-

Export ban sparks rush to process lithium in Zimbabwe

Export ban sparks rush to process lithium in Zimbabwe

-

Pakistani sculptor turns scrap into colossal metal artworks

-

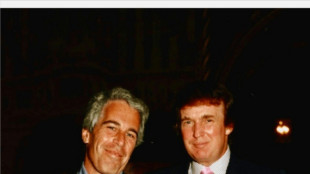

Epstein files reveal links to cash, women, power in Africa

Epstein files reveal links to cash, women, power in Africa

-

Where are Southeast Asia's data centres?

-

Where AI lives: Southeast Asia's data centre boom

Where AI lives: Southeast Asia's data centre boom

-

Seoul hits fresh record on mixed day for Asia markets

-

Kyiv residents pool together for solar panels and batteries amid Russian strikes

Kyiv residents pool together for solar panels and batteries amid Russian strikes

-

North Korea's Kim says could 'get along' with US but shuns South

-

Cuba kills four on US-registered speedboat trying to 'infiltrate'

Cuba kills four on US-registered speedboat trying to 'infiltrate'

-

UK Labour party threatened by hard-right, leftists in heartland

-

Australian PM sorry after saying sexual assault survivor 'difficult'

Australian PM sorry after saying sexual assault survivor 'difficult'

-

Kim Jong Un spurns olive branch from 'hostile' South Korea

-

DR Congo sanctuary resists bloody forest sell-off

DR Congo sanctuary resists bloody forest sell-off

-

North Korea looking to replicate youth success at Women's Asian Cup

-

Deal or no deal: What's the state of Trump's tariffs?

Deal or no deal: What's the state of Trump's tariffs?

-

Hillary Clinton to testify in US House panel's Epstein probe

-

African migrants won legal protections - then Trump deported them

African migrants won legal protections - then Trump deported them

-

US women's ice hockey captain responds to 'distasteful' Trump remark

-

US presses missile issue as new Iran talks to open in Geneva

US presses missile issue as new Iran talks to open in Geneva

-

US government accused of major 'cover-up' over Trump sex abuse claims

-

US eases Cuba oil embargo but demands 'dramatic' change

US eases Cuba oil embargo but demands 'dramatic' change

-

IMF urges US to work with partners to ease trade restrictions

-

Brumbies not getting carried away by emphatic Super Rugby start

Brumbies not getting carried away by emphatic Super Rugby start

-

Cuba coast guard kills four on US-registered speedboat

-

Juve lick wounds after painful Champions League exit

Juve lick wounds after painful Champions League exit

-

Real Madrid victory for 'everyone against racism': Tchouameni

-

Wallabies skipper Wilson back from injury in clash of heavyweight coaches

Wallabies skipper Wilson back from injury in clash of heavyweight coaches

-

PSG coach Luis Enrique calls on team to raise their game in Champions League last 16

