-

Chelsea paid for costly errors in Arsenal defeat, says Rosenior

Chelsea paid for costly errors in Arsenal defeat, says Rosenior

-

Morocco beat Nigeria on penalties to reach Africa Cup of Nations final

-

Golden Globes viewership shrinks again

Golden Globes viewership shrinks again

-

NASA reports record heat but omits reference to climate change

-

Real Madrid crash out of Copa del Rey at Albacete on Arbeloa debut

Real Madrid crash out of Copa del Rey at Albacete on Arbeloa debut

-

Trump says Iran killings stopped as US scales back Qatar base

-

Arsenal beat Rosenior's Chelsea in League Cup semi first leg

Arsenal beat Rosenior's Chelsea in League Cup semi first leg

-

US stocks fall again as Iran worries lift oil prices

-

Inter extend Serie A lead to six points after Napoli slip

Inter extend Serie A lead to six points after Napoli slip

-

Bayern beat Cologne to move 11 points clear in Bundesliga

-

Mane takes Senegal past Egypt into final of his last AFCON

Mane takes Senegal past Egypt into final of his last AFCON

-

'Bridgerton' premieres in Paris promising 'Cinderella with a twist'

-

California begins probe of Musk's Grok over sexualized AI images

California begins probe of Musk's Grok over sexualized AI images

-

Astronauts set to leave ISS in first-ever medical evacuation

-

Napoli's stalemate with Parma opens door for Serie A leaders Inter

Napoli's stalemate with Parma opens door for Serie A leaders Inter

-

Denmark says White House talks failed to alter US designs on Greenland

-

Venezuela looking to 'new era' after Maduro ouster, says interim leader

Venezuela looking to 'new era' after Maduro ouster, says interim leader

-

Mane takes dominant Senegal past Egypt into AFCON final

-

Promoter says Joshua will return to ring when 'time is right' after horror crash

Promoter says Joshua will return to ring when 'time is right' after horror crash

-

California investigating Grok AI over lewd fake images

-

Wales's Faletau set to miss bulk of Six Nations

Wales's Faletau set to miss bulk of Six Nations

-

England sweating on Fin Smith's fitness for Six Nations opener

-

NASA acknowledges record heat but avoids referencing climate change

NASA acknowledges record heat but avoids referencing climate change

-

England rugby league coach Wane quits role

-

Oil prices extend gains on Iran worries

Oil prices extend gains on Iran worries

-

European basketball pioneer Schrempf lauds 'global' NBA

-

Denmark, Greenland in crunch White House talks as Trump ups pressure

Denmark, Greenland in crunch White House talks as Trump ups pressure

-

Mitchell hits ton as New Zealand down India to level ODI series

-

Syrian army tells civilians to stay away from Kurdish positions east of Aleppo

Syrian army tells civilians to stay away from Kurdish positions east of Aleppo

-

Spurs sign England midfielder Gallagher from Atletico Madrid

-

Russian captain tried to avoid North Sea crash: court

Russian captain tried to avoid North Sea crash: court

-

Battle over Chinese-owned chipmaker Nexperia rages in Dutch court

-

Transatlantic ties 'disintegrating': German vice chancellor

Transatlantic ties 'disintegrating': German vice chancellor

-

Five problems facing Ukraine's new defence chief

-

Italian influencer Ferragni acquitted in Christmas cake fraud trial

Italian influencer Ferragni acquitted in Christmas cake fraud trial

-

Ryanair hits out at 'stupid' Belgium over aviation taxes

-

Burkina Faso sack coach Traore after AFCON exit

Burkina Faso sack coach Traore after AFCON exit

-

African manufacturers welcome US trade deal, call to finalise it

-

What happens when fire ignites in space? 'A ball of flame'

What happens when fire ignites in space? 'A ball of flame'

