-

Macron slams 'bourgeois' drug users as French activist says won't be silenced

Macron slams 'bourgeois' drug users as French activist says won't be silenced

-

EU moves to delay 'high-risk' AI rules, cut cookie banners

-

Governance and rape allegations threaten famed French comics festival

Governance and rape allegations threaten famed French comics festival

-

UEFA approves Barcelona's Camp Nou return in Champions League

-

Stocks steadier before key Nvidia results

Stocks steadier before key Nvidia results

-

Netherlands halts Nexperia takeover in gesture to China: minister

-

China passes US to return as Germany's top trade partner

China passes US to return as Germany's top trade partner

-

Arsenal to end partnership with Visit Rwanda

-

Christie's suspends Paris sale of world's 'first calculator'

Christie's suspends Paris sale of world's 'first calculator'

-

Santner fireworks give New Zealand ODI series win over West Indies

-

Eight-time world surf champion Gilmore set for comeback

Eight-time world surf champion Gilmore set for comeback

-

England keep options open as Stokes tells team 'don't be afraid'

-

England include spinner Bashir in 12-man squad for Ashes opener

England include spinner Bashir in 12-man squad for Ashes opener

-

Thousands of Kenyans displaced by Lake Naivasha flooding

-

Stocks struggle as Nvidia takes centre stage amid AI bubble fears

Stocks struggle as Nvidia takes centre stage amid AI bubble fears

-

Hope century blasts West Indies to 247-9 against New Zealand

-

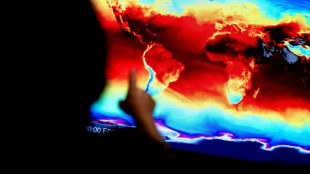

Without US satellites, 'we go dark', climate monitor tells AFP

Without US satellites, 'we go dark', climate monitor tells AFP

-

Rediscovering Iznik's lost art of vibrant Ottoman tilemaking

-

LeBron makes winning return for Lakers in 23rd season

LeBron makes winning return for Lakers in 23rd season

-

China to halt Japan seafood imports amid Taiwan spat: reports

-

Roblox game platform launches age checks for chat

Roblox game platform launches age checks for chat

-

Why is bitcoin plunging?

-

LeBron debuts in NBA record 23rd season as Pistons win streak hits 11

LeBron debuts in NBA record 23rd season as Pistons win streak hits 11

-

Curacao seal World Cup fairytale as Haiti, Panama qualify

-

South Africa to host G20 summit boycotted by US

South Africa to host G20 summit boycotted by US

-

Confident Japan eye World Cup history after impressive year

-

England face daunting task to break Ashes drought in Australia

England face daunting task to break Ashes drought in Australia

-

Asian markets bounce as Nvidia takes centre stage amid AI bubble fears

-

Ireland's data centres power digital age, drain the grid

Ireland's data centres power digital age, drain the grid

-

Under pressure, EU to scale back digital rules

-

India's Bollywood battles paid reviews and fake sale claims

India's Bollywood battles paid reviews and fake sale claims

-

Ronaldo and Musk attend Trump's dinner with Saudi prince

-

USA thrash Uruguay 5-1 in friendly rout

USA thrash Uruguay 5-1 in friendly rout

-

Belgian climate case pits farmer against TotalEnergies

-

Auction of famed CIA cipher shaken after archive reveals code

Auction of famed CIA cipher shaken after archive reveals code

-

UK spy agency warns MPs over Chinese 'headhunters'

-

Nuts and beer: booze-free bar offers Saudis a pub vibe

Nuts and beer: booze-free bar offers Saudis a pub vibe

-

Klimt portrait becomes second most expensive artwork sold at auction

-

In blow to Trump, US court tosses redrawn Texas congressional map

In blow to Trump, US court tosses redrawn Texas congressional map

-

Ultra-processed foods a rising threat to health: researchers

-

'Piggy.' 'Terrible.' Trump lashes out at female reporters

'Piggy.' 'Terrible.' Trump lashes out at female reporters

-

ENTO Subsidiary Grid AI Announces Letter of Intent with First Hyperscaler AI Data-Center Customer

-

Xenetic Biosciences, Inc. Extends Research and Development Collaboration with Institute Investigator at Scripps Research to Advance DNase Platform

Xenetic Biosciences, Inc. Extends Research and Development Collaboration with Institute Investigator at Scripps Research to Advance DNase Platform

-

Nixxy, Inc. Provides Update on Strategic Review of Digital Asset Treasury Structures

-

Diamond Renewable Energy Wins 2025 Consumer Choice Award for Solar Energy Systems in Barrie

Diamond Renewable Energy Wins 2025 Consumer Choice Award for Solar Energy Systems in Barrie

-

5E Advanced Materials Announces Substantial Resource Upgrade; Total Measured and Indicated Borate Resources Increase 61% and Lithium Resources Increase 54%

