-

Trump takes centre stage as 2026 World Cup draw takes place

Trump takes centre stage as 2026 World Cup draw takes place

-

Trump all smiles as he wins FIFA's new peace prize

-

US panel votes to end recommending all newborns receive hepatitis B vaccine

US panel votes to end recommending all newborns receive hepatitis B vaccine

-

Title favourite Norris reflects on 'positive' Abu Dhabi practice

-

Stocks consolidate as US inflation worries undermine Fed rate hopes

Stocks consolidate as US inflation worries undermine Fed rate hopes

-

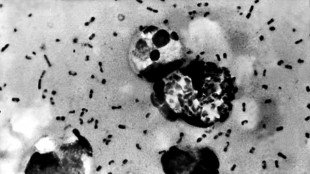

Volcanic eruptions may have brought Black Death to Europe

-

Arsenal the ultimate test for in-form Villa, says Emery

Arsenal the ultimate test for in-form Villa, says Emery

-

Emotions high, hope alive after Nigerian school abduction

-

Another original Hermes Birkin bag sells for $2.86 mn

Another original Hermes Birkin bag sells for $2.86 mn

-

11 million flock to Notre-Dame in year since rising from devastating fire

-

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

-

Lebanon president says country does not want war with Israel

-

France takes anti-drone measures after flight over nuclear sub base

France takes anti-drone measures after flight over nuclear sub base

-

Signing up to DR Congo peace is one thing, delivery another

-

'Amazing' figurines find in Egyptian tomb solves mystery

'Amazing' figurines find in Egyptian tomb solves mystery

-

Palestinians say Israeli army killed man in occupied West Bank

-

McLaren will make 'practical' call on team orders in Abu Dhabi, says boss Brown

McLaren will make 'practical' call on team orders in Abu Dhabi, says boss Brown

-

Stocks rise as investors look to more Fed rate cuts

-

Norris completes Abu Dhabi practice 'double top' to boost title bid

Norris completes Abu Dhabi practice 'double top' to boost title bid

-

Chiba leads Liu at skating's Grand Prix Final

-

Meta partners with news outlets to expand AI content

Meta partners with news outlets to expand AI content

-

Mainoo 'being ruined' at Man Utd: Scholes

-

Guardiola says broadcasters owe him wine after nine-goal thriller

Guardiola says broadcasters owe him wine after nine-goal thriller

-

Netflix to buy Warner Bros. Discovery in deal of the decade

-

French stars Moefana and Atonio return for Champions Cup

French stars Moefana and Atonio return for Champions Cup

-

Penguins queue in Paris zoo for their bird flu jabs

-

Netflix to buy Warner Bros. Discovery for nearly $83 billion

Netflix to buy Warner Bros. Discovery for nearly $83 billion

-

Sri Lanka issues fresh landslide warnings as toll nears 500

-

Root says England still 'well and truly' in second Ashes Test

Root says England still 'well and truly' in second Ashes Test

-

Chelsea's Maresca says rotation unavoidable

-

Italian president urges Olympic truce at Milan-Cortina torch ceremony

Italian president urges Olympic truce at Milan-Cortina torch ceremony

-

Norris edges Verstappen in opening practice for season-ending Abu Dhabi GP

-

Australia race clear of England to seize control of second Ashes Test

Australia race clear of England to seize control of second Ashes Test

-

Stocks, dollar rise before key US inflation data

-

Trump strategy shifts from global role and vows 'resistance' in Europe

Trump strategy shifts from global role and vows 'resistance' in Europe

-

Turkey orders arrest of 29 footballers in betting scandal

-

EU hits X with 120-mn-euro fine, risking Trump ire

EU hits X with 120-mn-euro fine, risking Trump ire

-

Arsenal's Merino has earned striking role: Arteta

-

Putin offers India 'uninterrupted' oil in summit talks with Modi

Putin offers India 'uninterrupted' oil in summit talks with Modi

-

New Trump strategy vows shift from global role to regional

-

World Athletics ditches long jump take-off zone reform

World Athletics ditches long jump take-off zone reform

-

French town offers 1,000-euro birth bonuses to save local clinic

-

After wins abroad, Syria leader must gain trust at home

After wins abroad, Syria leader must gain trust at home

-

