-

North Korea's Kim shuns South but could 'get along' with US

North Korea's Kim shuns South but could 'get along' with US

-

Spurs win 10th straight, Pistons silence Thunder in battle of NBA's best

-

Germany's Merz visits China AI hub hoping for business deals

Germany's Merz visits China AI hub hoping for business deals

-

Post-uprising polls won't shake Nepal's delicate India-China balance

-

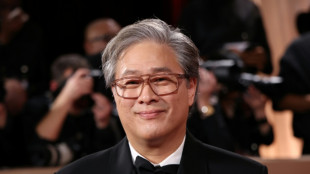

S.Korea's Park Chan-wook to head Cannes festival jury

S.Korea's Park Chan-wook to head Cannes festival jury

-

Australian ex-PM says 'more important than ever' to ditch UK monarchy

-

Dressed for succession? Kim Jong Un, daughter fuel speculation with matching coats

Dressed for succession? Kim Jong Un, daughter fuel speculation with matching coats

-

US-Ukraine talks to open in Geneva after overnight Russian strikes

-

Export ban sparks rush to process lithium in Zimbabwe

Export ban sparks rush to process lithium in Zimbabwe

-

Pakistani sculptor turns scrap into colossal metal artworks

-

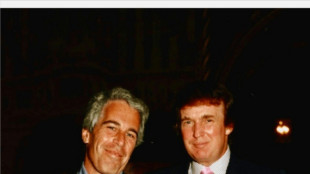

Epstein files reveal links to cash, women, power in Africa

Epstein files reveal links to cash, women, power in Africa

-

Where are Southeast Asia's data centres?

-

Where AI lives: Southeast Asia's data centre boom

Where AI lives: Southeast Asia's data centre boom

-

Seoul hits fresh record on mixed day for Asia markets

-

Kyiv residents pool together for solar panels and batteries amid Russian strikes

Kyiv residents pool together for solar panels and batteries amid Russian strikes

-

North Korea's Kim says could 'get along' with US but shuns South

-

Cuba kills four on US-registered speedboat trying to 'infiltrate'

Cuba kills four on US-registered speedboat trying to 'infiltrate'

-

UK Labour party threatened by hard-right, leftists in heartland

-

Australian PM sorry after saying sexual assault survivor 'difficult'

Australian PM sorry after saying sexual assault survivor 'difficult'

-

Kim Jong Un spurns olive branch from 'hostile' South Korea

-

DR Congo sanctuary resists bloody forest sell-off

DR Congo sanctuary resists bloody forest sell-off

-

North Korea looking to replicate youth success at Women's Asian Cup

-

Deal or no deal: What's the state of Trump's tariffs?

Deal or no deal: What's the state of Trump's tariffs?

-

Hillary Clinton to testify in US House panel's Epstein probe

-

African migrants won legal protections - then Trump deported them

African migrants won legal protections - then Trump deported them

-

US women's ice hockey captain responds to 'distasteful' Trump remark

-

US presses missile issue as new Iran talks to open in Geneva

US presses missile issue as new Iran talks to open in Geneva

-

US government accused of major 'cover-up' over Trump sex abuse claims

-

US eases Cuba oil embargo but demands 'dramatic' change

US eases Cuba oil embargo but demands 'dramatic' change

-

IMF urges US to work with partners to ease trade restrictions

-

Brumbies not getting carried away by emphatic Super Rugby start

Brumbies not getting carried away by emphatic Super Rugby start

-

Cuba coast guard kills four on US-registered speedboat

-

Juve lick wounds after painful Champions League exit

Juve lick wounds after painful Champions League exit

-

Real Madrid victory for 'everyone against racism': Tchouameni

-

Wallabies skipper Wilson back from injury in clash of heavyweight coaches

Wallabies skipper Wilson back from injury in clash of heavyweight coaches

-

PSG coach Luis Enrique calls on team to raise their game in Champions League last 16

-

Nvidia smashes forecasts with record quarter as AI boom rolls on

Nvidia smashes forecasts with record quarter as AI boom rolls on

-

Vinicius seals Real Champions League progress as PSG edge out Monaco

-

Galatasaray survive Juve scare to squeeze into Champions League last 16

Galatasaray survive Juve scare to squeeze into Champions League last 16

-

PSG survive Monaco scare to reach Champions League last 16

-

Vinicius hits winner as Real Madrid eliminate Benfica after racism row

Vinicius hits winner as Real Madrid eliminate Benfica after racism row

-

Harden fractures thumb in blow to in-form Cavaliers

-

Hope fades in search for missing after Brazil rains kill 46

Hope fades in search for missing after Brazil rains kill 46

-

Trump, Zelensky speak before Ukraine-US talks in Geneva

-

Scam centres 'destroying' Cambodia's economy, PM tells AFP

Scam centres 'destroying' Cambodia's economy, PM tells AFP

-

Last-gasp Atalanta eliminate Dortmund to reach Champions League last 16

-

Iran negotiators arrive in Geneva for high-stakes US talks

Iran negotiators arrive in Geneva for high-stakes US talks

-

Antonio Tejero, leader of Spain's failed 1981 coup, dies at 93

-

Hakimi, set to face trial for rape, in PSG team for Champions League game

Hakimi, set to face trial for rape, in PSG team for Champions League game

-

Eleven men lured into Russia war returned to South Africa

Paragon Technologies News Release

To the Shareholders of Paragon Technologies:

