-

How AFP has used data analysis to cover the Ukraine war

How AFP has used data analysis to cover the Ukraine war

-

Paris says US envoy pledges not to 'interfere' in France affairs

-

Iran says students must respect 'red lines' after protests

Iran says students must respect 'red lines' after protests

-

Italian biathlete Giacomel has heart surgery after Olympic withdrawal

-

Gazans salvage ancient books in mosque library damaged by war

Gazans salvage ancient books in mosque library damaged by war

-

Farhan scores 63 as England restrict Pakistan to 164-9

-

Stocks bounce as traders assess AI fallout, tariffs

Stocks bounce as traders assess AI fallout, tariffs

-

Brazil court tries politicians over hit on Black councilwoman

-

Senegal PM vows to double penalty for same-sex relations

Senegal PM vows to double penalty for same-sex relations

-

UK govt backs releasing documents tied to 'rude' ex-prince Andrew

-

Novo Nordisk to slash prices of weightloss drugs in US

Novo Nordisk to slash prices of weightloss drugs in US

-

Welllage says Sri Lanka can rescue T20 World Cup campaign

-

UK's royal protection officers urged to speak up in Epstein probe

UK's royal protection officers urged to speak up in Epstein probe

-

Aid groups petition Israel's top court to halt ban on Gaza, West Bank ops

-

UEFA can make fight against racism more than a slogan: Real Madrid's Arbeloa

UEFA can make fight against racism more than a slogan: Real Madrid's Arbeloa

-

Bali flooding prompts tourist evacuation: official

-

Jones says Borthwick's 'title-decider' comments behind England collapse

Jones says Borthwick's 'title-decider' comments behind England collapse

-

UK fines Reddit nearly $20 mn over children's data failures

-

PSG star Hakimi faces trial for alleged rape

PSG star Hakimi faces trial for alleged rape

-

Netflix, Prime and Disney+ face UK broadcasting regulation

-

Greece set new tourism record in 2025

Greece set new tourism record in 2025

-

Zelensky says Ukraine unbroken after 4 years, but Russia vows to fight on

-

Zelenksy says Ukraine unbroken after 4 years, but Russia vows to fight on

Zelenksy says Ukraine unbroken after 4 years, but Russia vows to fight on

-

Snoop Dogg 'can't wait' for first Swansea visit

-

Stocks fluctuate as traders assess AI fallout, tariffs

Stocks fluctuate as traders assess AI fallout, tariffs

-

Post-it maker 3M faces Belgian trial over 'forever' chemicals

-

UK comedian Russell Brand pleads not guilty to new rape, assault charges

UK comedian Russell Brand pleads not guilty to new rape, assault charges

-

Duterte drew up 'death lists', boasted about murders: ICC prosecutor

-

UK govt urged to release documents linked to ex-prince Andrew

UK govt urged to release documents linked to ex-prince Andrew

-

Rights group slams treatment of viral Japanese monkey

-

Inside the bunker where Zelensky led response to Russian invasion

Inside the bunker where Zelensky led response to Russian invasion

-

France demands explanation from US envoy over 'surprise' no-show

-

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

-

China tightens Japanese trade restrictions as spat worsens

-

Ukraine war exhibition opens at Berlin Nazi bunker museum

Ukraine war exhibition opens at Berlin Nazi bunker museum

-

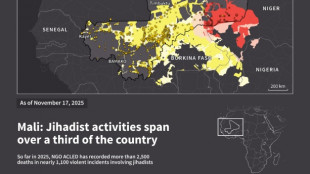

Jihadist threat puts eastern Senegal on edge

-

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

-

North Korea ruling party promotes Kim Jong Un's younger sister

-

Mexico's Jalisco cautiously tries returning to normal after cartel violence

Mexico's Jalisco cautiously tries returning to normal after cartel violence

-

Mexico's violence-hit Guadalajara to host World Cup games

-

Mourinho's Bernabeu homecoming upended by suspension, racism row

Mourinho's Bernabeu homecoming upended by suspension, racism row

-

China targets Japanese companies over military ties

-

Griezmann in talks to join MLS side Orlando City: source

Griezmann in talks to join MLS side Orlando City: source

-

France to revoke US envoy's govt access after summons no-show

-

Spurs overpower Pistons in clash of NBA's form teams

Spurs overpower Pistons in clash of NBA's form teams

-

Inoue to fight Nakatani in Tokyo in May: reports

-

Canada PM to push trade, rebuild fractured ties in India trip

Canada PM to push trade, rebuild fractured ties in India trip

-

Asian markets mixed as traders weigh AI and tariffs outlook

-

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

-

Venezuela says exiles welcome to return following mass amnesty

Small Business Brokers: What Are They, How to Choose and More (Guide Released)

IRAEmpire is proud to announce the release of its updated guide on "Small Business Brokers". It aims to help business owners navigate the complex markets of business brokers and M&A advisors.

