-

Emery seeks Europa League lift with Villa as Forest end long absence

Emery seeks Europa League lift with Villa as Forest end long absence

-

Egypt frees activist Alaa Abdel Fattah after Sisi pardon

-

Gibbs, Montgomery doubles as Lions rampage over Ravens

Gibbs, Montgomery doubles as Lions rampage over Ravens

-

Asian markets struggle as focus turns to US inflation

-

Schools shut, flights cancelled as Typhoon Ragasa nears Hong Kong

Schools shut, flights cancelled as Typhoon Ragasa nears Hong Kong

-

Maverick Georgian designer Demna debuts for Gucci in Milan

-

What do some researchers call disinformation? Anything but disinformation

What do some researchers call disinformation? Anything but disinformation

-

Jimmy Kimmel show to return Tuesday

-

Unification Church leader arrested in South Korea

Unification Church leader arrested in South Korea

-

Singapore firm rejects $1bn Sri Lankan pollution damages

-

Chile presidential contender vows to deport 'all' undocumented migrants

Chile presidential contender vows to deport 'all' undocumented migrants

-

China may strengthen climate role amid US fossil fuel push

-

Ryder Cup captains play upon emotions as practice begins

Ryder Cup captains play upon emotions as practice begins

-

Bradley defends US Ryder Cup player payments as charity boost

-

Trump ties autism risk to Tylenol as scientists urge caution

Trump ties autism risk to Tylenol as scientists urge caution

-

Dembele beats Yamal to Ballon d'Or as Bonmati retains women's award

-

Strength in Nvidia, Apple helps lift US equities to new records

Strength in Nvidia, Apple helps lift US equities to new records

-

Man City 'keeper Donnarumma says would have stayed at PSG

-

49ers ace Bosa to miss season after knee injury: reports

49ers ace Bosa to miss season after knee injury: reports

-

Canada wildlife decline 'most severe' in decades: WWF

-

PSG star Dembele wins men's Ballon d'Or

PSG star Dembele wins men's Ballon d'Or

-

Napoli beat battling Pisa to maintain perfect Serie A start

-

Spain's Aitana Bonmati wins Women's Ballon d'Or

Spain's Aitana Bonmati wins Women's Ballon d'Or

-

Jimmy Kimmel show to return Tuesday: Disney

-

Marseille inflict first defeat of season on PSG in Ligue 1

Marseille inflict first defeat of season on PSG in Ligue 1

-

White House promises US-controlled TikTok algorithm

-

Trump expected to tie autism risk to Tylenol as scientists urge caution

Trump expected to tie autism risk to Tylenol as scientists urge caution

-

Macron recognizes Palestinian state at landmark UN summit

-

Hong Kong prepares for 'serious threat' from Super Typhoon Ragasa

Hong Kong prepares for 'serious threat' from Super Typhoon Ragasa

-

S. Korea court issues arrest warrant for Unification Church leader: Yonhap

-

New US Fed governor says rates should be around 'mid-2%'

New US Fed governor says rates should be around 'mid-2%'

-

14 killed as rival Ecuadoran inmates fight with guns, explosives

-

Dozens of French towns flout government warning to fly Palestinian flag

Dozens of French towns flout government warning to fly Palestinian flag

-

Nvidia to invest up to $100 bn in OpenAI data centers

-

US mulls economic lifeline for ally Argentina

US mulls economic lifeline for ally Argentina

-

France to recognize Palestinian state at contentious UN

-

Museum or sheikh? World's second largest diamond awaits home

Museum or sheikh? World's second largest diamond awaits home

-

UK charities axe Prince Andrew's ex-wife over Epstein email

-

Google fights breakup of ad tech business in US court

Google fights breakup of ad tech business in US court

-

US pleads for new beefed-up multi-national force in Haiti

-

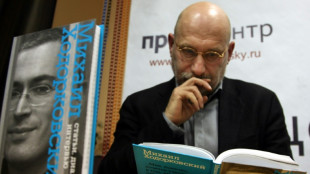

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

-

Stocks steady ahead of key US inflation data

-

Jews flock to Ukraine for New Year pilgrimage despite travel warning

Jews flock to Ukraine for New Year pilgrimage despite travel warning

-

Trump autism 'announcement' expected Monday

-

Over 60,000 Europeans died from heat during 2024 summer: study

Over 60,000 Europeans died from heat during 2024 summer: study

-

Clashes as tens of thousands join pro-Palestinian demos in Italy

-

UK charity axes Prince Andrew's ex-wife over Epstein email

UK charity axes Prince Andrew's ex-wife over Epstein email

-

France, others to recognize Palestinian state at UN

-

IAEA says Iran nuclear diplomacy at a 'difficult juncture'

