-

Defending champ Scheffler in 5-way tie for lead at Hero World Challenge

Defending champ Scheffler in 5-way tie for lead at Hero World Challenge

-

Man Utd rue missed chance in West Ham draw

-

Nigeria stalwart Troost-Ekong retires just before AFCON

Nigeria stalwart Troost-Ekong retires just before AFCON

-

Trump revels in peace institute renamed after himself

-

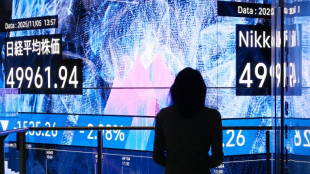

Mixed day for US equities as Japan's Nikkei rallies

Mixed day for US equities as Japan's Nikkei rallies

-

Odermatt dominates Beaver Creek World Cup downhill

-

Frank favours Spurs victory over Brentford sentiment

Frank favours Spurs victory over Brentford sentiment

-

Eurovision hit by boycotts after Israel cleared to compete

-

Trump, Rwanda and DR Congo leaders sign deal despite fresh violence

Trump, Rwanda and DR Congo leaders sign deal despite fresh violence

-

Past is history says Mueller ahead of MLS Messi clash

-

To counter climate denial, UN scientists must be 'clear' about human role: IPCC chief

To counter climate denial, UN scientists must be 'clear' about human role: IPCC chief

-

Virginia man arrested in January 6 pipe-bomb case

-

Hamilton plans team shake-up at Ferrari after miserable season

Hamilton plans team shake-up at Ferrari after miserable season

-

Facebook 'supreme court' admits 'frustrations' in 5 years of work

-

Eurovision faces withdrawals after Israel OK'd to compete

Eurovision faces withdrawals after Israel OK'd to compete

-

Iran filmmaker Panahi says to return home despite prison sentence

-

Trump envoys press plan with Ukraine as sanctions eased on Russia

Trump envoys press plan with Ukraine as sanctions eased on Russia

-

Global markets scent US rate cuts

-

Trump hosts Rwanda, DR Congo accord signing even as violence rages

Trump hosts Rwanda, DR Congo accord signing even as violence rages

-

Hegseth's Signal use risked harm to US forces, watchdog says

-

2026 Winter Olympics flame lands in Italy

2026 Winter Olympics flame lands in Italy

-

UK, Norway to jointly 'hunt Russian submarines' under new pact

-

Antonelli thanks Verstappen for support after online death threats

Antonelli thanks Verstappen for support after online death threats

-

'Motivated' Bordeaux-Begles launch Champions Cup defence at 'Bull Ring'

