-

Trump has options on Iran, but first must define goal

Trump has options on Iran, but first must define goal

-

Paris FC's Ikone stuns PSG to knock out former club from French Cup

-

Australia's ambassador to US leaving post, marked by Trump rift

Australia's ambassador to US leaving post, marked by Trump rift

-

Slot angered by 'weird' Szoboszlai error in Liverpool FA Cup win

-

Szoboszlai plays hero and villain in Liverpool's FA Cup win

Szoboszlai plays hero and villain in Liverpool's FA Cup win

-

Hawaii's Kilauea volcano puts on spectacular lava display

-

US stocks at records despite early losses on Fed independence angst

US stocks at records despite early losses on Fed independence angst

-

Koepka rejoins PGA Tour under new rules for LIV players

-

Ex-France, Liverpool defender Sakho announces retirement

Ex-France, Liverpool defender Sakho announces retirement

-

Jerome Powell: The careful Fed chair standing firm against Trump

-

France scrum-half Le Garrec likely to miss start of Six Nations

France scrum-half Le Garrec likely to miss start of Six Nations

-

AI helps fuel new era of medical self-testing

-

Leaders of Japan and South Korea meet as China flexes muscles

Leaders of Japan and South Korea meet as China flexes muscles

-

Trump sets meeting with Venezuelan opposition leader, Caracas under pressure

-

Australia captain Alyssa Healy to retire from cricket

Australia captain Alyssa Healy to retire from cricket

-

US 'screwed' if Supreme Court rules against tariffs: Trump

-

NATO, Greenland vow to boost Arctic security after Trump threats

NATO, Greenland vow to boost Arctic security after Trump threats

-

Israel to take part in first Eurovision semi-final on May 12

-

How Alonso's dream Real Madrid return crumbled so quickly

How Alonso's dream Real Madrid return crumbled so quickly

-

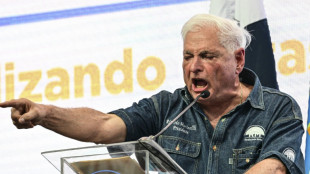

Former Panama leader on trial over mega Latin America corruption scandal

-

Trump keeping Iran air strikes on the table: White House

Trump keeping Iran air strikes on the table: White House

-

Paramount sues in hostile bid to buy Warner Bros Discover

-

Ugandan opposition leader Bobi Wine warns of protests if polls rigged

Ugandan opposition leader Bobi Wine warns of protests if polls rigged

-

Airbus delivers more planes in 2025

-

Alonso leaves Real Madrid, Arbeloa appointed as coach

Alonso leaves Real Madrid, Arbeloa appointed as coach

-

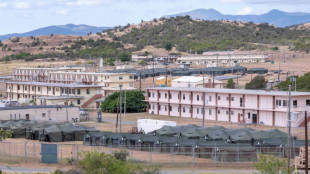

UK pays 'substantial' compensation to Guantanamo inmate: lawyer

-

Iran protest toll mounts as government stages mass rallies

Iran protest toll mounts as government stages mass rallies

-

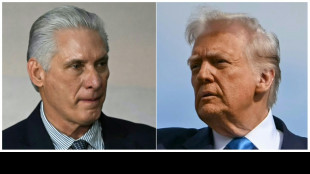

Cuba denies being in talks with Trump on potential deal

-

Scientists reveal what drives homosexual behaviour in primates

Scientists reveal what drives homosexual behaviour in primates

-

Venezuela releases more political prisoners as pressure builds

-

15,000 NY nurses stage largest-ever strike over conditions

15,000 NY nurses stage largest-ever strike over conditions

-

Rosenior plots long Chelsea stay as Arsenal loom

-

Zuckerberg names banker, ex-Trump advisor as Meta president

Zuckerberg names banker, ex-Trump advisor as Meta president

-

Reza Pahlavi: Iran's ex-crown prince dreaming of homecoming

-

Venezuela releases more political prisoners

Venezuela releases more political prisoners

-

Kenya's NY marathon champ Albert Korir gets drug suspension

-

US prosecutors open probe of Fed chief, escalating Trump-Powell clash

US prosecutors open probe of Fed chief, escalating Trump-Powell clash

-

Russian captain in fiery North Sea crash faces UK trial

-

Carrick is frontrunner for interim Man Utd job: reports

Carrick is frontrunner for interim Man Utd job: reports

-

Iran government stages mass rallies as alarm grows over protest toll

-

Variawa leads South African charge over Dakar dunes

Variawa leads South African charge over Dakar dunes

-

Swiss inferno bar owner detained for three months

-

Heathrow airport sees record high annual passenger numbers

Heathrow airport sees record high annual passenger numbers

-

Georgia jails ex-PM for five years amid ruling party oustings