LOS ANGELES, CA / ACCESS Newswire / October 13, 2025 / Selling a small business involves several complex steps, including valuation, marketing, negotiations, and legal documentation. Many business owners find that the process requires more time, expertise, and market knowledge than they expected.

A small business broker serves as an intermediary between business owners and potential buyers, ensuring that the sale is handled efficiently and confidentially. Their role is to simplify the process, protect the seller's interests, and help achieve a fair market price for the business.

This article explains what small business brokers do, how they operate, and why engaging a professional broker can be beneficial for business owners preparing to sell.

Check Out the Best Small Business Brokers in the US on IRAEmpire

What Exactly Is a Small Business Broker?

A small business broker is a professional who assists in the purchase and sale of privately owned businesses. Their primary function is to act as a neutral intermediary-connecting business owners who wish to sell with individuals or entities looking to buy.

Ryan Paulson, Chief Editor at IRAEmpire says, "Brokers handle key aspects of the transaction, such as assessing the business's market value, preparing it for sale, identifying qualified buyers, and facilitating negotiations between both parties. In many cases, they also coordinate with accountants, attorneys, and lenders to ensure that the transaction complies with legal and financial requirements."

Unlike real estate agents who specialize in property sales, business brokers specialize in selling ongoing enterprises. They understand how to present a company's financials, goodwill, and operational potential in a way that attracts serious buyers.

What Does a Business Broker Actually Do?

A small business broker manages several aspects of the sale process to ensure a smooth and confidential transaction. Their responsibilities typically include the following:

Business Valuation:

Brokers help determine a realistic market value based on financial performance, industry trends, and comparable sales.Preparing the Business for Sale:

They compile financial statements, operational details, and marketing materials that accurately represent the business to potential buyers.Marketing and Buyer Search:

Brokers use professional networks, listing platforms, and confidential marketing strategies to reach qualified and serious buyers.Screening and Qualifying Buyers:

Before sharing sensitive business information, brokers verify that interested parties have the financial capability and intent to proceed.Negotiation and Offer Management:

Brokers act as intermediaries during negotiations, helping both sides reach a fair and balanced agreement.Coordinating Due Diligence and Closing:

They oversee the due diligence process, ensuring that all documentation, legal requirements, and financial arrangements are completed correctly before closing.

Through these activities, business brokers help business owners maintain focus on day-to-day operations while managing the complexities of the sale.

Learn About the No.1 Ranked Small Business Broker in the US Here.

Why Hiring a Business Broker Makes a Difference

Engaging a qualified business broker can significantly improve the chances of completing a successful sale. Selling a business involves more than listing it for buyers-it requires strategic positioning, accurate valuation, and experienced negotiation. A business broker provides the structure and expertise necessary to manage these areas effectively.

Key advantages include:

Accurate Valuation:

Brokers rely on financial data, industry benchmarks, and market conditions to determine a fair and realistic price range.Confidential Marketing:

Maintaining confidentiality is critical when selling a business. Brokers know how to market a business discreetly without disclosing sensitive information publicly.Access to Qualified Buyers:

Experienced brokers have established databases and professional networks that connect sellers with serious, pre-screened buyers.Negotiation Expertise:

By acting as intermediaries, brokers help balance the interests of both parties and facilitate smoother negotiations.Time and Efficiency:

Selling a business can be time-consuming. A broker manages the entire process, allowing the owner to continue running operations without major disruption.

In short, hiring a business broker helps minimize risk, streamline the transaction, and often leads to better financial outcomes for the seller.

How Much Does a Business Broker Cost?

Business brokers are typically compensated through a commission-based structure, meaning they earn a percentage of the final sale price once the transaction is completed. This is often referred to as a success fee, as payment is contingent upon the sale closing successfully.

For small to mid-sized businesses, commissions generally range between 8% and 12% of the sale value. The percentage may vary depending on factors such as:

The size and complexity of the business

The industry and deal structure

The broker's experience and network

The level of service provided (valuation, marketing, due diligence coordination, etc.)

In some cases, brokers may charge a small upfront or retainer fee to cover marketing and administrative expenses, though this varies by firm. Business owners should clarify all costs in writing before engaging a broker to ensure transparency and mutual understanding.

While the commission may seem substantial, many sellers find that professional representation leads to higher offers, faster sales, and fewer complications-offsetting the cost of brokerage services.

What to Look for in a Good Business Broker

Selecting the right broker is one of the most important decisions a business owner can make when preparing to sell. The right professional can streamline the process and help secure a favorable outcome, while an inexperienced or inattentive broker can cause unnecessary delays or missteps.