-

Death of author's baby son puts Nigerian healthcare in spotlight

-

France bans 10 British anti-migrant activists

France bans 10 British anti-migrant activists

-

2025 was third hottest year on record: climate monitors

-

Hydrogen planes 'more for the 22nd century': France's Safran

Hydrogen planes 'more for the 22nd century': France's Safran

-

Julio Iglesias, the Spanish crooner who won global audience

-

'We can't make ends meet': civil servants protest in Ankara

'We can't make ends meet': civil servants protest in Ankara

-

UK prosecutors appeal Kneecap rapper terror charge dismissal

-

UK police chief blames AI for error in evidence over Maccabi fan ban

UK police chief blames AI for error in evidence over Maccabi fan ban

-

Oil prices extend gains on Iran unrest

-

France bans 10 UK far-right activists over anti-migrant actions

France bans 10 UK far-right activists over anti-migrant actions

-

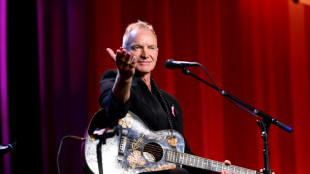

Every cent you take: Sting, ex-Police band mates in royalty battle

US stocks fall again as Iran worries lift oil prices

Wall Street stocks fell again Wednesday as investors shrugged off solid bank earnings and US data while oil prices jumped on rising tensions between Washington and Tehran.

Executives with Citigroup, Bank of America and Wells Fargo described US consumers as resilient while releasing a batch of generally good earnings with no major bombshells.

But shares of all three banks fell decisively.

The broader market was also not buoyed by US data for November that showed a 0.6 percent increase in retail sales, topping expectations.

Major indices spent most of the day firmly in the red, with the S&P 500 closing down 0.5 percent.

"Investor attitudes are changing," said Jack Ablin of Cresset Capital Management. "Some negativity is creeping in."

Ablin described investor unease about President Donald Trump's threats to Federal Reserve autonomy, most recently in the Department of Justice's criminal probe of the central bank.

He also pointed to Trump's proposed 10 percent interest rate cap on credit cards as an unwelcome wildcard that has added to a broader sense of unpredictability.

There's "uncertainty around these capricious policies and markets are already expensive," Ablin said.

Other topics that have dominated headlines include Trump's ambitions to take over Greenland that have raised worry in Europe and a rise in rhetoric between the United States and Iran over the latter's handling of protests.

The latter issue helped propel oil prices about 1.5 percent higher.

Iran warned the United States that it was capable of responding to any attack, as Washington appeared to be pulling personnel out of a base that Iran targeted in a strike last year.

"Traders are closely watching the political unrest in Iran and possible US intervention, which could threaten disruption to the country's...oil production," said Helge Andre Martinsen, senior energy analyst at DNB Carnegie.

In European stocks trading London set a fresh all-time high thanks to gains in mining stocks, but Frankfurt and Paris slid lower.

Asian stock markets mostly gained.

Tokyo shares jumped by 1.5 percent while the yen slumped to its lowest value since mid-2024 amid media reports that Prime Minister Sanae Takaichi planned to hold an election as soon as February 8.

Takaichi's cabinet -- riding high in opinion polls -- has approved a record 122.3-trillion-yen ($768 billion) budget for the fiscal year from April 2026.

She has vowed to get parliamentary approval as soon as possible to address inflation and shore up the world's fourth-largest economy.

On the corporate front, British energy giant BP revealed a write-down of up to $5 billion linked to its energy transition efforts that will be reflected in the company's upcoming annual results.

Its share price traded lower most of the day but closed the day with a gain of 1.5 percent.

- Key figures at around 2115 GMT -

Brent North Sea Crude: UP 1.6 percent at $66.52 per barrel

West Texas Intermediate: UP 1.4 percent at $62.02 per barrel

New York - Dow: DOWN 0.1 percent at 49,124.17 points

New York - S&P 500: DOWN 0.7 percent at 6,917.81

New York - Nasdaq Composite: DOWN 1.1 percent at 23,440.38

London - FTSE 100: UP 0.5 percent at 10,184.35 (close)

Paris - CAC 40: DOWN 0.2 percent at 8,330.97 (close)

Frankfurt - DAX: DOWN 0.5 percent at 25,286.24 (close)

Tokyo - Nikkei 225: UP 1.5 percent at 54,341.23 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 26,999.81 (close)

Shanghai - Composite: DOWN 0.3 percent at 4,126.09 (close)

Euro/dollar: UP at $1.1647 from $1.1641 on Tuesday

Pound/dollar: DOWN at $1.3433 from $1.3465

Dollar/yen: DOWN at 158.56 yen from 158.14 yen

Euro/pound: DOWN at 86.68 pence from 86.64 pence

burs-jmb/sla

F.Schneider--AMWN