-

Struggling McIlroy pulls in crowds as three share Australian Open lead

Struggling McIlroy pulls in crowds as three share Australian Open lead

-

Israel awaits return of last hostage remains from Gaza

-

Slew of top brands suspected in Italy sweatshop probe

Slew of top brands suspected in Italy sweatshop probe

-

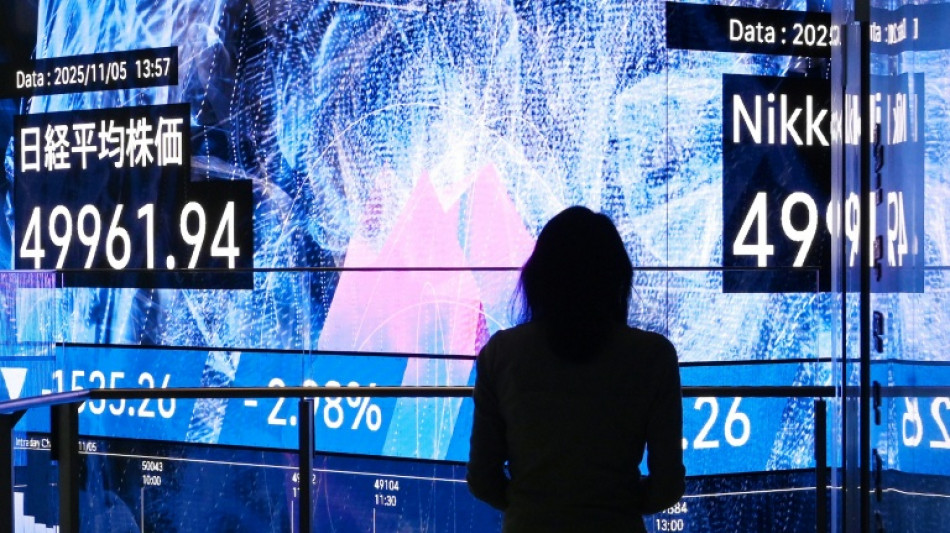

Markets mixed as traders struggle to hold Fed cut rally

-

Starc becomes most prolific left-arm quick in Test history

Starc becomes most prolific left-arm quick in Test history

-

Keep energy infrastructure out of war, Turkey warns Moscow, Kyiv

-

Coin toss curse puts India in a million-to-one heads or tailspin

Coin toss curse puts India in a million-to-one heads or tailspin

-

Asian markets mixed as traders struggle to hold Fed cut rally

-

Crawley, Root guide England recovery after Starc's double strike

Crawley, Root guide England recovery after Starc's double strike

-

In Turkey, ancient carved faces shed new light on Neolithic society

-

Eurovision members debate call to boycott Israel

Eurovision members debate call to boycott Israel

-

Ravindra, Latham tons put New Zealand in command of West Indies Test

-

Seoul says six nationals held in North Korea, vows to help them

Seoul says six nationals held in North Korea, vows to help them

-

Hepatitis B vaccine for newborns faces scrutiny in US

-

Most EU citizens see 'high risk' of war with Russia: poll

Most EU citizens see 'high risk' of war with Russia: poll

-

Ruthless Murray scores 52 to lead Nuggets, Bucks' Antetokounmpo injured

-

Macron tells Xi China, France must overcome 'differences'

Macron tells Xi China, France must overcome 'differences'

