-

Schools shut, flights cancelled as Typhoon Ragasa nears Hong Kong

Schools shut, flights cancelled as Typhoon Ragasa nears Hong Kong

-

Maverick Georgian designer Demna debuts for Gucci in Milan

-

What do some researchers call disinformation? Anything but disinformation

What do some researchers call disinformation? Anything but disinformation

-

Jimmy Kimmel show to return Tuesday

-

Unification Church leader arrested in South Korea

Unification Church leader arrested in South Korea

-

Singapore firm rejects $1bn Sri Lankan pollution damages

-

Chile presidential contender vows to deport 'all' undocumented migrants

Chile presidential contender vows to deport 'all' undocumented migrants

-

China may strengthen climate role amid US fossil fuel push

-

Ryder Cup captains play upon emotions as practice begins

Ryder Cup captains play upon emotions as practice begins

-

Bradley defends US Ryder Cup player payments as charity boost

-

Trump ties autism risk to Tylenol as scientists urge caution

Trump ties autism risk to Tylenol as scientists urge caution

-

Dembele beats Yamal to Ballon d'Or as Bonmati retains women's award

-

Strength in Nvidia, Apple helps lift US equities to new records

Strength in Nvidia, Apple helps lift US equities to new records

-

Man City 'keeper Donnarumma says would have stayed at PSG

-

49ers ace Bosa to miss season after knee injury: reports

49ers ace Bosa to miss season after knee injury: reports

-

Canada wildlife decline 'most severe' in decades: WWF

-

PSG star Dembele wins men's Ballon d'Or

PSG star Dembele wins men's Ballon d'Or

-

Napoli beat battling Pisa to maintain perfect Serie A start

-

Spain's Aitana Bonmati wins Women's Ballon d'Or

Spain's Aitana Bonmati wins Women's Ballon d'Or

-

Jimmy Kimmel show to return Tuesday: Disney

-

Marseille inflict first defeat of season on PSG in Ligue 1

Marseille inflict first defeat of season on PSG in Ligue 1

-

White House promises US-controlled TikTok algorithm

-

Trump expected to tie autism risk to Tylenol as scientists urge caution

Trump expected to tie autism risk to Tylenol as scientists urge caution

-

Macron recognizes Palestinian state at landmark UN summit

-

Hong Kong prepares for 'serious threat' from Super Typhoon Ragasa

Hong Kong prepares for 'serious threat' from Super Typhoon Ragasa

-

S. Korea court issues arrest warrant for Unification Church leader: Yonhap

-

New US Fed governor says rates should be around 'mid-2%'

New US Fed governor says rates should be around 'mid-2%'

-

14 killed as rival Ecuadoran inmates fight with guns, explosives

-

Dozens of French towns flout government warning to fly Palestinian flag

Dozens of French towns flout government warning to fly Palestinian flag

-

Nvidia to invest up to $100 bn in OpenAI data centers

-

US mulls economic lifeline for ally Argentina

US mulls economic lifeline for ally Argentina

-

France to recognize Palestinian state at contentious UN

-

Museum or sheikh? World's second largest diamond awaits home

Museum or sheikh? World's second largest diamond awaits home

-

UK charities axe Prince Andrew's ex-wife over Epstein email

-

Google fights breakup of ad tech business in US court

Google fights breakup of ad tech business in US court

-

US pleads for new beefed-up multi-national force in Haiti

-

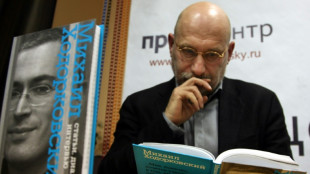

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

-

Stocks steady ahead of key US inflation data

-

Jews flock to Ukraine for New Year pilgrimage despite travel warning

Jews flock to Ukraine for New Year pilgrimage despite travel warning

-

Trump autism 'announcement' expected Monday

-

Over 60,000 Europeans died from heat during 2024 summer: study

Over 60,000 Europeans died from heat during 2024 summer: study

-

Clashes as tens of thousands join pro-Palestinian demos in Italy

-

UK charity axes Prince Andrew's ex-wife over Epstein email

UK charity axes Prince Andrew's ex-wife over Epstein email

-

France, others to recognize Palestinian state at UN

-

IAEA says Iran nuclear diplomacy at a 'difficult juncture'

