-

Rahm accuses DP World Tour of 'extorting players' with LIV deal

Rahm accuses DP World Tour of 'extorting players' with LIV deal

-

Thousands of Afghans displaced by Pakistan conflict

-

China, North Korea make winning starts at Women's Asian Cup

China, North Korea make winning starts at Women's Asian Cup

-

EU asylum applications down but Iran concerns mount

-

Rahm accuses DP World Tour of 'exorting players' with LIV deal

Rahm accuses DP World Tour of 'exorting players' with LIV deal

-

Drones hit US embassy as vengeful Iran targets Mideast cities

-

Mideast war exposes fragile oil, gas dependency

Mideast war exposes fragile oil, gas dependency

-

How the T20 World Cup semi-finalists shape up

-

Oil extends gains and stocks dive as Middle East war spreads

Oil extends gains and stocks dive as Middle East war spreads

-

Warming El Nino may return later this year: UN

-

Trump says US-UK relationship 'not like it used to be'

Trump says US-UK relationship 'not like it used to be'

-

Eight years on, trial begins in Argentina submarine implosion

-

Beijing votes out three generals from political advisory body

Beijing votes out three generals from political advisory body

-

The French village where Ayatollah Khomeini fomented Iran's revolution

-

South Africa, India eye T20 World Cup rematch as semi-finals begin

South Africa, India eye T20 World Cup rematch as semi-finals begin

-

Trump hosts Germany's Merz for talks eclipsed by Mideast war

-

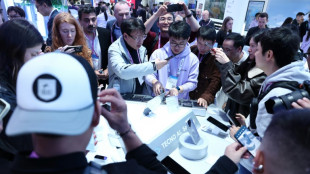

Second-hand phones surf rising green consumer wave

Second-hand phones surf rising green consumer wave

-

Pakistanis at remote border describe scramble to leave Iran

-

China votes to oust three generals from political advisory body

China votes to oust three generals from political advisory body

-

Murray scores 45 as Nuggets hold off Jazz

-

Five things about the 2026 F1 season

Five things about the 2026 F1 season

-

Scrum-half Gibson-Park: Ireland's 'petit general'

-

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

-

Myong hat-trick as North Korea cruise at Women's Asian Cup

-

AI disinformation turns Nepal polls into 'digital battleground'

AI disinformation turns Nepal polls into 'digital battleground'

-

New Israel, Iran attacks across region: Latest developments in Middle East war

-

China's overstretched healthcare looks to AI boom

China's overstretched healthcare looks to AI boom

-

Oil extends gains and stocks drop as Iran conflict spreads

-

Rituals of resilience: how Afghan women stay sane in their 'cage'

Rituals of resilience: how Afghan women stay sane in their 'cage'

-

Strait of Hormuz impasse squeezes world shipping

-

Oscar-nominated Iranian doc offers different vision of leadership

Oscar-nominated Iranian doc offers different vision of leadership

-

Oscar-nominated docs take on hot-button US social issues

-

'I couldn't breathe': The dark side of Bolivia's silver boom

'I couldn't breathe': The dark side of Bolivia's silver boom

-

Underground party scene: Israelis celebrate Purim in air raid shelters

-

Flowers, music, and soldiers at funeral of drug lord

Flowers, music, and soldiers at funeral of drug lord

-

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

-

Trump to attend White House Correspondents' dinner

Trump to attend White House Correspondents' dinner

-

Will Iran's missiles drain US interceptor stocks?

-

A New Chapter Begins: WeTrade Continues Partnership with Phantom Global Racing

A New Chapter Begins: WeTrade Continues Partnership with Phantom Global Racing

-

The Agentic Era Redefines Customer Intimacy as AI is Set to Become the Primary Brand Interface

-

MindMaze Therapeutics Provides Corporate Update and Publishes March 2026 Investor Presentation

MindMaze Therapeutics Provides Corporate Update and Publishes March 2026 Investor Presentation

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - March 03

-

New eBook Challenges the Popular Narrative That Manifestation Is Always Positive

New eBook Challenges the Popular Narrative That Manifestation Is Always Positive

-

Trump warns of longer Iran war as violence spreads

-

Energy infrastructure emerges as war target, lifting prices

Energy infrastructure emerges as war target, lifting prices

-

Trump warns of longer Iran war, Rubio points at Israel

-

US urges to 'depart now' from Middle East: Latest developments in Iran war

US urges to 'depart now' from Middle East: Latest developments in Iran war

-

Ecuador launches joint anti-drug operations with US

-

Getafe deal flat Real Madrid La Liga title race blow

Getafe deal flat Real Madrid La Liga title race blow

-

Rubio, Hezbollah and Qatar: Latest developments in Iran war

CSPi Reports Continued Business Momentum and Profitability During Fiscal 2025 First Quarter; Services Revenue Grow 17% and Gross Margin Expands

