-

Israel says Hamas 'will be disarmed' after group proposes weapons freeze

Israel says Hamas 'will be disarmed' after group proposes weapons freeze

-

ECB proposes simplifying rules for banks

-

Toll in deadly Indonesia floods near 1,000, frustrations grow

Toll in deadly Indonesia floods near 1,000, frustrations grow

-

Myanmar junta air strike on hospital kills 31, aid workers say

-

General strike hits planes, trains and services in Portugal

General strike hits planes, trains and services in Portugal

-

Vietnam's capital chokes through week of toxic smog

-

Stocks mixed as US rate cut offset by Fed outlook, Oracle earnings

Stocks mixed as US rate cut offset by Fed outlook, Oracle earnings

-

Mexico approves punishing vape sales with jail time

-

Desert dunes beckon for Afghanistan's 4x4 fans

Desert dunes beckon for Afghanistan's 4x4 fans

-

Myanmar junta air strike on hospital kills 31: aid worker

-

British porn star faces Bali deportation after studio raid

British porn star faces Bali deportation after studio raid

-

US, Japan hold joint air exercise after China-Russia patrols

-

Skydiver survives plane-tail dangling incident in Australia

Skydiver survives plane-tail dangling incident in Australia

-

Filipino typhoon survivors sue Shell over climate change

-

Eurogroup elects new head as Russian frozen assets debate rages

Eurogroup elects new head as Russian frozen assets debate rages

-

Thunder demolish Suns, Spurs shock Lakers to reach NBA Cup semis

-

Fighting rages along Cambodia-Thailand border ahead of expected Trump call

Fighting rages along Cambodia-Thailand border ahead of expected Trump call

-

Hay fifty on debut helps put New Zealand on top in West Indies Test

-

Taiwan to keep production of 'most advanced' chips at home: deputy FM

Taiwan to keep production of 'most advanced' chips at home: deputy FM

-

Warmer seas, heavier rains drove Asia floods: scientists

-

Ex-Man Utd star Lingard scores on tearful farewell to South Korea

Ex-Man Utd star Lingard scores on tearful farewell to South Korea

-

Hay fifty on debut helps New Zealand to 73-run lead against West Indies

-

South Korea minister resigns over alleged bribes from church

South Korea minister resigns over alleged bribes from church

-

Yemeni city buckles under surge of migrants seeking safety, work

-

Breakout star: teenage B-girl on mission to show China is cool

Breakout star: teenage B-girl on mission to show China is cool

-

Chocolate prices high before Christmas despite cocoa fall

-

Debut fifty for Hay takes New Zealand to 200-5 in West Indies Test

Debut fifty for Hay takes New Zealand to 200-5 in West Indies Test

-

Sweet 16 as Thunder demolish Suns to reach NBA Cup semis

-

Austria set to vote on headscarf ban in schools

Austria set to vote on headscarf ban in schools

-

Asian traders cheer US rate cut but gains tempered by outlook

-

Racing towards great white sharks in Australia

Racing towards great white sharks in Australia

-

Fighting rages at Cambodia-Thailand border ahead of expected Trump call

-

Venezuelan opposition leader emerges from hiding after winning Nobel

Venezuelan opposition leader emerges from hiding after winning Nobel

-

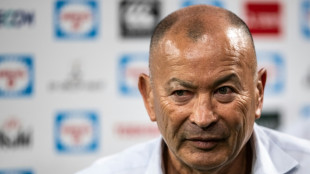

Eddie Jones given Japan vote of confidence for 2027 World Cup

-

Kennedy's health movement turns on Trump administration over pesticides

Kennedy's health movement turns on Trump administration over pesticides

-

On Venezuela, how far will Trump go?

-

AI's $400 bn problem: Are chips getting old too fast?

AI's $400 bn problem: Are chips getting old too fast?

