-

UK, Norway to jointly 'hunt Russian submarines' under new pact

UK, Norway to jointly 'hunt Russian submarines' under new pact

-

Antonelli thanks Verstappen for support after online death threats

-

'Motivated' Bordeaux-Begles launch Champions Cup defence at 'Bull Ring'

'Motivated' Bordeaux-Begles launch Champions Cup defence at 'Bull Ring'

-

European leaders in phone call voiced distrust of US over Ukraine: report

-

German broadcaster backs Israel in Eurovision debate

German broadcaster backs Israel in Eurovision debate

-

Norris rejects idea of team loyalty before Formula 1 title showdon

-

Spanish star Rosalia to go on world tour in 2026

Spanish star Rosalia to go on world tour in 2026

-

South Africa says wants equal treatment, after US G20 exclusion

-

Trump despair drives folk icon Joan Baez back to the studio

Trump despair drives folk icon Joan Baez back to the studio

-

One in three French Muslims say suffer discrimination: report

-

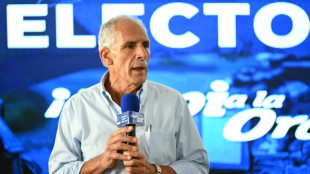

Trump favorite reclaims narrow lead in Honduras presidential vote

Trump favorite reclaims narrow lead in Honduras presidential vote

-

UN Security Council says ready to support Syria on first-ever visit

-

Assumed likelihood of US rate cuts lifts global markets

Assumed likelihood of US rate cuts lifts global markets

-

Suspect arrested in US capital pipe bomb case: media

-

Putin found 'morally responsible' for nerve agent death in UK

Putin found 'morally responsible' for nerve agent death in UK

-

Olympic favourite Malinin stumbles at Grand Prix Final

-

Israel launches fresh strikes on south Lebanon after warnings

Israel launches fresh strikes on south Lebanon after warnings

-

Trump to sign Rwanda, DR Congo agreement even as violence rages

-

Memphis soul guitarist Steve Cropper dead at 84

Memphis soul guitarist Steve Cropper dead at 84

-

Devastating landslides turn Sri Lanka village into burial ground

-

'Wasim's still better' says Starc after left-arm wicket landmark

'Wasim's still better' says Starc after left-arm wicket landmark

-

Salah does not have 'unlimited credit' at Liverpool, Van Dijk says

-

Microsoft faces complaint in EU over Israeli surveillance data

Microsoft faces complaint in EU over Israeli surveillance data

-

South Africa prepared to 'take a break' from G20 after US ban

-

Milan-Cortina organisers rush to ready venues as Olympic flame arrives in Italy

Milan-Cortina organisers rush to ready venues as Olympic flame arrives in Italy

-

1,327 days: Families pine for OSCE employees detained in Russia

-

'Chuffed for him': Crawley, Starc pay tribute to 'flawless' Root

'Chuffed for him': Crawley, Starc pay tribute to 'flawless' Root

-

Truth commission urges Finland to rectify Sami injustices

-

Root's superb first ton in Australia guides England to 325-9

Root's superb first ton in Australia guides England to 325-9

-

French rugby great Blanco eyes bid for Biarritz mayorship

-

S.Africa must tackle 'xenophobic' health clinic protests, court says

S.Africa must tackle 'xenophobic' health clinic protests, court says

-

Stocks rise eyeing series of US rate cuts

-

Italy sweatshop probe snares more luxury brands

Italy sweatshop probe snares more luxury brands

-

Senegal baskets are hot, but women weavers ask where's the money?