When evaluating potential brokers, consider the following criteria:

Experience and Track Record:

Look for a broker with proven experience in your industry or similar types of businesses. Past successful transactions are often a good indicator of competence.Licensing and Credentials:

In many regions, brokers must hold a business or real estate license. Membership in professional associations such as the International Business Brokers Association (IBBA) or M&A Source also reflects professionalism and adherence to ethical standards.Transparency and Communication:

A good broker provides clear explanations about fees, timelines, and processes. Open communication ensures both parties understand expectations.Marketing Strategy:

Evaluate how the broker plans to market your business-through online listings, buyer databases, or industry networks. A strong marketing plan increases visibility among qualified buyers.Reputation and References:

Request references from previous clients to assess reliability and performance. Online reviews and industry recommendations can also provide useful insight.Alignment with Your Goals:

The broker should understand your motivations for selling-whether maximizing price, ensuring continuity for employees, or closing quickly-and tailor their strategy accordingly.

Taking time to research and interview multiple brokers helps ensure a professional partnership that aligns with both your business and personal objectives.

View the Best Business Brokers List of 2025 on IRAEmpire

When Is the Right Time to Contact a Broker?

Ideally, business owners should contact a broker well before they plan to sell-typically six to twelve months in advance. Early engagement gives the broker time to assess the business, organize financial documentation, and identify areas that could improve its market value.

Even if the sale is not immediate, an early consultation helps owners understand current market conditions, potential buyer demand, and realistic pricing expectations. This insight allows for better preparation and decision-making.

Business brokers can also assist owners who are simply exploring their options. For example, they can provide an informal valuation or outline steps to make the business more appealing to future buyers.

In contrast, waiting until the last moment to engage a broker can limit marketing time and negotiation flexibility. Planning ahead ensures that the sale process proceeds smoothly and that the business is presented to buyers at its strongest position.

FAQs About Small Business Brokers

1. Do I really need a business broker to sell my business?

While it is possible to sell a business independently, many owners choose to work with a broker for their expertise, networks, and ability to manage complex negotiations. A broker's involvement often leads to faster sales and better outcomes.

2. How do business brokers find buyers?

Brokers use a mix of private databases, professional associations, industry contacts, and online listing platforms to locate qualified buyers. They also market the business confidentially to protect sensitive information.

3. Can a broker help me determine my business's value?

Yes. Most brokers perform a preliminary valuation based on financial records, assets, earnings, and comparable sales. This helps establish a fair asking price that reflects market realities.

4. What is the difference between a business broker and an M&A advisor?

Business brokers typically handle small to mid-sized business sales (valued under $5 million), while M&A advisors work on larger, more complex transactions involving corporate buyers or investors.

5. How long does it take to sell a business with a broker?

The average sale process ranges from six months to one year, depending on the business type, industry demand, and financial documentation. A well-prepared business often sells faster.

6. Are broker fees negotiable?

Commission rates are sometimes negotiable, especially for larger deals. However, experienced brokers typically maintain standard rates that reflect the level of service, marketing, and negotiation involved.

Learn About the No.1 Ranked Small Business Brokers in USA

Conclusion

Selling a business is a significant financial and personal decision that requires careful planning and professional guidance. A qualified business broker plays a central role in this process-helping owners establish accurate valuations, maintain confidentiality, and connect with serious buyers.

By managing marketing, negotiations, and due diligence, brokers enable business owners to focus on running operations until the sale is complete. Their experience and structured approach can minimize uncertainty, reduce errors, and often result in a stronger overall outcome.

For business owners considering a sale, consulting with a broker early in the process can provide clarity on both the market landscape and the steps required to achieve a smooth transition.

About IRAEmpire

IRAEmpire is a leading online resource dedicated to helping investors make smarter decisions about retirement planning, precious metals, and alternative investments. Built with a mission to simplify complex financial topics, IRAEmpire provides in-depth reviews, comparison guides, and educational content focused on Gold IRAs, Silver IRAs, and other self-directed retirement accounts.

The platform is designed for investors who want clarity, transparency, and unbiased insights before committing to a retirement strategy. Unlike generic finance sites, IRAEmpire specializes in the precious metals niche, ensuring that its articles, rankings, and company reviews are tailored specifically to the needs of retirement savers seeking stability in uncertain times.

Key features include detailed breakdowns of top Gold IRA companies, step-by-step investment guides, and market trend analysis. By combining data-driven research with easy-to-understand explanations, IRAEmpire empowers readers to compare providers, evaluate fees, and choose the right partner for their long-term financial security.

Whether you're a first-time investor exploring precious metals or an experienced retiree looking to diversify, IRAEmpire serves as a trusted guide. Its goal is simple: to help you protect and grow your wealth through smart, informed retirement planning.

CONTACT:

Ryan Paulson

[email protected]

SOURCE: IRAEmpire LLC

View the original press release on ACCESS Newswire

O.Johnson--AMWN