EASTON, PA / ACCESS Newswire / August 8, 2025 / It has been a busy few weeks since the conclusion of the annual meeting as we are hard at work restoring Paragon Technologies, Inc. (OTCID:PGNT) ('Paragon' or the 'Company') and I realize many of you have lots of questions. The purpose of this letter is to provide a brief overview of where our Company sits today given the events that have transpired over the past months.

Thanks to an overwhelming show of support, our slate was elected with a supermajority of the vote - a strong mandate for change, and for stewardship that reflects the values of ownership, discipline, and integrity.

Now that the campaign is behind us, Paragon is back again focused on doing the simple things that made the Company an enormous success for over a decade: delivering value to our clients, operating efficiently with a disciplined approach to expenditure, avoiding waste and bureaucracy, behaving with candor, being faithful stewards, and acting opportunistically.

For the past nine months, former directors Samuel Weiser, Tim Eriksen, Howard Brownstein and David Lontini, a group of directors who had no real economic interest in Paragon, were focused solely on perpetuating themselves in control and wasting millions of dollars of Paragon's capital to achieve that goal. We have now learned what we suspected all along: mindless tactics led to mindless waste. Based on an internal review, we have learned the following and feel our shareholders should be aware of these findings so shareholders are clearly aware of the substantial financial impact they will have on our upcoming financial results:

Approximately $3.7 million spent on their entrenchment schemes.

Another $1.2-$1.4 million in estimated remaining liabilities related to the prior Board decisions including passage of the poison pill, manipulating the Company's bylaws, and the pursuit of a costly and selfish proxy contest against significant shareholder support - rather than engage in a resolution, they wasted shareholder money. But these are the choices often made when management has no real economic stake in a business.

The liquidation of over $1 million of Paragon's marketable securities in April and May when markets were volatile, selling securities during market lows resulting in meaningful realized losses for Paragon. Today those securities would have appreciated meaningfully.

The quick sale of real estate assets without proper board approval on hastily negotiated terms that likely left $100,000 - $200,000 on the table.

Mismanagement of SI Systems, leading to a significant increase in operating costs without achieving any meaningful revenue gains.

Prior to my removal as CEO, all three of Paragon's subsidiaries were profitable and Paragon's assets included nearly $5 million in cash and marketable securities, net of expenses associated with our previous corporate campaign. Today that figure sits just above $1 million. Some of the wasted resources may be recouped, but the timing and likelihood of any recoupment is uncertain at this time.

Certainly, these expenditures will have a significant financial impact on Paragon and its financial results for the remainder of the year as we clear out the debris left behind. However, this episode also reveals Paragon's underlying strength and resiliency - resiliency that was painstakingly built over years of stewardship by management that was economically aligned with stockholders. We will do it again.

Protecting the downside is the core of our philosophy at Paragon. By prioritizing protecting stockholder capital, we are prioritizing our commitment to enhancing all stakeholder value. Our customers and other partners can rest assured Paragon will continue to be committed to providing them with value in our products and we will serve you with the utmost reliability, quality, and service.

And that brings us to the future-where our energy is now fully focused. Our mood and outlook are positive. The right leaders are back at the Company, and we have quickly acted and are seeing some results. SEDC just posted its highest monthly sales of the year in July, exceeding $13 million. We are already hard at work executing on the plan we laid out to shareholders: re-engaging with our partners, setting the initial steps for the expansion of our distribution and automation businesses and cutting unnecessary costs. We are focusing on long-term value while also prioritizing the need to minimize future financial loss in the short term.

To the vast majority of shareholders who stood with us through this process, we thank you. We can never promise perfection, but you can once again rely on us to communicate candidly, conduct our business affairs with prudence and integrity, and make decisions through the lens of owners - a recipe that has produced a decade of tremendous achievement for Paragon. At Paragon, our vision has always been to build something that lasts - and nothing will shake our confidence in doing just that. We have some rebuilding to do and that will take time, but the Company again has management 100% economically aligned with stockholders. We will act boldly and opportunistically, but most of all carefully.

The 2025 annual letter to shareholders is forthcoming (that streak will not be broken!) and I look forward to providing a more detailed overview of Paragon towards the end of the third quarter.

Sincerely

Sham Gad

CEO

Paragon Technologies, Inc.

CONTACT:

[email protected]

SOURCE: Paragon Technologies Inc.

View the original press release on ACCESS Newswire

J.Williams--AMWN