Board Declares $0.03 per Share Quarterly Dividend

LOWELL, MA / ACCESS Newswire / February 10, 2025 / CSP Inc. (NASDAQ:CSPI), an award-winning provider of security and packet capture products, managed IT and professional services and technology solutions, today announced results for the fiscal 2025 first quarter ended December 31, 2024. The Company also announced that the Board of Directors declared a quarterly dividend of $0.03 per share payable March 10, 2025, to shareholders of record at the close of business on February 24, 2025.

Recent Achievements and Operating Highlights

Led by growth in cloud-base and recurring revenue sources, services revenue increased 17%.

Signed several new ARIA Zero Trust Protect (AZT PROTECT™) customers as the Company continues to make initial entry into high growth industries, including utility and wastewater treatment.

Maintained a robust balance sheet with approximately $30.7 million in cash and cash equivalents for the Company to implement near and long-term business initiatives to generate sustained growth and profitability.

"The team did an excellent job of continuing our fourth quarter marketplace momentum, which resulted in a solid start to our fiscal 2025," commented Victor Dellovo, Chief Executive Officer. "We reported increases in total and services revenue, expanded our gross margin and generated a quarterly net income of $0.05 per common share - diluted. The Technology Solutions (TS) business performed well throughout the quarter and generated operating income as the cloud-based business remained strong and the sales to cruise lines increased. Additionally, we signed several new customers for the AZT PROTECT™ offering and increased both the referenceable industries and customers as we continue to build our presence in the operational technology (OT) market and drive the High Performance Products (HPP) business. Our goal for the remainder of the year is to leverage the momentum, increase the recurring revenue base and scale up the AZT PROTECT™ business through our partnership with Rockwell Automation and other distributors."

Fiscal 2025 First Quarter Results

Revenue for the fiscal 2025 first quarter ended December 31, 2024, increased 2% to $15.7 million compared to revenue of $15.4 million for the fiscal 2024 first quarter ended December 31, 2023. Services revenue represented $4.7 million of overall sales, rising 17% compared to the year-ago services revenue of $4.0 million. Gross profit for the three months ended December 31, 2024, increased 11% to $4.6 million compared to $4.1 million. Gross margin for the fiscal first quarter ended December 31, 2024, increased over 200 basis points to 29.1% of sales compared to 26.6% of sales for the year ago fiscal 2024 first quarter. This demonstrates the continued execution of the Company's strategy to focus on higher margin offerings. Driven by the improved gross margin, interest income, and foreign exchange gain, the Company reported net income of $0.5 million, or $0.05 per diluted common share for the fiscal 2025 first quarter, compared to a net loss of $(73,000), or $(0.01) per diluted common share for the prior year fiscal first quarter.

The Company continued to maintain a robust balance sheet and as of December 31, 2024, had cash and cash equivalents of $30.7 million. The financial resources enhances the Company's ability to pay a quarterly cash dividend while executing growth strategies, which include the continued rollout and market awareness activities of the AZT PROTECT™ product offering.

Conference Call Details

CSPi Chief Executive Officer Victor Dellovo and Chief Financial Officer Gary W. Levine will host a conference call at 10:00 a.m. (ET) today to review CSPi's financial results and provide a business update. To listen to a live webcast of the call, the event link is https://www.webcaster4.com/Webcast/Page/2912/52010. Individuals also may listen to the call via telephone, by dialing 973-528-0011 or 888-506-0062 and use the Participant Access Code: 321679 when greeted by the live operator. A replay of the webcast will be available for approximately one year on the CSPi website.

About CSPi

CSPi (NASDAQ:CSPI) operates two divisions, each with unique expertise in designing and implementing technology solutions to help customers use technology to success. The High Performance Product division, including ARIA Cybersecurity Solutions, recognizes that better, stronger, more effective cybersecurity starts with a smarter approach. ARIA's solutions provide new ways for organizations to protect their most critical assets-they can shield their critical applications from cyberattack with the AZT solution, while monitoring internal traffic, device-level logs, and alert output with our ARIA ADR solution to substantially improve threat detection and surgically disrupt cyberattacks and data exfiltration. Rounding out the portfolio, Aria's AZT Gateway Software allows us to interrogate network packets at 100mbps line-rate to enforce forwarding and capture policies on the fly. Customers in a range of industries rely on our solutions to accelerate incident response, automate breach detection, and protect their most critical assets and applications-no matter where they are stored, used, or accessed.