-

Nvidia smashes forecasts with record quarter as AI boom rolls on

Nvidia smashes forecasts with record quarter as AI boom rolls on

-

Vinicius seals Real Champions League progress as PSG edge out Monaco

-

Galatasaray survive Juve scare to squeeze into Champions League last 16

Galatasaray survive Juve scare to squeeze into Champions League last 16

-

PSG survive Monaco scare to reach Champions League last 16

-

Vinicius hits winner as Real Madrid eliminate Benfica after racism row

Vinicius hits winner as Real Madrid eliminate Benfica after racism row

-

Harden fractures thumb in blow to in-form Cavaliers

-

Hope fades in search for missing after Brazil rains kill 46

Hope fades in search for missing after Brazil rains kill 46

-

Trump, Zelensky speak before Ukraine-US talks in Geneva

-

Scam centres 'destroying' Cambodia's economy, PM tells AFP

Scam centres 'destroying' Cambodia's economy, PM tells AFP

-

Last-gasp Atalanta eliminate Dortmund to reach Champions League last 16

-

Iran negotiators arrive in Geneva for high-stakes US talks

Iran negotiators arrive in Geneva for high-stakes US talks

-

Antonio Tejero, leader of Spain's failed 1981 coup, dies at 93

-

Hakimi, set to face trial for rape, in PSG team for Champions League game

Hakimi, set to face trial for rape, in PSG team for Champions League game

-

Eleven men lured into Russia war returned to South Africa

-

Brazil politicians convicted for ordering murder of black activist councilor

Brazil politicians convicted for ordering murder of black activist councilor

-

Ex-US Treasury chief Summers quits Harvard over Epstein ties

-

Modi says India stands 'firmly' with Israel during visit

Modi says India stands 'firmly' with Israel during visit

-

New Zealand knock sorry Sri Lanka out of T20 World Cup

-

Berlinale meet called over film director's anti-Israel speech

Berlinale meet called over film director's anti-Israel speech

-

Van der Poel to make season bow at Omloop Het Nieuwsblad

-

Maria Grazia Chiuri's Fendi homecoming feted in Milan

Maria Grazia Chiuri's Fendi homecoming feted in Milan

-

Norway's King Harald to stay in hospital to treat infection: doctor

Ondas Holdings Inc. Announces Proposed Public Offering of Common Stock

BOSTON, MA / ACCESS Newswire / August 12, 2025 / Ondas Holdings Inc. (NASDAQ:ONDS) ("Ondas" or the "Company"), a leading provider of private industrial wireless networks and commercial drone and automated data solutions through its Ondas Networks and Ondas Autonomous Systems business units, today announced that it intends to offer and sell shares of its common stock. Ondas also expects to grant the underwriters a 30-day option to purchase additional shares of common stock offered in the public offering. All of the shares in the proposed offering are to be sold by Ondas. The offering is subject to market conditions, and there can be no assurance as to whether or when the offering may be completed, or as to the actual size or terms of the offering. Ondas intends to use the net proceeds from the proposed offering for working capital, general corporate purposes and potential strategic transactions, including acquisitions of businesses or assets, joint ventures or investments in businesses, products or technologies.

Oppenheimer & Co. Inc. is acting as the sole book-running manager. Northland Capital Markets is acting as the lead manager for the offering. Ladenburg Thalmann & Co. Inc. and Lake Street Capital Markets, LLC are acting as co-managers for the offering.

A shelf registration statement on Form S-3 (File No. 333-286642) relating to the shares to be issued in the proposed offering was filed with the Securities and Exchange Commission ("SEC") on April 18, 2025, and was declared effective on April 25, 2025. A preliminary prospectus supplement and accompanying prospectus describing the terms of the proposed offering will be filed with the SEC. The shares may be offered only by means of a prospectus, including a prospectus supplement, forming a part of the effective registration statement. Copies of the preliminary prospectus supplement and the accompanying prospectus relating to the shares being offered may also be obtained from Oppenheimer & Co. Inc. Attention: Syndicate Prospectus Department, 85 Broad Street, 26th Floor, New York, NY 10004, or by telephone at (212) 667-8055, or by email at [email protected]. Electronic copies of the preliminary prospectus supplement and accompanying prospectus will also be available on the SEC's website at http://www.sec.gov. The final terms of the offering will be disclosed in a final prospectus supplement to be filed with the SEC.

This press release does not constitute an offer to sell, or the solicitation of an offer to buy, the shares, nor will there be any sale of the shares in any state or other jurisdiction in which such offer, solicitation or sale is not permitted.

Forward-Looking Statements

Statements made in this release that are not statements of historical or current facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the completion and anticipated use of proceeds of the proposed offering. We caution readers that forward-looking statements are predictions based on our current expectations about future events. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. These risks and uncertainties relate, among other things, to fluctuations in our stock price, changes in market conditions and satisfaction of customary closing conditions related to the proposed public offering. Our actual results, performance, or achievements, including our ability to conduct and complete a public offering of our common stock on terms acceptable to us or at all, could differ materially from those expressed or implied by the forward-looking statements as a result of a number of factors, including the risks discussed under the heading "Risk Factors" discussed under the caption "Item 1A. Risk Factors" in Part I of our most recent Annual Report on Form 10-K or any updates discussed under the caption "Item 1A. Risk Factors" in Part II of our Quarterly Reports on Form 10-Q and in our other filings with the SEC. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law.

Contacts

IR Contact for Ondas Holdings Inc.

888.350.9994

[email protected]

Media Contact for Ondas

Escalate PR

[email protected]

Preston Grimes

Marketing Manager, Ondas Holdings Inc.

[email protected]

SOURCE: Ondas Holdings Inc.

View the original press release on ACCESS Newswire

T.Ward--AMWN