-

Israel says Hamas 'will be disarmed' after group proposes weapons freeze

Israel says Hamas 'will be disarmed' after group proposes weapons freeze

-

ECB proposes simplifying rules for banks

-

Toll in deadly Indonesia floods near 1,000, frustrations grow

Toll in deadly Indonesia floods near 1,000, frustrations grow

-

Myanmar junta air strike on hospital kills 31, aid workers say

-

General strike hits planes, trains and services in Portugal

General strike hits planes, trains and services in Portugal

-

Vietnam's capital chokes through week of toxic smog

-

Stocks mixed as US rate cut offset by Fed outlook, Oracle earnings

Stocks mixed as US rate cut offset by Fed outlook, Oracle earnings

-

Mexico approves punishing vape sales with jail time

-

Desert dunes beckon for Afghanistan's 4x4 fans

Desert dunes beckon for Afghanistan's 4x4 fans

-

Myanmar junta air strike on hospital kills 31: aid worker

-

British porn star faces Bali deportation after studio raid

British porn star faces Bali deportation after studio raid

-

US, Japan hold joint air exercise after China-Russia patrols

-

Skydiver survives plane-tail dangling incident in Australia

Skydiver survives plane-tail dangling incident in Australia

-

Filipino typhoon survivors sue Shell over climate change

-

Eurogroup elects new head as Russian frozen assets debate rages

Eurogroup elects new head as Russian frozen assets debate rages

-

Thunder demolish Suns, Spurs shock Lakers to reach NBA Cup semis

-

Fighting rages along Cambodia-Thailand border ahead of expected Trump call

Fighting rages along Cambodia-Thailand border ahead of expected Trump call

-

Hay fifty on debut helps put New Zealand on top in West Indies Test

-

Taiwan to keep production of 'most advanced' chips at home: deputy FM

Taiwan to keep production of 'most advanced' chips at home: deputy FM

-

Warmer seas, heavier rains drove Asia floods: scientists

-

Ex-Man Utd star Lingard scores on tearful farewell to South Korea

Ex-Man Utd star Lingard scores on tearful farewell to South Korea

-

Hay fifty on debut helps New Zealand to 73-run lead against West Indies

-

South Korea minister resigns over alleged bribes from church

South Korea minister resigns over alleged bribes from church

-

Yemeni city buckles under surge of migrants seeking safety, work

-

Breakout star: teenage B-girl on mission to show China is cool

Breakout star: teenage B-girl on mission to show China is cool

-

Chocolate prices high before Christmas despite cocoa fall

-

Debut fifty for Hay takes New Zealand to 200-5 in West Indies Test

Debut fifty for Hay takes New Zealand to 200-5 in West Indies Test

-

Sweet 16 as Thunder demolish Suns to reach NBA Cup semis

-

Austria set to vote on headscarf ban in schools

Austria set to vote on headscarf ban in schools

-

Asian traders cheer US rate cut but gains tempered by outlook

-

Racing towards great white sharks in Australia

Racing towards great white sharks in Australia

-

Fighting rages at Cambodia-Thailand border ahead of expected Trump call

-

Venezuelan opposition leader emerges from hiding after winning Nobel

Venezuelan opposition leader emerges from hiding after winning Nobel

-

Eddie Jones given Japan vote of confidence for 2027 World Cup

-

Kennedy's health movement turns on Trump administration over pesticides

Kennedy's health movement turns on Trump administration over pesticides

-

On Venezuela, how far will Trump go?

-

AI's $400 bn problem: Are chips getting old too fast?

AI's $400 bn problem: Are chips getting old too fast?

-

Conway fifty takes New Zealand to 112-2 in West Indies Test

-

Winners Announced at the Energy Storage Awards 2025

Winners Announced at the Energy Storage Awards 2025

-

Formation Metals Further Validates Open Pit Potential at N2 Gold Project: Intersects Over 100 Metres of Near Surface Target Mineralization in Three New Drillholes

-

Genflow to Attend Healthcare Conference

Genflow to Attend Healthcare Conference

-

HyProMag USA Finalizes Long-Term Lease For Dallas-Fort Worth Rare Earth Magnet Recycling and Manufacturing Hub

-

Ur-Energy Announces Pricing of $100 Million Offering of 4.75% Convertible Senior Notes Due 2031

Ur-Energy Announces Pricing of $100 Million Offering of 4.75% Convertible Senior Notes Due 2031

