-

Beijing votes out three generals from political advisory body

Beijing votes out three generals from political advisory body

-

The French village where Ayatollah Khomeini fomented Iran's revolution

-

South Africa, India eye T20 World Cup rematch as semi-finals begin

South Africa, India eye T20 World Cup rematch as semi-finals begin

-

Trump hosts Germany's Merz for talks eclipsed by Mideast war

-

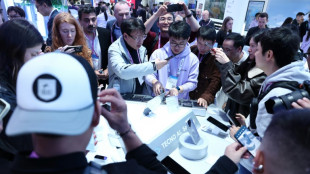

Second-hand phones surf rising green consumer wave

Second-hand phones surf rising green consumer wave

-

Pakistanis at remote border describe scramble to leave Iran

-

China votes to oust three generals from political advisory body

China votes to oust three generals from political advisory body

-

Murray scores 45 as Nuggets hold off Jazz

-

Five things about the 2026 F1 season

Five things about the 2026 F1 season

-

Scrum-half Gibson-Park: Ireland's 'petit general'

-

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

-

Myong hat-trick as North Korea cruise at Women's Asian Cup

-

AI disinformation turns Nepal polls into 'digital battleground'

AI disinformation turns Nepal polls into 'digital battleground'

-

New Israel, Iran attacks across region: Latest developments in Middle East war

-

China's overstretched healthcare looks to AI boom

China's overstretched healthcare looks to AI boom

-

Oil extends gains and stocks drop as Iran conflict spreads

-

Rituals of resilience: how Afghan women stay sane in their 'cage'

Rituals of resilience: how Afghan women stay sane in their 'cage'

-

Strait of Hormuz impasse squeezes world shipping

-

Oscar-nominated Iranian doc offers different vision of leadership

Oscar-nominated Iranian doc offers different vision of leadership

-

Oscar-nominated docs take on hot-button US social issues

-

'I couldn't breathe': The dark side of Bolivia's silver boom

'I couldn't breathe': The dark side of Bolivia's silver boom

-

Underground party scene: Israelis celebrate Purim in air raid shelters

-

Flowers, music, and soldiers at funeral of drug lord

Flowers, music, and soldiers at funeral of drug lord

-

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

-

Trump to attend White House Correspondents' dinner

Trump to attend White House Correspondents' dinner

-

Will Iran's missiles drain US interceptor stocks?

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - March 03

InterContinental Hotels Group PLC Announces Transaction in Own Shares - March 03

-

New eBook Challenges the Popular Narrative That Manifestation Is Always Positive

-

Trump warns of longer Iran war as violence spreads

Trump warns of longer Iran war as violence spreads

-

Energy infrastructure emerges as war target, lifting prices

-

Trump warns of longer Iran war, Rubio points at Israel

Trump warns of longer Iran war, Rubio points at Israel

-

US urges to 'depart now' from Middle East: Latest developments in Iran war

-

Ecuador launches joint anti-drug operations with US

Ecuador launches joint anti-drug operations with US

-

Getafe deal flat Real Madrid La Liga title race blow

-

Rubio, Hezbollah and Qatar: Latest developments in Iran war

Rubio, Hezbollah and Qatar: Latest developments in Iran war

-

Rubio says Israel's strike plan triggered US attack on Iran

-

'Thank you, madam president': Melania Trump leads UN Security Council as Iran war rages

'Thank you, madam president': Melania Trump leads UN Security Council as Iran war rages

-

Bombing Iran, Trump has 'epic fury' but endgame undefined

-

US slaps sanctions on Rwanda military over DR Congo 'violation'

US slaps sanctions on Rwanda military over DR Congo 'violation'

-

US Congress to debate Trump's war powers

-

US appeals court denies Trump bid to delay tariff refund lawsuits

US appeals court denies Trump bid to delay tariff refund lawsuits

-

Trump warns of longer Iran war

-

Fire-damaged Six nations trophy to be replaced

Fire-damaged Six nations trophy to be replaced

-

Trump mulls ground troops: latest developments in US-Iran war

-

Middle East war puts shipping firms in tight insurance spot

Middle East war puts shipping firms in tight insurance spot

-

Qatar downs Iran jets as Tehran targets oil and gas in spiralling Gulf crisis

-

UK PM says US will not use British bases in Cyprus

UK PM says US will not use British bases in Cyprus

-

Can Anthropic survive taking on Trump's Pentagon?

-

Real Madrid superstar Mbappe in Paris for treatment on knee injury

Real Madrid superstar Mbappe in Paris for treatment on knee injury

-

Mideast war risks sending global economy into stagflation

Paragon Technologies Nominating and Corporate Governance Committee Responds to Open Letter by Sham Gad

EASTON, PA / ACCESS Newswire / February 18, 2025 / The Nominating and Corporate Governance Committee of Paragon Technologies (OTC PINK:PGNT), consisting of three recently appointed independent directors, is responding to the open letter by Sham Gad, director and former CEO of Paragon, released on February 11, 2025.

In his open letter, Mr. Gad alleges that there has been "inaccurate and misleading information" coming from the Company and then proceeds to tell shareholders inaccurate and misleading information by cherry picking starting and ending dates in order to make his performance as CEO and Chairman appear better than it was. Mr. Gad conveniently selects only financial information for calendar year 2017 to the end of 2023, and stock price information only from the end of 2016 though the end of 2023. Yet Mr. Gad became Chairman on March 16, 2012, and CEO on May 20, 2014, and was not terminated as CEO until August 9, 2024. Why did Mr. Gad use different, or inaccurate, starting and ending dates? We can only assume it was done to mislead shareholders.

