-

Morocco part company with coach Regragui as World Cup looms

Morocco part company with coach Regragui as World Cup looms

-

Lens beat Lyon on penalties to reach French Cup semis

-

El Salvador's Bukele holding dozens of political prisoners: rights group

El Salvador's Bukele holding dozens of political prisoners: rights group

-

With Iran war, US goes it alone like never before

-

Spurs slip deeper into relegation trouble after loss to Palace

Spurs slip deeper into relegation trouble after loss to Palace

-

Pete Hegseth: Trump's Iran war attack dog

-

Celtics' Tatum could make injury return on Friday

Celtics' Tatum could make injury return on Friday

-

'Enemy at home': Iranian authorities tighten grip as war rages

-

Bethell set for 'hell of a career', says England captain Brook

Bethell set for 'hell of a career', says England captain Brook

-

France coach Galthie slams Scotland for 'smallest changing room in the world'

-

Medvedev arrives in Indian Wells after being stranded in Dubai

Medvedev arrives in Indian Wells after being stranded in Dubai

-

Trump fires homeland security chief Kristi Noem

-

Mideast war risks pulling more in as conflict boils over

Mideast war risks pulling more in as conflict boils over

-

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

-

India hero Samson eyes 'one more' big knock in T20 World Cup final

India hero Samson eyes 'one more' big knock in T20 World Cup final

-

Britney Spears detained on suspicion of driving while intoxicated

-

Grooming makes Crufts debut as UK dog show widens offer

Grooming makes Crufts debut as UK dog show widens offer

-

Townsend insists Scots' focus solely on France not Six Nations title race

-

UK sends more fighter jets to Gulf: PM

UK sends more fighter jets to Gulf: PM

-

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

-

Leagues Cup to hold matches in Mexico for first time

Leagues Cup to hold matches in Mexico for first time

-

India reach T20 World Cup final after England fail in epic chase

-

Conservative Anglicans press opposition to Church's first woman leader

Conservative Anglicans press opposition to Church's first woman leader

-

Sri Lanka takes control of Iranian ship fearing new US sub attack

-

Iran players sing anthem and salute at Women's Asian Cup

Iran players sing anthem and salute at Women's Asian Cup

-

India beat England in high-scoring T20 World Cup semi-final

-

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

-

Italy bring back Brex to face England

-

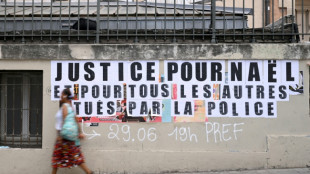

French policeman to be tried over 2023 killing of teen

French policeman to be tried over 2023 killing of teen

-

More flights take off despite continued fighting in Middle East

-

Ukraine, Russia free 200 POWs each

Ukraine, Russia free 200 POWs each

-

Middle East war halts work at WHO's Dubai emergency hub

-

Paramount's Ellison vows CNN editorial independence

Paramount's Ellison vows CNN editorial independence

-

US says attacks on alleged drug boats have spooked traffickers

-

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

-

India pile up 253-7 against England in T20 World Cup semi-final

-

Wary Europeans pledge 'defensive' military aid in Mideast war

Wary Europeans pledge 'defensive' military aid in Mideast war

-

Oil prices rise, stocks drop as Middle East war stirs supply concerns

-

Seven countries to boycott Paralympics ceremony over Russia: organisers

Seven countries to boycott Paralympics ceremony over Russia: organisers

-

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

Second Iranian ship nears Sri Lanka after submarine attack

-

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

Union loses fight against Tesla at German factory

-

Wales revel in being the underdogs, says skipper Lake

-

German school students rally against army recruitment drive

German school students rally against army recruitment drive

-

Wary European states pledge military aid for Cyprus, Gulf

-

Liverpool injuries frustrating Slot in tough season

Liverpool injuries frustrating Slot in tough season

-

Real Madrid will 'keep fighting' in title race, vows Arbeloa

TaxBandits PRO Features Empower Tax Professionals To Streamline 1099, W-2, 94x, and ACA Filings for the 2024 Tax Year

ROCK HILL, SC / ACCESS Newswire / January 20, 2025 / The year-end tax season is here! With January 31, 2025, rapidly approaching, tax professionals face the challenge of completing filings accurately and on time. TaxBandits, a trusted IRS-authorized e-file provider with over a decade of experience, offers a comprehensive solution designed to streamline the process for tax professionals.

With advanced features and reliable compliance tools, TaxBandits simplifies filings for 1099, W-2, 940, 941, and ACA forms, empowering tax professionals to navigate the year-end tax season with confidence and efficiency.

The Easiest Way to Handle Year-End Filings

TaxBandits simplifies the e-filing of over 100+ tax forms with federal and state agencies while making the distribution of recipient copies easier than ever. Tax professionals can choose flexible options, including secure online access, which provides recipients lifetime availability to view and download their forms anytime, from anywhere, or traditional postal mailing for physical copies.

