-

Post-it maker 3M faces Belgian trial over 'forever' chemicals

Post-it maker 3M faces Belgian trial over 'forever' chemicals

-

UK comedian Russell Brand pleads not guilty to new rape, assault charges

-

Duterte drew up 'death lists', boasted about murders: ICC prosecutor

Duterte drew up 'death lists', boasted about murders: ICC prosecutor

-

UK govt urged to release documents linked to ex-prince Andrew

-

Rights group slams treatment of viral Japanese monkey

Rights group slams treatment of viral Japanese monkey

-

Inside the bunker where Zelensky led response to Russian invasion

-

France demands explanation from US envoy over 'surprise' no-show

France demands explanation from US envoy over 'surprise' no-show

-

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

-

China tightens Japanese trade restrictions as spat worsens

China tightens Japanese trade restrictions as spat worsens

-

Ukraine war exhibition opens at Berlin Nazi bunker museum

-

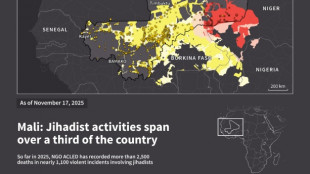

Jihadist threat puts eastern Senegal on edge

Jihadist threat puts eastern Senegal on edge

-

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

-

North Korea ruling party promotes Kim Jong Un's younger sister

North Korea ruling party promotes Kim Jong Un's younger sister

-

Mexico's Jalisco cautiously tries returning to normal after cartel violence

-

Mexico's violence-hit Guadalajara to host World Cup games

Mexico's violence-hit Guadalajara to host World Cup games

-

Mourinho's Bernabeu homecoming upended by suspension, racism row

-

China targets Japanese companies over military ties

China targets Japanese companies over military ties

-

Griezmann in talks to join MLS side Orlando City: source

-

France to revoke US envoy's govt access after summons no-show

France to revoke US envoy's govt access after summons no-show

-

Spurs overpower Pistons in clash of NBA's form teams

-

Inoue to fight Nakatani in Tokyo in May: reports

Inoue to fight Nakatani in Tokyo in May: reports

-

Canada PM to push trade, rebuild fractured ties in India trip

-

Asian markets mixed as traders weigh AI and tariffs outlook

Asian markets mixed as traders weigh AI and tariffs outlook

-

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

-

Venezuela says exiles welcome to return following mass amnesty

Venezuela says exiles welcome to return following mass amnesty

-

Australia buys parts for future AUKUS sub reactor

-

Ukraine marks four years since Russian invasion

Ukraine marks four years since Russian invasion

-

Brazil court to try politicians over hit on black councilwoman

-

Interim president says Venezuelans welcome to return after amnesty law

Interim president says Venezuelans welcome to return after amnesty law

-

Man kills police officer in Moscow train station blast

-

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

-

Simulab Launches TraumaMan(R) System Ultrasound Module for Realistic Trauma Training

-

Bytek Joins the Google Cloud Ready - BigQuery Program

Bytek Joins the Google Cloud Ready - BigQuery Program

-

Formation Metals Intersects 0.95 g/t Au over 61.1 Metres, including 1.68 g/t Au over 26.5 Metres at the Advanced N2 Gold Project; Bulk-Tonnage Gold Target Identified with 8 Kilometres of Strike to Explore