CSPi's Technology Solutions division helps clients achieve their business goals and accelerate time to market through innovative IT solutions and professional services by partnering with best-in-class technology providers. For organizations that want the benefits of an IT department without the cost, we offer a robust catalog of Managed IT Services providing 24×365 proactive support. Our team of engineers have expertise across major industries supporting five key technology areas: Advanced Security; Communication and Collaboration; Data Center; Networking; and Wireless & Mobility.

Safe Harbor

The Company wishes to take advantage of the "Safe Harbor" provisions of the Private Securities Litigation Reform Act of 1995 with respect to statements that may be deemed to be forward-looking under the Act. Such forward-looking statements may include but are not limited to, projections or guidance concerning business performance, revenue, earnings, cash flow, the current economic environment, liquidity, strategic decisions and actions, and other financial and operational measures. Statements include our goal for the remainder of the year is to leverage the momentum, increase the recurring revenue base and scale up the AZT PROTECT™ business through our partnership with Rockwell Automation and other distributors and from our robust balance sheet generate sustained growth and profitability.

The Company cautions that numerous factors could cause actual results to differ materially from forward-looking statements made by the Company. Such risks include general economic conditions, market factors, competitive factors and pricing pressures, and others described in the Company's filings with the Securities and Exchange Commission ("SEC"). Please refer to the section on forward-looking statements included in the Company's filings with the SEC.

CONTACT:

CSP Inc.

Gary Levine, 978-954-5040

Chief Financial Officer

CSP INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

December 31, 2024 | September 30, 2024 | |||

(unaudited) | ||||

Assets | ||||

Current assets: | ||||

Cash and cash equivalents | $ | 30,654 | $ | 30,585 |

Accounts receivable, net | 14,888 | 14,494 | ||

Financing receivables, net | 2,478 | 4,384 | ||

Inventories | 1,955 | 2,293 | ||

Other current assets | 2,215 | 3,093 | ||

Total current assets | 52,190 | 54,849 | ||

Financing receivables due after one year, net | 2,641 | 2,922 | ||

Cash surrender value of life insurance | 5,623 | 5,589 | ||

Other assets | 7,069 | 6,076 | ||

Total assets | $ | 67,523 | $ | 69,436 |

Liabilities and Shareholders' Equity | ||||

Current liabilities | $ | 16,558 | $ | 18,682 |

Pension and retirement plans | 1,290 | 1,306 | ||

Other non-current liabilities | 2,219 | 2,178 | ||

Shareholders' equity | 47,456 | 47,270 | ||

Total liabilities and shareholders' equity | $ | 67,523 | $ | 69,436 |

CSP INC. AND SUBSIDIARIES

CONDENSED UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except per share data)

Three months ended | ||||||

December 31, | December 31, | |||||

2024 | 2023 | |||||

Sales: | ||||||

Product | $ | 11,015 | $ | 11,407 | ||

Services | 4,655 | 3,968 | ||||

Total sales | 15,670 | 15,375 | ||||

Cost of sales: | ||||||

Product | 9,119 | 9,228 | ||||

Services | 1,987 | 2,052 | ||||

Total cost of sales | 11,106 | 11,280 | ||||

Gross profit | 4,564 | 4,095 | ||||

Operating expenses: | ||||||

Engineering and development | 786 | 700 | ||||

Selling, general and administrative | 4,132 | 3,738 | ||||

Total operating expenses | 4,918 | 4,438 | ||||

Operating loss | (354 | ) | (343 | ) | ||

Other income, net | 711 | 283 | ||||

Income (loss) before income taxes | 357 | (60 | ) | |||

Income tax (benefit) expense | (115 | ) | 13 | |||

Net income (loss) | $ | 472 | $ | (73 | ) | |

Net income (loss) attributable to common shareholders | $ | 438 | $ | (73 | ) | |

Net income (loss) per common share - basic | $ | 0.05 | $ | (0.01 | ) | |

Weighted average shares outstanding - basic | 9,124 | 8,864 | ||||

Net income (loss) per common share - diluted | $ | 0.05 | $ | (0.01 | ) | |

Weighted average shares outstanding net income - diluted | 9,619 | 8,864 | ||||

SOURCE: CSP Inc.

View the original press release on ACCESS Newswire

X.Karnes--AMWN