With its bulk filing option, TaxBandits empowers tax professionals to e-file large volumes of tax forms efficiently. Whether it's 1099s, W-2s, or ACA filings, tax pros can process thousands of forms seamlessly through a streamlined workflow.

Built-in validations like TIN Matching, USPS Validation, and Form Validation based on IRS Business Rules help minimize errors upfront. Even in case of rejections, TaxBandits allows forms to be corrected and retransmitted at no additional cost, ensuring compliance without added complications.

What Sets TaxBandits Apart?

User-Friendly Interface with AI-Powered Assistance: TaxBandits offers a user-friendly, intuitive interface that simplifies every aspect of the tax filing process. From seamless integrations with accounting platforms like QuickBooks, Xero, ZohoBooks, FreshBooks, and Sage Intacct to intuitive features like bulk data uploads and real-time validations, the platform is designed to save time and reduce complexity for tax professionals.

Additionally, TaxBandits includes a Schedule Filing option, enabling tax professionals to prepare tax forms in advance and schedule them for later transmission. This feature allows for necessary edits and reviews before submission, ensuring accuracy and flexibility.

To further enhance the user experience, TaxBandits offers BanditAI, an AI-powered chatbot that provides real-time guidance and support. BanditAI helps address queries, resolve issues, and streamline the filing process, making it more efficient and stress-free for tax professionals. See BanditAI in action:

Trusted Compliance Partner

As one of the first providers to obtain the IRS IRIS A2A Transmitter Control Code (TCC), TaxBandits ensures accurate filings that align with IRS, SSA, and state regulations. This commitment to compliance makes TaxBandits a reliable partner for year-end tax filings.

Advanced Security

TaxBandits is a SOC-2-certified e-filing service provider that adheres to standard security protocols to protect sensitive personal information (PII). Tax pros can rely on the highest standards of data protection, including two-factor authentication (2FA) to prevent unauthorized access to accounts.

Fraud Prevention

TaxBandits prioritizes preventing identity thefts and tax frauds. Adhering to IRS, SSA, and state agency guidelines, the platform employs robust fraud prevention measures to reduce fraudulent filings.

World-Class Customer Support - 24/7

TaxBandits provides expert assistance through email, phone, and live chat. The dedicated support team is always available to guide tax pros and ensure a smooth filing experience from start to finish.

PRO Features Built to Support Tax Professionals

TaxBandits offers advanced features specifically designed to help tax professionals manage their operations with precision and efficiency:

Client Portal

Tax professionals can provide their clients with a secure, customizable portal tailored to reflect their own brand. Through this portal, tax professionals can:

Share forms for client review before filing.

Send messages and communicate securely with clients.

Share or receive important files effortlessly.

In addition, tax pros can customize email communications sent to clients to maintain a professional and branded experience. This streamlined approach enhances client collaboration while maintaining security and professionalism.

Team Management

Tax pros can invite unlimited team members to collaborate on filings, assign specific roles, such as preparer, approver, or transmitter, based on their responsibilities, and delegate filings efficiently, ensuring clear accountability and streamlined workflows. With centralized tracking, it's easy to monitor progress and ensure all filings are completed on time.

Reports

TaxBandits enables tax professionals to gain actionable insights with detailed reports on filing activity, client data, and team performance. These reports help tax professionals monitor compliance, analyze trends, and make informed decisions to optimize their filing processes.

Tax professionals can e-file 1099-NEC,1099-MISC, other 1099s, and W-2 year-end tax filings at TaxBandits.com by signing up for a free account today.

About TaxBandits

TaxBandits is an IRS-authorized e-file provider specializing in various tax forms, such as Form 941, Form 940, Form 1099, Form W-2, Form 1095-C, Form 1095-B, and Form W-9. Serving businesses, service providers, and tax professionals of every shape and size, TaxBandits offers a complete solution that fulfills all filing needs.

TaxBandits provides another advantage for high-volume filers and software providers. TaxBandits API enables seamless preparation and e-filing of 1099, W-2, 941, 940, and ACA 1095 forms and BOI reporting. Use the developer filing 1099 API to request W-9 and automate the filing efficiently.

About SPAN Enterprises

SPAN Enterprises, headquartered in Rock Hill, South Carolina, has created cutting-edge software solutions for e-filing and business management for over ten years. The company's suite of products includes TaxBandits, Tax990, TaxExemptBonds, ACAwise, ExpressExtension, 123PayStubs, and TruckLogics.

Please direct all media inquiries to Carol D'Agostino, Legal & Government Liaison, at [email protected].

###

SOURCE: TaxBandits

View the original press release on ACCESS Newswire

O.Norris--AMWN