-

Bolt Metals Announces Closing of Fully Subscribed Private Placement

Bolt Metals Announces Closing of Fully Subscribed Private Placement

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 24

-

Nikon Expands Popular Monarch and Prostaff Binocular Lines

Nikon Expands Popular Monarch and Prostaff Binocular Lines

-

Australian PM seeks removal of UK's Andrew from line of succession

-

Carrick hails 'ruthless' Man Utd match-winner Sesko

Carrick hails 'ruthless' Man Utd match-winner Sesko

-

N.Korea leader's sister promoted at party congress

-

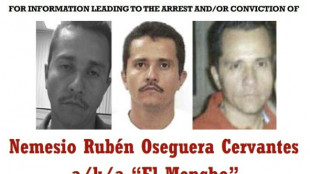

The key to taking down Mexico's most-wanted narco? His girlfriend

The key to taking down Mexico's most-wanted narco? His girlfriend

-

Winter storm blankets US northeast as travel bans imposed

-

Super-sub Sesko fires Man Utd to win at Everton

Super-sub Sesko fires Man Utd to win at Everton

-

YouTube exec says goal was viewer value not addiction

-

Panama wrests control of canal ports from Hong Kong group

Panama wrests control of canal ports from Hong Kong group

-

Trump denies top US officer warned of Iran strike risks

-

Mayweather to fight Pacquiao in Las Vegas in September

Mayweather to fight Pacquiao in Las Vegas in September

-

US stocks tumble on tariff fog, worries over AI

-

US says China 'massively expanded' nuclear arsenal

US says China 'massively expanded' nuclear arsenal

-

US forces to complete withdrawal from Syria within a month

Gold and Silver IRA: Best Providers, Rules, Taxes and More (Guide Released)

IRAEmpire has launched a new guide on Gold and Silver IRA. The guide explores the various aspects of this account to help consumers make well-informed decisions.

NEW YORK CITY, NEW YORK / ACCESS Newswire / October 20, 2025 / In an era of market volatility, rising inflation, and global uncertainty, many U.S. investors are seeking ways to make their retirement savings more resilient. While traditional assets such as stocks and bonds remain the foundation of most portfolios, there is growing interest in tangible assets like gold and silver - metals that have held intrinsic value for thousands of years.

Ryan Paulson of IRA Empire says, "A Gold and Silver IRA, sometimes called a Precious Metals IRA, allows investors to include physical gold and silver within a tax-advantaged retirement account. These accounts function much like standard IRAs but are designed to hold approved bullion and coins instead of paper-based assets."

Learn About the Best Gold and Silver IRA Companies of 2025 on IRAEmpire.

For investors concerned about inflation, currency depreciation, or market corrections, precious metals offer a potential hedge and a way to diversify long-term wealth. This article provides a comprehensive overview of Gold and Silver IRAs - explaining what they are, how they work, their benefits, and what to consider before opening one.

Understand Gold IRA Investing with This Free Guide.

What Is a Gold and Silver IRA?

A Gold and Silver IRA is a type of self-directed individual retirement account (SDIRA) that allows investors to hold physical precious metals - primarily gold and silver - as part of their retirement savings. It operates under the same federal tax laws that apply to Traditional and Roth IRAs, but with a key distinction: instead of paper assets like stocks, bonds, or mutual funds, the account contains tangible metals.

The Internal Revenue Service (IRS) permits the inclusion of gold, silver, platinum, and palladium in self-directed IRAs, provided the metals meet strict purity and storage requirements. For example:

Gold must have a minimum purity of 99.5%, and

Silver must have a minimum purity of 99.9%.

Investors cannot hold these metals personally at home or in a safe deposit box. Instead, they must be stored in an IRS-approved depository, under the supervision of an authorized custodian.

The custodian - typically a trust company or financial institution - manages account setup, ensures IRS compliance, and coordinates with precious metal dealers and storage facilities. This structure gives investors the benefits of diversification and physical ownership, while maintaining the same tax advantages and contribution limits as other IRAs.

Why Investors Choose Gold and Silver

Gold and silver have long been regarded as safe-haven assets that retain value across generations. For retirement investors, these metals play an important role in reducing portfolio risk and protecting against external economic pressures. While both are precious metals, each serves a slightly different purpose in a balanced investment strategy.

Inflation Protection and Currency Stability

Gold and silver are often viewed as hedges against inflation and the erosion of the U.S. dollar. When prices rise and the purchasing power of cash declines, these metals tend to hold or even increase their real value. Historically, gold in particular has performed well during periods of high inflation and monetary expansion.

Portfolio Diversification

Diversification is one of the most effective ways to manage investment risk. Because gold and silver prices generally move independently of equities and fixed income markets, including them in a retirement portfolio can help smooth out performance during economic downturns. Many investors allocate 5-10% of their portfolios to precious metals for this reason.