IAEA says Iran nuclear diplomacy at a 'difficult juncture'

-

Merz tasks banker with luring investment to Germany

-

Russia offers to extend nuclear arms limits with US by one year

Russia offers to extend nuclear arms limits with US by one year

-

Stocks turn lower ahead of key US inflation data

-

Gavi to undergo knee operation on meniscus injury: Barcelona

Gavi to undergo knee operation on meniscus injury: Barcelona

-

Frenchman denies killing wife in case that captivated France

Wall Street falls as Fed meets, Europe rebounds

European stocks rallied Tuesday along with oil prices, while Wall Street ended lower as markets nervously eyed the impasse over Ukraine while awaiting a key Federal Reserve decision.

A day after suffering deep losses, Frankfurt, Paris and London all pushed higher, following a topsy-turvy session in New York on Monday when the Dow recovered more than 1,200 points to finish in positive territory.

But sentiment remained brittle on Tuesday.

"Notwithstanding yesterday's huge intraday reversal -- one of the largest ever for the Nasdaq -- the stock market isn't necessarily in a celebratory mood," Briefing.com analyst Patrick O'Hare said.

US stocks briefly rallied in the afternoon, but were unable to match Monday's pattern. Though the S&P 500 ended far above its session lows, it was still down 1.2 percent.

"Market volatility remains elevated as investors are still feeling jittery over a very tense Ukraine-Russia situation, a whole range of inflationary issues that include a potentially aggressive Fed and a global chip problem that just won’t get any better," Oanda's Edward Moya said.

"Optimism remains that a massive correction is still unlikely to happen because the US growth story will likely remain intact this year, but Wall Street is not seeing many buyers emerge ahead of the Fed and as the conflict in Ukraine escalates."

The United States warned Moscow it faces damaging sanctions, including high-tech export curbs, as Russian combat troops near Ukraine launched new exercises.

Meanwhile, Fed officials kicked off a two-day policy meeting that is expected to produce more information on how Fed Chair Jerome Powell's recent focus on containing inflation will affect monetary policy.

The International Monetary Fund trimmed its world GDP forecast for 2022 to 4.4 percent, half a point lower than the October estimate as the Omicron variant of Covid-19 weighs on activity.

And amid ongoing global supply chain snags, analysts cited a Commerce Department report warning that US firms have an average of less than five days worth of semiconductors on hand.

In other markets, oil prices advanced amid worries the Ukraine impasse could hit production. either because of sanctions that Russia or an outage on key petroleum infrastructure.

- Key figures around 2140 GMT -

New York - Dow: DOWN 0.2 percent at 34,297.73 (close)

New York - S&P 500: DOWN 1.2 percent at 4,356.45 (close)

New York - Nasdaq: DOWN 2.3 percent at 13,539.29 (close)

London - FTSE 100: UP 1.0 percent at 7,371.46 (close)

Paris - CAC 40: UP 0.7 percent at 6,837.96 (close)

Frankfurt - DAX: UP 0.8 percent at 15,123.87 (close)

EURO STOXX 50: UP 0.6 percent at 4,078.26 (close)

Tokyo - Nikkei 225: DOWN 1.7 percent at 27,131.34 (close)

Hong Kong - Hang Seng Index: DOWN 1.7 percent at 24,243.61 (close)

Shanghai - Composite: DOWN 2.6 percent at 3,433.06 (close)

Euro/dollar: DOWN at $1.1305 from $1.1326 late Monday

Pound/dollar: UP at $1.3507 from $1.3488

Euro/pound: DOWN at 83.66 pence from 83.97 pence

Dollar/yen: DOWN at 113.87 yen from 113.95 yen

Brent North Sea crude: UP 2.2 percent at $88.20 per barrel

West Texas Intermediate: UP 2.7 percent at $85.60 per barrel

burs-jmb/hs

S.F.Warren--AMWN