-

2026 Winter Olympics flame handed to Milan-Cortina organisers

2026 Winter Olympics flame handed to Milan-Cortina organisers

-

Joe Root: England great conquers final frontier with Ashes ton

-

Kolisi backs Erasmus rotation policy with third straight World Cup title in mind

Kolisi backs Erasmus rotation policy with third straight World Cup title in mind

-

Joe Root scores his first Ashes century in Australia

-

EU hits Meta with antitrust probe over WhatsApp AI features

EU hits Meta with antitrust probe over WhatsApp AI features

-

Russia's Putin heads to India for defence, trade talks

-

Kate Winslet 'so proud' as directorial debut premieres

Kate Winslet 'so proud' as directorial debut premieres

-

South Africa telecoms giant Vodacom to take control of Kenya's Safaricom

-

Flamengo add Brazilian title four days after Copa Libertadores win

Flamengo add Brazilian title four days after Copa Libertadores win

-

Oil refinery shutdown could cost Serbia for years, experts warn

-

Root edges closer to elusive ton as England reach 196-4

Root edges closer to elusive ton as England reach 196-4

-

South Africa will 'take a break' from G20 after US ban

-

Struggling McIlroy pulls in crowds as three share Australian Open lead

Struggling McIlroy pulls in crowds as three share Australian Open lead

-

Israel awaits return of last hostage remains from Gaza

-

Slew of top brands suspected in Italy sweatshop probe

Slew of top brands suspected in Italy sweatshop probe

-

Markets mixed as traders struggle to hold Fed cut rally

| RIO | -1.12% | 73.46 | $ | |

| CMSC | 0.26% | 23.5 | $ | |

| SCS | -1.21% | 16.155 | $ | |

| NGG | -0.31% | 76.25 | $ | |

| BCE | 0.32% | 23.255 | $ | |

| RYCEF | 1.39% | 14.4 | $ | |

| RELX | 0.94% | 40.57 | $ | |

| VOD | 0.55% | 12.66 | $ | |

| RBGPF | -0.83% | 78.35 | $ | |

| CMSD | -0.11% | 23.325 | $ | |

| BTI | 0.66% | 57.895 | $ | |

| BCC | -1.61% | 75.35 | $ | |

| AZN | -0.95% | 89.995 | $ | |

| GSK | -0.28% | 48.835 | $ | |

| JRI | 0.69% | 13.795 | $ | |

| BP | 0.03% | 37.25 | $ |

Assumed likelihood of US rate cuts lifts global markets

World stock markets mostly rose Thursday after the latest batch of US data reinforced expectations that the Federal Reserve will cut US interest rates next week and in 2026.

Eying a third straight session in the green, Wall Street was barely up minutes after the opening bell as the Dow added 0.1 percent but the tech-heavy Nasdaq slipped back almost 0.2 percent amid lingering concerns over high tech valuations.

The wider S&P was little changed, and the major European markets were higher.

Bets on a December reduction for US interest rates have surged after several Fed officials said supporting jobs was more important than keeping a lid on elevated inflation.

The need for more action was further stoked by Wednesday's data from payrolls firm ADP showing 32,000 posts were lost in November, compared with an expected rise of 10,000.

The drop was the most since early 2023 and is the latest example of a stuttering American labour market.

"Right now, the data argues for additional Fed funds rate cuts," noted Elias Haddad, markets analyst at Brown Brothers Harriman & Co.

"US labor demand is weak, consumer spending is showing early signs of cracking, and upside risks to inflation are fading."

Kathleen Brooks, research director at XTB noted that "there seems to be one main driver for stocks this year: an increase in expectations of a Fed rate cut next week. The Fed Fund Futures market is now pricing in a 98 percent chance of a cut next week."

London, Paris and Frankfurt were all ahead around half of one percent some two hours out from the close while Tokyo earlier rallied more than two percent in a positive Asian session which also saw Hong Kong, Sydney, Taipei and Bangkok finish higher.

A healthy 30-year Japanese government bond sale provided some support for Tokyo's market, as it eased tensions about a possible rate hike from the Bank of Japan this month.

The news compounded a strong response to a 10-year auction earlier in the week that settled some nerves.

While market players remain confident that the Fed will continue to cut interest rates into the new year, economists at Bank of America still had a note of caution.

"The most immediate source of volatility remains the US Federal Reserve," they wrote.

"While inflation has moderated and the trajectory of policy easing is intact, uncertainty around timing persists. Any delay in rate cuts could remain a source of volatility."

On currency markets, the dollar traded mixed and the Indian rupee wallowed at record lows of more than 90 against the greenback as investors grow increasingly worried about a lack of progress in India-US trade talks.

- Key figures at around 1500 GMT -

New York - Dow: UP 0.1 percent at 47,939.73 points

New York - S&P 500: FLAT at 6,851.81

New York - Nasdaq Composite: DOWN 0.2 percent at 23,414.84

London - FTSE 100: UP 0.1 percent at 9,711.52

Paris - CAC 40: UP 0.5 percent at 8,129.97

Frankfurt - DAX: UP 0.9 percent at 23,913.03

Tokyo - Nikkei 225: UP 2.3 percent at 51,028.42 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,935.90 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,875.79 (close)

Euro/dollar: UP at $1.1672 from $1.1667 on Wednesday

Pound/dollar: DOWN at $1.3362 from $1.3352

Dollar/yen: DOWN at 154.64 yen from 155.23 yen

Euro/pound: DOWN at 87.35 pence from 87.39 pence

Brent North Sea Crude: UP 0.3 percent at $62.88 per barrel

West Texas Intermediate: UP 0.4 percent at $59.17 per barrel

D.Sawyer--AMWN