Geopolitical and Market Uncertainty

Both metals have a history of stability during times of political tension or financial instability. When global markets fluctuate or investor confidence declines, demand for tangible assets like gold and silver typically rises. This characteristic makes them valuable components for investors seeking stability during unpredictable periods.

Tangible and Finite Assets

Gold and silver are physical, finite resources that cannot be printed or artificially created. Unlike digital securities, they have intrinsic value based on global demand and scarcity. For many retirement savers, the ability to own something tangible - stored securely and independently of financial markets - provides a sense of security not found in paper-based investments.

Complementary Roles

While gold is often seen as a store of value, silver has a dual function: it is both a precious and industrial metal used in electronics, solar panels, and manufacturing. This gives silver additional growth potential, though it also introduces more short-term price volatility. Many investors hold both metals to balance gold's stability with silver's potential upside.

Learn About the Best Gold and Silver IRA Companies of 2025 on IRAEmpire.

How a Gold and Silver IRA Works

Setting up and managing a Gold and Silver IRA follows a structured process designed to ensure compliance with IRS regulations while providing investors with secure ownership of their metals. The account functions much like a traditional or Roth IRA but requires additional coordination between custodians, metal dealers, and approved storage facilities.

Open a Self-Directed IRA

The first step is to open a self-directed individual retirement account (SDIRA) with an IRS-approved custodian. Unlike standard IRAs offered through banks or brokerage firms, self-directed IRAs allow investors to hold alternative assets, including precious metals, real estate, or private equity.

The custodian is responsible for administrative oversight, maintaining compliance, and ensuring that all transactions meet federal requirements.

Fund the Account

Once the account is established, investors can fund it in one of three ways:

Direct Contribution: Contributing new funds up to the annual IRA limit ($7,000 for individuals under 50 and $8,000 for those 50 or older in 2025).

Transfer: Moving funds from an existing IRA to the new self-directed account.

Rollover: Transferring funds from an employer-sponsored plan such as a 401(k) or 403(b) into the Gold and Silver IRA without triggering taxes or penalties.

It is important that rollovers and transfers are done through a trustee-to-trustee process to preserve the account's tax-advantaged status.

Select Approved Precious Metals

After funding, the investor chooses which metals to purchase. The IRS allows only specific coins and bars that meet minimum purity standards:

Gold: 99.5% purity (e.g., American Gold Eagle, Canadian Maple Leaf, Gold Buffalo).

Silver: 99.9% purity (e.g., American Silver Eagle, Austrian Philharmonic, Silver Maple Leaf).

The custodian or IRA facilitator assists in purchasing the metals from an approved dealer and verifying their compliance with IRS regulations.

Arrange for Secure Storage

All physical gold and silver held in an IRA must be stored in an IRS-approved depository, not at home or in a personal vault.

Depositories provide:

Segregated or commingled storage options

Full insurance coverage against theft or damage

Regular third-party audits for accountability

Custodians coordinate directly with these facilities to track holdings and report valuations to the IRS.

Manage and Monitor the Account

As with any IRA, account holders can view periodic statements showing their holdings and valuations. Investors may choose to rebalance their portfolio by buying or selling metals within the account.

When the investor reaches retirement age (59½ or older), distributions can be taken in one of two ways:

Cash distribution: Metals are sold, and the proceeds are distributed as cash.

In-kind distribution: The physical metals are delivered directly to the investor.

Withdrawals before age 59½ generally incur taxes and penalties, just as with traditional IRAs.

A properly managed Gold and Silver IRA offers the same tax advantages as conventional retirement accounts, while allowing investors to hold tangible assets that historically perform well during economic uncertainty.

What is a Precious Metals IRA? Learn More Here.

Gold vs. Silver - Key Differences for Retirement Investors

Although gold and silver share similar characteristics as precious metals, they serve slightly different purposes within a retirement portfolio. Understanding how the two differ in terms of performance, volatility, and practical use can help investors build a more balanced and strategic precious metals IRA.

Volatility and Market Behavior

Gold tends to be more stable and less volatile than silver. It is primarily driven by investment demand, central bank reserves, and macroeconomic factors such as inflation and interest rates. Silver, by contrast, is more volatile because its value is influenced by both investment and industrial demand. It is widely used in electronics, medical technology, and renewable energy industries, which can amplify price fluctuations.

