-

Recalled Ndiaye takes Senegal past 10-man Mali into AFCON semis

Recalled Ndiaye takes Senegal past 10-man Mali into AFCON semis

-

'Devastated' Switzerland grieves New Year inferno victims

-

Man pleads guilty to sending 'abhorrent messages' to England women's footballer Carter

Man pleads guilty to sending 'abhorrent messages' to England women's footballer Carter

-

PGA Tour unveils fall slate with Japan, Mexico, Bermuda stops

-

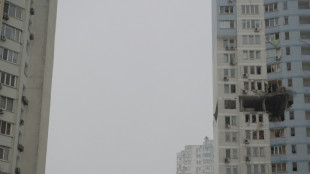

'Unhappy' Putin sends message to West with Ukraine strike on EU border

'Unhappy' Putin sends message to West with Ukraine strike on EU border

-

Fletcher defends United academy after Amorim criticism

-

Kyiv mayor calls for temporary evacuation over heating outages

Kyiv mayor calls for temporary evacuation over heating outages

-

Families wait in anguish for prisoners' release in Venezuela

-

Littler signs reported record £20 million darts deal

Littler signs reported record £20 million darts deal

-

'Devastated' Switzerland grieves deadly New Year fire

-

Syria threatens to bomb Kurdish district in Aleppo as fighters refuse to evacuate

Syria threatens to bomb Kurdish district in Aleppo as fighters refuse to evacuate

-

Britain's Princess Catherine 'deeply grateful' after year in cancer remission

-

Russia joins Chinese, Iran warships for drills off South Africa

Russia joins Chinese, Iran warships for drills off South Africa

-

40 white roses: shaken mourners remember Swiss fire victims

-

German trial starts of 'White Tiger' online predator

German trial starts of 'White Tiger' online predator

-

Stocks rise despite mixed US jobs data

-

'Palestine 36' director says film is about 'refusal to disappear'

'Palestine 36' director says film is about 'refusal to disappear'

-

US December hiring misses expectations, capping weak 2025

-

Switzerland 'devastated' by fire tragedy: president

Switzerland 'devastated' by fire tragedy: president

-

Rosenior not scared of challenge at 'world class' Chelsea

-

Polish farmers march against Mercosur trade deal

Polish farmers march against Mercosur trade deal

-

Swiatek wins in 58 minutes as Poland reach United Cup semis

-

Ski great Hirscher pulls out of Olympics, ends season

Ski great Hirscher pulls out of Olympics, ends season

-

'War is back in vogue,' Pope Leo says

-

Storms pummel northern Europe causing travel mayhem and power cuts

Storms pummel northern Europe causing travel mayhem and power cuts

-

France has right to say 'no' to US, Paris says

-

TikTok drives 'bizarre' rush to Prague library's book tower

TikTok drives 'bizarre' rush to Prague library's book tower

-

EU countries override France to greenlight Mercosur trade deal

-

Russia joins Chinese, Iran warships for drills off S.Africa

Russia joins Chinese, Iran warships for drills off S.Africa

-

Stocks rise ahead of US jobs data and key tariffs ruling

-

'All are in the streets': Iranians defiant as protests grow

'All are in the streets': Iranians defiant as protests grow

-

Kurdish fighters refuse to leave Syria's Aleppo after truce

-

Grok turns off AI image generation for non-payers after nudes backlash

Grok turns off AI image generation for non-payers after nudes backlash

-

Germany factory output jumps but exports disappoint

-

Defiant Khamenei insists 'won't back down' in face of Iran protests

Defiant Khamenei insists 'won't back down' in face of Iran protests

-

Russian strikes cut heat to Kyiv, mayor calls for temporary evacuation

-

Switzerland holds day of mourning after deadly New Year fire

Switzerland holds day of mourning after deadly New Year fire

-

Hundreds of thousands without power as storms pummel Europe

-

Man City win race to sign forward Semenyo

Man City win race to sign forward Semenyo

-

Experts say oceans soaked up record heat levels in 2025

-

'Would be fun': Alcaraz, Sinner tease prospect of teaming up in doubles

'Would be fun': Alcaraz, Sinner tease prospect of teaming up in doubles

-

Man City win race to sign Semenyo

-

Chinese AI unicorn MiniMax soars 109 percent in Hong Kong debut

Chinese AI unicorn MiniMax soars 109 percent in Hong Kong debut

-

Iran rocked by night of protests despite internet blackout: videos

-

Swiatek romps to United Cup victory in 58 minutes

Swiatek romps to United Cup victory in 58 minutes

-

Procession of Christ's icon draws thousands to streets of Philippine capital

-

Every second counts for Japan's 'King Kazu' at 58

Every second counts for Japan's 'King Kazu' at 58

-

Syria announces ceasefire with Kurdish fighters in Aleppo

-

Russia hits Ukraine with hypersonic missile after rejecting peacekeeping plan

Russia hits Ukraine with hypersonic missile after rejecting peacekeeping plan

-

Asian stocks mixed ahead of US jobs, Supreme Court ruling

Swiss mining giant Glencore reveals merger talks with Rio Tinto

Swiss mining and commodity trading group Glencore said Friday it was in merger talks with British-Australian rival Rio Tinto to create a global resources giant.

The firm said it was in preliminary discussions with Rio Tinto "about a possible combination of some or all of their businesses".

The deal could proceed as an all-share merger, it added in a statement.

The Financial Times was first to report that the two were discussing a "megamerger" to create the world's largest mining company.

Together, they would have a value of more than US$260 billion, the paper said.

As a combined force they would have greater leverage to buy copper resources, a metal that is growing in demand as countries expand electrical networks to harness renewable energies.

Glencore chief executive Gary Nagle in December outlined plans to become one of the world's largest copper producers.

"Our portfolio, in particular in copper, is world class," he told an investor presentation.

The "current expectation" is that Rio Tinto would acquire Glencore by a court-sanctioned scheme of arrangement, the Swiss firm said.

Shares in Rio Tinto, which confirmed the merger talks in a separate statement, fell five percent in late morning trade in Sydney.

The two groups said there was no certainty that the preliminary talks would result in a merger.

Analysts said the two firms would have to bridge cultural differences, with Rio Tinto having exited its coal assets and Glencore holding on to the fossil fuel.

- 'Cultural divide' -

"Strategically, Rio Tinto might be interested in Glencore's copper assets, aligning with its focus on sustainable, future-facing metals," CreditSights researchers said in a report.

Any merger would need "careful stitching" to avoid unwanted asset overlaps, they said.

"Culturally, Rio Tinto is traditionally seen as conservative and focused on stability, whereas Glencore is known for its aggressive approach and constantly pushing the envelope in its operations," the report added.

"This cultural divide might pose challenges in integration and decision-making if a merger were to proceed."

Glencore announced in August that it had decided against spinning off its coal business, saying its shareholders viewed the fuel as a cash-generating activity.

The mining group had considered merging newly acquired Elk Valley Resources with its own coal activities and spinning it off.

But Glencore said it needed the cash flow from its coal mines to invest in raw materials useful for the green transition, such as copper and cobalt.

"The coal business supports the energy needs of today as we transition in the world," Glencore's chief executive said in December.

The strategy has been criticised by environmental groups and by some shareholders, who noted that coal is banned from some investment portfolios.

Norway's sovereign wealth fund, the world's largest, has excluded Glencore shares from its portfolio since 2020.

Oil, gas and coal companies are under pressure to transition away from fossil fuels, which are the biggest contributor to climate change.

Rio Tinto said it had until February 5 to announce whether or not it is going ahead with the Glencore merger.

F.Dubois--AMWN