-

Abu Dhabi showdown - how the F1 title can be won

-

Daraya reborn: the rebels rebuilding Syria's deserted city

Daraya reborn: the rebels rebuilding Syria's deserted city

-

Rain forecasts raise fears in flood-hit Indonesia, Sri Lanka

-

Tsunoda vows to return to F1 grid after 'tough' Red Bull axing

Tsunoda vows to return to F1 grid after 'tough' Red Bull axing

-

'No food': Indonesians scrounge for supplies after flood disaster

-

Tree branches to fleece jackets: Chemicals plant in Germany bets on biomass

Tree branches to fleece jackets: Chemicals plant in Germany bets on biomass

-

Latham ton puts New Zealand firmly in charge of West Indies Test

-

Asian markets stumble as traders struggle to hold Fed cut rally

Asian markets stumble as traders struggle to hold Fed cut rally

-

'Believe. Belong. Become': Brisbane 2032 Olympics unveils motto

-

Florida's Venezuelans divided on US military buildup

Florida's Venezuelans divided on US military buildup

-

Norris faces nerve-shredding three-way scrap to claim maiden title

-

Five of the best F1 last race title fights

Five of the best F1 last race title fights

-

Visa chaos and host city threats: how Trump disrupted World Cup plans

-

France's Macron meets Xi for Ukraine, trade talks

France's Macron meets Xi for Ukraine, trade talks

-

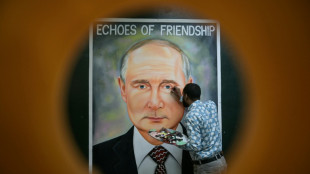

Putin visits India for defence, trade talks

-

Trump to sign Rwanda, DR Congo accord even as violence rages

Trump to sign Rwanda, DR Congo accord even as violence rages

-

Egypt's Sinai mountain megaproject threatens the people of St Catherine

-

Nintendo launches long-awaited 'Metroid Prime 4' sci-fi blaster

Nintendo launches long-awaited 'Metroid Prime 4' sci-fi blaster

-

World Cup draw starts countdown to 2026 finals with Trump presiding

-

All Blacks relishing prospect of South Africa clash at World Cup

All Blacks relishing prospect of South Africa clash at World Cup

-

France's Macron to meet Xi for Ukraine, trade talks

-

Democrats release photos of Epstein's notorious private island

Democrats release photos of Epstein's notorious private island

-

Meta starts removing under-16s from social media in Australia

-

New Zealand build 164-run lead but Windies claim Williamson

New Zealand build 164-run lead but Windies claim Williamson

-

Conor McGregor sexual assault lawsuit dropped

-

Meta says starting to remove under-16s from social media in Australia

Meta says starting to remove under-16s from social media in Australia

-

Evotec-Partner Bayer Starts Phase 2 Study for Treatment of Patients with Alport Syndrome

-

Grande Portage Resources Announces C$5Million Investment by Eric Sprott

Grande Portage Resources Announces C$5Million Investment by Eric Sprott

-

Tocvan Announces Positive Surface Results From North Block And Drill Program Update At Gran Pilar