Price and Accessibility

Silver is considerably more affordable per ounce than gold, making it an accessible entry point for investors with smaller budgets. This allows broader diversification within a portfolio, but it also means that silver requires more physical storage space for equivalent dollar values. Gold, though more expensive, offers higher value density, allowing investors to store significant wealth in a smaller volume of metal.

Inflation and Economic Performance

Both metals serve as effective hedges against inflation, but gold is often regarded as the stronger monetary hedge. Gold typically outperforms during financial crises or when confidence in paper assets declines. Silver tends to perform well during periods of economic growth, when industrial demand is strong, though it can also experience sharp declines during recessions.

Liquidity and Global Demand

Gold enjoys broader global liquidity and is widely recognized by central banks, institutional investors, and governments. Silver is also liquid but traded on a smaller scale, with price movements influenced by industrial supply chains and manufacturing trends. For investors prioritizing liquidity and global recognition, gold is typically preferred.

Historical Performance

Historically, gold has shown steady long-term appreciation with fewer price swings, making it ideal for capital preservation. Silver has produced stronger percentage gains during bull markets but is more susceptible to sharp corrections. For many investors, a mix of both metals balances gold's stability with silver's growth potential.

Tax Rules and Rollover Options

Gold and Silver IRAs are governed by the same IRS rules that apply to other retirement accounts, offering familiar tax benefits while allowing ownership of physical precious metals. Understanding how these accounts are taxed - and how to move funds into them properly - is essential to avoid penalties and maintain compliance.

Read this Gold IRA Tax Rules Guide to Learn More

Tax Structure: Traditional vs. Roth

A Gold and Silver IRA can be established as either a Traditional or a Roth IRA, each with distinct tax implications.

Traditional IRA: Contributions may be tax-deductible, reducing taxable income in the year of contribution. Earnings within the account grow tax-deferred until withdrawals begin, typically after age 59½. Distributions are then taxed as ordinary income.

Roth IRA: Contributions are made with after-tax dollars, meaning they are not deductible upfront. However, all qualified withdrawals - including growth - are tax-free once the account has been open for at least five years and the investor is 59½ or older.

Both account types allow investors to hold gold and silver without losing the inherent tax advantages of retirement savings.

Contribution Limits

Gold and Silver IRAs follow the same contribution limits as other IRAs:

For 2025, the annual contribution limit is $7,000 for individuals under age 50, and $8,000 for those age 50 and older.

These limits apply to the combined total of all IRA accounts an investor holds (traditional, Roth, or self-directed).

Rollover and Transfer Options

Investors who already have existing retirement savings - such as a 401(k), 403(b), or traditional IRA - can move those funds into a Gold and Silver IRA through a rollover or transfer.

Direct Transfer: Funds move directly from one IRA custodian to another, with no taxes or penalties incurred.

Rollover: Funds from an employer-sponsored plan are sent to the investor, who then has 60 days to deposit them into a new Gold and Silver IRA. Failure to do so within the window can result in taxes and early withdrawal penalties.

To maintain tax-deferred status and avoid complications, most investors opt for a trustee-to-trustee transfer, where the money never passes through the investor's hands.

Required Minimum Distributions (RMDs)

Traditional Gold and Silver IRAs are subject to required minimum distributions (RMDs) beginning at age 73 (as of 2025). Because metals are physical assets, the account holder must either:

Sell enough metal to cover the RMD amount, or

Take an in-kind distribution of the metals, which will be taxed based on their current market value.

Roth IRAs, by contrast, are not subject to RMDs during the account owner's lifetime.

Importance of Professional Guidance

Given the complexity of rollover rules and tax reporting, consulting a qualified financial advisor or tax professional is strongly recommended before initiating a transfer. Proper structuring ensures compliance with IRS rules and helps preserve the tax advantages of the account.

When managed correctly, Gold and Silver IRAs provide the same tax-deferred or tax-free growth opportunities as traditional retirement accounts - with the added benefit of owning assets that have historically preserved value during periods of inflation and market instability.