Below is what Mr. Gad claims (shown in red italics) in his open letter, versus the truth.

Mr. Gad said Paragon has "Earned in aggregate over $17 million in net profits for stockholders from 2017 to 2023." What he doesn't tell you is the time period he chose only includes part of his tenure, and excludes the $2 million of losses from 2013 to 2016, nor does it note that of the $17 million in net profits, over $4.2 million was from purchase gain accounting, which is non-economic.

Mr. Gad said Paragon has "Grown shareholders' equity from $2.8 million to over $22 million, or a compound annual rate of approximately 20.4% from the end of 2016 through the end of 2023. " What he doesn't mention is the period from March 2012 through 2016, where equity declined from $4.9 million to $2.8 million, nor that he is including the non-controlling interest, which is not attributable to shareholders, or that he includes the acquisition purchase gain. Mr. Gad apparently struggles with math, since his cherry picked time period CAGR would actually be 34.7%, but that is irrelevant because it is based on pure fantasy. As we said, it cherry picks starting and end points, includes the benefit of purchase gain, and includes NCI (non-controlling interest) which is not attributable to shareholders. Over Mr. Gad's tenure as Chairman from March 31, 2012 through June 30, 2024, the actual shareholders' equity CAGR attributable to common shareholders is 11.3%, including the purchase gain and 8.9% excluding the gain. In other words, results are about half of what Mr. Gad claims.[i]

Mr. Gad said Paragon has "Increased book value per share from $1.66 to $13.04, a CAGR of approximately 20.4%. " Once again, Mr. Gad uses the same cherry-picked dates to make his performance look better than it was. He excludes his first four years as Chairman and two and a half years as CEO and stops the clock at the end of 2023, eight months before his removal. If you can count stats based on starting and stopping the clock when you want, Bronny James could be an All Star. Once again, Mr. Gad's math is way off. He did get the share prices correct though. The seven-year CAGR would be 34.3% but it is also pure baloney. As noted before, it includes the benefit of purchase gain accounting, which is non-economic, and includes non-controlling interest, which is not attributable to common shareholders. His full tenure as Chairman, 12.25 years, results in a book value per share CAGR of 11.8% including purchase gain and NCI, 10.3% excluding NCI, and only 8.0% excluding the purchase gain and NCI. [ii] In other words, results are about half of what Mr. Gad claims.

Mr. Gad said Paragon has "Increased its stock price from $1.20 to $9.00, a CAGR of approximately 33.5 %." Mr. Gad got the math right on this one. Of course the timeframe is still all cherry picked. By the time of his removal as CEO on August 9, 2024, the price had fallen to $6.90 per share. If we use Mr. Gad's full tenure as Chairman, 12.35 years, the share price CAGR is 7.7% (using $2.75 per share price on March 31, 2012 and the $6.90 closing price on August 9, 2024). How does that compare to major indices? The NASDAQ rose 14.6% CAGR, S&P500 (SPY) 13.4% with dividends, and the Russell 2000 compounded at 9.2% over the same time period. In other words, results are about a quarter of what Mr. Gad claims.

Mr. Gad said Paragon "Began investing excess cash in risk-free interest-bearing securities in 2022 to ensure downside protection against a campaign that was championed by the entire Board." That is an interesting way to phrase the board instructing Mr. Gad to stop pursuing an activist strategy that had cost shareholders millions. How does that ensure downside protection? What it did was stop losses and the board should be commended for it.

Why has Mr. Gad's track record been so poor? Board member, Nominating Committee chairman, fund manager, and successful activist, Tim Eriksen said, "In my opinion, Mr. Gad's poor track record is due to his poor capital allocation and a misguided, and some would say, unethical approach to activism that appears to be a cover for self-dealing. Mr. Gad repeatedly caused Paragon to purchase very small positions in companies and then used corporate resources (i.e. shareholder money) to wage an activist fight. The cost of the fight was often multiples of the dollar amount of stock purchased. If Mr. Gad was victorious, he would gain a board seat at the target company along with all the board fees. Shareholders were left with paying all the costs of the activism while Mr. Gad reaped the benefits. Don't be fooled, Mr. Gad's interests were never aligned with shareholders."

The Committee respectfully asks that shareholders wait for the internal investigation to be completed and for the Committee to complete its work before passing judgment.

Thank you,

Paragon Technologies Nominating and Corporate Governance Committee

[i] Shareholders' equity was $4.919 million on March 31, 2012, the quarter after Mr. Gad became Chairman. Shareholders' equity was $21.489 million on June 30, 2024, including NCI, $18.243 million excluding NCI, and $14,017 excluding NCI and the 4,226,000 accounting purchase gain in 2017.

[ii] Book value per share was $3.16 on March 31, 2012. It was $12.41 per share on June 30, 2024, including NCI and the purchase gain, $10.54 per share excluding NCI, and $8.10 per share excluding NCI and the $4,226,000 purchase gain.

About Paragon Technologies

Paragon Technologies, Inc. is a holding company owning subsidiaries that engage in diverse business activities, including material handling, distribution, real estate, and investments. For additional information please visit: www.pgntgroup.com.

Paragon Technologies Contact:

[email protected]

SOURCE: Paragon Technologies Inc.

View the original press release on ACCESS Newswire

Ch.Havering--AMWN