-

Kyiv buries medic killed in Russian drone strike

Kyiv buries medic killed in Russian drone strike

-

Israel revokes French researcher's travel permit

-

India and Germany seek to boost defence industry ties

India and Germany seek to boost defence industry ties

-

French coach and football pundit Rolland Courbis dies at 72

-

UK regulator opens probe into X over sexualised AI imagery

UK regulator opens probe into X over sexualised AI imagery

-

AFCON organisers investigate incidents after Algeria-Nigeria clash

US stocks at records despite early losses on Fed independence angst

Wall Street stocks finished at new records Monday, shrugging off worries about a US criminal probe of the Federal Reserve that initially weighed on equities.

Both the Dow and S&P 500 ended the day with modest gains of 0.2 percent, which was good enough to lift both indices to records for a second straight day.

The Nasdaq also bounced back from early losses after Sunday night's disclosure of the US Department of Justice probe into the Federal Reserve dented stocks in the early going, while lifting gold and silver prices to new all-time highs.

Fed Chair Jerome Powell confirmed the "unprecedented" subpoenas against the bank in a rare video address, which he blasted as part of US President Donald Trump's pressure campaign for aggressive interest rate cuts.

Powell said in his statement that "the threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the president."

But there was extensive pushback against Trump, not only in a forceful statement jointly signed by three former Fed chiefs, but on Capitol Hill, where at least two Republican senators balked at moves to undermine central bank independence.

"The market doesn't really believe it's going to come to a prosecution," said Briefing.com analyst Patrick O'Hre. "It's a lot of bluster."

O'Hare said Monday's gains reflect investors' inclination to "keep calm and buy the trend," which has been pointing higher.

European stocks finished mostly higher after a strong showing in Asia.

The dollar fell against the euro and the pound, as did the price of the benchmark 10-year US Treasury bond, sending its yield slightly higher.

Gold climbed above $4,600 an ounce while silver approached $86 an ounce as investors sought traditional safe havens.

"Beyond monetary and political concerns, gold remains well supported by ongoing geopolitical risks," said Forex.com analyst Fawad Razaqzada.

Trump said Sunday that he was considering military action against Iran following reports of hundreds of deaths during a violent crackdown on the protesters.

"We're looking at it very seriously," Trump told reporters on Air Force One. "The military is looking at it, and we're looking at some very strong options."

Oil prices edged higher in volatile trading Monday as protests in Iran and the US seizure of Venezuela's crude supplies stoking geopolitical risks.

Banking stocks meanwhile took a hit from Trump's call to cap credit card costs at 10 percent, a change that would make credit less available and hurt consumers and businesses.

American Express, JPMorgan Chase and Visa were among the biggest losers on Wall Street's blue-chip Dow index.

Asian markets advanced Monday, led by gains in Hong Kong and Shanghai and tracking Wall Street's record close at the end of last week.

Tokyo was closed for a holiday.

- Key figures at around 2130 GMT -

New York - Dow: UP 0.2 percent at 49,590.20 (close)

New York - S&P 500: UP 0.2 percent at 6,977.27 (close)

New York - Nasdaq Composite: UP 0.3 percent at 23,733.90 (close)

London - FTSE 100: UP 0.2 percent at 10,140.70 (close)

Paris - CAC 40: FLAT at 8,358.76 (close)

Frankfurt - DAX: UP 0.6 percent at 25,405.34 (close)

Hong Kong - Hang Seng Index: UP 1.4 percent at 26,608.48 (close)

Shanghai - Composite: UP 1.1 percent at 4,165.29 (close)

Tokyo - Nikkei 225: (closed for holiday)

Euro/dollar: UP at $1.1666 from $1.1637 on Friday

Pound/dollar: UP at $1.3466 from $1.3404

Dollar/yen: UP at 158.17 yen from 157.89 yen

Euro/pound: DOWN at 86.63 pence from 86.81 pence

Brent North Sea Crude: UP 0.8 percent at $63.87 per barrel

West Texas Intermediate: UP 0.6 percent at $59.50 per barrel

burs-jmb/dw

Y.Kobayashi--AMWN