Choosing the Right Custodian and Storage Provider

A Gold and Silver IRA cannot be managed directly by the investor; it must be administered by an IRS-approved custodian and stored in an approved depository. The choice of custodian and storage facility is critical to maintaining compliance, ensuring security, and protecting long-term value. Selecting reputable institutions minimizes the risk of errors, fraud, or regulatory violations.

See the Best Gold and Silver IRA Providers in the USA.

Role of the Custodian

The custodian is the financial institution legally responsible for administering the IRA. Their duties include:

Opening and maintaining the account

Executing transactions and purchases on behalf of the investor

Coordinating with precious metal dealers and depositories

Handling all IRS reporting, including valuations and distributions

Custodians must be approved by the IRS to manage self-directed IRAs. These entities are typically trust companies, banks, or specialized financial institutions with experience in alternative asset management.

When evaluating custodians, investors should consider:

Experience with precious metals IRAs specifically

Transparency in fee structures and account management

Access to secure and insured depositories

Quality of customer support and compliance assistance

Importance of Secure Storage

IRS rules prohibit investors from storing IRA-owned metals personally - at home, in a safe deposit box, or in private vaults. Instead, all precious metals must be stored in an IRS-approved depository that meets strict regulatory and security standards.

Approved depositories typically offer:

High-level physical security, including vault protection and video surveillance

Comprehensive insurance coverage against theft, loss, or damage

Regular independent audits to verify holdings and maintain transparency

Segregated or commingled storage options, depending on investor preference

Segregated storage keeps an investor's metals separate and specifically identifiable.

Commingled storage stores multiple investors' holdings together, though ownership records remain distinct.

Verification and Compliance

Before selecting a storage provider, investors should confirm that the facility is recognized by major industry bodies such as COMEX, LBMA (London Bullion Market Association), or similar auditing organizations.

Investors should also verify that their chosen custodian and depository have a direct working relationship, as this ensures efficient coordination, accurate reporting, and secure asset transfers.

Avoiding Unapproved or "Home Storage" Schemes

Some companies promote "home storage" IRAs or offer to set up LLCs to bypass IRS storage rules. These arrangements are not compliant with federal law and can lead to account disqualification, immediate taxation, and penalties. Always confirm that both the custodian and the depository are explicitly approved by the IRS before purchasing metals.

Evaluating Gold and Silver IRA Companies

Selecting a trustworthy Gold and Silver IRA company is one of the most important decisions an investor will make. The right provider ensures compliance with IRS regulations, transparent pricing, and efficient coordination between the custodian, dealer, and storage facility. Conversely, choosing an inexperienced or opaque company can expose investors to unnecessary risks, high fees, or non-compliant practices.

Reputation and Accreditation

A credible IRA company should have a proven track record and verifiable credentials. Investors should confirm that the firm:

Has an established history specializing in self-directed IRAs and precious metals

Maintains strong customer ratings with organizations such as the Better Business Bureau (BBB) and Business Consumer Alliance (BCA)

Has few or no unresolved complaints or regulatory actions

Reputation and longevity in the industry often signal consistent compliance and customer satisfaction.

Transparency in Fees and Pricing

Investors should request a full written disclosure of all account-related costs before opening an IRA. This includes:

Setup and administrative fees

Annual custodian and storage fees

Dealer markups or premiums on metals

Avoid companies that advertise "no fees" or refuse to provide clear cost details. Some may offset hidden charges by inflating metal prices or promoting unnecessary add-ons.

Educational Approach Over Sales Pressure

Reputable companies focus on education, not persuasion. They provide clear information about how Gold and Silver IRAs work, the risks involved, and the role of IRS compliance.

Firms offering free investor guides, market insights, and one-on-one consultations tend to prioritize transparency. In contrast, high-pressure sales tactics, time-limited "special offers," or claims of guaranteed returns should be treated as warning signs.

Quality of Buyback and Liquidity Options

A well-structured company offers a buyback program that allows investors to sell their metals back to the firm at competitive market rates. This feature is important for liquidity, especially when rebalancing portfolios or meeting required minimum distributions (RMDs).

Before purchasing, investors should confirm the terms of the buyback policy - including fees, timelines, and minimum transaction requirements.

