

New York - Nasdaq Composite: UP 0.2 percent at 23,454.09 (close)

London - FTSE 100: DOWN 0.1 percent at 9,692.07 (close)

Paris - CAC 40: UP 0.2 percent at 8,087.42 (close)

Frankfurt - DAX: DOWN 0.1 percent at 23,693.71 (close)

Tokyo - Nikkei 225: UP 1.1 percent at 49,864.68 (close)

Hong Kong - Hang Seng Index: DOWN 1.3 percent at 25,760.73 (close)

Shanghai - Composite: DOWN 0.5 percent at 3,878.00 (close)

Euro/dollar: UP at $1.1667 from $1.1625 on Tuesday

Pound/dollar: UP at $1.3352 from $1.3213

Dollar/yen: DOWN at 155.23 yen from 155.88 yen

Euro/pound: DOWN at 87.39 pence from 88.00 pence

Brent North Sea Crude: UP 0.4 percent at $62.67 per barrel

West Texas Intermediate: UP 0.5 percent at $58.95 per barrel

burs-jmb/iv

F.Pedersen--AMWN