Slot spots 'positive' signs at struggling Liverpool

-

Eyes of football world on 2026 World Cup draw with Trump centre stage

Eyes of football world on 2026 World Cup draw with Trump centre stage

-

South Africa rugby coach Erasmus extends contract until 2031

-

Ex-Manchester Utd star Lingard announces South Korea exit

Ex-Manchester Utd star Lingard announces South Korea exit

-

Australia edge ominously within 106 runs of England in second Ashes Test

-

Markets rise ahead of US data, expected Fed rate cut

Markets rise ahead of US data, expected Fed rate cut

-

McIlroy survives as Min Woo Lee surges into Australian Open hunt

| RIO | -0.79% | 73.15 | $ | |

| CMSC | -0.34% | 23.4 | $ | |

| JRI | 0.22% | 13.78 | $ | |

| SCS | -0.31% | 16.18 | $ | |

| BCC | -1.23% | 73.36 | $ | |

| CMSD | -0.32% | 23.245 | $ | |

| BTI | -1.45% | 57.21 | $ | |

| RYCEF | -0.96% | 14.51 | $ | |

| BCE | 1.07% | 23.47 | $ | |

| NGG | -0.6% | 75.455 | $ | |

| RBGPF | 0% | 78.35 | $ | |

| VOD | -1.23% | 12.48 | $ | |

| GSK | -0.61% | 48.275 | $ | |

| BP | -2.8% | 36.215 | $ | |

| RELX | -0.22% | 40.45 | $ | |

| AZN | 0.24% | 90.25 | $ |

Stocks consolidate as US inflation worries undermine Fed rate hopes

World stock markets gave a mixed picture Friday, with sentiment underpinned by hopes for sustained US central bank rate cuts, but nagging inflationary worries sparking some pre-weekend selling.

Market optimists now expect the Federal Reserve to cut rates not just this month, but also on several more occasions throughout next year.

Such expectations are, however, contingent on tame inflation in the US.

On that front, Friday's personal consumption expenditures (PCE) index -- the Fed's preferred gauge of inflation -- was less than reassuring, analysts said.

The PCE reading, which came in line with forecasts, "should cement a rate cut at next week's Fed meeting", said Bret Kenwell, US Investment Analyst at etoro, a trading firm.

But, he cautioned, "it continues to point toward a sticky inflation situation".

Optimism on a series of 2026 rate cuts has been mostly based on reports reinforcing the view that the US jobs market is softening.

- Netflix takeover -

Netflix's takeover of Warner Bros. Discovery, announced before Wall Street's opening, caught investor attention in New York business.

The deal represents the biggest consolidation in the entertainment sector this decade but could, according to analysts, run into regulatory problems because of its size.

Netflix shares were around three percent lower in late-morning New York trading, while Warner Bros. Discovery shares rose by almost the same percentage.

Earlier Friday in Asia, Mumbai equities won a boost from a rate cut by the Indian central bank.

The rupee, which this week hit a record low against the dollar, rose.

On the corporate front in Asia, shares in Chinese group Moore Threads Technology, which makes chips for the artificial intelligence sector, soared more than 500 percent on its market debut in Shanghai after the company raised $1.1 billion in an initial public offering.

"This IPO has become a barometer for faith in China's next-gen AI‑chip ambitions," said Dilin Wu, research strategist at Pepperstone.

In Europe, shares in Swiss Re were down more than six percent at the close after the reinsurance giant's profit target for 2026 and plans for share buybacks disappointed financial analysts.

- Key figures at around 1655 GMT -

New York - Dow: UP 0.2 percent at 47,942.10 points

London - FTSE 100: DOWN 0.5 percent at 9,667.01 (close)

Paris - CAC 40: DOWN 0.1 percent at 8,114.74 (close)

Frankfurt - DAX: UP 0.6 percent at 24,028.14 (close)

Tokyo - Nikkei 225: DOWN 1.1 percent at 50,491.87 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 26,085.08 (close)

Shanghai - Composite: UP 0.7 percent at 3,902.81 (close)

Euro/dollar: DOWN at $1.1634 from $1.1648 on Thursday

Pound/dollar: DOWN at $1.3325 from $1.3335

Dollar/yen: UP at 155.29 yen from 155.03 yen

Euro/pound: UP at 87.33 pence from 87.00 pence

Brent North Sea Crude: UP 0.6 percent at $63.61 per barrel

West Texas Intermediate: UP 0.5 percent at $59.95

burs-jh/jj

H.E.Young--AMWN