-

US drops bid to preserve FIFA bribery convictions

-

Oracle shares dive as revenue misses forecasts

Oracle shares dive as revenue misses forecasts

-

'Grateful' Alonso feels Real Madrid stars' support amid slump

-

Arsenal crush Club Brugge to keep 100% Champions League record

Arsenal crush Club Brugge to keep 100% Champions League record

-

Venezuelans divided on Machado peace prize, return home

-

Ukraine sends US new plan to end the war as Trump blasts Europe

Ukraine sends US new plan to end the war as Trump blasts Europe

-

Haaland stuns Real as Arsenal remain perfect in Brugge

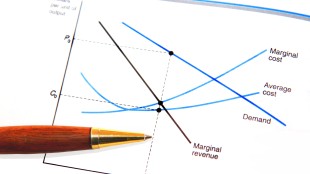

US Fed appears set for third rate cut despite sharp divides

The US Federal Reserve is expected to deliver a further interest rate cut Wednesday despite divisions among its ranks, with chief Jerome Powell's ability to secure support from fellow policymakers put to the test.

Financial markets expect a third straight 25 basis points reduction, bringing levels to a range between 3.50 percent and 3.75 percent. This would be the lowest in around three years.

But divides within the Fed have grown even as policymakers voted to slash rates twice in recent months to boost the weakening employment market.

"We look for at least two dissents in favor of no action and one in favor of a larger cut," said Michael Feroli, chief US economist at JP Morgan.

"There are almost equally compelling reasons to cut and to hold," he added in a recent note.

The Fed's rate-setting committee consists of 12 voting members -- including seven members of the board of governors, the New York Fed president and a rotation of reserve bank presidents -- who take a majority vote in deciding the path of rates.

Powell noted in October that inflation separate from President Donald Trump's tariffs is not too far from officials' two-percent target.

But the costs of goods have risen on the back of Trump's wide-ranging levies this year, and some officials are cautious that higher prices could become persistent.

The Fed pursues maximum employment and stable prices as it decides the path of interest rates, although the goals can sometimes be in conflict. Lower rates typically stimulate the economy while higher levels hold back activity and tamp down inflation.

- 'Risk management' -

Powell will likely be able to "persuade several hesitant policymakers to support a third consecutive 'risk management' rate cut," said EY-Parthenon chief economist Gregory Daco.

This comes as the most recent available figures confirmed a slowdown in the jobs market, while a government shutdown from October to mid-November delayed the publication of more updated federal data.

But Daco also expects Powell to signal "firmly that additional easing is unlikely before next spring," unless there is material weakening in the world's biggest economy.

This is because rates are close to "neutral," a level that neither stimulates nor restricts economic activity, analysts believe.

Feroli of JP Morgan observed that most Fed governors appear to favor lowering rates, while most reserve bank presidents seem inclined to keeping them unchanged.

But New York Fed President John Williams' remarks that there was room for another cut in the near-term tilts the balance.

"We believe he was speaking for the rest of the leadership," Feroli said, referring to Powell and Vice Chair Philip Jefferson. "This should weigh the votes firmly toward a cut."

Meanwhile Fed Governor Stephen Miran, who is on leave from his role heading the White House Council of Economic Advisers, is expected to push for a larger rate cut.

- Litmus test -

This week's gathering is the last before 2026, a year of key changes for the central bank -- including the accession of a new chief and tests of its independence as political pressure mounts.

In an interview with Politico published Tuesday, Trump signaled that he would judge Powell's successor on whether they immediately cut interest rates.

Asked if this was a "litmus test" for his handpicked candidate, Trump responded "yes."

Powell's term as Fed chair ends in May 2026, and Trump has hinted that he wants to nominate his chief economic adviser Kevin Hassett to the top post.

Hassett currently chairs the White House National Economic Council, and appears to be in lockstep with the president on key economic questions facing the Fed.

If appointed, however, Hassett could also face pressure from financial markets to diverge from the White House on interest rates -- particularly if inflation worsens.

Miran's term as governor also ends in January, creating an opening among the Fed's top officials. And Trump has sought to free up another seat in attempting to fire Fed Governor Lisa Cook earlier this year.

Cook challenged her ousting, and the Supreme Court barred the president from immediately removing her while awaiting oral arguments on the case in January.

S.Gregor--AMWN