-

Root says England still 'well and truly' in second Ashes Test

Root says England still 'well and truly' in second Ashes Test

-

Chelsea's Maresca says rotation unavoidable

-

Italian president urges Olympic truce at Milan-Cortina torch ceremony

Italian president urges Olympic truce at Milan-Cortina torch ceremony

-

Norris edges Verstappen in opening practice for season-ending Abu Dhabi GP

-

Australia race clear of England to seize control of second Ashes Test

Australia race clear of England to seize control of second Ashes Test

-

Stocks, dollar rise before key US inflation data

-

Trump strategy shifts from global role and vows 'resistance' in Europe

Trump strategy shifts from global role and vows 'resistance' in Europe

-

Turkey orders arrest of 29 footballers in betting scandal

-

EU hits X with 120-mn-euro fine, risking Trump ire

EU hits X with 120-mn-euro fine, risking Trump ire

-

Arsenal's Merino has earned striking role: Arteta

-

Putin offers India 'uninterrupted' oil in summit talks with Modi

Putin offers India 'uninterrupted' oil in summit talks with Modi

-

New Trump strategy vows shift from global role to regional

-

World Athletics ditches long jump take-off zone reform

World Athletics ditches long jump take-off zone reform

-

French town offers 1,000-euro birth bonuses to save local clinic

-

After wins abroad, Syria leader must gain trust at home

After wins abroad, Syria leader must gain trust at home

-

Slot spots 'positive' signs at struggling Liverpool

-

Eyes of football world on 2026 World Cup draw with Trump centre stage

Eyes of football world on 2026 World Cup draw with Trump centre stage

-

South Africa rugby coach Erasmus extends contract until 2031

-

Ex-Manchester Utd star Lingard announces South Korea exit

Ex-Manchester Utd star Lingard announces South Korea exit

-

Australia edge ominously within 106 runs of England in second Ashes Test

-

Markets rise ahead of US data, expected Fed rate cut

Markets rise ahead of US data, expected Fed rate cut

-

McIlroy survives as Min Woo Lee surges into Australian Open hunt

-

German factory orders rise more than expected

German factory orders rise more than expected

-

India's Modi and Russia's Putin talk defence, trade and Ukraine

-

Flooding kills two as Vietnam hit by dozens of landslides

Flooding kills two as Vietnam hit by dozens of landslides

-

Italy to open Europe's first marine sanctuary for dolphins

-

Hong Kong university suspends student union after calls for fire justice

Hong Kong university suspends student union after calls for fire justice

-

Asian markets rise ahead of US data, expected Fed rate cut

-

Nigerian nightlife finds a new extravagance: cabaret

Nigerian nightlife finds a new extravagance: cabaret

-

Tanzania tourism suffers after election killings

-

Yo-de-lay-UNESCO? Swiss hope for yodel heritage listing

Yo-de-lay-UNESCO? Swiss hope for yodel heritage listing

-

Weatherald fires up as Australia race to 130-1 in second Ashes Test

-

Georgia's street dogs stir affection, fear, national debate

Georgia's street dogs stir affection, fear, national debate

-

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

-

Gibbs runs for three TDs as Lions down Cowboys to boost NFL playoff bid

Gibbs runs for three TDs as Lions down Cowboys to boost NFL playoff bid

-

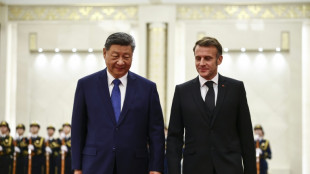

Pandas and ping-pong: Macron ending China visit on lighter note

-

TikTok to comply with 'upsetting' Australian under-16 ban

TikTok to comply with 'upsetting' Australian under-16 ban

-

Hope's resistance keeps West Indies alive in New Zealand Test

-

Pentagon endorses Australia submarine pact

Pentagon endorses Australia submarine pact

-

India rolls out red carpet for Russia's Putin

-

Softbank's Son says super AI could make humans like fish, win Nobel Prize

Softbank's Son says super AI could make humans like fish, win Nobel Prize

-

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

-

England all out for 334 in second Ashes Test

England all out for 334 in second Ashes Test

-

