-

In India's mining belt, women spark hope with solar lamps

In India's mining belt, women spark hope with solar lamps

-

After 15 years, Dutch anti-blackface group declares victory

-

Eyes of football world fixed on 2026 World Cup draw with Trump presiding

Eyes of football world fixed on 2026 World Cup draw with Trump presiding

-

West Indies on the ropes in record run chase against New Zealand

-

'Only a miracle can end this nightmare': Eritreans fear new Ethiopia war

'Only a miracle can end this nightmare': Eritreans fear new Ethiopia war

-

Unchecked mining waste taints DR Congo communities

-

McIntosh swims second-fastest 400m free ever in US Open triumph

McIntosh swims second-fastest 400m free ever in US Open triumph

-

Asian markets mixed ahead of US data, expected Fed rate cut

-

French almond makers revive traditions to counter US dominance

French almond makers revive traditions to counter US dominance

-

Tech tracking to tackle human-wildlife conflict in Zimbabwe

-

Olympic swim star Thorpe to race gruelling Sydney-Hobart on top yacht

Olympic swim star Thorpe to race gruelling Sydney-Hobart on top yacht

-

'Land without laws': Israeli settlers force Bedouins from West Bank community

-

No yolk: police 'recover' Faberge egg swallowed by thief

No yolk: police 'recover' Faberge egg swallowed by thief

-

Liverpool's defensive woes deepen, Arsenal face Villa test

-

Pandas and ping-pong: Macron to end China visit on lighter note

Pandas and ping-pong: Macron to end China visit on lighter note

-

Trump set for soccer -- or football -- diplomacy at World Cup draw

-

Messi eyes first MLS crown as Miami face Mueller-led Vancouver

Messi eyes first MLS crown as Miami face Mueller-led Vancouver

-

Aid cuts causing 'tragic' rise in child deaths, Bill Gates tells AFP

-

Abortion in Afghanistan: 'My mother crushed my stomach with a stone'

Abortion in Afghanistan: 'My mother crushed my stomach with a stone'

-

Lyon 'absolutely filthy' at being dropped for Ashes Test

-

Study says African penguins starved en masse off South Africa

Study says African penguins starved en masse off South Africa

-

West Indies face colossal 531-run target in first New Zealand Test

-

US signs health aid deal with Kenya in Trump first

US signs health aid deal with Kenya in Trump first

-

German president urges European 'self-confidence' on UK state visit

-

Chiefs face must-win clash as fierce NFL rivalries renewed

Chiefs face must-win clash as fierce NFL rivalries renewed

-

Amorim frustrated by wasteful Man Utd

-

Defending champ Scheffler in 5-way tie for lead at Hero World Challenge

Defending champ Scheffler in 5-way tie for lead at Hero World Challenge

-

Man Utd rue missed chance in West Ham draw

-

Nigeria stalwart Troost-Ekong retires just before AFCON

Nigeria stalwart Troost-Ekong retires just before AFCON

-

Trump revels in peace institute renamed after himself

-

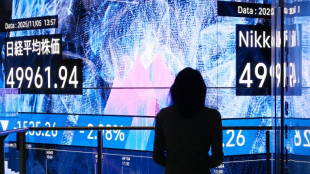

Mixed day for US equities as Japan's Nikkei rallies

Mixed day for US equities as Japan's Nikkei rallies

-

Odermatt dominates Beaver Creek World Cup downhill

-

Frank favours Spurs victory over Brentford sentiment

Frank favours Spurs victory over Brentford sentiment

-

Eurovision hit by boycotts after Israel cleared to compete

-

Trump, Rwanda and DR Congo leaders sign deal despite fresh violence

Trump, Rwanda and DR Congo leaders sign deal despite fresh violence

-

Past is history says Mueller ahead of MLS Messi clash

-

To counter climate denial, UN scientists must be 'clear' about human role: IPCC chief

To counter climate denial, UN scientists must be 'clear' about human role: IPCC chief