-

European leaders in phone call voiced distrust of US over Ukraine: report

European leaders in phone call voiced distrust of US over Ukraine: report

-

German broadcaster backs Israel in Eurovision debate

-

Norris rejects idea of team loyalty before Formula 1 title showdon

Norris rejects idea of team loyalty before Formula 1 title showdon

-

Spanish star Rosalia to go on world tour in 2026

-

South Africa says wants equal treatment, after US G20 exclusion

South Africa says wants equal treatment, after US G20 exclusion

-

Trump despair drives folk icon Joan Baez back to the studio

-

One in three French Muslims say suffer discrimination: report

One in three French Muslims say suffer discrimination: report

-

Trump favorite reclaims narrow lead in Honduras presidential vote

-

UN Security Council says ready to support Syria on first-ever visit

UN Security Council says ready to support Syria on first-ever visit

-

Assumed likelihood of US rate cuts lifts global markets

-

Suspect arrested in US capital pipe bomb case: media

Suspect arrested in US capital pipe bomb case: media

-

Putin found 'morally responsible' for nerve agent death in UK

-

Olympic favourite Malinin stumbles at Grand Prix Final

Olympic favourite Malinin stumbles at Grand Prix Final

-

Israel launches fresh strikes on south Lebanon after warnings

-

Trump to sign Rwanda, DR Congo agreement even as violence rages

Trump to sign Rwanda, DR Congo agreement even as violence rages

-

Memphis soul guitarist Steve Cropper dead at 84

-

Devastating landslides turn Sri Lanka village into burial ground

Devastating landslides turn Sri Lanka village into burial ground

-

'Wasim's still better' says Starc after left-arm wicket landmark

-

Salah does not have 'unlimited credit' at Liverpool, Van Dijk says

Salah does not have 'unlimited credit' at Liverpool, Van Dijk says

-

Microsoft faces complaint in EU over Israeli surveillance data

-

South Africa prepared to 'take a break' from G20 after US ban

South Africa prepared to 'take a break' from G20 after US ban

-

Milan-Cortina organisers rush to ready venues as Olympic flame arrives in Italy

-

1,327 days: Families pine for OSCE employees detained in Russia

1,327 days: Families pine for OSCE employees detained in Russia

-

'Chuffed for him': Crawley, Starc pay tribute to 'flawless' Root

-

Truth commission urges Finland to rectify Sami injustices

Truth commission urges Finland to rectify Sami injustices

-

Root's superb first ton in Australia guides England to 325-9

| RBGPF | -0.83% | 78.35 | $ | |

| CMSC | 0.17% | 23.48 | $ | |

| RYCEF | 3.07% | 14.65 | $ | |

| GSK | -0.82% | 48.57 | $ | |

| SCS | -0.74% | 16.23 | $ | |

| RIO | -0.75% | 73.73 | $ | |

| VOD | 0.4% | 12.64 | $ | |

| NGG | -0.76% | 75.91 | $ | |

| RELX | 0.86% | 40.54 | $ | |

| JRI | 0.36% | 13.75 | $ | |

| CMSD | -0.13% | 23.32 | $ | |

| BP | -0.03% | 37.23 | $ | |

| BCC | -3.1% | 74.26 | $ | |

| BTI | 0.91% | 58.04 | $ | |

| BCE | 0.17% | 23.22 | $ | |

| AZN | -0.91% | 90.03 | $ |

Mixed day for US equities as Japan's Nikkei rallies

Wall Street stocks finished mixed at the end of a choppy session Thursday as markets digested varying labor market data and looked ahead to next week's Federal Reserve decision.

Strong gains by Facebook parent Meta and tech giant Salesforce helped lift the Nasdaq into positive territory, while the Dow finished slightly lower.

Earlier, bourses in London, Paris and Frankfurt all pushed higher.

A weekly report of initial US jobless claims showed a drop of 27,000. That upbeat figure came on the heels of data on Wednesday from private payroll firm ADP that showed a surprise decline in hiring last month.

A separate report Thursday by the executive placement firm Challenger, Gray & Christmas showed a jump in job cuts in November, lifting the 2025 total to the highest level since 2020.

"The market is trying to figure out how to interpret the jobs data today," said Tom Cahill of Ventura Wealth Management. "There's some confusion."

Cahill said widespread expectations that the Fed will cut interest rates next week is "putting a floor under equity prices and other risk assets."

Tokyo earlier rallied more than two percent in a positive Asian session which also saw Hong Kong, Sydney, Taipei and Bangkok finish higher.

A healthy 30-year Japanese government bond sale provided some support as it slightly eased tensions about a possible rate hike by the central bank this month. The news compounded a strong response to a 10-year auction earlier in the week that settled some nerves.

Elsewhere, oil prices advanced about one percent, with analysts pointing to uncertainty over the prospects for diplomatic efforts to end the Russia-Ukraine war.

Shares in Meta rose 3.4 percent after a report that the Facebook parent is significantly cutting back on virtual-reality investments in a pivot toward artificial intelligence.

According to Bloomberg, Meta plans to cut its Metaverse costs by 30 percent -- news that drove its share price up as much as four percent in Thursday trading on Wall Street.

Salesforce jumped 3.7 percent as the tech giant raised its full-year sales forecast.

- Key figures at around 2115 GMT -

New York - Dow: DOWN 0.1 percent at 47,850.94 (close)

New York - S&P 500: UP 0.1 percent at 6,857.12 (close)

New York - Nasdaq Composite: UP 0.2 percent at 23,505.14 (close)

London - FTSE 100: UP 0.2 percent at 9,710.87 (close)

Paris - CAC 40: UP 0.4 percent at 8,122.03 (close)

Frankfurt - DAX: UP 0.8 percent at 23,882.03 (close)

Tokyo - Nikkei 225: UP 2.3 percent at 51,028.42 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,935.90 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,875.79 (close)

Euro/dollar: DOWN at $1.1648 from $1.1671 on Wednesday

Pound/dollar: DOWN at $1.3335 from $1.3353

Dollar/yen: DOWN at 155.03 yen from 155.25 yen

Euro/pound: DOWN at 87.00 pence from 87.40 pence

Brent North Sea Crude: UP 0.9 percent at $63.26 per barrel

West Texas Intermediate: UP 1.1 percent at $59.67 per barrel

F.Dubois--AMWN