-

Southland Registrations Ltd. Recognized With 2025 Consumer Choice Award for Licence and Registry Services in Southern Alberta

Southland Registrations Ltd. Recognized With 2025 Consumer Choice Award for Licence and Registry Services in Southern Alberta

-

Sama Eliminates Repetitive Work in AI Data Labeling with Launch of Bulk Annotation

-

LDR Capital Management Announces Merger of the Altegris/AACA Opportunistic Real Estate Fund into the LDR Real Estate Value Opportunity Fund

LDR Capital Management Announces Merger of the Altegris/AACA Opportunistic Real Estate Fund into the LDR Real Estate Value Opportunity Fund

-

GT Biopharma, Inc. (NASDAQ:GTBP) Offers Near-Term Catalyst Opportunity with Advancing Phase 1 Trials

| RBGPF | -0.17% | 77.09 | $ | |

| CMSC | -0.21% | 23.59 | $ | |

| GSK | -0.34% | 47.37 | $ | |

| RYCEF | -1% | 13.96 | $ | |

| BCC | -0.88% | 66.07 | $ | |

| RELX | -0.27% | 40.27 | $ | |

| BCE | -0.09% | 23.02 | $ | |

| NGG | -0.53% | 77.53 | $ | |

| RIO | -1.08% | 69.74 | $ | |

| SCS | 0.96% | 15.66 | $ | |

| JRI | -1.28% | 13.27 | $ | |

| CMSD | 0.04% | 23.87 | $ | |

| AZN | 0.17% | 89.55 | $ | |

| VOD | 0.33% | 12.25 | $ | |

| BTI | 0.27% | 54.86 | $ | |

| BP | 0.52% | 36.69 | $ |

Stocks steadier before key Nvidia results

Stocks struggled to kickstart a recovery Wednesday following heavy losses triggered by worries over an AI-fuelled bubble.

Bitcoin held above $90,000, the dollar strengthened and oil prices dropped.

"Investors will breathe a sigh of relief that the market sell-off has lost momentum," noted Russ Mould, investment director at AJ Bell.

"Pockets of Europe and Asia were up... and futures prices imply a similar trend when Wall Street opens later today."

Mould said "the key question is whether this is simply the calm before the storm.

"Nvidia reports tonight and the slightest bit of news to disappoint investors has the potential to whip up a tornado across global markets."

Investors have endured a tough November as speculation has grown that the tech-led rally this year may have gone too far, and valuations have become frothy enough to warrant a stiff correction.

With the Magnificent Seven -- including Amazon, Meta, Alphabet and Apple -- powering recent record highs on Wall Street, there are worries that a change in sentiment could have huge ripple effects on markets.

The spotlight Wednesday turns on the earnings report from the biggest of the bunch: chip giant Nvidia, which last month became the first $5-trillion company.

Investors are nervous that any sign of weakness could be the pin that pops the artificial intelligence bubble, having spent months fearing that the hundreds of billions invested may have been excessive.

"The AI complex, once the undisputed locomotive of 2025's rally, now sounds like an engine with sand in the gears," said Stephen Innes at SPI Asset Management.

"This isn't a crash, or a panic, or even a proper correction; it's the unmistakable sensation of a market trading at altitude with borrowed oxygen, suddenly aware of how thin the air has become."

He added that four days of losses in Wall Street's S&P 500, the VIX "fear index" hitting 25 -- a level that causes traders concern -- and a tone shift were "all signs that investors are finally blinking at the speed and scale of the AI capex boom".

Meanwhile, a Bank of America survey of fund managers found that more than half thought AI stocks were already in a bubble and 45 percent thought that that was the biggest "tail risk" to markets, more so than inflation.

That came after the BBC released an interview with the head of Google's parent company Alphabet -- Sundar Pichai -- who warned every company would be impacted if the AI bubble were to burst.

- Key figures at around 1115 GMT -

London - FTSE 100: UP 0.1 percent at 9,559.89 points

Paris - CAC 40: DOWN 0.1 percent at 7,957.56

Frankfurt - DAX: UP 0.1 percent at 23,212.35

Tokyo - Nikkei 225: DOWN 0.3 percent at 48,537.70 (close)

Hong Kong - Hang Seng Index: DOWN 0.4 percent at 25,830.65 (close)

Shanghai - Composite: UP 0.2 percent at 3,946.74 (close)

New York - Dow: DOWN 1.1 percent at 46,091.74 (close)

Euro/dollar: DOWN at $1.1570 from $1.1580

Pound/dollar: DOWN at $1.3105 from $1.3146

Dollar/yen: UP at 156.28 yen from 155.53 yen on Tuesday

Euro/pound: UP at 88.27 from 88.09 pence

Brent North Sea Crude: DOWN 0.9 percent at $64.34 per barrel

West Texas Intermediate: DOWN 0.8 percent at $60.24 per barrel

Y.Nakamura--AMWN