-

Virginia man arrested in January 6 pipe-bomb case

-

Hamilton plans team shake-up at Ferrari after miserable season

Hamilton plans team shake-up at Ferrari after miserable season

-

Facebook 'supreme court' admits 'frustrations' in 5 years of work

-

Eurovision faces withdrawals after Israel OK'd to compete

Eurovision faces withdrawals after Israel OK'd to compete

-

Iran filmmaker Panahi says to return home despite prison sentence

-

Trump envoys press plan with Ukraine as sanctions eased on Russia

Trump envoys press plan with Ukraine as sanctions eased on Russia

-

Global markets scent US rate cuts

-

Trump hosts Rwanda, DR Congo accord signing even as violence rages

Trump hosts Rwanda, DR Congo accord signing even as violence rages

-

Hegseth's Signal use risked harm to US forces, watchdog says

-

2026 Winter Olympics flame lands in Italy

2026 Winter Olympics flame lands in Italy

-

UK, Norway to jointly 'hunt Russian submarines' under new pact

-

Antonelli thanks Verstappen for support after online death threats

Antonelli thanks Verstappen for support after online death threats

-

'Motivated' Bordeaux-Begles launch Champions Cup defence at 'Bull Ring'

| RBGPF | -0.83% | 78.35 | $ | |

| CMSC | 0.17% | 23.48 | $ | |

| CMSD | -0.13% | 23.32 | $ | |

| RIO | -0.75% | 73.73 | $ | |

| GSK | -0.82% | 48.57 | $ | |

| BTI | 0.91% | 58.04 | $ | |

| RYCEF | 3.07% | 14.65 | $ | |

| SCS | -0.74% | 16.23 | $ | |

| VOD | 0.4% | 12.64 | $ | |

| NGG | -0.76% | 75.91 | $ | |

| RELX | 0.86% | 40.54 | $ | |

| BCC | -3.1% | 74.26 | $ | |

| JRI | 0.36% | 13.75 | $ | |

| AZN | -0.91% | 90.03 | $ | |

| BP | -0.03% | 37.23 | $ | |

| BCE | 0.17% | 23.22 | $ |

Asian markets mixed ahead of US data, expected Fed rate cut

Asian markets struggled into the weekend on Friday following a bland lead from Wall Street as a mixed bag of US data did little to move the needle on expectations the Federal Reserve will cut interest rates next week.

Investors have in recent sessions struggled to match last week's healthy gains fuelled by comments from central bank officials indicating their preference for a further easing of monetary policy.

However, optimism has been helped by reports reinforcing the view that the jobs market is softening, including payrolls firm ADP saying more than 30,000 posts were lost in November.

And while figures Thursday on jobless claims and layoffs came in slightly better than expected, markets have priced the chances of a rate cut Wednesday at around 90 percent.

Focus is now on the release later Friday of the personal consumption expenditures (PCE) index, the Fed's preferred gauge of inflation, with a below-forecast reading tipped to ramp up hopes for several more rate reductions in 2026.

Data on income and spending is also due to come out.

Still, debate continues to swirl over the bank's plans for the next 12 months as inflation remains stubbornly above target.

"While the US labour market is showing signs of slowing with the latest ADP report seeing a decline in hiring, there is a sense that it is still reasonably resilient," said Michael Hewson at MCH Market Insights.

With key jobs creation data not due until after the Fed's decision, "any further move to cut rates by another 25 basis points could well be a leap of faith on the part of some members of the committee", he wrote.

He warned that "markets are pricing in the likelihood of another cut, which means any delay could prompt a significant adverse reaction".

"Of course, there is another scenario where the Fed cuts rates, but then signals a pause as it looks to assess the effect that three successive rate cuts have had on the US economy."

Wall Street ended on a tepid note, with the S&P 500 and Nasdaq slightly higher but the Dow marginally off.

Tokyo shed more than one percent, having jumped more than two percent Thursday, while Hong Kong, Shanghai, Singapore and Wellington were also off. Sydney, Seoul, Taipei, Manila and Jakarta edged up.

In corporate news, Chinese artificial intelligence chip maker Moore Threads Technology soared more than 450 percent on its debut in Shanghai after raising $1.13 billion in an initial public offering.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 1.1 percent at 50,465.14 (break)

Hong Kong - Hang Seng Index: DOWN 0.5 percent at 25,800.74

Shanghai - Composite: DOWN 0.2 percent at 3,868.09

Euro/dollar: UP at $1.1652 from $1.1648 on Thursday

Pound/dollar: DOWN at $1.3330 from $1.3335

Dollar/yen: UP at 155.08 yen from 155.03 yen

Euro/pound: UP at 87.40 pence from 87.00 pence

West Texas Intermediate: DOWN 0.3 percent at $59.52 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $63.17 per barrel

New York - Dow: DOWN 0.1 percent at 47,850.94 (close)

London - FTSE 100: UP 0.2 percent at 9,710.87 (close)

A.Mahlangu--AMWN