-

Liverpool fear factor gone, admits Slot

Liverpool fear factor gone, admits Slot

-

Maresca blasts 'very poor' Chelsea after damaging Leeds defeat

-

Arteta fears injury woes will hamper Arsenal title charge

Arteta fears injury woes will hamper Arsenal title charge

-

Trump scraps Biden's fuel-economy standards, sparking climate outcry

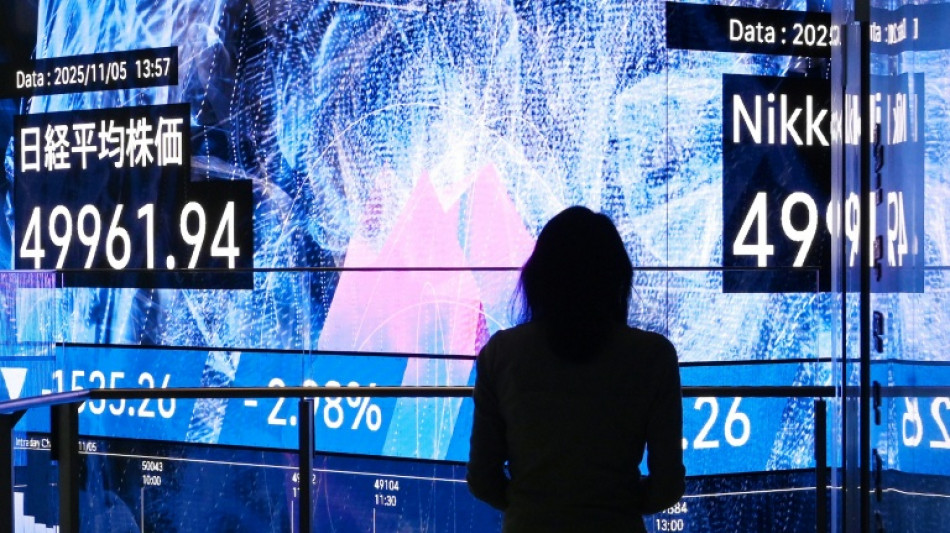

Markets mixed as traders struggle to hold Fed cut rally

Asian and European markets were mixed Thursday after the latest batch of US data reinforced expectations that the Federal Reserve will cut interest rates for a third successive time next week.

Wall Street rose for a second straight day after a minor selloff on Monday, though regional traders moved a little more tentatively as worries over extended valuations in the tech sector continued to linger.

Bets on a US reduction on Wednesday have surged to around 90 percent in the past two weeks, after several Fed officials backed such a move saying supporting jobs was more important than keeping a lid on elevated inflation.

The need for more action was further stoked by data from payrolls firm ADP showing 32,000 posts were lost in November, compared with an expected rise of 10,000, according to Bloomberg.

"Hiring has been choppy of late as employers weather cautious consumers and an uncertain macroeconomic environment," ADP chief economist Nela Richardson said.

The reading was also the most since early 2023 and is the latest example of a stuttering labour market.

"Right now, the data argues for additional Fed funds rate cuts. US labor demand is weak, consumer spending is showing early signs of cracking, and upside risks to inflation are fading," Elias Haddad, of Brown Brothers Harriman & Co, wrote.

After New York's advance, Tokyo rallied more than two percent, with Hong Kong, Sydney, Taipei and Bangkok also up, along with London, Paris and Frankfurt.

Shanghai, Seoul, Singapore, Wellington, Manila, Mumbai and Bangkok slipped.

A healthy 30-year Japanese government bond sale provided some support as it slightly eased tensions about a posible rate hike by the central bank this month. The news compounded a strong response to a 10-year auction earlier in the week that settled some nerves.

On stocks, Pepperstone's Michael Brown said in a note: "Path continues to point to the upside, with the bull case remaining a very solid one indeed, and with participants seeking to ride the coattails of the rally higher, especially amid the increased influence of FOMO/FOMU flows as we move into the end of the year."

However, while market players remain confident that the Fed will continue to cut interest rates into the new year, economists at Bank of America still had a note of caution.

"The most immediate source of volatility remains the US Federal Reserve," they wrote.

"While inflation has moderated and the trajectory of policy easing is intact, uncertainty around timing persists. Any delay in rate cuts could remain a source of volatility."

On currency markets the Indian rupee wallowed at record lows of more than 90 per dollar as investors grow increasingly worried about a lack of progress in trade talks with Washington, as observers say Donald Trump's 50 percent tariffs are taking a toll on the economy.

- Key figures at around 0815 GMT -

Tokyo - Nikkei 225: UP 2.3 percent at 51,028.42 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,935.90 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,875.79 (close)

London - FTSE 100: UP 0.1 percent at 9,701.92

Euro/dollar: DOWN at $1.1663 from $1.1667 on Wednesday

Pound/dollar: DOWN at $1.3337 from $1.3352

Dollar/yen: UP at 155.25 yen from 155.23 yen

Euro/pound: UP at 87.45 pence from 87.39 pence

West Texas Intermediate: UP 0.7 percent at $59.36 per barrel

Brent North Sea Crude: UP 0.6 percent at $63.04 per barrel

New York - Dow: UP 0.9 percent at 47,882.90 (close)

O.Karlsson--AMWN