-

Conway fifty takes New Zealand to 112-2 in West Indies Test

-

Winners Announced at the Energy Storage Awards 2025

Winners Announced at the Energy Storage Awards 2025

-

Formation Metals Further Validates Open Pit Potential at N2 Gold Project: Intersects Over 100 Metres of Near Surface Target Mineralization in Three New Drillholes

-

Genflow to Attend Healthcare Conference

Genflow to Attend Healthcare Conference

-

HyProMag USA Finalizes Long-Term Lease For Dallas-Fort Worth Rare Earth Magnet Recycling and Manufacturing Hub

-

Ur-Energy Announces Pricing of $100 Million Offering of 4.75% Convertible Senior Notes Due 2031

Ur-Energy Announces Pricing of $100 Million Offering of 4.75% Convertible Senior Notes Due 2031

-

US drops bid to preserve FIFA bribery convictions

-

Oracle shares dive as revenue misses forecasts

Oracle shares dive as revenue misses forecasts

-

'Grateful' Alonso feels Real Madrid stars' support amid slump

-

Arsenal crush Club Brugge to keep 100% Champions League record

Arsenal crush Club Brugge to keep 100% Champions League record

-

Venezuelans divided on Machado peace prize, return home

-

Ukraine sends US new plan to end the war as Trump blasts Europe

Ukraine sends US new plan to end the war as Trump blasts Europe

-

Haaland stuns Real as Arsenal remain perfect in Brugge

AI's $400 bn problem: Are chips getting old too fast?

In pursuit of the AI dream, the tech industry this year has plunked down about $400 billion on specialized chips and data centers, but questions are mounting about the wisdom of such unprecedented levels of investment.

At the heart of the doubts: overly optimistic estimates about how long these specialized chips will last before becoming obsolete.

With persistent worries of an AI bubble and so much of the US economy now riding on the boom in artificial intelligence, analysts warn that the wake-up call could be brutal and costly.

"Fraud" is how renowned investor Michael Burry, made famous by the movie "The Big Short," described the situation on X in early November.

Before the AI wave unleashed by ChatGPT, cloud computing giants typically assumed that their chips and servers would last about six years.

But Mihir Kshirsagar of Princeton University's Center for Information Technology Policy says the "combination of wear and tear along with technological obsolescence makes the six-year assumption hard to sustain."

One problem: chip makers -- with Nvidia the unquestioned leader -- are releasing new, more powerful processors much faster than before.

Less than a year after launching its flagship Blackwell chip, Nvidia announced that Rubin would arrive in 2026 with performance 7.5 times greater.

At this pace, chips lose 85 to 90 percent of their market value within three to four years, warned Gil Luria of financial advisory firm D.A. Davidson.

Nvidia CEO Jensen Huang made the point himself in March, explaining that when Blackwell was released, nobody wanted the previous generation of chip anymore.

"There are circumstances where Hopper is fine," he added, referring to the older chip. "Not many."

AI processors are also failing more often than in the past, Luria noted.

"They run so hot that sometimes the equipment just burns out," he said.

A recent Meta study on its Llama AI model found an annual failure rate of 9 percent.

- Profit risk -

For Kshirsagar and Burry alike, the realistic lifespan of these AI chips is just two or three years.

Nvidia pushed back in an unusual November statement, defending the industry's four-to-six-year estimate as based on real-world evidence and usage trends.

But Kshirsagar believes these optimistic assumptions mean the AI boom rests on "artificially low" costs -- and consequences are inevitable.

If companies were forced to shorten their depreciation timelines, "it would immediately impact the bottom line" and slash profits, warned Jon Peddie of Jon Peddie Research.

"This is where companies get in trouble with creative bookkeeping."

The fallout could ripple through an economy increasingly dependent on AI, analysts warn.

Luria isn't worried about giants like Amazon, Google, or Microsoft, which have diverse revenue streams. His concern focuses on AI specialists like Oracle and CoreWeave.

Both companies are already heavily indebted while racing to buy more chips to compete for cloud customers.

Building data centers requires raising significant capital, Luria points out.

"If they look like they're a lot less profitable" because equipment must be replaced more frequently, "it will become more expensive for them to raise the capital."

The situation is especially precarious because some loans use the chips themselves as collateral.

Some companies hope to soften the blow by reselling older chips or using them for less demanding tasks than cutting-edge AI.

A chip from 2023, "if economically viable, can be used for second-tier problems and as a backup," Peddie said.

Th.Berger--AMWN