IAEA says Iran nuclear diplomacy at a 'difficult juncture'

-

Merz tasks banker with luring investment to Germany

Fed signals first US rate hike since pandemic could come in March

The Federal Reserve on Wednesday indicated it is ready to raise US interest rates in March for the first time since cutting them to zero when Covid-19 broke out, pointing to persistently high inflation and the job market's recovery from the mass layoffs that defined the start of the pandemic.

The decision by the Federal Open Market Committee (FOMC) at the conclusion of its two-day meeting contained few surprises and no signs the central bank would take more aggressive actions than expected to contain the inflation wave, which pushed consumer price up to multi-decade highs last year.

"With inflation well above two percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate," the FOMC said in a statement following the meeting.

Policymakers continue to expect price pressures to recede, noting that "progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation."

However, they noted ongoing risks posed by future variants of Covid-19.

Wall Street indices had sold off sharply in recent days as traders pondered the possibility of aggressive Fed action, but stocks rose higher after the FOMC's decision, with the tech-rich Nasdaq up 2.8 percent around 1913 GMT.

The rate liftoff likely will come as soon as March, when the US central bank's bond-buying stimulus program is scheduled to end.

Fed Chair Jerome Powell has said the Fed won't begin to increase the benchmark borrowing rate until that is completed.

After pledging to keep rates lower for longer to ensure marginalized groups benefit from the economic recovery, the Fed pivoted quickly to fighting the price surge as it accelerated last year.

But the FOMC statement said, "Progress on vaccinations and an easing of supply constraints" should lead to lower inflation.

- Wild Wall Street ride -

The committee also released guidelines for "significantly reducing" the size of its massive holdings of bonds and securities accumulated mostly during the recent economic crisis, when it intervened to bolster financial markets.

The FOMC provided not timeframe but said it "expects that reducing the size of the Federal Reserve's balance sheet will commence after the process of increasing the target range for the federal funds rate has begun."

New York stock indices surged to record levels during the pandemic despite the economic gloom caused by Covid-19, thanks in part to the Fed's easy money policies.

The sell-off in recent days was seen as a consequence of investors' fears that Powell could signal repeated or bigger interest rate hikes to stop inflation when the FOMC meeting ended.

"The Fed has done everything but bash investors over the head with a sledgehammer to warn them that rate hikes are coming," economist Joel Naroff said.

"That suddenly everyone is worried about rate hikes proves another of my favorite sayings: 'Markets may be efficient, but that doesn't mean they are rational.'"

US consumer prices rose by seven percent last year for a variety of factors.

These include global issues such as supply chain snarls and the semiconductor shortage, and domestic concerns like government stimulus policies that have fattened Americans' wallets, as more people spent on goods that grew scarce, rather than services.

Rate hikes can chill demand that push prices higher, but they also impact borrowing conditions worldwide. On Tuesday, top IMF official Gita Gopinath praised the Fed's signaling of its policy thus far.

But in an interview with AFP, she warned, "This is going to be a challenge for central bankers this year to be able to communicate the transition to tighter monetary policy, and they should handle that with care."

- Fearing uncertainty -

While stocks were initially sanguine about the announcement, future chaos could weigh on the Fed.

Last week, the Nasdaq -- rich with tech stocks that boomed thanks to the Fed's easy money policies -- lost seven percent, while on Monday, the S&P 500 oscillated wildly, sinking 3.5 percent before ending trading with a slight gain.

Upheaval in the markets isn't a good look for the central bank, Naroff said, and further selloffs may sway Powell and his colleagues into moving slower with rate hikes.

"The markets may dictate what the Fed does once again, and if that happens, it is too bad," he said.

J.Williams--AMWN