Integration With Approved Custodians and Depositories

The company should have established relationships with IRS-approved custodians and depositories, ensuring smooth and compliant transactions. Coordination between all parties reduces administrative delays and minimizes the risk of reporting errors.

Compliance and Ethical Standards

Investors should confirm that the firm adheres to industry best practices, such as:

Providing accurate IRS documentation for all transactions

Offering only approved metals that meet purity standards

Avoiding promotions of home storage or collectible coins

A company that emphasizes compliance and provides ongoing account support demonstrates a long-term commitment to client protection.

Customer Support and Accessibility

Strong customer service is essential in managing self-directed accounts. Investors should look for firms that assign dedicated account representatives and offer accessible communication channels, including phone, email, and secure online portals.

Choosing the right Gold and Silver IRA company ensures that each stage of the process - from account setup to purchase and storage - is handled professionally and transparently. Due diligence upfront protects investors from avoidable risks and helps create a compliant, tax-advantaged, and well-managed retirement asset base.

Check Out the Best Gold and Silver IRA Companies of 2025 Here.

Is a Gold and Silver IRA Right for You?

A Gold and Silver IRA can serve as a valuable component of a diversified retirement portfolio, but it is not appropriate for every investor. Determining whether this type of account aligns with your goals depends on your investment objectives, time horizon, and tolerance for risk.

When It May Be a Good Fit

Gold and Silver IRAs are generally well-suited for investors who:

Want to hedge against inflation and economic instability.

Prefer tangible assets that retain value independently of financial markets.

Are nearing or in retirement and wish to preserve purchasing power rather than pursue aggressive growth.

Seek portfolio diversification beyond traditional equities and fixed-income securities.

For investors concerned about long-term fiscal policies, global uncertainty, or currency devaluation, precious metals can serve as a stabilizing force that balances exposure to volatile financial assets.

When It May Not Be Ideal

Investors focused on growth and short-term returns may find a Gold and Silver IRA less suitable. Precious metals do not pay dividends or interest, meaning they do not provide income during retirement. Additionally:

The account may involve higher annual costs due to storage and custodial fees.

Selling metals to meet liquidity needs or required minimum distributions (RMDs) may require additional planning.

Those with limited retirement savings may prefer to first build a foundation in traditional assets with predictable returns.

In short, a Gold and Silver IRA is designed for wealth preservation, not rapid capital appreciation.

How Much to Allocate

Most financial professionals recommend allocating 5% to 10% of a retirement portfolio to precious metals, depending on risk tolerance and investment goals. This allows for the benefits of diversification without overexposure to a single asset class. The optimal allocation should reflect an investor's full financial picture, including income needs, age, and other holdings.

Professional Guidance

Because self-directed IRAs involve additional administrative and regulatory steps, it is advisable to consult a licensed financial advisor or tax professional before establishing one. These experts can help determine:

Whether a Gold and Silver IRA fits within your broader retirement plan

How to structure contributions or rollovers efficiently

The most appropriate mix between gold and silver based on market conditions and personal objectives

Be Sure to Learn About the Best Companies to Avoid Investing Mistakes.

About IRAEmpire

IRAEmpire is a leading online resource dedicated to helping investors make smarter decisions about retirement planning, precious metals, and alternative investments. Built with a mission to simplify complex financial topics, IRAEmpire provides in-depth reviews, comparison guides, and educational content focused on Gold IRAs, Silver IRAs, and other self-directed retirement accounts.

The platform is designed for investors who want clarity, transparency, and unbiased insights before committing to a retirement strategy. Unlike generic finance sites, IRAEmpire specializes in the precious metals niche, ensuring that its articles, rankings, and company reviews are tailored specifically to the needs of retirement savers seeking stability in uncertain times.

Whether you're a first-time investor exploring precious metals or an experienced retiree looking to diversify, IRAEmpire serves as a trusted guide. Its goal is simple: to help you protect and grow your wealth through smart, informed retirement planning.

CONTACT:

Ryan Paulson

[email protected]

SOURCE: IRAEmpire LLC

View the original press release on ACCESS Newswire

B.Finley--AMWN