Hong Kong university axes student union after calls for fire justice

-

'Annoying' Raphinha pulling Barca towards their best

'Annoying' Raphinha pulling Barca towards their best

-

Prolific Kane and Undav face off as Bayern head to Stuttgart

-

Napoli's title defence continues with visit of rivals Juventus

Napoli's title defence continues with visit of rivals Juventus

-

Nice host Angers with storm clouds gathering over the Riviera

-

OpenAI strikes deal on US$4.6 bn AI centre in Australia

OpenAI strikes deal on US$4.6 bn AI centre in Australia

-

Rains hamper Sri Lanka cleanup after deadly floods

Stocks, dollar rise before key US inflation data

Major stock markets mostly rose and the dollar gained slightly Friday as investors awaited the release of key US inflation data that could cement expectations that the Federal Reserve will cut interest rates next year.

The personal consumption expenditures (PCE) index is the Fed's preferred gauge of inflation and a below-forecast reading is tipped to ramp up forecasts of several rate reductions in 2026, following an almost certain cut next week.

After much of Asia closed out their trading with gains, European indices traded higher around midday. Wall Street ended mixed on Thursday.

"With the December rate cut apparently in the bag, thoughts are turning to the pace and level of subsequent reductions next year," noted Richard Hunter, head of markets at Interactive Investor.

"Inflation remains the elephant in the room, however, and the Fed's hitherto cautious stance on monetary easing has so far been vindicated."

Debate swirls over the bank's plans for the next 12 months as US inflation remains stubbornly above target.

Stock market investors have in recent sessions struggled to match last week's healthy gains fuelled by comments from Fed officials indicating their preference for more rate cuts.

Optimism has been helped, however, by reports reinforcing the view that the US jobs market is softening, including from payrolls firm ADP which said that more than 30,000 posts were lost in November.

In Asia on Friday, Mumbai equities won a boost from a cut to interest rates by the Indian central bank, as low inflation provided room to help cushion the economy against US President Donald Trump's tariff blitz.

The rupee, which this week hit a record low against the dollar, rose.

On the corporate front, shares in Chinese group Moore Threads Technology, which makes chips for the artificial intelligence sector, soared more than 500 percent on its market debut in Shanghai after the company raised $1.1 billion in an initial public offering.

The blockbuster opening -- which came after the IPO was more than 4,000 times oversubscribed -- suggested there was plenty of confidence in the country's homegrown AI chip industry.

"The noise is real, but so is the signal: this IPO has become a barometer for faith in China's next-gen AI‑chip ambitions," said Dilin Wu, research strategist at Pepperstone.

In Europe, shares in Swiss Re slumped by more than seven percent at one point Friday after the reinsurance giant's profit target for 2026 and plans for share buybacks disappointed financial analysts.

"The 2026 group profit target of $4.5 billion is eight percent below our estimate and five percent below consensus," Vontobel analyst Matteo Lindauer wrote in a note to investors.

- Key figures at around 1115 GMT -

London - FTSE 100: UP 0.2 percent at 9,729.68 points

Paris - CAC 40: UP 0.5 percent at 8,159.39

Frankfurt - DAX: UP 0.7 percent at 24,048.07

Tokyo - Nikkei 225: DOWN 1.1 percent at 50,491.87 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 26,085.08 (close)

Shanghai - Composite: UP 0.7 percent at 3,902.81 (close)

New York - Dow: DOWN 0.1 percent at 47,850.94 (close)

Euro/dollar: DOWN at $1.1647 from $1.1648 on Thursday

Pound/dollar: DOWN at $1.3333 from $1.3335

Dollar/yen: UP at 155.13 yen from 155.03 yen

Euro/pound: UP at 87.37 pence from 87.00 pence

Brent North Sea Crude: DOWN 0.1 percent at $63.17 per barrel

West Texas Intermediate: DOWN 0.2 percent at $59.55 per barrel

burs-bcp/ajb/rl

Y.Kobayashi--AMWN